Nexity : 9M 2020 business activity and revenue : Very good

performance of Nexity during the first nine months of the year

showing the strong resilience of its business model

|

9M 2020 BUSINESS ACTIVITY AND REVENUEVERY

GOOD PERFORMANCE OF NEXITY DURING THE FIRST NINE MONTHS OF THE YEAR

SHOWING THE STRONG RESILIENCE OF ITS BUSINESS

MODELGUIDANCE FOR 2020 AND 2021

SPECIFIED |

| |

| Paris, Wednesday

28 October 2020, 5:45 p.m.

CET |

9M 2020 business activity and revenue

- Strong growth in our market shares for new homes in

France: +4.3 points (16,4% in H1 2020 compared to 12,1% in

H1 2019)

- New home reservations in France: 13,635 units

representing €2,948 million (down 3% by volume and

up 4% by value)

- Commercial Real Estate order intake: €230 million

excluding VAT

- Development backlog: €5.7 billion (up 12% from

end-December 2019)

- Revenue: €2,737 million (down 2% from 9M

2019)

Guidance

for 2020 and 2021

2020 business activity

- New home reservations for Nexity: around 20,000 units,

expected to substantially outperform the market

- High level of Commercial real estate new orders

expected in Q4

Financial aspects

- Revenue of at least €4.2 billion in

2020, with a current operating margin

of around 5%, reaching a low

point

- For 2021, revenue growth of at least 10% relative to

2020 and a current operating margin of at least

7%

- Development pipeline (backlog + land under

options) of around €20 billion

- Net financial debt (before lease liabilities)

less than €1.2 billion at 31 December

2020

This guidance is based on business

assumptions considering new lockdown measures but excluding an

extended shutdown of construction sites.

Alain Dinin, Chairman and CEO of Nexity,

commented:

“After a start to the year marked by the shock

of a widespread lockdown, Nexity saw its business activity recover

starting in June, and this recovery has continued since then, with

the second wave of the Covid-19 pandemic not significantly

affecting our businesses today, although it has obviously weighed

on French consumer confidence.

Our new home reservations in the first nine

months of the year were almost equivalent by volume to those

recorded in 9M 2019 and were even higher by value. French housing

demand remained high, and Nexity demonstrated its capacity to meet

this demand. The introduction of stricter bank conditions weighed

on the solvency of lower-income clients, but strong demand from

institutional investors helped us offset this impact. Thanks to

Nexity’s geographic distribution, the diversity of our products and

client types, and our land sourcing capacity, we confirmed and

expanded our leadership position in our market. The ground-breaking

agreement we signed with Gecina to develop 4,000 homes together

illustrates this.

In the office space market, Nexity has confirmed

the steady development of the programmes in its portfolio, secured

by commitments made by high-calibre investors and users, and is

preparing to respond to the new context with unique solutions that

stand out with regard to their environmental performance, carbon

footprint and integration of services and user features.

With a new organisation2, Nexity has entered a

new phase in the development of our Property Management for

Individuals activities, making the client our teams’ number-one

priority by developing close relationships focused on quality of

service, offering solutions tailored to each client profile,

upgrading our digital tools and expanding our geographic coverage

to bolster our local presence.

For Nexity – France’s number-one timber-frame

developer and the first operator to achieve E3C2 certification for

a commercial building, deeply committed to championing an

environmentally responsible approach – the now central role of

energy renovation confirms the relevance of our Property Management

for Individuals businesses, with nearly 20,000 buildings managed on

behalf of condominium owners.

Based on these elements, and barring the

implementation of lockdown measures resulting in an extended

shutdown of construction sites, we are now ready to specify our

guidance:

- Around 20,000 new home reservations expected this year

- Revenue of at least €4.2 billion in 2020, and growth of at

least 10% in 2021

- Current operating margin of around 5% (low point) in 2020

and at least 7% in 2021

- Development pipeline of around €20 billion

- Net financial debt at 31 December 2020 less than €1.2

billion.

Lastly, Nexity has launched an assessment of the

performance and capacity to create value of the Group’s different

business lines and their relevance in offering our clients the

expanded range of services they are looking for, which will be used

to update our strategic plan. This plan will be presented to our

different stakeholders when we publish our 2020 accounts.”

***

9M 2020 BUSINESS ACTIVITY

INDIVIDUAL CLIENTS

Residential Real Estate

In the first six months of 2020, the MALONE3

market totalled 57,732 reservations, down 26% with respect to

end-June 2019. Market trends were primarily held back by a supply

deficit aggravated by the re-evaluation of local urban planning

policies following the shift in power that took place after the

second round of local elections in France. This supply shortage

resulted in an increase in prices, despite the fact that they

should logically decrease. In this context, Nexity demonstrated its

resilience and its market share surged to 16.4%, 4 points higher

than at 30 June 2019 (12.1%).

For full-year 2020, Nexity anticipates a sharp

downturn in the French market for new homes4 (around 125,000 units,

down around 25% compared to 2019), with a sharp decline in the

retail sales sector due to the lockdown period and the ongoing

public health crisis, while bulk sales are expected to grow,

spurred on by institutional investors’ appetite for residential

property. Nexity’s market share should continue to grow thanks to

its multi-product, multi-service and multi-brand strategy; its

geographical positioning, which is concentrated in Greater Paris

and major cities, where underlying demand is very buoyant; and its

unrivalled offering of products and services, enabling the Group to

meet the needs of all types of clients.

At end-September 2020, net new home reservations

in France totalled 13,635 units for €2,948 million including VAT,

down 3% by volume and up 4% by value with respect to end-September

2019.

This increase in reservations was mainly

concentrated in bulk sales (up 55% relative to 9M 2019), and more

specifically the growth in reservations made by institutional

investors (which tripled relative to 9M 2019). This change

reflected Nexity’s ability to adapt its offering to respond to this

demand. The firm commitment signed with CDC Habitat in April 2020

for 7,450 housing units contributed to reservations for the period

(2,880 reservations at end-September 2020, more than 2,000 of which

should have notarial deeds of sale signed by the end of the year),

but a growing number of other institutional investors have also

approached the Group. They include Gecina, with which the Group

signed an innovative partnership in early October5 to develop 4,000

new homes over a four-year period in supply-constrained areas.

Conversely, retail sales were lower (down 28%

from 9M 2019) amidst the public health crisis. First-time buyers

were also affected by the introduction of stricter conditions for

mortgage approval, despite financing terms remaining highly

attractive (1.22% on average in September 2020). Individual

investors also showed a certain wait-and-see attitude in view of

the current economic situation.

In the third quarter of 2020 alone, reservations

were down 8% by volume and up 2% by value at 4,184 units and €925

million including VAT, due to the supply deficit. Retail sales were

down 17% compared to Q3 2019, partially offset by a 7% increase in

bulk sales over the same period.

After including subdivisions (901 units, down

28% compared to 9M 2019, in line with the change observed in the

individual client market) and international sales (432

reservations, up 29% relative to 9M 2019), business activity for

Residential Real Estate at end-September 2020 came to 14,968 units

reserved and €3,088 million including VAT, down 4% by volume and up

3% by value relative to 9M 2019.

The average price including VAT of new homes

reserved by Nexity’s individual clients at end-September 2020 was

€241 thousand, up 6% compared to end-September 2019, due both to

the increase in the average floor area per home (up 2%) and the

average price per square metre including VAT (up 4%), amid a

context of lower volumes and supply shortage.

The average level of pre-selling booked at the

start of construction work was very high (76% at end-September

2020). The supply of homes for sale dropped back 18% from its level

at end-December 2019 to stand at 7,271 units at end-September 2020,

due to a particularly swift take-up period of 4.1 months6

(compared with 5.1 months in 9M 2019). Unsold completed stock

(72 units) as a proportion of the total supply for sale

remained very low.

At end-September 2020, the business potential

for new homes7 was down 7% from year-end 2019 and came to 51,365

units. This represented potential revenue of €9.6 billion excluding

VAT. This change reflected the one-off impact of the spring

lockdown and changes in political leadership at the local

government level with respect to project structuring. Including

subdivisions and international operations, the business potential

of Residential Real Estate represented €12.1 billion in potential

revenue excluding VAT.

Real Estate Services to Individuals

Property Management for Individuals

The portfolio of units under management amounted

to over 878,000 units at 30 September 2020, a slight decrease (down

0.7% from end-December 2019. This portfolio stability was due in

part to the postponement of annual meetings of condominium owners

that should have been held during the second quarter, which delayed

the renewal of managing agent mandates.

Brokerage activities (lettings and sales by

Nexity agencies and Century 21 franchises) gradually returned to a

satisfactory level of business activity, continuing the strong

recovery observed in June 2020.

Serviced residences

Nexity Studéa had 124 student

residences under management at 30 September 2020, totalling more

than 15,000 units (remaining stable since end-December 2019). The

marketing campaign for the 2020/2021 university year was not

affected by the public health crisis. At end-September 2020, the

occupancy rate returned to its normal level and came to 98%.

Domitys opened 10 new

residences since the beginning of the year, bringing its portfolio

to 110 serviced residences and over 12,500 residential units.

At end-September 2020, the rolling 12-month occupancy rate was 85%,

representing a slight increase relative to end-December 2019

(84%).

Distribution activities

In the period to end-September 2020,

iSelection and PERL recorded 2,700 reservations

(down 21% compared to 9M 2019). This decrease was in line with the

contraction of the individual investor market.

COMMERCIAL CLIENTS – NEXITY ENTERPRISE

SOLUTIONS8

Commercial Real Estate

As a result of the public health crisis, take-up

of office space in the Paris region and the overall amount of

investment in commercial real estate in France in the period to

end-September 2020 decreased sharply (down 46% and 33%,

respectively, relative to 9M 2019).

Order intake in the first nine months of 2020

was €230 million excluding VAT.

Business potential for Commercial Real Estate6

totalled €2.8 billion at end-September 2020 (down 6% from year-end

2019). This includes the La Garenne-Colombes eco-business park

project for approximately one billion euros (Nexity’s share), which

has been secured under a purchase agreement since Q4 2019 and is

still scheduled to be sold in the fourth quarter.

Real Estate Services to Companies

At end-September 2020, the volume of units under

management totalled 19.5 million sq.m, stable with respect to

year-end 2019.

At end-September 2020, Morning – a leading

player in the Paris coworking space market – operated 24 coworking

spaces totalling more than 55,000 sq.m and corresponding to

around 6,500 workstations. Given the length of lease terms,

and in line with our expectations, the occupancy rate was slightly

lower than in June 2020 (69% versus 77%).

BACKLOG AND BUSINESS POTENTIAL AT 30

SEPTEMBER 2020

The Group’s backlog at end-September 2020 stood

at €5,719 million (€5,397 million for Residential Real Estate and

€321 million for Commercial Real Estate).

Furthermore, development business potential at

end-September 2020 totalled over €14.9 billion in revenue

(€12.1 billion for Residential Real Estate and €2.8 billion

for Commercial Real Estate), providing the Group with high

visibility on its future business levels.

SOCIAL AND ENVIRONMENTAL

RESPONSIBILITY

The public health crisis and the spring lockdown

revealed or accelerated several pre-existing underlying trends in

the real estate market: the desire to be closer to nature; the need

for modular, flexible living spaces and workspaces; the rise of

sustainable transport; and concerns about indoor air quality.

Nexity is committed to making cities inclusive

and sustainable and aims to respond to its different Clients’ needs

with immediate, real-world solutions adapted to the current

context, as well as more long-term solutions for which the Group

plans to accelerate the development and/or widespread rollout.

The Group wishes to include access to nature in

its residential real estate programmes. Today, 90% of programmes

delivered include outside living space and access to private or

shared green space. Eventually the Group aims to make this

100%.

For a number of years Nexity has offered its

condominium owner clients tailored energy renovation solutions to

help them actively manage expenses while improving everyday comfort

and the value of their property. In this regard, the French

government’s energy stimulus plan should boost the Group’s

activities.

Nexity’s commitment to pursuing an ambitious

low-carbon policy was illustrated in particular by the completion

of the Palazzo Nice Méridia, France’s tallest timber-frame office

building with E+C- (positive-energy, low-carbon) certification,

which is the first commercial building in France to obtain the E3C2

level.

In September 2020, Nexity obtained Great Place

to Work certification for the Group in France, recognising its

approach taken for a number of years focused on making the Group an

employer of choice.

9M 2020 CONSOLIDATED REVENUE –

OPERATIONAL REPORTING9

Revenue for the first nine

months of 2020 was €2,737 million, down €68 million or 2% compared

to 9M 2019, versus the 7% drop in H1 2020 compared to H1 2019. This

change resulted from an excellent performance achieved in the third

quarter (€1,021 million, up 6% relative to Q3 2019).

|

(in millions of euros) |

|

9M 2020 |

|

9M 2019 |

|

% change |

| Individual Clients |

|

2,292.5 |

|

2,452.2 |

|

-6.5% |

| Residential Real Estate* |

|

1,640.0 |

|

1,797.1 |

|

-8.7% |

| Real Estate Services to Individuals |

|

652.5 |

|

655.1 |

|

-0.4% |

|

Property Management for Individuals (incl. franchises) |

|

246.2 |

|

268.6 |

|

-8.3% |

|

Serviced residences |

|

248.2 |

|

223.7 |

|

+10.9% |

|

Distribution activities |

|

158.0 |

|

162.8 |

|

-2.9% |

| Commercial Clients |

|

444.6 |

|

351.7 |

|

+26.4% |

| Commercial Real Estate* |

|

368.6 |

|

282.4 |

|

+30.5% |

| Real Estate Services to Companies |

|

76.0 |

|

69.3 |

|

+9.6% |

| Other Activities |

|

0.0 |

|

0.9 |

|

n.s. |

|

Revenue |

|

2,737.1 |

|

2,804.9 |

|

-2.4% |

* Revenue generated by Residential Real Estate

and Commercial Real Estate from VEFA off-plan sales and CPI

development contracts is recognised using the

percentage-of-completion method, i.e. on the basis of notarised

sales and pro-rated to reflect the progress of all inventoriable

costs.

Revenue for the Residential Real

Estate division was down €157 million or 9% relative to 9M

2019. In the third quarter alone, revenue was up 12% with respect

to Q3 2019 and reflected business activity starting up again after

the lockdown period. Revenue generated by the German subsidiary

Pantera, acquired in March 2020, was not significant over the

period.

Real Estate Services to

Individuals posted revenue of €652 million for the period

ended 30 September 2020 (stable with respect to 9M 2019). In the

third quarter alone, revenue was up 6% with respect to Q3 2019.

Growth in the portfolio of serviced residences and the strong

recovery in distribution activities (up 13% in Q3 2020) offset

lower business activity in Property Management for Individuals and

franchises (down 2% in Q3 2020).

Revenue growth in Commercial Real

Estate (up €86 million or 31% compared to 9M 2019) mainly

arose from the sale of the completed Influence 2.0 building in

Saint-Ouen (Seine-Saint-Denis)10 in the second quarter.

Revenue from Real Estate Services to

Companies amounted to €76 million, up €7 million. While

Morning posted revenue growth for the first nine months of the year

(€5 million), revenue was affected by lower occupancy rates at its

shared workspaces than at the beginning of the year, following the

lockdown period.

REVENUE UNDER IFRS

In IFRS terms, revenue to end-September 2020

totalled €2,554 million, down 4% relative to 9M 2019. This figure

excludes revenue from joint ventures, in accordance with IFRS 11,

which requires joint ventures – proportionately consolidated in the

Group’s operational reporting – to be accounted for using the

equity method.

GUIDANCE FOR 2020 AND 2021

Nexity has good visibility, with a backlog of

nearly €6 billion, business potential totalling nearly €15 billion

in development revenue, and a strong cash position, with €919

million in cash and €355 million in confirmed undrawn bank

borrowing facilities. The Group, which suspended its guidance on 7

April 2020, has specified its guidance for 2020 and 2021, within

the still-fraught context of the public health crisis considering

the implementation of lockdown measures but excluding an extended

shutdown of construction sites:

2020 business activity

- New home reservations for Nexity: around 20,000 units,

expected to substantially outperform the market

- High level of Commercial real estate new orders

expected in Q4

Financial aspects

- Revenue of at least €4.2 billion in

2020, with a current operating margin

of around 10%, reaching a low

point

- For 2021, revenue growth of at least 5% relative to

2020 and a current operating margin of at least

7%

- Development pipeline (backlog + land under

options) of around €20 billion

- Net financial debt (before lease liabilities)

less than €1.2 billion at 31 December

2020.

FINANCIAL CALENDAR & PRACTICAL

INFORMATION

|

2020 annual results (after market close) |

Wednesday, 24 February 2021 |

|

Q1 2021 revenue and business activity (after market close) |

Wednesday, 28 April 2021 |

|

2021 Shareholders’ Meeting |

Wednesday, 19 May 2021 |

|

2021 interim results (after market close) |

Wednesday, 28 July 2021 |

A conference call on 9M 2020

revenue and business activity will be held today in English at 6:30

p.m. CET, which may be accessed using code 1236373 by calling one

of the following numbers:

|

- Calling from France |

+33 (0)1 76 77 22 57 |

|

- Calling from elsewhere in

Europe |

+44 (0)330 336 9411 |

|

- Calling from the United States |

+1 720 452 9217 |

The presentation accompanying this conference

will be available on the Group’s website from 6:15 p.m. CET and may

be viewed at the following address:

https://orange.webcasts.com/starthere.jsp?ei=1385552&tp_key=f1f7879e9b

The conference call will be available on replay

at https://www.nexity.fr/en/group/finance from the following

day.

Disclaimer

The information, assumptions and estimates that

the Company could reasonably use to determine its targets are

subject to change or modification, notably due to economic,

financial and competitive uncertainties. Furthermore, it is

possible that some of the risks described in Section 2 of the

Universal Registration Document filed with the AMF under number

D.20-0280 on 9 April 2020, as revised by an amendment filed with

the AMF on 28 April 2020, could have an impact on the Group’s

operations and the Company’s ability to achieve its targets.

Accordingly, the Company cannot give any assurance as to whether it

will achieve its stated targets and makes no commitment or

undertaking to update or otherwise revise this information.

AT NEXITY, WE AIM TO SERVE ALL OUR CLIENTS AS THEIR REAL

ESTATE NEEDS EVOLVE

With more than 11,000 employees and €4.5 billion

in revenue, Nexity is France’s leading integrated real estate

group, with a nationwide presence and business operations in all

areas of real estate development and services for individuals,

companies and local authorities.Our services platform is designed

to serve all our clients as their real estate needs evolve.Firmly

committed to focusing on people and how they are connected with

each other, their cities and the environment, Nexity was ranked the

number-one low-carbon real estate developer in France by BBCA in

2019, is a member of the Bloomberg Gender-Equality Index (GEI) and

obtained Great Place to Work certification in 2020.Nexity is listed

on the SRD, Euronext’s Compartment A and the SBF 120.

CONTACTSDomitille Vielle – Head of Investor

Relations / +33 (0)1 85 55 19 34 –

investorrelations@nexity.frGéraldine Bop – Deputy Head of Investor

Relations / +33 (0)1 85 55 18 43 – investorrelations@nexity.fr

ANNEX 1: OPERATIONAL REPORTING

Reservations: Residential Real Estate

|

Reservations (units and €m) |

|

9M 2020 |

|

9M 2019 |

|

% change |

| New homes

(France) |

|

13,635 |

|

14,043 |

|

-2.9% |

|

Subdivisions |

|

901 |

|

1,252 |

|

-28.0% |

|

International |

|

432 |

|

334 |

|

+29.3% |

|

Total reservations (number of units) |

|

14,968 |

|

15,629 |

|

-4.2% |

| New homes

(France) |

|

2,948 |

|

2,833 |

|

+4.1% |

|

Subdivisions |

|

74 |

|

101 |

|

-26.6% |

|

International |

|

65 |

|

53 |

|

+23.9% |

|

Total reservations (€m incl. VAT) |

|

3,088 |

|

2,987 |

|

+3.4% |

|

Breakdown of new home reservations by client – France |

|

9M 2020 |

|

9M 2019 |

| Homebuyers |

|

2,305 |

|

17% |

|

3,041 |

|

22% |

|

o/w: - First-time buyers |

|

1,970 |

|

14% |

|

2,420 |

|

17% |

|

-

Other homebuyers |

|

335 |

|

2% |

|

621 |

|

4% |

| Individual

investors |

|

4,680 |

|

34% |

|

6,721 |

|

48% |

| Professional

landlords |

|

6,650 |

|

49% |

|

4,281 |

|

30% |

|

o/w: - Institutional investors |

|

4,201 |

|

31% |

|

1,520 |

|

11% |

|

- Social

housing operators |

|

2,449 |

|

18% |

|

2,761 |

|

20% |

|

Total |

|

13,635 |

|

100% |

|

14,043 |

|

100% |

Real Estate Services to Individuals

|

Property Management for Individuals – Portfolio of units under

management |

|

Sept. 2020 |

|

Dec. 2019 |

|

Change |

|

- Condominium management |

|

704,000 |

|

709,000 |

|

-0.8% |

|

- Rental management |

|

174,000 |

|

175,000 |

|

-0.2% |

|

Franchise networks – Century 21 |

|

|

|

|

|

|

|

- Number of agencies |

|

899 |

|

898 |

|

+0.1% |

|

Serviced residences – Students – Studéa |

|

|

|

|

|

|

|

- Number of residences in operation |

|

124 |

|

124 |

|

0 |

|

- Rolling 12-month occupancy rate |

|

94.2% |

|

94.7% |

|

-0.5

pts |

|

Serviced residences – Seniors – Domitys |

|

|

|

|

|

|

|

- Total number of residences in operation |

|

110 |

|

100 |

|

+10 |

|

o/w: Number of residences opened more than 2 years ago

(France) |

|

72 |

|

58 |

|

+14 |

|

- Rolling 12-month occupancy rate |

|

85.0% |

|

84.2% |

|

+0.8

pts |

|

Distribution activities – iSelection and PERL |

|

Sept. 2020 |

|

Sept. 2019 |

|

|

|

- Total reservations |

|

2,700 |

|

3,406 |

|

-20.7% |

|

- Reservations on behalf of third parties |

|

1,521 |

|

1,929 |

|

-21.2% |

QUARTERLY FIGURES

Reservations: Residential Real Estate

| |

|

2020 |

|

2019 |

|

2018 |

|

Number of units |

|

Q3 |

Q2 |

Q1 |

|

Q4 |

Q3 |

Q2 |

Q1 |

|

Q4 |

Q3 |

Q2 |

Q1 |

| New homes

(France) |

|

4,184 |

5,794 |

3,657 |

|

7,794 |

4,557 |

5,603 |

3,883 |

|

6,600 |

4,757 |

4,634 |

3,618 |

| Subdivisions |

|

244 |

297 |

360 |

|

836 |

435 |

559 |

258 |

|

812 |

336 |

576 |

339 |

|

International |

|

193 |

74 |

165 |

|

307 |

161 |

137 |

36 |

|

170 |

80 |

75 |

40 |

|

Total (number of units) |

|

4,621 |

6,165 |

4,182 |

|

8,937 |

5,153 |

6,299 |

4,177 |

|

7,582 |

5,173 |

5,285 |

3,997 |

|

Value (€m incl. VAT) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| New homes

(France) |

|

925 |

1,231 |

792 |

|

1,529 |

909 |

1,150 |

773 |

|

1,327 |

922 |

951 |

715 |

| Subdivisions |

|

19 |

25 |

30 |

|

76 |

35 |

46 |

20 |

|

63 |

28 |

51 |

28 |

|

International |

|

29 |

11 |

26 |

|

47 |

37 |

13 |

3 |

|

15 |

7 |

6 |

4 |

|

Total (€m incl. VAT) |

|

973 |

1,267 |

847 |

|

1,652 |

981 |

1,209 |

797 |

|

1,405 |

956 |

1,008 |

747 |

Revenue

| |

|

2020 |

|

2019 |

|

2018 |

|

(in millions of euros) |

|

Q3 |

Q2 |

Q1 |

|

Q4 |

Q3 |

Q2 |

Q1 |

|

Q4 |

Q3 |

Q2 |

Q1 |

| Individual Clients |

|

930.7 |

659.4 |

702.4 |

|

1,562.0 |

840.8 |

849.4 |

761.6 |

|

1,470.3 |

764.3 |

712.3 |

603.1 |

| Residential Real Estate |

|

690.1 |

459.0 |

490.9 |

|

1,251.9 |

615.2 |

629.4 |

552.5 |

|

1,133.8 |

545.3 |

524.2 |

445.1 |

| Real Estate Services to Individuals |

|

240.5 |

200.4 |

211.5 |

|

310.1 |

225.6 |

219.9 |

209.1 |

|

336.5 |

219.0 |

188.1 |

158.0 |

| Property

Management for Individuals (including

franchises) |

|

87.9 |

76.8 |

81.6 |

|

90.2 |

90.0 |

91.7 |

86.9 |

|

91.5 |

91.6 |

91.8 |

84.9 |

| Serviced

residences |

|

87.6 |

76.4 |

84.2 |

|

92.5 |

78.5 |

73.3 |

71.9 |

|

68.9 |

70.1 |

21.3 |

22.5 |

|

Distribution activities |

|

65.1 |

47.3 |

45.7 |

|

127.3 |

57.1 |

54.9 |

50.3 |

|

176.1 |

57.3 |

75.0 |

50.6 |

| Commercial Clients |

|

90.3 |

269.9 |

84.4 |

|

132.0 |

123.2 |

109.6 |

118.9 |

|

167.3 |

174.2 |

154.4 |

84.7 |

| Commercial Real Estate |

|

63.7 |

247.6 |

57.3 |

|

102.0 |

96.1 |

88.0 |

98.3 |

|

146.1 |

157.6 |

138.7 |

69.6 |

| Real Estate Services to Companies |

|

26.6 |

22.2 |

27.1 |

|

30.0 |

27.1 |

21.6 |

20.6 |

|

21.2 |

16.6 |

15.8 |

15.1 |

| Other Activities |

|

(0.0) |

(0.0) |

0.0 |

|

0.0 |

(0.0) |

0.4 |

0.5 |

|

0.9 |

1.5 |

1.4 |

0.5 |

|

Revenue |

|

1,021.0 |

929.3 |

786.8 |

|

1,694.0 |

964.0 |

959.4 |

881.1 |

|

1,638.5 |

940.1 |

868.1 |

688.3 |

Backlog

| |

|

2020 |

|

2019 |

|

2018 |

|

(in millions of euros, excluding VAT) |

|

9M |

H1 |

Q1 |

|

12M |

9M |

H1 |

Q1 |

|

12M |

9M |

H1 |

Q1 |

| Residential Real Estate – New homes |

|

5,214 |

5,095 |

4,623 |

|

4,455 |

4,328 |

4,321 |

4,109 |

|

3,979 |

4,065 |

3,724 |

3,451 |

| Residential Real Estate – Subdivisions |

|

183 |

191 |

173 |

|

185 |

182 |

172 |

160 |

|

182 |

188 |

201 |

182 |

| Residential Real Estate

backlog |

|

5,397 |

5,285 |

4,796 |

|

4,640 |

4,510 |

4,493 |

4,269 |

|

4,161 |

4,253 |

3,924 |

3,634 |

| Commercial Real Estate backlog |

|

321 |

373 |

398 |

|

456 |

401 |

269 |

222 |

|

308 |

379 |

332 |

409 |

|

Total Group backlog |

|

5,719 |

5,659 |

5,194 |

|

5,095 |

4,911 |

4,762 |

4,491 |

|

4,469 |

4,632 |

4,256 |

4,042 |

ANNEX 2: BREAKDOWN BETWEEN DEVELOPMENT AND

SERVICES

To offer an additional tool for analysing its

operational performance, the Group also provides a breakdown of its

revenue by business line, separating its Real Estate Development

activities (Residential Real Estate and Commercial Real Estate)

from its Services businesses (Property Management for Individuals

including franchises, serviced residences, distribution activities

and Real Estate Services to Companies).

Revenue

|

(in millions of euros) |

|

9M 2020 |

|

9M 2019 |

|

% change |

| Development* |

|

2,008.6 |

|

2,079.5 |

|

-3.4% |

| Residential Real Estate |

|

1,640.0 |

|

1,797.1 |

|

-8.7% |

| Commercial Real Estate |

|

368.6 |

|

282.4 |

|

+30.5% |

| Services |

|

728.4 |

|

724.5 |

|

+0.5% |

| Property Management for Individuals,

Franchises, Property Management for Companies |

|

297.2 |

|

318.3 |

|

-6.6% |

| Serviced Residences, Shared Office

Space |

|

273.2 |

|

243.4 |

|

+12.2% |

| Distribution |

|

158.0 |

|

162.8 |

|

-2.9% |

| Other Activities |

|

0.0 |

|

0.9 |

|

n.s. |

|

Total Group revenue |

|

2,737.1 |

|

2,804.9 |

|

-2.4% |

* Revenue generated by Residential Real Estate and Commercial

Real Estate from VEFA off-plan sales and CPI development contracts

is recognised using the percentage-of-completion method, i.e. on

the basis of notarised sales and pro-rated to reflect the progress

of all inventoriable costs.

GLOSSARY

Business potential: The total

volume of potential business at any given moment, expressed as a

number of units and/or revenue excluding VAT, within future

projects in Residential Real Estate (New homes, Subdivisions and

International) as well as Commercial Real Estate, validated by the

Group’s Committee, in all structuring phases, including the

programmes of the Group’s urban regeneration business (Villes &

Projets); this business potential includes the Group’s current

supply for sale, its future supply (project phases not yet marketed

on purchased land, and projects not yet launched associated with

land secured through options)

Current operating profit:

Includes all operating profit items with the exception of items

resulting from unusual, abnormal and infrequently occurring

transactions. In particular, impairment of goodwill is not included

in current operating profit

Development backlog (or order

book): The Group’s already secured future revenue,

expressed in euros, for its Residential Real Estate and Commercial

Real Estate businesses. The backlog includes reservations for which

notarial deeds of sale have not yet been signed and the portion of

revenue remaining to be generated on units for which notarial deeds

of sale have already been signed (portion remaining to be

built)

EBITDA: Defined by Nexity as

equal to current operating profit before depreciation, amortisation

and impairment of non-current assets, net changes in provisions,

share-based payment expenses and the transfer from inventory of

borrowing costs directly attributable to property developments,

plus dividends received from equity-accounted investees whose

operations are an extension of the Group’s business. Depreciation

and amortisation includes right-of-use assets calculated in

accordance with IFRS 16, together with the impact of neutralising

internal margins on disposal of an asset by development companies,

followed by take-up of a lease by a Group company

EBITDA after lease payments:

EBITDA net of expenses recorded for lease payments that are

restated to reflect the application of IFRS 16 Leases

Free cash flow: Cash generated

by operating activities after taking into account tax paid,

financial expenses, changes in WCR, dividends received from

companies accounted for under the equity method and net investments

in operating assets, and before repayment of lease liabilities

Gearing: Net debt divided by

consolidated equity

Joint ventures: Entities over

whose activities the Group has joint control, established by

contractual agreement. Most joint ventures are Residential or

Commercial Real Estate developments undertaken with another

developer (co-developments)

Land bank: The amount of

projects in France for which the Group has acquired development

rights, before obtaining a building permit and in some cases other

planning permissions, expressed as an amount recognised within the

working capital requirement

MALONE (Marché du Logement

Neuf): New home market in France, calculated by adding

together the number of retail sales (source: French

Commissioner-General for Sustainable Development – CGDD) and bulk

sales (source: French Federation of Real Estate Developers –

FPI)

Net profit before non-recurring

items: Group share of net profit restated for

non-recurring items such as change in fair value adjustments in

respect of the ORNANE bond issue and items included in non-current

operating profit (any goodwill impairment losses, remeasurement of

equity-accounted investments following the assumption of

control)

Operational reporting:

According to IFRS but with joint ventures proportionately

consolidated. This presentation is used by management as it better

reflects the economic reality of the Group’s business

activities

Order intake – Commercial Real

Estate: The total of selling prices excluding VAT as

stated in definitive agreements for Commercial Real Estate

programmes, expressed in euros for a given period (notarial deeds

of sale or development contracts)

Property Management for Individuals

(PMI): Management of rented properties on behalf of

individual clients (management for the owner of all relations with

the tenant, management of the sale of the property if applicable)

as well as the management of the common areas of apartment

buildings (as a managing agent) on behalf of condominium owners.

This also includes brokerage activities

Reservations by value (or expected

revenue from reservations) – Residential Real Estate: The

net total of selling prices including VAT as stated in reservation

agreements for development programmes, expressed in euros for a

given period, after deducting all reservations cancelled during the

period

Residences open for more than 2 years

(Domitys): Residences open since 1 January 2018

The financial data and indicators used in this press release –

including forward-looking information – are based on Nexity’s

operational reporting with joint ventures proportionately

consolidated.

2 See press release of 21 October 2020

3 French market for new homes, including bulk

sales. Source: ECLN for retail sales and FPI for bulk sales

4 See glossary on page 11

5 See press release of 1 October 2020

6 Take-up period: Available market supply / Reservations for the

last 12 months, expressed in months

7 See glossary on page 11

8 Source of market data: Immostat

9 See glossary on page 11

10 See press release of 17 April 2020

- 20201028_PR_Q32020_28102020 vdef2

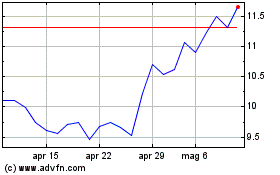

Grafico Azioni Nexity (EU:NXI)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Nexity (EU:NXI)

Storico

Da Apr 2023 a Apr 2024