TIDMMOTR

RNS Number : 5405G

Motorpoint Group plc

26 November 2020

26(th) November 2020

Motorpoint Group PLC

("Motorpoint", the "Company" or the "Group"))

Interim Results

Strong return from lockdown, well positioned to drive market

share growth

Motorpoint, the leading independent omni-channel vehicle

retailer in the UK, today announces its unaudited interim results

for the six months ended 30 September 2020 (FY21 H1).

Financial highlights

-- Revenue decreased 27% to GBP387.7m (FY20 H1: GBP533.9m)

reflecting the enforced closure of retail branches and preparation

centres in April to June.

-- Operating expenses decreased 16% to GBP24.3m (FY20 H1: GBP29.1m).

-- EBITDA(1) improved 4% to GBP14.0m (FY20 H1: GBP13.4m).

-- Profit before tax increased 3% to GBP9.7m (FY20 H1: GBP9.4m)

reflecting strong trading upon all retail branches fully reopening

in June and July.

-- Gross margin increased to 9.1% (FY20 H1: 7.5%) following

strong customer demand and increased stock turn.

-- Basic earnings per share increased 10% to 8.8p (FY20 H1: 8.0p).

-- No interim dividend is proposed, dividend policy remains under review (FY20 H1: 2.6p)

-- Government support received during closure through

Coronavirus Job Retention Scheme and Business Rates relief. All

taxes that could be deferred were paid in full by 30 September.

-- Maintained strong cash flow from operations conversion(2) of 159% (FY20 H1: 233%).

-- Robust balance sheet, with no structural debt and net cash of

GBP13.6m at 30 September 2020.

Operational highlights

-- Significant acceleration of Online sales growth in period;

accounting for over 40% of sales in H1.

-- Home Deliveries represented 20% of Online sales in September.

-- 14-day money back guarantee launched for all online customers.

-- Successful roll-out of free nationwide Home Delivery service

across all branches as well as a 'Contactless Collection' service

to extend our 'Reserve and Collect' e-commerce offering.

-- Decisive and swift actions taken upon lockdown to preserve

cash, reduces costs and subsequently reopened all branches

successfully.

-- Comprehensive roll-out of social distancing and safety

measures to protect our teams and customers.

-- Continued improvements to vehicle preparation speed and cost

with FY20 H2 improvements now embedded.

-- Market share growth following full reopening of all branches.

-- Senior team remuneration voluntarily reduced to maintain all

lower paid team members at 100% of earnings throughout closure.

-- Supported over 500 NHS workers across the UK through GBP300 purchase discount.

-- 13(th) branch (Swansea) performing ahead of expectations.

-- 14 (th) branch (Stockton on Tees) on schedule to open late December 2020.

(1) Calculated as operating profit of GBP11.1m adding back depreciation

of GBP2.9m (FY20 H1: Operating profit of GBP11.1m adding

back depreciation of GBP2.3m)

(2) Calculated as cash generated from operations of GBP17.7m

divided by operating profit of GBP11.1m (FY20 H1: Cash generated

from operations of GBP25.9m divided by operating profit of

GBP11.1m)

Outlook

Management remain confident that the Group's digitally

underpinned Home Delivery and Reserve & Collect offerings will

continue to service our existing customers and access new markets.

Our leading brand and compelling customer proposition of Car Buying

Made Easy will continue to offer unrivalled Choice, Value, Service

and Quality irrespective of whether the chosen purchase method is

online or at a branch.

Given the uncertainty of future demand and margin levels caused

by the ongoing impact of Covid-19 no earnings guidance will be

provided at this time.

Mark Carpenter, Chief Executive Officer of Motorpoint Group PLC

commented:

"During a very challenging period, I am exceptionally proud of

how the Group has responded. Through operational rigour and a focus

on e-commerce solutions, the Group delivered an improvement in

profit before tax against the prior year, despite a complete

closure during the UK-wide lockdown from March 24(th) , and order

fulfilment limited to home delivery only from May 21(st) . Since

fully reopening all branches in July, demand levels have exceeded

management's expectations and indeed the prior year performance.

Margins have also been above recent levels, reflecting strong

customer demand and continued improvements in vehicle preparation

speed and marketing effectiveness.

The enforced closure of all branches resulted in substantial

trading losses in April and May. Actions taken during the closure

to preserve cash and reduce costs included suspending capital

projects, reducing discretionary spending, furloughing a large

proportion of our team and all of our Senior team Leadership Team

and Board members taking voluntary pay reductions to help maintain

our lowest paid team members at 100% of earnings. The Group

returned to profitability in June.

The Group has demonstrated its agility to respond quickly to

changing trading conditions. We accelerated our investment in our

digital offering through the rollout of our free national Home

Delivery service and a streamlined, contactless Reserve and Collect

option for the majority of customers who still want to view their

car before completing their purchase. These initiatives, alongside

the incredible hard work of our team and the strengths of our

market-leading platform, resulted in online sales growth that

outpaced our branch sales growth in the remainder of H1 and grew to

43% of sales in the three months to 30 September 2020, a volume

increase of 39%. Our free Home Delivery service represented 8% of

total sales in the same period, from zero only six months ago. The

increase in demand has meant that we have created around 30

additional preparation and customer service logistics roles since

reopening.

As a result of this strong trading since reopening, the Group

delivered a profit before tax for the six months to 30 September

ahead of the prior year. This underlines the strength and agility

of the Motorpoint business model, its high-quality digital offering

and the Group's ability to react quickly to external challenges

while maintaining its industry leading customer proposition.

Notwithstanding the challenging macroeconomic backdrop, we look to

the future with confidence as we continue to innovate and build on

the strengths of our low-cost, independent, flexible operating

model and leading brand to drive further market share growth."

Analyst Webinar

A virtual meeting for sell-side analysts will be held at 09:30am

today, the details of which can be obtained from FTI

Consulting.

Enquiries:

Motorpoint Group PLC via FTI Consulting

Mark Carpenter, Chief Executive

Officer

FTI Consulting (Financial PR) 020 3727 1000

Alex Beagley ( motorpoint@fticonsulting.com

)

James Styles

Sam Macpherson

Certain information contained in this announcement would have

constituted inside information (as defined by Article 7 of

Regulation (EU) No 596/2014) prior to its release as part of this

announcement.

Notes to editors

Motorpoint is the leading independent omni-channel vehicle

retailer in the United Kingdom. The Group's principal business is

the sale of nearly-new vehicles, the majority of which are up to

two years old and which have covered less than 15,000 miles.

Motorpoint sells vehicles from brands representing over 95 per cent

of new vehicle sales in the United Kingdom, with models from Ford,

Vauxhall, Volkswagen, Nissan, Hyundai, Audi and BMW being amongst

the top sellers. The Group operates from 13 retail branches across

the United Kingdom; Derby, Burnley, Glasgow, Newport, Peterborough,

Chingford, Birmingham, Widnes, Birtley, Castleford, Oldbury,

Sheffield and Swansea; together with a national contact-centre

dealing with online enquiries.

More information is available at www.motorpointplc.com and

www.motorpoint.co.uk .

Cautionary Statement

This announcement contains unaudited information and

forward-looking statements that are based on current expectations

or beliefs, as well as assumptions about future events. These

forward looking statements can be identified by the fact that they

do not relate only to historical or current facts. Undue reliance

should not be placed on any such statements because they speak only

as at the date of this document and are subject to known and

unknown risks and uncertainties and can be affected by other

factors that could cause actual results, and the Group's plans and

objectives, to differ materially from those expressed or implied in

the forward looking statements. Motorpoint undertakes no obligation

to revise or update any forward-looking statement contained within

this announcement, regardless of whether those statements are

affected as a result of new information, future events or

otherwise, save as required by law and regulations.

FINANCIAL REVIEW

The Key Performance Indicators for the Group for the current

period and comparative periods are outlined below.

Group KPI (post IFRS 16) 6 months 6 months Change

to 30 September to 30 September

2020 2019

Revenue GBP387.7m GBP533.9m -27.4%

----------------- ----------------- -------

Gross profit GBP35.4m GBP40.2m -11.9%

----------------- ----------------- -------

EBITDA(1) GBP14.0m GBP13.4m +4.5%

----------------- ----------------- -------

Operating profit GBP11.1m GBP11.1m -%

----------------- ----------------- -------

Gross profit to operating expenses(2)

ratio 146% 138% +8pp

----------------- ----------------- -------

Profit Before Tax GBP9.7m GBP9.4m +3.2%

----------------- ----------------- -------

Cash flow from operations GBP17.7m GBP25.9m -31.7%

----------------- ----------------- -------

Cash flow from operations conversion(3) 159% 233% - 74pp

----------------- ----------------- -------

Net cash and cash equivalents GBP13.6m GBP10.3m +32%

----------------- ----------------- -------

Basic Earnings per Share (p) (4) 8.8 8.0 +10.0%

----------------- ----------------- -------

Number of branche s 13 12 +1

----------------- ----------------- -------

(1) Calculated as operating profit of GBP11.1m adding back

depreciation of GBP2.9m (FY20 H1: Operating profit of GBP11.1m

adding back depreciation of GBP2.3m).

(2) Calculated as gross profit of GBP35.4m divided by operating

expenses of GBP24.3m (FY20 H1: Gross profit of GBP40.2m divided by

operating expenses of GBP29.1m).

(3) Calculated as cash generated from operations of GBP17.7m

divided by operating profit of GBP11.1m (FY20 H1: Cash generated

from operations of GBP25.9m divided by operating profit of

GBP11.1m).

(4) Calculated by dividing the earnings attributable to equity

shareholders by the number of ordinary shares in issue at the

reporting date.

Despite the ongoing Covid-19 pandemic, the Group improved profit

before tax compared to the same period last year and generated cash

flow from operations of GBP17.7m, equating to a cash flow from

operations conversion of 159% (FY20 H1: 233%), resulting tight cash

controls during the period and a further improvement in stock

turn.

The Group's banking facilities include a committed GBP20m

facility provided by Santander UK PLC which was undrawn as at the

reporting date. An additional GBP15m uncommitted overdraft facility

was agreed with Santander UK PLC to help support working capital

and potential short-term cash impacts from any market disruption

during the Coronavirus pandemic. As at 30 September 2020, the Group

was supported by stocking facilities provided by Lombard of GBP26m

and Black Horse Limited of GBP75m of which GBP80.5m was drawn in

total.

OPERATIONAL REVIEW

Motorpoint's strategy is delivered through its retail branches

and its e-commerce platforms of Motorpoint.co.uk and

Auction4Cars.com. The Group's strategy is threefold; (i) to achieve

organic sales growth at existing branches (ii) to increase digital

sales through our e-commerce offering, and (iii) to open new

branches to expand into new markets across the UK.

The opening of Swansea in January 2020 was our eighth new branch

in eight years. These new branche s continue to mature in line with

our expectations with all branch es, including the latest addition

in Swansea, which achieved a positive contribution in the period.

Expanding our branch network to around 20 locations in the UK in

the medium-term remains our target with management continuing to

evaluate opportunities for our next retail branch locations. Our

14(th) branch , in Stockton On Tees, is due to open in December

2020.

The Group continues to evolve its operating model with the

introduction of our first dedicated preparation centre during FY20

and the opening of Swansea and Stockton On Tees as sales only

branches. The Group has further focussed its vehicle preparation by

moving preparation activities away from of some of our smaller

branches to other, larger, nearby branches. This change creates

economies of scale within preparation and also makes best use of

the retail capacity within the smaller locations allowing us to

better service our customers, providing them with increased choice.

As a result the Group has seen an increased speed of preparation

contributing towards improved gross margins.

MOTORPOINT VIRTUOUS CIRCLE

Motorpoint's operating model revolves around our three key

stakeholders; our team, our customers and our shareholders. Our

vision to offer our customers unrivalled Choice, Value, Service and

Quality along with supporting business plans are aligned to our

Virtuous Circle. The actions of everyone within Team Motorpoint,

regardless of role, are underpinned by a common mind-set, our

behaviours and our values of being proud, supportive, honest and

happy.

Our values are our DNA and we are immensely proud of them. They

epitomise what Motorpoint is about and are a very powerful tool in

driving our engagement and performance levels.

TEAM

We believe that by supporting our team, encouraging employee

engagement, and driving a common set of values as part of our

everyday activities our employees will remain motivated and driven

to succeed. Through having engaged and happy employees, each of our

customers receives a positive experience. We continue to learn from

every interaction as we strive for continual improvement in what we

deliver to our customers.

The Group furloughed all branch -based employees during March

2020 as well as the majority of head office staff. In addition to

utilising the Government's Coronavirus Job Retention Scheme, all of

our senior team took voluntary pay reductions to ensure that lower

paid team members could continue to receive 100% of their

earnings.

Further evidence of the strong cultural values within the Group

is demonstrated by our continued inclusion within The Sunday Times

Top 100 Mid-Sized Companies to Work For for the sixth consecutive

year. Our interim scores from October 2020 show a further

improvement in our Team engagement.

To support our team engagement, we continue to offer a number of

share schemes including an annual Performance Share Plan for senior

staff, a Share Incentive Plan and an annual Save As You Earn scheme

open to all of our team.

CUSTOMERS

The second part of our Virtuous Circle focuses on the customer

and our customer proposition of Car Buying Made Easy by providing

unrivalled Choice, Value, Service and Quality .

Our key measures of service are NPS (Net Promoter Score) and our

Feefo and Google ratings, and to ensure our level of customer

service is appropriate, all commissions and bonus schemes

throughout the business are tied to customer satisfaction.

Metric 6 months to 12 months to 6 months to

30 September 2020 31 March 2020 30 September 2019

NPS 72% 81% 81%

------------------- --------------- -------------------

Feefo 4.3/5 4.5/5 4.5/5

------------------- --------------- -------------------

Google 4.5/5 4.4/5 4.6/5

------------------- --------------- -------------------

Customer satisfaction in the current period was lower than the

same period last year driven primarily by the first two months of

trade on re-opening from lockdown. Strong demand placed substantial

pressure on our team as materially higher volumes than expected

were prepared and sold. A concerted effort to increase preparation

capacity and improve our customer journey gradually improved our

NPS scores to 79% in September, just short of last year's H1

average and 82% in October.

The Group's investment in our marketing team reflects a

continued commitment to understanding our customer base, ensuring

that our product and service offering delivers on our goal to make

car buying easy. While the introduction of free nationwide Home

Delivery, contactless 'Reserve & Collect' for online orders and

unaccompanied test drives reflect our versatility within an

evolving market, we continue to recognise that the majority of our

customers still want to browse our impressive choice of vehicles in

person, with customers able to take advantage of our popular same

day driveaway service.

DIVID

The Group is not declaring an interim dividend for FY21 (FY20

H1: 2.6p) due to the ongoing Covid-19 pandemic and its potential

impact on future demand. The business continues to be cash

generative and our dividend policy will be kept under review.

RECENT MARKET TRS

Motorpoint's core proposition is the sale of low mileage, nearly

new cars, the vast majority of which are up to two years old and

have covered fewer than 15,000 miles. The Group's remaining sales

are from vehicles that have covered up to 30,000 miles and are

under 4 years old as well as Light Commercial Vehicles.

The Group's business model continues to evolve in an

ever-changing marketplace, notably demonstrated in the period by

our swift enhanced digital offering through a free national Home

Delivery service as well as a "Contactless collection" option . We

are dedicated to providing all of our customers with a service and

product offering which suits them.

With the ongoing pandemic and Brexit nearly upon us there are

inherent uncertainties surrounding consumer demand in the short

term, however we remain confident that our current business model

and the dedication of our Team will allow us to continue to take

market share. Despite the obvious challenges within the current

economic climate, Motorpoint continues to strive to deliver for all

key stakeholders.

OUTLOOK

The H2 outlook has been impacted by the regional and subsequent

national 4-week lockdown in England, as well as the 17 day

'firebreak' lockdown in Wales from late October. Beyond these

measures, the existing restrictions in place surrounding Covid-19

are likely to continue to put pressure on H2 volumes as a result of

diminished consumer confidence and customer mobility

restrictions.

It is also worth noting that the Government's Brexit

negotiations could further influence our future performance in

unpredictable ways.

Despite this, management remain confident that the Group's

digitally underpinned Home Delivery and Reserve & Collect

offerings will continue to service our existing customers and help

us access new markets. Our leading brand and compelling customer

proposition of Car Buying Made Easy will continue to offer

unrivalled Choice, Value, Service and Quality irrespective of

whether the chosen purchase method is online or at a branch.

RESPONSIBILITY STATEMENT OF THE DIRECTORS IN RESPECT OF THE FY21 UNAUDITED INTERIM RESULTS

The Directors confirm that these condensed consolidated interim

financial statements have been prepared in accordance with

International Accounting Standard 34, 'Interim Financial

Reporting', as adopted by the European Union and that the interim

management report includes a fair review of the information

required by DTR 4.2.7 and DTR 4.2.8, namely:

-- an indication of important events that have occurred during

the first six months and their impact on the condensed consolidated

interim financial statements, and a description of the principal

risks and uncertainties for the remaining six months of the

financial year; and

-- material related-party transactions in the first six months and any material changes in the related-party transactions described in the last annual report.

A list of current Directors and their biographies is maintained

on the Motorpoint Group PLC website www.motorpointplc.com

By order of the Board

Mark Carpenter

Chief Executive Officer

26(th) November 2020

Condensed Consolidated Income Statement

For the six months ended 30 September 2020

Unaudited Six Months

ended 30 September Unaudited Six Months Year ended 31 March

2020 ended 30 September 2019 2020

Note GBPm GBPm GBPm

Revenue 5 387.7 533.9 1,018.0

Cost of sales (352.3) (493.7) (939.1)

----------------------- ------------------------ ------------------------

Gross profit 35.4 40.2 78.9

Operating expenses (24.3) (29.1) (56.6)

----------------------- ------------------------ ------------------------

Operating profit 11.1 11.1 22.3

----------------------- ------------------------ ------------------------

Finance costs 6 (1.4) (1.7) (3.5)

----------------------- ------------------------ ------------------------

Profit before tax 9.7 9.4 18.8

Taxation 7 (1.8) (1.9) (3.6)

----------------------- ------------------------ ------------------------

Profit and total

comprehensive

income for the period/year

attributable to equity

holders of

the parent 7.9 7.5 15.2

----------------------- ------------------------ ------------------------

Earnings per share

Basic 9 8.8p 8.0p 16.4p

Diluted 9 8.7p 7.9p 16.4p

----------------------- ------------------------ ------------------------

The Company's activities all derive from continuing

operations.

The Company has no other comprehensive income. Total

comprehensive income for the period/year is equal to the profit for

the financial period/year and is all attributable to the

shareholders of the Company.

Condensed Consolidated Balance Sheet

As at 30 September 2020

30 September 2020 (unaudited) 30 September 2019 (unaudited) 31 March 2020

Note GBPm GBPm GBPm

ASSETS

Non-current assets

Property, plant and equipment 10 18.3 13.8 18.9

Right-of-use assets 11 41.3 41.7 41.6

Deferred tax assets 1.3 1.6 1.3

Total non-current assets 60.9 57.1 61.8

------------------------------ ------------------------------ --------------

Current assets

Inventories 102.5 82.1 111.8

Trade and other receivables 12 6.0 7.9 4.4

Current tax receivable 1.1 0.2 0.9

Cash and cash equivalents 13.6 10.3 10.8

------------------------------

Total current assets 123.2 100.5 127.9

------------------------------ ------------------------------ --------------

TOTAL ASSETS 184.1 157.6 189.7

------------------------------ ------------------------------ --------------

LIABILITIES

Current liabilities

Borrowings - - (10.0)

Lease liabilities 13 (2.8) (2.0) (2.3)

Trade and other payables 14 (108.1) (91.9) (111.6)

Contract liabilities - (0.8) (0.2)

Provisions 15 - (0.2) (0.2)

Current tax liabilities - - -

Total current liabilities (110.9) (94.9) (124.3)

------------------------------ ------------------------------ --------------

NET CURRENT ASSETS 12.3 5.6 3.6

Non-current liabilities

Lease liabilities 13 (43.1) (43.5) (43.1)

Provisions 15 (2.1) (1.7) (2.1)

Contract liabilities - (0.1) -

Total non-current liabilities (45.2) (45.3) (45.2)

------------------------------ ------------------------------ --------------

TOTAL LIABILITIES (156.1) (140.2) (169.5)

NET ASSETS 28.0 17.4 20.2

------------------------------ ------------------------------ --------------

EQUITY

Share capital 0.9 0.9 0.9

Capital redemption reserve 0.1 0.1 0.1

Capital reorganisation reserve (0.8) (0.8) (0.8)

Retained earnings 27.8 17.2 20.0

------------------------------ ------------------------------ --------------

TOTAL EQUITY 28.0 17.4 20.2

------------------------------ ------------------------------ --------------

Condensed Consolidated Statement of Changes in Equity

For the six months ended 30 September 2020

Six Months

Ended 30 Capital Capital Total equity

September redemption Retained Reorganisation

2020 Share capital reserve earnings Reserve GBPm

(Unaudited) Note GBPm GBPm GBPm GBPm

-------------- ------------- -------------- ---------------- --------------

At 1 April 2020 0.9 0.1 20.0 (0.8) 20.2

Profit and total

comprehensive income

for the period - - 7.9 - 7.9

IFRS 2 Share Based

Payment - - (0.1) - (0.1)

At 30 September

2020 0.9 0.1 27.8 (0.8) 28.0

Six Months

Ended 30 Capital Capital Total equity

September redemption Retained Reorganisation GBPm

2019 Share capital reserve earnings Reserve

(Unaudited) Note GBPm GBPm GBPm GBPm

-------------- -------------- -------------- ---------------- --------------

At 1 April 2019 1.0 - 25.8 (0.8) 26.0

Profit and total

comprehensive income

for the period - - 7.5 - 7.5

Share-based payments - - (0.2) - (0.2)

Transactions with

shareholders

Buy back and

cancellation of

shares (0.1) - (11.1) - (11.2)

Final dividend for the

year ended 31 March

2020 8 - - (4.7) - (4.7)

At 30 September

2019 0.9 - 17.3 (0.8) 17.4

Year Ended Capital Capital Total equity

31 March 2020 redemption Retained Reorganisation GBPm

Share capital reserve earnings Reserve

Note GBPm GBPm GBPm GBPm

-------------- ---------------- ---------------- ---------------- --------------

At 1 April 2019 1.0 - 25.8 (0.8) 26.0

Profit and total

comprehensive

income for the

year - - 15.2 - 15.2

Share-based

payments - - (0.9) - (0.9)

Transactions with

shareholders

Buy back and

cancellation of

shares (0.1) 0.1 (13.1) - (13.1)

Final dividend for

the year ended 31

March 2019 8 - - (4.7) - (4.7)

Interim dividend

for the year

ended 31 March

2020 8 - - (2.3) - (2.3)

At 31 March 2020 0.9 0.1 20.0 (0.8) 20.2

Condensed Consolidated Cash Flow Statement

For the six months ended 30 September 2020

Note Unaudited Six Months Unaudited Six Months ended

ended 30 September 2020 30 September 2019 Year ended 31 March 2020

GBPm GBPm GBPm

Cash flows from operating

activities

Cash generated from

operations 16 17.7 25.9 33.2

Interest paid (1.4) (1.7) (3.5)

Income tax paid (2.0) (4.2) (6.4)

-------------------------- --------------------------- -------------------------

Net cash generated from

operating activities 14.3 20.0 23.3

-------------------------- --------------------------- -------------------------

Cash flows from investing

activities

Purchases of property,

plant and equipment (0.3) (6.2) (12.3)

Net cash used in investing

activities (0.3) (6.2) (12.3)

Cash flows from financing

activities

Dividends 8 - (4.7) (7.0)

Payments to acquire own

shares - (11.2) (13.1)

Payments to satisfy

employee share plan

obligations - - (0.9)

Repayment on leases (1.2) (1.4) (3.0)

Proceeds from borrowings - - 29.0

Repayment of borrowings (10.0) - (19.0)

-------------------------- --------------------------- -------------------------

Net cash used in financing

activities (11.2) (17.3) (14.0)

-------------------------- --------------------------- -------------------------

Net increase/(decrease) in

cash and cash equivalents 2.8 (3.5) (3.0)

Cash and cash equivalents

at the beginning of the

period 10.8 13.8 13.8

--------------------------

Cash and cash equivalents

at end of period/year 13.6 10.3 10.8

-------------------------- --------------------------- -------------------------

Net cash and cash

equivalents comprises:

Cash at bank 13.6 10.3 10.8

-------------------------- --------------------------- -------------------------

The notes form an integral part of these Condensed Consolidated

Interim Financial Statements.

1. Basis of Preparation

Motorpoint Group PLC ('the Company') is incorporated and

domiciled in the UK. The address of the registered office is

Chartwell Drive, West Meadows Industrial Estate, Derby, DE21 6BZ.

The Condensed Consolidated Interim Financial Statements of the

Company as at and for the six months ended 30 September 2020

comprise the Company and its subsidiaries, together referred to as

the "Group".

The Condensed Consolidated Interim Financial Statements for the

six months ended 30 September 2020 are unaudited and the auditors

have not performed a review in accordance with ISRE 2410, Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity.

Going concern

The Interim financial statements are prepared on a going concern

basis. The Group regularly reviews market and financial forecasts,

and has reviewed its trading prospects in its key markets. As a

result of Coronavirus the Group operations were closed for 6 weeks

from late March to the end of April. Subsequent to the interim

period end the Group's Wales based sites were subject to a two week

closure and its England based sites are presently closed as part of

a four week Government imposed lockdown. All of these closures

directly impact upon short term performance and liquidity. The

Group took immediate actions during April 2020 to limit the impact

of the first closures and have secured additional finance

facilities, including an uncommitted GBP15.0m overdraft, to support

operational cash flows if required. During the later periods of

closure the Group is taking similar actions to reduce cash outflows

while maintaining a reduced sales level through home delivery and

contactless collections.

The Board has reviewed the latest forecasts of the Group,

including the impact of multiple future site closures, and

considered the obligations of the financing arrangements.

The board have considered a stressed budget position, which

models significantly reduced sales volumes in the short and medium

term, reflecting periods of site closures through Winter months.

The actions which management have already taken to control costs

have been factored into this scenario, including the utilisation of

certain Government support initiatives. Whilst this stressed

scenario places additional pressures on both cash flow and

profitability, the Group ultimately expects to return to normal

levels of volume upon reopening.

The period considered for going concern purposes is a minimum of

12 months from the date of signing the accounts.

The board have taken a reverse stress test approach in

considering the going concern status of the Group, reducing volumes

to the point at which the Group is either no longer compliant with

banking covenants or depletes liquid resources required to continue

trading, whichever is earlier. Plausible mitigating actions were

built into the model including; reducing spend on specific variable

cost lines including marketing and site trading expenses, team

costs most notably sales commissions, pausing new stock commitments

and extending the period for which expansionary capital spend and

share buybacks are suspended. All of these actions could

conceivably be performed within and throughout the going concern

period.

In light of the immediate impacts, including the period of

temporary site closure, the Group has already taken extensive

actions to minimise the impact on short term cash flows; reducing

capital expenditure, furloughing team members, suspending the share

buyback programme and reducing all non-essential spend. The Group

is making use of the Government's Coronavirus Job Retention Scheme

and continues to work closely with its banking partners, notably in

securing an additional uncommitted GBP15m overdraft facility with

Santander UK PLC. As this is an uncommitted facility all of our

downside planning has excluded the ability to draw these funds.

The Directors have considered the speed with which the Group

returned to previous levels of sales volumes following the previous

site closures to provide additional assurance around the continuing

viability of the business. While at present ten of the Groups sites

remain closed, the continued sales through home delivery and

contactless collections provide further comfort to the continuing

strength of the Group in an active market.

Given the continued historical liquidity of the Group and

sufficiency of reserves and cash in the stressed scenarios

modelled, the Board has concluded that the Group has adequate

resources to continue in operational existence over the going

concern period and into the foreseeable future thereafter.

Accordingly, they continue to adopt the going concern basis in

preparing the consolidated financial statements.

New accounting standards, interpretations and amendments adopted

by the Group

The accounting policies adopted in the preparation of the

interim financial statements are the same as those set out in the

Group's annual financial statements for the year ended 31 March

2020.The Group has not early adopted any other standard,

interpretation or amendment that has been issued but is not

effective.

2. Statement of Compliance

These Condensed Consolidated Interim Financial Statements have

been prepared in accordance with International Accounting Standard

34 Interim Financial Reporting as adopted by the European Union.

The financial information included does not constitute statutory

accounts within the meaning of section 434 of the Companies Act

2006 ('the Act') and do not include all the information required

for full annual financial statements. Accordingly, they should be

read in conjunction with the Annual Report and Financial Statements

of Motorpoint Group PLC for the year ended 31 March 2020 which are

prepared in accordance with International Financial Reporting

Standards as adopted by the European Union. These condensed

consolidated interim financial statements were approved by the

Board of Directors on 25 November 2020.

3. Significant Accounting Policies

The same accounting policies, presentation and methods of

computation which were followed in the preparation of the Annual

Report and Financial Statements for Motorpoint Group PLC for the

period ended 31 March 2020 have been applied to these Condensed

Consolidated Interim Financial Statements where applicable. The

accounting policies and details of new standards adopted in the

year ended 31 March 2020 are listed in the Motorpoint Group PLC

Annual Report and Financial Statements on pages 82-88.

4. Comparative Figures

The comparative figures for the financial year ended 31 March

2020 are extracted from the Motorpoint Group PLC Annual Report and

Financial Statements for that financial year. The accounts have

been reported on by the Company's auditor and delivered to the

Registrar of Companies. The report of the auditor was (i)

unqualified (ii) did not include a reference to any matters to

which the auditor drew attention by way of emphasis without

qualifying their report and (iii) did not contain a statement under

section 498(2) or (3) of the Act.

The comparative figures for the six month period ended 30

September 2019 are as reported in the prior year and were prepared

in accordance with International Accounting Standard 34 Interim

Financial Reporting as adopted by the European Union.

5. Segment Reporting and Revenue

The Company's reportable operating segment is considered to be

the United Kingdom operations. The Company's chief operating

decision maker is considered to be the Board of Directors.

Revenue represents amounts chargeable, net of value added tax,

in respect of the sale of goods and services to customers. Revenue

is measured at the fair value of the consideration receivable, when

it can be reliably measured, and the specified recognition criteria

for the sales type have been met.

The transaction price is determined based on periodically

reviewed prices and are separately identified on the customer's

invoice. There are no estimates of variable consideration.

(i) Sales of motor vehicles

Revenue from sale of motor vehicles is recognised when the

control has passed, that is, when the vehicle has been collected by

the customer. Payment of the transaction price is due immediately

when the customer purchases the vehicle.

(ii) Sales of motor related services and commissions

Motor related services sales include commissions on finance

introductions, extended guarantees and vehicle asset protection as

well as the sale of paint protection products. Sales of paint

protection products are recognised when the control has passed,

that is, the protection has been applied and the product is

supplied to the customer.

Vehicle extended guarantees where the Group is contractually

responsible for future claims are accounted for by deferring the

guarantee income received along with direct selling costs and then

releasing the income on a straight -- line basis over the remaining

life of the guarantee. Costs in relation to servicing the extended

guarantee income are expensed to the income statement as incurred.

The Group has not sold any of these policies in the current or

prior period but continues to release income in relation to legacy

sales.

Vehicle extended guarantees and asset protection (gap insurance)

where the Group is not contractually responsible for future claims,

are accounted for by recognising the commissions attributable to

Motorpoint at the point of sale to the customer.

Where the Group receives finance commission income, primarily

arising when the customer uses third-party finance to purchase the

vehicle, the Group recognises such income on an 'as earned' basis.

Under IFRS 15, the assessment will be based on whether the Group

controls the specific goods and services before transferring them

to the end customer, rather than whether it has exposure to

significant risks and rewards associated with the sale of goods or

services.

Products and Nature, timing of satisfaction of performance

services obligations and significant payment terms

Sale of motor The Group sells nearly new vehicles to retail

vehicles customers. Revenue is recognised at the point

the vehicle is collected by the customer. The

satisfaction of the performance obligation occurs

on delivery or collection of the product.

The Group sells vehicles acquired through retail

customer trade-ins to trade customers through

their website auction4cars. Vehicles do not leave

the premises until they are paid for in full and

therefore the revenue and the profit are recognised

at the point of sale. The satisfaction of the

performance obligation occurs on collection of

the vehicle.

The Group operates a return policy which is consistent

with the relevant consumer protection regulations.

---------------------------------------------------------

Sales of motor The Group receives commissions when it arranges

related services finance, insurance packages, extended warranty

and commissions and paint protection for its customers, acting

as agent on behalf of a limited number of finance,

insurance and other companies. For finance and

insurance packages, commission is earned and recognised

as revenue when the customer draws down the finance

or commences the insurance policy from the supplier

which coincides with the delivery of the product

or service. Commissions receivable are paid typically

in the month after the finance is drawn down.

For extended warranty and paint protection, the

commission earned by the Group as an agent is

recognised as revenue at the point of sale on

behalf of the Principal.

The Group o ered an Extended Guarantee for either

12 or 24 months, which commenced from the end

of the manufacturer's warranty period. The revenue

is deferred until the start of the policy period,

and then released on a straight -- line basis

over the policy term. Any directly attributable

costs from the sale (e.g. sales commission) are

also deferred and released over the same period.

Customer claims are taken to the Income Statement

as they are incurred during the policy term.

---------------------------------------------------------

Six Months Six Months

ended 30 ended 30 Year ended

September September 31 March

2020 2019 2020

GBPm GBPm GBPm

Revenue from sale of motor vehicles 370.2 506.4 965.5

Revenue from motor related services

and commissions 15.7 22.9 45.8

Revenue recognised that was

included in deferred income

at the beginning of the period

- Sale of motor vehicles 1.3 1.9 3.3

Revenue recognised that was

included in deferred income

at the beginning of the period

- Motor related services and

commissions 0.5 2.0 2.0

Revenue recognised that was

included in the contract liability

balance at the beginning of

the period -

Extended guarantee income - 0.7 1.4

------------ ------------ ------------

Total Revenue 387.7 533.9 1,018.0

------------ ------------ ------------

6. Finance Cost

Six Months ended 30

September Six Months ended 30

2020 September 2019 Year ended 31 March 2020

GBPm GBPm GBPm

Interest on bank borrowings - - 0.2

Interest on stocking finance

facilities 0.6 0.8 1.7

Other interest payable 0.8 0.9 1.6

----------------------------- ---------------------------- --------------------------

Total finance costs 1.4 1.7 3.5

----------------------------- ---------------------------- --------------------------

7. Taxation

The tax charge for the period is provided at the effective rate

of 18.6% (FY20 H1: 20%) representing the best estimate of the

average annual tax rate for the full year profit.

8. Dividends

Six Months ended 30 September Six Months ended 30

2020 September 2019 Year ended 31 March 2020

GBPm GBPm GBPm

Final dividend for the year

ended 31 March 2019 - 4.7 4.7

Interim dividend for the

year ended 31 March 2020 - - 2.3

Total dividends - 4.7 7.0

------------------------------ ---------------------------- -------------------------

9. Earnings per Share

Basic and diluted earnings per share are calculated by dividing

the earnings attributable to equity shareholders by the weighted

average number of ordinary shares at the end of the period.

Six Months ended 30 Six Months ended 30

September 2020 September 2019 Year ended 31 March 2020

----------------------------- ----------------------------- -------------------------

Profit Attributable to

Ordinary Shareholders

(GBPm) 7.9 7.5 15.2

----------------------------- ----------------------------- -------------------------

Weighted average number of

ordinary shares in Issue

('000) 90,190 94,385 92,521

----------------------------- ----------------------------- -------------------------

Basic Earnings per share

(pence) 8.8 8.0 16.4

----------------------------- ----------------------------- -------------------------

Diluted Number of Shares in

Issue ('000) 90,453 94,750 92,577

----------------------------- ----------------------------- -------------------------

Diluted Earnings per share

(pence) 8.7 7.9 16.4

----------------------------- ----------------------------- -------------------------

The difference between the basic and diluted weighted average

number of shares represents the dilutive effect of the SAYE scheme.

This is shown below.

The shares for the SIP scheme were issued ahead of vesting. The

PSP awards up to and including FY20 have performance criteria which

have not been met as at the date of these interim financial

statements so the options are not yet deemed dilutive. Those shares

for PSP that have met the criteria and those awarded in FY21 as

Restricted Share Awards may be considered dilutive, however at

present the Company is not intending to satisfy these by way of

fresh issue of shares.

Six Months ended 30 Six Months ended 30

September 2020 September 2019 Year ended 31 March 2020

Weighted average number of

ordinary shares in Issue

('000) 90,190 94,385 92,521

Adjustment for share options

('000) 263 365 56

----------------------------- ----------------------------- -------------------------

Weighted average number of

ordinary shares for diluted

earnings per share ('000) 90,453 94,750 92,577

10. Property, plant and equipment

Short term Fixtures

Freehold leasehold Plant and Office

WIP Land property improvement and machinery fittings equipment Total

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

At 1 April

2020

Cost 2.5 6.2 5.9 7.2 1.5 1.3 3.2 27.8

Accumulated

depreciation - - (0.1) (4.3) (1.0) (1.1) (2.4) (8.9)

----- ----- ----------- ------------- --------------- ---------- ----------- ------

Net book value 2.5 6.2 5.8 2.9 0.5 0.2 0.8 18.9

----- ----- ----------- ------------- --------------- ---------- ----------- ------

Opening net

book value 2.5 6.2 5.8 2.9 0.5 0.2 0.8 18.9

Additions 0.1 - 0.1 - - - 0.1 0.3

Depreciation - - (0.1) (0.4) (0.1) (0.1) (0.2) (0.9)

----- ----- ----------- ------------- --------------- ---------- ----------- ------

Closing net

book value 2.6 6.2 5.8 2.5 0.4 0.1 0.7 18.3

----- ----- ----------- ------------- --------------- ---------- ----------- ------

At 30 September

2020

Cost 2.6 6.2 6.0 7.2 1.5 1.3 3.3 28.1

Accumulated

depreciation - - (0.2) (4.7) (1.1) (1.2) (2.6) (9.8)

----- ----- ----------- ------------- --------------- ---------- ----------- ------

Net book value 2.6 6.2 5.8 2.5 0.4 0.1 0.7 18.3

----- ----- ----------- ------------- --------------- ---------- ----------- ------

11. Right of use assets

Six Months ended 30 September Six Months ended 30 September

2020 2019 Year ended 31 March 2020

Right of use assets GBPm GBPm GBPm

Balance brought forward 41.6 42.6 42.6

Additions 1.7 0.7 2.4

Depreciation charge (2.0) (1.6) (3.4)

41.3 41.7 41.6

------------------------------ ------------------------------- --------------------------

12. Trade and other receivables

30 September 2020 30 September 2019

31 March 2020

Due within one year GBPm GBPm GBPm

Trade receivables 3.9 4.2 3.0

Other receivables 0.5 0.3 1.0

Prepayments 1.4 2.2 0.3

Accrued income 0.2 1.2 0.1

------------------ ------------------ ----------------

6.0 7.9 4.4

------------------ ------------------ ----------------

The Directors' assessment is that the fair value of trade and

other receivables is equal to the carrying value.

13. Lease liabilities

Six Months ended 30

September Six Months ended 30

2020 September 2019 Year ended 31 March 2020

Lease liabilities GBPm GBPm GBPm

Balance brought forward 45.4 46.2 46.2

Additions to lease

liabilities 1.7 0.7 2.2

Repayment of lease

liabilities (including

interest element) (2.0) (2.2) (4.6)

Interest expense related to

lease liabilities 0.8 0.8 1.6

45.9 45.5 45.4

----------------------------- ---------------------------- --------------------------

Current 2.8 2.0 2.3

Non-current 43.1 43.5 43.1

----------------------------- ---------------------------- --------------------------

45.9 45.5 45.4

----------------------------- ---------------------------- --------------------------

14. Trade and other payables

Due less than 1 year

30 September 2020 30 September 2019

31 March 2020

GBPm GBPm GBPm

Trade payables

* Trade creditors 6.8 6.5 10.6

80.5 66.1 86.1

* Stocking finance facilities

Other taxes and social security

* VAT payable 3.2 4.4 1.4

0.8 0.7 0.8

* PAYE/NI payable

Accruals 16.8 14.2 12.7

------------------ ------------------ ----------------

108.1 91.9 111.6

------------------ ------------------ ----------------

The Directors' assessment is that the fair value of trade and

other payables is equal to the carrying value.

15. Provisions

30 September 2020 30 September 2019

31 March 2020

GBPm GBPm GBPm

Make good provision(1) 1.9 1.7 1.9

Onerous leases(2) 0.2 0.2 0.4

2.1 1.9 2.3

------------------ ------------------ ----------------

Current - 0.2 0.2

Non-current 2.1 1.7 2.1

------------------ ------------------ ----------------

2.1 1.9 2.3

------------------ ------------------ ----------------

(1) Make good provision

Motorpoint Limited is required

to restore the leased premises

of its retail stores to

their original condition

at the end of the respective

lease terms. A provision

has been recognised for

the present value of the

estimated expenditure required

to remove any leasehold

improvements. These costs

have been capitalised as

part of the cost of right-of-use

assets and are amortised

over the shorter of the

term of the lease and the

useful life of the assets.

(2) Onerous leases

The Group operates across

a number of locations and

if there is clear indication

that a property will no

longer be used for its

intended operation, a provision

may be required based on

an estimate of potential

liabilities for periods

of lease where the property

will not be used at the

end of the reporting period,

to unwind over the remaining

term of the lease.

16. Cash flow from operations

Six Months ended 30 Six Months ended 30

September 2020 September 2019 Year ended 31 March 2020

GBPm GBPm GBPm

Profit for the year,

attributable to equity

shareholders 7.9 7.5 15.2

Adjustments for:

Taxation charge 1.8 1.9 3.6

Finance costs 1.4 1.7 3.5

Operating profit 11.1 11.1 22.3

Share Based Compensation

Charge (0.1) (0.2) (0.1)

Loss on disposal of

property, plant and

equipment - - 0.1

Depreciation charge 2.9 2.3 5.0

Cash flow from operations

before movements in working

capital 13.9 13.2 27.3

Decrease/(Increase) in

inventory 9.3 34.1 4.4

(Increase)/Decrease in trade

and other receivables (1.6) 5.1 8.6

(Decrease)/Increase in trade

and other payables (3.9) (26.5) (7.1)

Cash generated from

operations 17.7 25.9 33.2

----------------------------- ----------------------------- -------------------------

17. Share buybacks

Movements in the issued share capital during the period are

shown in the table below:

30 September 2020 30 September 2020 31 March 2020 31 March 2020

Shares '000 GBPm Shares '000 GBPm

Shares in issue at start of period / year 90,190 0.9 96,166 1.0

Brought back and cancelled - - (5,976) (0.1)

Brought back and held as treasury shares - - (5) -

Released from treasury to satisfy employee - - 5 -

share plan obligations

------------------ ------------------ -------------- --------------

Shares in issue at end of period / year 90,190 0.9 90,190 0.9

------------------ ------------------ -------------- --------------

The total cost of shares purchased for cancellation as shown in

the Statement of Changes in Equity was GBPnil (FY20 H1:

GBP11.2m).

18. Risks and uncertainties

There are certain risk factors which could result in the actual

results of the Group differing materially from expected results.

These factors include: the ongoing impact of Covid-19, a negative

implication to the Motorpoint brand and customer perception,

inability to maintain relationships with suppliers, fluctuation on

exchange rate having an impact on vehicle pricing, economic

conditions impacting trading, market driven fluctuations in vehicle

values, litigation and regulatory risk, failure of Group

information and systems, and availability of credit and vehicle

financing.

All other principal risks are consistent with those detailed in

the Motorpoint Group PLC Annual Report and Financial Statements .

The Board continually reviews the risk factors which could impact

on the Group achieving its expected results and confirm that the

above principal factors will remain relevant for the final six

months of the Financial Year ended 31 March 2021.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DELFLBFLZFBF

(END) Dow Jones Newswires

November 26, 2020 02:00 ET (07:00 GMT)

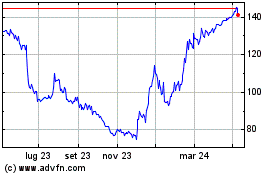

Grafico Azioni Motorpoint (LSE:MOTR)

Storico

Da Mar 2024 a Apr 2024

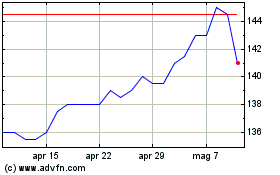

Grafico Azioni Motorpoint (LSE:MOTR)

Storico

Da Apr 2023 a Apr 2024