TIDMMUL

RNS Number : 9117F

Mulberry Group PLC

21 July 2021

Mulberry Group plc

Preliminary results for the 52 weeks ended 27 March 2021

Strong growth in Asian markets and robust digital

performance

Mulberry Group plc ("the Group" or "Mulberry"), the British

luxury brand, announces results for the 52 weeks ended 27 March

2021 (the "period").

FINANCIAL RESULTS

The income statement set out below is included to show the

underlying performance of the Group. It does not form part of the

consolidated financial statements for the 52 weeks ended 27 March

2021 and 52 weeks ended 28 March 2020.

52 weeks ended 27 March 52 weeks ended 28 March

2021 2020

GBP'million Underlying Adjusting Reported Underlying Adjusting Reported

items items

Revenue 115.0 115.0 149.3 - 149.3

------------------------- ------------------------- ------------------------- ------------------------- ------------------------- -------------------------

Gross profit 73.1 73.1 91.1 - 91.1

Impairment

charge

related to

property,

plant and

equipment - (0.6) (0.6) - (7.1) (7.1)

Impairment

charge

related to

right

of use assets - (5.7) (5.7) - (24.9) (24.9)

Lease

modification - 4.0 4.0 - - -

Restructuring

costs - (2.4) (2.4) - (0.7) (0.7)

Store closure

credit/(costs) 3.7 3.7 - (0.9) (0.9)

Other operating

expenses (68.9) (0.3) (69.2) (101.5) (0.1) (101.6)

Other operating

income 6.0 6.0 1.1 - 1.1

Operating

profit/(loss) 10.2 (1.3) 8.9 (9.3) (33.7) (43.0)

Share of

results

of associates (0.1) (0.1) - - -

Finance income - - 0.1 - 0.1

Finance expense (4.2) - (4.2) (5.0) - (5.0)

Profit/(loss)

before tax 5.9 (1.3) 4.6 (14.2) (33.7) (47.9)

Financial Highlights

-- Group revenue down 23% to GBP115.0m (2020: GBP149.3m)

primarily reflecting impact of COVID-19 and closure of majority of

physical stores during the period

-- Digital sales up 55% to GBP56.4m (2020: GBP36.3m)

-- International retail sales increased 4% to GBP33.8m (2020: GBP32.4m)

o Asia Pacific growth of 36% driven by ongoing development in

the region, China retail sales up 81% and South Korea retail sales

up by 36%, Rest of World retail sales down 27%

-- Underlying profit before tax of GBP5.9m (2020: loss before tax GBP14.2m)

Operating Highlights

-- Digital sales represented 49% of total revenue (2020: 24%),

as customers migrated to digital channels

-- Improved margins due to lower markdown sales

-- Established a European distribution facility to support online sales post-Brexit

-- Re-launched best-selling Alexa family as part of 50th anniversary celebrations

Sustainability Highlights

-- Made To Last Manifesto was launched, with a commitment to

transform the business to a regenerative and circular model

encompassing the entire supply chain, from field to wardrobe by

2030

-- 80% of the collection now using leather sourced from

environmentally accredited tanneries; this will increase to 100% by

Autumn/Winter 2022

-- Repairs Centre at The Rookery restores more than 10,000 bags a year

-- Became an accredited Living Wage Employer

-- Supported the community and the response to the COVID-19 pandemic:

o Produced over 15,000 reusable PPE gowns for frontline NHS

workers

o Worked with the Felix Project to provide over 177k meals for

those in need

o Partnered with National Emergencies Trust to help deliver

vital aid to those most affected by the coronavirus outbreak

Current Trading

-- Group revenue in the period to date is 45% ahead of last

year, with retail revenue 30% ahead due to a strong recovery in the

UK, and continuing growth in Asia, with China retail sales up

46%.

THIERRY ANDRETTA, CHIEF EXECUTIVE OFFICER, COMMENTED:

"I have been immensely proud to lead Mulberry this year. In the

last 12 months our teams have faced enormous challenges posed by

the global health crisis and have responded with resilience,

resolve and passion.

"We have been able to leverage our leading omni-channel

position, achieving very strong growth in Asia, and have served the

communities in which we operate, including repurposing our

factories to produce over 15,000 reusable PPE gowns for frontline

NHS workers.

We have delivered a robust financial performance and have made

good strategic progress in our journey to build Mulberry as a

leading sustainable global luxury brand."

FOR FURTHER DETAILS PLEASE CONTACT:

Mulberry

Charles Anderson Tel: +44 (0) 20 7605 6793

Headland (Public Relations)

Lucy Legh / KIRSTY CARRUTHERS Tel: +44 (0) 20 3805 4822

mulberry@headlandconsultancy.com

GCA Altium Limited (NOMAD)

Tim Richardson Tel: +44 (0) 20 7484 4040

Chairman's Letter

Dear Shareholder,

This has been a year like no other, with the COVID-19 pandemic

affecting all our lives in ways that we could scarcely imagine

prior to the outbreak. Whilst our performance over the past year

has undoubtedly been affected, I am incredibly proud of Mulberry's

response; reacting swiftly to adapt to the new circumstances,

protecting our people, leveraging our global digital network to

replace retail sales with digital wherever possible, ensuring the

Group was the correct size and structure to reflect market

conditions and conserving our capital. it is because of this

response, combined with the growing contribution from our Asian

business, that we have been able to rebuild our capital reserves

and can now look ahead with optimism.

Looking ahead, our mission is to be the leading responsible

British luxury lifestyle brand and a pioneer in sustainability. We

are making huge steps towards achieving this: in April, on World

Earth Day, we launched our Made to Last Manifesto outlining our

vision and sustainability targets.

As we celebrate 50 years of Mulberry this year, we look back at

our values that have shaped us as a business, namely a Made to Last

ethos, combined with responsible innovation. This year we reaffirm

our commitment to keeping these values at the heart of our brand,

to ensure we are building a sustainable legacy for the next 50

years and beyond.

In the coming months, we will be expanding our circular economy

programme, via Mulberry Exchange, Mulberry.com and Vestiaire

Collective, giving our customers access to vintage pieces, designed

to be handed down from generation to generation. We will also

launch our first, locally made, "farm to finished product" bags,

using the world's lowest carbon leather. The collection further

underpins our commitment to reaching zero carbon emissions by

2035.

I am extremely proud of the achievements we have made to date,

and the progress we are making towards our targets. Further actions

for change, and how we are building a future regenerative and

circular model encompassing the entire supply chain, are detailed

later in this report.

I would like to take this opportunity to thank all the team for

their hard work and ongoing commitment as we continue to navigate

these times of uncertainty. Together with our strategy, which

Thierry will outline in more detail on the following pages, we are

in a strong position for a prosperous future.

Godfrey Davis

Chairman

21 July 2021

Strategic Report

Chief Executive's Statement

Overview

I have been immensely proud to lead Mulberry this year. In the

last 12 months our teams have faced enormous challenges posed by

the global health crisis and have responded with resilience,

resolve and passion. We have been able to leverage our leading

omni-channel position, and have served the communities in which we

operate, including repurposing our factories to produce over 15,000

reusable PPE gowns for frontline NHS workers. We have not only

delivered a robust financial performance, but we have made good

strategic progress in our journey to build Mulberry as a leading

sustainable global luxury brand.

Robust Financial Performance

Our results demonstrated our resilience and adaptability in

responding to the COVID-19 pandemic:

During the 52 weeks to 27 March 2021 our stores were subject to

a number of national lockdowns and our UK factories were closed

during the first lockdown. This materially affected our ability to

trade. The strength of our omni-channel business and ongoing

development in Asia Pacific helped to offset the impact of these

lockdowns with Group revenue down 23% to GBP115.0m (2020:

GBP149.3m). China retail sales increased by 81% and South Korea

retail sales increased by 36%, which helped to drive the 36%

increase in Asia Pacific retail sales. Digital sales increased by

55%, as our market leading global digital network enabled us to

respond with agility, replacing retail sales with digital wherever

possible. Digital sales as a proportion of Group revenue were 49%

(2020: 24%)

The Group's underlying profit before tax was GBP5.9m (2020: loss

before tax GBP14.2m), reflecting the strength of our omni-channel

business, cost actions taken in response to COVID-19 and government

support programmes, combined with a significantly improved

contribution from our Asian businesses, which moved into profit

after a number of years of heavy investment. We ended the period

with net cash of GBP11.8m (2020: GBP7.2m) and deferred liabilities

of GBP4.7m (2020: GBP3.0m).

We are grateful for the government support, including the UK

Coronavirus Job Retention Scheme ("CJRS"), which enabled us to take

a measured look at the changes required to our business as a result

of COVID-19. Without the time afforded by the CJRS ([1]) , we would

have been forced to act earlier and make deeper cuts.

The success of our direct to customer model means that we

continue to enhance the customer experience, drive customer

engagement, and build brand loyalty. In April 2020, we implemented

a new global pricing strategy, which now applies the same retail

price globally, which has helped to drive growth.

Sustainability

The Made to Last manifesto sets Mulberry apart from our

competition. This ambitious commitment, made in our 50(th) year, to

transform the business to a regenerative and circular model

encompassing the entire supply chain, from field to wardrobe by

2030 demonstrates our desire to be a brand that makes a difference

and does the right thing. We are proud to be a real living wage

employer and are committed to working with our suppliers to ensure

that workers not directly employed by Mulberry will also receive

the same.

Today, 82% of our collection uses leather sourced from

environmentally accredited tanneries, which will increase to 100%

by AW22. In April 2021 we also relaunched our signature Scotchgrain

in a new Eco fabrication, made from recombined Bio Plastic

materials. I'm also very proud that our Repairs Centre at The

Rookery, one of our Somerset factories, restores more than 10,000

bags a year, further demonstrating that our products are truly Made

to Last.

We launched Mulberry Exchange in February 2020, our circular

re-sell and buyback programme. This was further extended in March

2021 as we launched on Vestiaire Collective's Brand Approved

program, and also through the digital launch of Mulberry Exchange

program on mulberry.com in April 2021.

The past 12 months have demonstrated more than ever the need to

play an active role in supporting the communities of which we are a

part. At the height of the pandemic, we repurposed our UK

factories, producing over 15,000 reusable PPE gowns for frontline

NHS workers. We were very proud to partner with the National

Emergencies Trust to help deliver vital aid to those most affected

by the coronavirus outbreak across the UK, donating 15% of our UK

digital sales from March 23rd - April 24th to this important cause,

raising a total of GBP75,000. In addition, in December 2020,

Mulberry partnered with London based charity, The Felix Project, to

provide over 177,000 meals for those most in need.

[1] For the 52 weeks to 27 March 2021 GBP4.8m of grants were

received under the CJRS.

Marketing

A digital first approach has been important for our marketing

strategy. The team has continued to impress by finding new and

innovative ways to reach our global community and instilling a

sense of solidarity among our customer base.

With much of the world in lockdown, April 2020 saw Mulberry

reach out to its extensive community with the 'Take Root, Branch

Out campaign' that ran throughout the summer. November 2020 saw the

highly successful relaunch of a new, sustainable version of its

iconic Alexa bag. The 360-degree global campaign engaged VIP

customers and focussed on localised influencer seeding, content

collaborations and targeted media partnerships. The relaunch was

further supported by an impactful partnership and content

collaboration with luxury online retail platform, Farfetch. The

campaign drove widespread conversation and has ensured the iconic

silhouette bag is once again one of Mulberry's best sellers.

Mulberry took an agile and responsive approach to its festive

campaign in December, with joy and community at its core. The

creative campaign put product at the forefront and highlighted

Mulberry's exceptional services offering through a series of

animations. The content was brought to life through a digitally led

campaign that tested new and innovative media formats, and a

community-focused partnership with food redistribution charity, The

Felix Project.

Welcoming in the brand's 50th anniversary, February 2021 saw

Mulberry launch the Icon Editions collection, a hand-picked

offering of Mulberry's most era-defining silhouettes - recreated in

miniature sizes. The impactful, digital first approach was

supported with global influencer seeding and a series of content

collaborations. Additionally, we were delighted to sponsor the

V&A exhibition Bags: Inside out, which celebrates the unique

status of bags and the skill involved in their creation.

Current Trading and Outlook

Group revenue in the year to date is 45% ahead of last year,

with retail revenue 30% ahead due to a strong recovery in the UK,

as our stores re-opened after the third UK lockdown, and continuing

growth in Asia.

The Group started the new year with net cash of GBP11.8m and

deferred liabilities of GBP4.7m, which will unwind in the current

year. We have renewed our banking facilities with HSBC until March

2023. The cash position has been further enhanced by the sale of

the lease of our Paris store, announced on 6 July 2021, which will

add approximately GBP10.8 million to our resources.

Despite some remaining uncertainties, with the Group's ongoing

recovery from COVID-19 the Board expects the positive momentum to

continue, although sales in the current year may remain below their

pre-COVID-19 levels, in part due to the rationalisation of the

store network.

As part of the brand's 50(th) anniversary celebrations, our

series of product collaborations continued with the Priya Ahluwalia

capsule collection and the recent launch of the Mulberry x Alexa

Chung collaboration. This is an exciting update from our long-time

friend and the person who inspired one of our most iconic bags, the

Alexa.

Mulberry is an exceptional, powerful brand, with a rich heritage

in UK manufacturing, and internationally acclaimed for quality and

design. Underpinning this is a genuine desire to do the right thing

for our people, our customers, our partners and our communities, as

illustrated by the Made to Last manifesto. This year has tested us,

as it has the world, but because of our relentless focus on

delivering against our strategic goals, our agility in responding

to the situation, our market leading digital offer, our resilience

and our passion for quality that is made to last, I am delighted

and proud that we have emerged stronger, and we look to the future

with confidence.

Thierry Andretta

Chief Executive Officer

21 July 2021

Progress against our strategy

With our rich heritage in leather craftmanship and reputation

for innovation, we strive to grow the Group through our four

strategic pillars which focus on omni-channel distribution,

international development, constant innovation and a sustainable

lifecycle.

Strategic Pillar 1

Omni-channel distribution

Through our omni-channel distribution model, we aim to enhance

our customers' experience and drive engagement. This includes

developing our store network through selective store openings and

closures, the continued roll-out of the new Mulberry store concept

and further enhancements to our omni-channel approach, which allow

customers to research, buy and return product anywhere across our

stores and digital platforms. Our aim is to expand this across our

global network over the coming year.

Our new Mulberry store concept features design elements that

represent our distinctive British he ritage and enables us to

better display and promote our collections. The concept includes

innovative customer-facing technology, creates more space and

supports our omni-channel proposition. It has helped to elevate our

brand position with the new concept stores outperforming more

traditional outlets. As at the period end, the new store concept

had been implemented in 11 stores in the UK and 19 stores in

international markets and we will continue our roll-out over the

coming years. In addition in the UK we extended our omni-channel

proposition with the launch of same-day delivery in our standalone

retail stores, along with the standalone stores now having the

ability to fulfil digital orders. Over the coming year our plan is

to expand our omni-channel offer to our concession network.

In the UK we operated 45 retail stores at the period end, which

included 15 John Lewis, and 10 House of Fraser concessions. ([2])

We will continue to manage the business proactively and focus on

optimising the UK store network.

Digital sales represented 49% of Group revenue (2020: 24%). This

growth was largely driven by our customers switching to digital

channels while stores were closed during lockdown periods, along

with overall lower sales in the period, all of which were as a

result of the COVID-19 pandemic. There is also an element of

continued growth due to further enhancements in our market-leading

digital platforms including better functionality, localisation and

local fulfilment. For the coming period we expect the digital mix

to drop back to a rate of c.36% as stores reopen, however we do

expect an accelerated shift to digital/omni-channel shopping across

all regions.

Strategic Pillar 2

International Development

We are optimising our digital channels and global store network,

with a particular focus on Asia Pacific, which continues to offer a

significant growth opportunity.

Asia Pacific retail sales increased by 36%, driven by ongoing

investment in this region, with China retail sales up 81% and South

Korea retail sales up 36%. Japan, which was m ore widely impacted

by local lockdowns and restrictions saw a 9% increase in retail

sales. The investment in the Group's subsidiaries in China, South

Korea and Japan is making good progress and after several years of

heavy investment, these businesses moved into profit.

Our global pricing strategy which now applies the same retail

price globally, was implemented in April 2020 and has helped to

drive growth. We appointed a new General Manager for the North Asia

region towards the end of the period and are re-locating our team

to Shanghai (previously Hong Kong) to support growth in this key

market.

In the Rest of World we closed three locations, with the full

exit of Canada. Digital sales grew strongly in this region over the

period and in the US, we furthered our partnership with Nordstrom,

via their drop-ship model. In Europe, we opened a distribution

centre to support this business post Brexit.

[2] Store numbers include own stores and concessions operated by

Mulberry employees.

Strategic Pillar 3

Constant Innovation

During the period, we re-launched the Alexa bag, one of our most

desirable silhouettes. With new sustainable credentials, this

much-loved icon has been performing particularly well following its

global launch in November 2020. We continued to evolve our other

key families with new introductions made across Bayswater (Mini

Bayswater), Lily (Top-Handled Lily) and Iris (Iris Hobo). In March

2021, we launched the Typography Collection, a new collection

constructed using our newly introduced Eco-Scotchgrain made from

recombined Bio-Plastic materials.

Our Mini Bags range has performed particularly well, driven by

the Mini Alexa and Small Darley Satchel. Across our lifestyle

categories, eyewear and soft accessories also continued to have

strong sales.

The V&A X Mulberry collaboration was launched in December

2020, which celebrated our sponsorship of the V&A exhibition

Bags: Inside Out. The collection saw a signature print inspired by

a beautiful 20th century floral furnishing fabric held in the

museum's archive animate some of Mulberry's most iconic bag

silhouettes, creating timeless accessories steeped in design

history.

Strategic Pillar 4

Sustainable Lifecycle

Mulberry products have been 'Made to Last' from the outset and

we are committed to lifetime service for a Mulberry item. Our

world-class Repair Centre in the Rookery, one of our Somerset

factories, is a key feature in our journey towards a fully

sustainable product and service offer. Our responsible approach is

followed throughout our manufacturing processes and standards to

ensure we uphold and protect our heritage in leather craftsmanship.

We use innovative technology such as the latest digital cutting

machines, which ensure improved utilisation and reduced waste on

leather cutting.

We are proud to continue working with Zero Waste to Landfill

partners. Mulberry's contribution, made via the Carbon Balanced

fund will be invested in the long-term protection and restoration

of threatened tropical forests in Guatemala.

We aim to manufacture 50% of our bags in the UK (other

manufacturing areas include Europe and Asia) and during the period

82% of our range used leather and suede that is sourced from

environmentally accredited tanneries. Our goal is to achieve 100%

by 2022. In December 2020, we joined the Sustainable Leather

Foundation, a not-for-profit, community interest company with a

vision is to enable collective improvement and education globally,

for more sustainable practices in leather manufacturer and

production.

We continue to be a member of the Better Cotton Initiative (the

largest cotton sustainability programme in the world). Our target

is for all cotton to be sustainably sourced by 2025 - recycled,

organic or BCI. We also joined Textile Exchange's Sustainable

Cotton Challenge.

We launched Mulberry Exchange in February 2020, our circular

buyback and re-sell programme. This was further extended in March

2021 as we launched on Vestiaire Collective's Brand Approved

program, and also in April 2021 through the digital launch of

Mulberry Exchange program on mulberry.com. Items available through

Vestiaire Collective or directly through The Mulberry Exchange, are

fully authenticated and refurbished in-house by Mulberry at our

Repairs Centre in Somerset. The Mulberry Exchange offers customers

the chance to purchase pre-loved and coveted Mulberry archive

pieces, or trade in their own Mulberry bags for credit towards a

new purchase. Each bag that is returned will be given a second

lease of life: restored carefully by expert craftspeople and resold

through selected Mulberry stores and mulberry.com.

Financial review

Our results for the 52 weeks ended 27 March 2021 were materially

affected by the impact of COVID-19 on the Group and the wider

economy and the consequential effect on revenues. The impact was

mitigated to an extent by strong growth in our Asian markets, the

strength of our omni-channel business, cost actions taken in

response to COVID-19 and government support programmes.

Group revenue and gross profit

GBP Million 2020/21 2019/20 % Change

Digital 56.4 36.3 55%

Stores 43.6 89.1 -51%

Retail (omni-channel) 100.0 125.4 -20%

-------- -------- ---------

Wholesale and Franchise 15.0 23.9 -37%

-------- -------- ---------

Group Revenue 115.0 149.3 -23%

-------- -------- ---------

Digital 44.6 27.8 61%

Stores 21.6 65.2 -67%

UK 66.2 93.0 -29%

-------- -------- ---------

Digital 3.8 2.4 58%

Stores 18.0 13.6 33%

Asia Pacific 21.8 16.0 36%

-------- -------- ---------

Digital 8.0 6.1 31%

Stores 3.9 10.3 -62%

Rest of World 11.9 16.4 -27%

-------- -------- ---------

Retail (omni-channel) 100.0 125.4 -20%

-------- -------- ---------

UK 2.4 5.7 -58%

Asia Pacific 2.8 5.4 -48%

Rest of World 9.8 12.8 -23%

Wholesale and Franchise 15.0 23.9 -37%

-------- -------- ---------

At the start of the period 70% of our worldwide stores were

closed due to COVID-19, including all of our stores in the UK,

Europe and North America. Our stores in China and South Korea

re-opened in April 2020, followed by stores in Japan and Europe and

from 15 June 2020 a phased re-opening in the UK.

England entered its second lockdown on 5 November, which ended

on 2 December, but was replaced by a 3-tier system, which was

designed to keep restrictions in place for the most affected parts

of the country. This was amended on 20 December to create a

four-tier system, where non-essentials retail was forced to close

in tier 4 areas. On 5 January 2021, a third UK lockdown was imposed

across England, which resulted in the closure of all our stores in

England. These stores remained closed until 12 April 2021, which

was at the start of the new financial year.

The strength of our omni-channel business and growth in Asia

Pacific helped to offset the impact of the shutdowns in the UK,

Europe and North America. In Q1 retail sales were down 31%. We saw

an improving trend as stores re-opened with Q2 retail sales down

18%. This continued as we moved into Q3 with retail sales down 15%

in the quarter. However a number of our stores were closed again in

the final quarter of the period, which meant for Q4 our retail

stores were below prior year by 19%.

Asia Pacific sales increased by 36%, driven by ongoing

investment in this region, offset by a 27% decrease in rest of

world sales.

Wholesale and franchise sales decreased by 37%, in part due to

the continuing focus on our direct-to-customer model, but mainly

due to the impact of COVID-19 on our partners.

Gross margin for the period was 63.6% (2020: 61.0%).

Other Operating Expenses

The Group implemented a number of cost saving measures during

the period. COVID-19 has had a dramatic impact on our business and

we expect the recovery in our sales levels over the medium term to

be gradual. Our objective was to ensure that our cost base is in

line with anticipated trading levels. The cost saving actions

included a significant reduction in discretionary costs, the

freezing of pay and recruitment and a temporary 20% pay cut for PLC

directors. A reduction in employee numbers by approximately 25%

across the Group and the renegotiation or termination of leases

where possible. The Group also accessed relevant UK Government

support programmes, such as business rates relief and benefited

from lower retail depreciation resulting from the prior period

impairment charge.

These actions achieved a 32% reduction in operating expenses on

a full-year basis.

Other Operating Income

Included within other operating income is GBP4.8m (2020:

GBP0.2m) of grants receivable under HM Revenue & Customs

Coronavirus Job Retention Scheme (CJRS) and GBP0.5m from equivalent

schemes offered in other non-UK territories. As a result of the

progress that has been made, the Group has taken the decision not

to claim our entitlement to CJRS in the current period.

Profit before tax

The Group's underlying profit before tax for the period was

GBP5.9m (2020: loss before tax GBP14.2m). Adjusting items of

GBP1.3m (2020: GBP33.7m) include restructuring costs, store closure

costs (2020: credit) lease modifications and impairment charge

related to right of use assets, and property, plant and

equipment.

Taxation

The Group reported a tax credit of GBP43k (2020: GBP0.9m), an

effective rate of tax of (1%) (2020: 2%). The effective tax rate is

lower than the UK tax rate of 19%, primarily due to the use of

prior year tax losses, which were not recognised as a deferred tax

asset.

Dividends

The Board has taken the decision that no dividend will be

declared for the 52 weeks ended 27 March 2021 (2020: nil) and that

the Group's resources will be focussed on continuing the successful

investment in our international business, particularly in Asia.

Cashflow

The net increase in cash and cash equivalents per the cashflow

statement of GBP4.2m (2020: decrease of GBP4.6m) reflected the cost

actions taken to offset the decline in revenue, further working

capital benefits, including a reduction in inventory and lower

capital expenditure. The reduction in lease payments and interest

paid was in part due to the negotiation of extended payment terms

with landlords but also the renegotiation and termination of leases

where possible.

Borrowing Facilities

The Group's net cash balance (comprising cash and cash

equivalents, less overdrafts) at 27 March 2021 was GBP11.8m (2020:

GBP7.2m), with deferred liabilities of GBP4.7m (2020: GBP3.0m). Net

cash comprises cash balances of GBP11.8m (2020: GBP7.2m) less bank

borrowings of GBPnil (2020: GBPnil), which excludes loans from

related parties and non-controlling interests of GBP4.7m (2020:

GBP5.3m). Since the period end the Group has extended its revolving

credit facility with HSBC until March 2023, and renegotiated

banking covenants to reflect the ongoing COVID-19 environment. The

GBP15.0m revolving cash facility is secured, and covenants are

tested on quarterly basis and contain a net debt to EBITDA ratio,

and a fixed charge cover ratio. Covenants are tested on a "frozen

GAAP" basis and exclude the impact of IFRS16. In addition, the

Group has a GBP4.0m overdraft facility and a further USD 1.9m

overdraft facility in China, which are renewed annually.

Corporate Social Responsibility - Made To Last

"Made To Last" is the philosophy that goes to the very heart of

our business. It defines the quality standards we demand at every

stage of the sourcing and manufacturing of our products, and our

relationships with the communities around us.

Mulberry will transform our business to be a regenerative and

circular model that will encompass the entire supply chain, from

field to wardrobe, by 2030. We believe a future regenerative and

circular model will be based on six key actions for change;

1. Regenerative Agriculture & Sourcing Transparency; Pioneer

a hyper-local, hyper-transparent "farm to finished product" supply

chain model.

We are building a network of regenerative and organic farms to

supply the hides to create our leather across the UK and Europe. On

a regenerative and rotational farm livestock play an essential role

in maintaining soil health and healthy soil draws down and stores

carbon from the atmosphere.

By 2030 our entire leather supply chain will adhere to

transformative sourcing and production model. We will launch our

first "farm to finished product" British bags in 2021.

By 2022 all leather in Mulberry collections will be sourced from

Leather Working Group (LWG) accredited tanneries, and leather from

environmentally accredited tanneries is today available across 80%

of our collections.

2. Low Carbon Leather; Develop the world's lowest carbon leather

sourced from a network of environmentally conscious farms.

Leather goods are the foundation of our business and comprise

approximately 90% of our collection. We are committed to

transparency, regeneration and circularity across our leather

supply chain from farm to finished product.

We are working with farmers who are investing in regenerative

agriculture to source the hides that will product our leather and

we are also working with tanneries that are pioneers in ow impact

manufacturing and zero waste leather production.

Partners such as Scottish Leather Group source 98.6% of their

raw hides within the UK and Ireland, meaning transportation miles

are much lower, and they have their own water filtration and

recycling plant which enables them to re-use up to 40% of their

wastewater in leather production.

Across Europe, our tannery partners work with farms locally

within the EU to source hides for their leather production. We are

working with these pioneering tanneries to map and measure their

supply chains and follow traceability mechanisms from farm to

tannery.

Working with partners who source locally enables the level of

transparency required in building a future network of farms that

are invested in environmental stewardship.

3. Net Zero; Achieve net zero carbon emissions by 2035.

This commitment encompasses both the GHGs we emit directly and

those associated with our business activities, referred to as Scope

1, 2, and 3 emissions.

We are signatories of the UN Fashion Charter for Climate Action

and we are adopting a Science Based Target approach, working to set

an ambitious reduction strategy based on a 1.5 degree pathway

across Scope 1, 2, and 3.

We will continue to invest in renewable energy and nature-based

carbon offsetting solutions such as forest restoration through the

Woodland Trust and World Land Trust.

4. Repairs & Restoration; Continue to extend the life of

Mulberry products through repair and restoration.

We are passionate about extending the life of every Mulberry

product through repair, renewal, and repurposing. This commitment

is at the heart of our circular proposition, influencing the way we

design and manufacture, and the services we offer our

customers.

The Repairs Team at The Rookery, one of our Somerset factories

where we still make 50% of our bags, are masters in restoration,

breathing new life into more thank 10,000 bags every year, with

leather and hardware archives going back over 35 years.

5. Circular Economy; Buy back, resell or repurpose any Mulberry bag.

Our circular economy programme, The Mulberry Exchange was

launched in store in 2020, and on Mulberry.com in April 2021,

alongside a recently launched partnership with Vestiaire

Collective. The Mulberry Exchange enables customers to buy

pre-loved and vintage bags that have been expertly authenticated

and refurbished by the highly skilled artisans of our Somerset

repairs centre.

If the day comes that one of our bags really has reached the end

of the line, we will buy it back, and use it to power the

production of a new bag through an innovative energy reclaim system

unique to our strategic partner Muirhead, a member of the Scottish

Leather Group, ensuring that the line never ends, it just becomes a

circle.

6. Community; Extend our commitment to being a real Living Wage

employer by working with our network of suppliers to achieve the

same.

We are nothing without our people. All the actions we take are

dependent on their contribution and goodwill. For us, being net

positive is as much about the people and communities that we're a

part of as it is greenhouse gas emissions.

The baseline for us is being a real Living Wage employer and we

are extending that commitment by working with out suppliers to

achieve the goal that every person working within the Mulberry

supply chain is also paid a Living Wage, wherever that are in the

world.

We are focused on educating our workforce and building awareness

of the challenges facing women and minority groups in the work

environment and beyond. We are fostering a culture of open

discussion through our Diversity and Inclusion Committee that

supports our drive to facilitate positive change for all.

We also acknowledge that after the challenges of the past year,

team wellbeing has never been more important. We are focused

increasingly on mental health and wellbeing, and we have trained

mental health first aiders to support our employees across the

business.

Our Progress So Far;

Responsible innovation is the foundation of our creativity. We

design and make for today's lifestyles and better futures. We

believe products should be used and loved, repaired not

replaced.

Leather;

-- All leather will be sourced from environmentally accredited tanneries by Autumn/Winter 2022

-- Currently 80% of collection sourced from environmentally accredited tanneries

-- Founding partner of the Sustainable Leather Foundation, and members of LWG since 2012.

Link to key action 1, 2

Other Low Impact Materials;

-- All nylon sourced as regenerated ECONYL since Spring/Summer 2020

-- Launch of Eco Scotchgrain range in April 2021, made from recombined Bio-Plastic materials

-- Launch of sunglasses made from biodegradable and recyclable cellulose acetate in SS21

Link to key action 5

Carbon;

-- All UK operations carbon neutral since 2019

-- Working with charities such as the Woodland Trust to ensure efficient offsetting

-- Somerset factories work with Zero Waste to Landfill

providers, recovering energy from waste with cannot be reused or

recycled

-- Signatory of UN Fashion Industry Charter for Climate Action

-- In the process of mapping our carbon footprint

Link to key action 3

Product Circularity

-- Launched circular resell and buy back programme, The Mulberry Exchange in February 2020

-- Launched on Vestiaire Collective's Brand Approved program in March 2021

-- Repairs Centre restores over 10,000 bags a year

Link to key action 4, 5

Packaging;

-- Cupcycling introduced into customer packaging in January

2020, over 1.5 million coffee cups have been repurposed to make

Mulberry Green paper

-- All paper and card is FSC certified

-- All customer-facing packaging will be curb side recyclable by end of 2021

Link to key action 5

People & Community;

-- Produced over 15,000 reusable PPE gowns for frontline NHS healthcare workers in 2020

-- Raised GBP75,000 for the National Emergencies Trust in 2020

-- Worked with The Felix Project to provide over 177,000 meals

to those in need in December 2020.

-- Ongoing partnership with World Land Trust

-- Continue to manufacture over 50% of our bags in the UK and

invest in thriving apprenticeship program

Link to key action 6

GOING CONCERN

In determining whether the Group's accounts can be prepared on a

going concern basis, the Directors considered the Group's business

activities and cash requirements together with factors likely to

affect its performance and financial position, including the

current and future anticipated impact of COVID-19. The going

concern period reviews the 12-month period from the date of this

announcement to 31 July 2022.

The key judgements in relation to the going concern assessment

are in respect of the potential ongoing impact of COVID-19 on the

Group. They include the timing of the Group's recovery to

pre-COVID-19 trading levels in the UK, Europe and North America and

the likelihood and impact of further lockdowns in these regions,

including their duration and the impact on consumer demand in the

Group's markets. When making these judgements, the Directors

considered trading levels since the majority of the Group's stores

have re-opened and the outlook for the Group against their detailed

base case scenario. The Directors have also considered a reverse

stress test scenario and compared this to a reasonable worse case

downside scenario. These are described in further detail below.

The Group had net cash of GBP11.8m (2020: GBP7.2 million) and

deferred liabilities of GBP4.7m (2020: GBP3.0m) at 27 March 2021

and had not drawn down on its revolving credit facility.

Borrowing facilities

The Group has a GBP15m revolving credit facility with security

granted in favour of HSBC banking, which on 15 July 2021 was

extended for a further 12-month period to March 2023. Banking

covenants have been cautiously set to allow for further lockdowns

in the UK, Europe and North America and reduced revenue growth.

Covenants are tested on a quarterly basis and contain a net debt to

EBITDA ratio and a fixed charge cover ratio. Covenants are tested

on a 'frozen GAAP' basis and exclude the impact of IFRS 16. In

addition, the Group has a GBP4.0m overdraft facility and a further

USD1.9m overdraft facility in China, which are not committed

facilities and therefore not considered by the Directors as part of

the going concern assessment. The group overdraft is renewed

annually and the overdraft in China is renewed annually in

July.

The revolving credit facility was not drawn down at the period

end and remains undrawn at the date of this report. The Group had

net cash of GBP14.8m at 16 July 2021.

Base case scenario

The Directors' base case scenario assumes that revenues do not

recover to pre COVID-19 levels in the short term and there are no

further lockdowns in the Group's markets. The impact of COVID-19 on

the wider economy and the removal of the VAT Retail Export Scheme

in the UK will also have a consequential effect on demand. The base

case scenario assumes a 10% reduction in revenue for the financial

period ending 02 April 2022 against the financial period ending 28

March 2020 (pre-COVID-19 pandemic).

The Group is benefitting from further rates relief in the

current financial period, but no further relief or Government

support has been assumed after that point.

Under this scenario, banking covenants will be met and the

revolving credit facility remains undrawn although available to the

Group throughout the 12-month going concern period.

Reverse stress test and downside scenario

The Directors have reviewed a reverse stress test scenario that

models the decline in sales that the Group would be able to absorb

before triggering a breach of banking covenants. It should be noted

that the revolving credit facility is not forecast to be drawn down

under the reverse stress test, and therefore, despite the potential

covenant breach the revolving credit facility would not be

required. The Directors believe that this scenario is remote, for

the following reasons:

-- Trading during the first quarter of the period has been ahead

of the of the base case scenario. As demonstrated in previous

lockdowns, digital revenues are able to offset some of the lost

sales while stores are closed;

-- No further lockdowns are currently envisaged in the UK due to

the success of the UK vaccination program;

-- Revenue in this scenario is comparable with the prior period

where the Group was impacted by significant store closures for the

majority of the period; and

-- Further actions, including revenue opportunities, further

cost savings and working capital benefits are available.

The reverse stress test assumes a 20% reduction in revenue

against the base case scenario, offset by working capital

optimisation, capex savings and a 23% reduction in discretionary

costs (marketing, consumables, travel and other goods not for

resale). Inventory production and purchases have been reduced in

line with the anticipated demand under this scenario.

Under this scenario, the revolving credit facility remains

undrawn although available to the Group throughout the 12-month

going concern period, however, the fixed charge cover covenant

would be breached in May 2022. Whilst the Directors believe that

this scenario is remote, it would allow time for further actions to

be taken, including a possible further relaxation of banking

covenants. Whilst there is no guarantee that this will be agreed,

the Group currently maintains a good relationship with their

lender.

The Directors have considered a plausible but remote downside

scenario where the UK, Europe and North America experience a

4-month lockdown between October 2021 and January 2022. This

scenario assumes an uplift in digital sales while the stores are

closed in line with previous trends. No lockdown is assumed in

Asia, as early containment measures have proved effective in

curbing the pandemic. The impact of this would result in a 7%

reduction in Group revenue between October 2021 and January 2022

against the base case scenario.

Going concern basis

Based on the assessment outlined above, the Directors have a

reasonable expectation that the Group has access to adequate

resources to enable it to continue to operate as a going concern

for the foreseeable future. For these reasons, the Directors

consider it appropriate for the Group to continue to adopt the

going concern basis of accounting in preparing the Annual Report

and financial statements.

Group income statement

52 WEEKSED 27 MARCH 2021

52 weeks 52 weeks

ended ended

27 March 28 March

2021 2020

GBP'000 GBP'000

Revenue 114,951 149,321

Cost of sales (41,879) (58,203)

--------- ---------

Gross profit 73,072 91,118

Impairment charge related to property, plant

and equipment (590) (7,143)

Impairment charge related to right of use

assets (5,725) (24,947)

Store closure credit/(expense) 3,702 (886)

Lease modification 3,951 -

Other operating expenses (71,638) (102,255)

Other operating income 6,006 1,093

--------- ---------

Operating profit/(loss) 8,778 (43,020)

Share of results of associates (60) 49

Finance income 12 83

Finance expense (4,176) (4,978)

--------- ---------

Profit/(loss) before tax 4,554 (47,866)

Tax 43 998

--------- ---------

Profit/(loss) for the period 4,597 (46,868)

--------- ---------

Attributable to:

Equity holders of the parent 4,773 (44,136)

Non-controlling interests (176) (2,732)

--------- ---------

Profit/(loss) for the period 4,597 (46,868)

--------- ---------

Basic profit/(loss) per share 7.7p (78.9p)

Diluted profit/(loss) per share 7.7p (78.9p)

All activities arise from continuing operations.

Group statement of comprehensive income

52 WEEKSED 27 MARCH 2021

52 weeks 52 weeks

ended ended

27 March 28 March

2021 2020

GBP'000 GBP'000

Profit/(loss) for the period 4,597 (46,868)

Items that may be reclassified subsequently to

profit or loss

Exchange differences on translation of foreign

operations (49) 608

Gain on cash flow hedges - 123

Income tax relating to items that may be classified

subsequently to profit or loss - (129)

Total comprehensive income/(expense) for the period 4,548 (46,266)

--------- ---------

Attributable to:

Equity holders of the parent 4,294 (43,291)

Non-controlling interests 254 (2,975)

--------- ---------

Total comprehensive income/(expense) for the period 4,548 (46,266)

--------- ---------

Group balance sheet

AS AT 27 MARCH 2021

27 March 28 March

2021 2020

GBP'000 GBP'000

Non-current assets

Intangible assets 14,965 14,701

Property, plant and equipment 13,608 16,953

Right of use assets 33,511 45,920

Interests in associates 134 187

Deferred tax asset 1,234 1,488

--------- ---------------

63,452 79,249

--------- ---------------

Current assets

Inventories 31,476 34,853

Trade and other receivables 12,609 11,075

Current tax asset 525 420

Cash and cash equivalents 11,820 7,998

--------- ---------------

56,430 54,346

--------- ---------------

Total assets 119,882 133,595

--------- ---------------

Current liabilities

Trade and other payables (22,629) (21,955)

Lease liabilities (14,820) (15,329)

Borrowings - (3,424)

--------- ---------------

(37,449) (40,708)

--------- ---------------

Net current assets 18,981 13,638

--------- ---------------

Non-current liabilities

Lease liabilities (59,054) (76,775)

Borrowings (4,673) (2,591)

--------- ---------------

(63,727) (79,366)

Total liabilities (101,176) (120,074)

--------- ---------------

Net assets 18,706 13,521

--------- ---------------

Equity

Share capital 3,004 3,004

Share premium account 12,160 12,160

Own share reserve (1,277) (1,061)

Capital redemption reserve 154 154

Foreign exchange reserve 1,274 1,323

Retained earnings 6,957 1,761

Equity attributable to holders of the parent 22,272 17,341

Non-controlling interests (3,566) (3,820)

--------- ---------------

Total equity 18,706 13,521

--------- ---------------

Group statement of changes in equity

52 WEEKSED 27 MARCH 2021

Cash

Share Own Capital flow Foreign

Share premium share redemption hedge exchange Retained Non-controlling Total

capital account reserve reserve reserve reserve earnings Total interests equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at

30 March 2019 3,002 12,072 (1,378) 154 (100) 821 67,555 82,126 (1,419) 80,707

Impairment

on IFRS 16

transition - - - - - - (17,770) (17,770) - (17,770)

Loss for the

period - - - - - - (44,136) (44,136) (2,732) (46,868)

Other

comprehensive

income/(expense)

for the period - - - - 100 745 - 845 (243) 602

Total

comprehensive

income/(expense)

for the period - - - - 100 745 (44,136) (43,291) (2,975) (46,266)

Issue of share

capital 2 88 - - - - - 90 - 90

Credit for

employee

share-based

payments - - - - - - (24) (24) - (24)

Impairment

of shares

in trust - - 317 - - - (317) - - -

Non-controlling

interest foreign

exchange - - - - - (243) - (243) - (243)

Adjustment

arising from

movement in

non-controlling

interests - - - - - - (574) (574) 574 -

Dividends

paid - - - - - - (2,973) (2,973) - (2,973)

------------ -------------- ----------- ------------ ------------ ----------- ------------ -------- ---------------- --------

Balance at

28 March 2020 3,004 12,160 (1,061) 154 - 1,323 1,761 17,341 (3,820) 13,521

------------ -------------- ----------- ------------ ------------ ----------- ------------ -------- ---------------- --------

Profit/(loss)

for the period - - - - - - 4,773 4,773 (176) 4,597

Other

comprehensive

(expense)/income

for the period - - - - - (479) - (479) 430 (49)

Total

comprehensive

(expense)/income

for the period - - - - - (479) 4,773 4,294 254 4,548

Charge for

employee

share-based

payments - - - - - - 105 105 - 105

Own shares - - 101 - - - 5 106 - 106

Exercise of

share options - - - - - - (4) (4) - (4)

Release of

impairment

of shares

in trust - - (317) - - - 317 - - -

Non-controlling

interest foreign

exchange - - - - - 430 - 430 - 430

Balance at

27 March 2021 3,004 12,160 (1,277) 154 - 1,274 6,957 22,272 (3,566) 18,706

------------ -------------- ----------- ------------ ------------ ----------- ------------ -------- ---------------- --------

Group cash flow statement

52 WEEKSED 27 MARCH 2021

52 weeks 52 weeks

ended ended

27 March 28 March

2021 2020

GBP'000 GBP'000

Operating profit/(loss) for the period 8,778 (43,020)

Adjustments for:

Depreciation and impairment of property, plant

and equipment 4,777 13,627

Depreciation and impairment of right of use

assets 13,245 41,551

Amortisation of intangible assets 1,476 1,165

Gain on lease modifications and disposals (10,314) -

Loss/(profit) on sale of property, plant and

equipment 188 (16)

Own shares transferred from trust 106 -

Share-based payments (expense)/ credit 105 (24)

--------- ---------

Operating cash inflows

before movements in working capital 18,361 13,283

Decrease in inventories 3,420 5,006

(Increase)/decrease in receivables (1,534) 1,560

Increase in payables 75 1,848

--------- ---------

Cash generated from operations 20,322 21,697

Income taxes received 201 1,847

Interest paid (3,960) (4,978)

--------- ---------

Net cash inflow from operating activities 16,563 18,566

--------- ---------

Investing activities:

Interest received and gains on foreign exchange

contracts 12 83

Purchases of property, plant and equipment (1,895) (5,121)

Proceeds from disposal of property, plant and

equipment 26 39

Acquisition of intangible assets (2,233) (1,728)

Net cash used in investing activities (4,090) (6,727)

--------- ---------

Financing activities:

Dividends paid - (2,973)

Proceeds on issue of shares - 2

Increase in loans from non-controlling interests 167 783

Increase in loans from related parties - 1,707

Repayment of loans from non-controlling interests - (1,090)

Repayment of borrowings (750) (566)

Principle elements of lease payments (7,735) (14,257)

Settlement of share awards (4) -

--------- ---------

Net cash used in financing activities (8,322) (16,394)

--------- ---------

Net increase/(decrease) in cash and cash equivalents 4,151 (4,555)

--------- ---------

Cash and cash equivalents at beginning of period 7,998 12,377

Effect of foreign exchange rate changes (329) 176

--------- ---------

Cash and cash equivalents at end of period 11,820 7,998

--------- ---------

Cash and cash equivalents comprise cash and short-term bank

deposits with an original maturity of three months or less. The

carrying amount of these assets at the end of the reporting period

as shown in the consolidated statement of cash flows can be

reconciled to the related items in the Consolidated balance sheet

position as shown above. Cash and cash equivalents does not include

bank overdrafts that are not integral to the cash management of the

group.

SELECTED NOTES TO THE GROUP FINANCIAL STATEMENTS

1. BASIS OF PREPARATION

Mulberry Group plc, a Public Limited Company limited by shares

listed on AIM ("the Company"), is incorporated and domiciled in

England, United Kingdom. The Company acts as the holding company of

the Group. The Company's registration number is 01180514.

The financial information set out in this document does not

constitute the Group's statutory accounts for the 52 weeks ended 27

March 2021 or for the 52 weeks ended 28 March 2020.

Statutory accounts for the 52 weeks ended 28 March 2020 have

been delivered to the Registrar of Companies and those for the 52

weeks ended 27 March 2021 have been approved and will be delivered

to the Registrar of Companies following the Company's General

Meeting. The auditors have reported on those accounts, their

reports were unqualified and did not draw attention to any matters

by way of emphasis without qualifying their reports and did not

contain any statement under section 498 (2) or (3) of the Companies

Act 2006.

The financial statements and announcement for the period ended

27 March 2021 were approved and authorised for issue by the Board

of Directors on 20 July 2021.

2. SIGNIFICANT ACCOUNTING POLICIES

Basis of accounting

The financial statements have been prepared in accordance with

International Accounting Standards in conformity with the

requirements of the Companies Act 2006.

For the period ended 27 March 2021, the financial period runs

for the 52 weeks to 27 March 2021 (2020: 52 weeks ended 28 March

2020).

The financial statements are prepared under the historical cost

basis except for financial instruments that are measured at fair

values at the end of each reporting period as explained in the

accounting policies below. The principal accounting policies

adopted are set out below.

Going concern

The Directors have, at the time of approving the financial

statements, a reasonable expectation that the Company and the Group

have adequate resources to continue in operational existence for

the foreseeable future. As a result, they continue to adopt the

going concern basis of accounting in preparing the financial

statements.

3. BUSINESS AND GEOGRAPHICAL SEGMENTS

IFRS 8 requires operating segments to be identified on the basis

of internal reports about components of the Group that are

regularly reviewed by the Chief Operating Decision Maker, defined

as the Board of Directors, to allocate resources to the segments

and to assess their performance. Inter-segment pricing is

determined on an arm's length basis. The Group also presents

analysis by geographical destination and product categories.

(a) Business segment

The Group has identified one reportable segment.

The principal activities are as follows:

The accounting policies of the reportable segment are the same

as described in the Group's financial statements. Information

regarding the results of the reportable segment is included below.

The distribution of product globally is monitored and optimised at

a Group level and effected via the Group's distribution centres in

the UK, Europe, North America and Asia. Performance for the segment

is assessed based on operating profit/(loss).

The Group designs, manufactures and manages the Mulberry brand

for the segment and therefore the finance income and expense are

attributable to this segment.

Group income statement

52 weeks 52 weeks

ended ended

27 March 28 March

2021 2020

GBP'000 GBP'000

Revenue

Retail 43,586 89,167

Digital 56,365 36,242

Wholesale 15,000 23,912

--------- ---------

Total revenue 114,951 149,321

Cost of sales (41,879) (58,203)

--------- ---------

Gross profit 73,072 91,118

Impairment charge related to property, plant

and equipment (590) (7,143)

Impairment charge related to right of use assets (5,725) (24,947)

Store closure credit/(expense) 3,702 (886)

Lease modification 3,951 -

Operating expenses (71,638) (102,255)

Other operating income 6,006 1,093

--------- ---------

Operating profit/(loss) 8,778 (43,020)

Share of results of associates (60) 49

Finance income 12 83

Finance expense (4,176) (4,978)

--------- ---------

Profit/(loss) before tax 4,554 (47,866)

Tax 43 998

--------- ---------

Profit/(loss) for the period 4,597 (46,868)

Segment capital expenditure 3,996 6,401

Segment depreciation and amortisation* 19,498 56,343

Segment assets* 118,648 131,863

Segment liabilities 101,176 120,074

'* The prior year numbers were restated to

reflect the correct disclosure presentation.

For the purposes of monitoring the segment performance and

allocating resources the Chief Operating Decision Maker, which is

deemed to be the Board, monitors the tangible, intangible and

financial assets. All assets are allocated to the reportable

segment.

(b) Geographical markets

Sales revenue Non-current assets

by by

geographical market(1) geographical market

52 weeks 52 weeks

ended ended

27 March 28 March 27 March 28 March

2021 2020 2021 2020

GBP'000 GBP'000 GBP'000 GBP'000

UK 68,573 98,813 50,792 65,449

Rest of Europe 15,014 19,584 8,487 9,749

Asia 24,636 21,407 3,362 3,259

North America 6,261 9,038 811 792

Rest of world 467 479 - -

------------ ----------- ---------- ----------

Total revenue 114,951 149,321 63,452 79,249

------------ ----------- ---------- ----------

(1) Revenue by geographical market includes wholesale and

digital sales based on the location of the customer.

(c) Product categories

Leather accessories account for over 90% of the Group's

revenues, of which bags represent over 70% of revenues. Other

important product categories include small leather goods, shoes,

soft accessories and women's ready-to-wear. Net asset information

is not allocated by product category.

4. ALTERNATIVE PERFORMANCE MEASURES

A reconciliation of reported loss before tax to underlying

profit/(loss) before tax is set out below;

52 weeks 52 weeks

ended ended

27 March 28 March

Reconciliation to underlying profit/(loss) 2021 2020

before tax: GBP'000 GBP'000

Profit/(loss) before tax 4,554 (47,866)

Restructuring costs 2,370 676

Store closure (credit)/costs (3,702) 886

Impairment charge related to property, plant

and equipment 590 7,143

Impairment charge related to right of use

assets 5,725 24,947

Lease modification (3,951) -

Licence agreement exit costs 300 -

Underlying profit/(loss) before tax - non-GAAP

measure 5,886 (14,214)

Adjusted basic earnings/(loss) per share 10.5p (22.4p)

Adjusted diluted earnings/(loss) per share 10.5p (22.4p)

In reporting financial information, the Group presents

Alternative Performance Measures ("APMs"), which are not defined or

specified under the requirements of IFRS. The Group believes that

these APMs, which are not considered to be a substitute for, or

superior to, IFRS measures, provide stakeholders with additional

helpful information on the performance of the business. These APMs

are consistent with how the business performance is planned and

reported within the internal management reporting to the Board of

Directors. Some of these measures are also used for the purpose of

setting remuneration targets. The Group makes certain adjustments

to the statutory profit or loss measures in order to derive APMs.

Adjusting items are those items which, in the opinion of the

directors, should be excluded in order to provide a consistent and

comparable view of the performance of the Group's ongoing business.

Generally, this will include those items that are largely one-off

and material in nature as well as income or expenses relating to

acquisitions or disposals of businesses or other transactions of a

similar nature. Treatment as an adjusting item provides

stakeholders with additional useful information to assess the

year-on-year trading performance of the Group.

Restructuring costs

During the period, one-off charges of GBP2,370,000 (2020:

GBP676,000) were incurred relating to people restructuring

costs.

Store closure costs

During the period, two UK and two international stores were

closed (2020: one international store) which had not been trading

in line with expectations. The stores closure credit relates to the

release to the Income Statement of lease liabilities net of lease

exit and redundancy costs. The right of use and tangible assets for

these stores had been fully impaired in the 52 weeks ended March

2020.

Impairment charge related to property, plant and equipment and

right of use assets

The fixed assets and right of use assets of retail stores are

subject to impairment based on whether current or future events and

conditions suggest that their recoverable amount may be less than

their carrying value. The recoverable amount of each store is based

on the higher of the value in use and fair value less costs to

dispose. Value in use is calculated from expected future cash flows

using suitable discount rates, management assumptions and estimates

on future performance. The carrying value for each store is

considered net of the carrying value of any cash contribution

received in relation to that store. For impairment testing

purposes, the Group has determined that each store is a separate

cash-generating unit (CGU). Each CGU is tested for impairment if

any indicators of impairment have been identified. The value in use

of each CGU is calculated based on the Group's latest budget and

forecast cash flows. Cash flows are discounted using the weighted

average cost of capital ("WACC") and are modelled for each store

through to their lease expiry or break date. No lease extensions

have been assumed when forecasting. As a result of this assessment

impairment charges of GBP590,000 (2020: GBP7,143,000) and

GBP5,725,000 (2020: GBP24,947,000) were recognised in the period

against the property, plant and equipment and right of use assets

respectively for the stores which are impaired.

Lease modification

During the period the Group renegotiated a lease that had 14

years remaining to one where only 9 years remain as at March 2021.

The resulting reduction in the lease liability was treated as an

IFRS 16 lease modification. The resulting remeasurement of the

lease liability was in excess of the right of use asset and

resulted in a credit of GBP3,951,000 (2020: GBPnil) to the Income

Statement.

Licence agreement exit costs

During the period the Group incurred charges of GBP300,000

(2020: GBPnil) from the write-off of its ready-to-wear and footwear

licence relating to final samples and materials on non-renewal of

the licence and distribution agreement for these lifestyle

products.

5. OTHER OPERATING EXPENSES

52 weeks 52 weeks

ended ended

27 March 28 March

2021 2020

GBP'000 GBP'000

Other operating expenses have been arrived at after

charging/(crediting):

Net foreign exchange gain/(loss) 388 (796)

Amortisation of intangible assets 1,476 1,165

Depreciation of property, plant and equipment 4,187 6,484

Depreciation of right of use assets 7,520 16,604

Staff costs 36,330 44,418

Restructuring costs 2,370 676

Loss/(profit) on disposal of property, plant and equipment

and right of use assets 188 (16)

Bad debt expense/(credit) (592) 506

Other operating expenses 19,771 33,214

--------- ---------

71,638 102,255

6. DIVIDENDS

52 weeks 52 weeks

ended ended

27 March 28 March

2021 2020

GBP'000 GBP'000

Dividend for the period ended 28 March 2020 of nil

(2019: 5p) per share - 2,973

--------- ---------

Proposed dividend for the period ended 27 March 2021

of nil per share (2020: nil) - -

--------- ---------

7. EARNINGS PER SHARE ('EPS')

52 weeks 52 weeks

ended ended

27 March 28 March

2021 2020

pence pence

Basic loss per share 7.7 (78.9)

Diluted loss per share 7.7 (78.9)

Underlying basic earnings/(loss) per share 10.5 (22.4)

Underlying diluted earnings/(loss) per share 10.5 (22.4)

Earnings per share is calculated based on the following

data:

52 weeks 52 weeks

ended ended

27 March 28 March

2021 2020

GBP'000 GBP'000

Profit/(loss) for the period for basic and diluted earnings

per share 4,597 (46,868)

Adjusting items:

Restructuring costs* 1,931 584

Store closure credit/(costs)* (3,611) 886

Impairment relating to retail assets 590 7,143

Impairment charge related to right of use assets 5,725 24,947

Lease modification* (3,200) -

Licence agreement exit costs* 243 -

Profit/(loss) for the period for underlying basic and

diluted earnings per share 6,275 (13,308)

--------- ---------

*These items are included net of GBP346,000 (2020: GBP92,000

credit) of the corresponding tax expense.

52 weeks 52 weeks

ended ended

27 March 28 March

2021 2020

Million Million

Weighted average number of ordinary shares for the

purpose of basic EPS 59.5 59.4

Effect of dilutive potential ordinary shares: share

options - -

Weighted average number of ordinary shares for the

purpose of diluted EPS 59.5 59.4

--------- ---------

The weighted average number of ordinary shares in issue during

the period excludes those held by the Mulberry Group plc Employee

Share Trust.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR DKDBPDBKKAOB

(END) Dow Jones Newswires

July 21, 2021 02:00 ET (06:00 GMT)

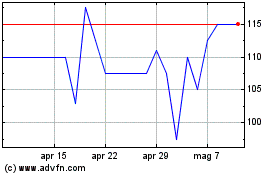

Grafico Azioni Mulberry (LSE:MUL)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Mulberry (LSE:MUL)

Storico

Da Apr 2023 a Apr 2024