Nordea AM Drops JBS Over Deforestation, Corruption, Worker Health

28 Luglio 2020 - 2:36PM

Dow Jones News

By Dieter Holger

Nordea Asset Management dropped Brazilian meat giant JBS SA from

all its funds this month over concerns stemming from the company's

handling of deforestation, corruption charges and employee health

and safety amid the coronavirus pandemic.

The Helsinki, Finland-based money manager made the decision

"after a period of engagement with the company, where we did not

feel that we were seeing the response that we were looking for,"

Eric Pedersen, head of responsible investments at Nordea Asset

Management, told The Wall Street Journal on Tuesday.

Mr. Pedersen said that the investment firm, which has some 223

billion euros ($261.8 billion) under management, pulled around

EUR40 million from JBS following a separate decision last year to

not buy more into the company.

The move comes as JBS continues to face allegations of fueling

deforestation by purchasing cattle from protected lands in the

Amazon rainforest. In June, nonprofit Greenpeace said that

JBS--along with other Brazilian meat producers--had bought cattle

from a farm that sourced the animals from another ranch in a

protected reserve in the Mato Grosso region.

Under Brazilian law, meatpackers must ensure that they slaughter

cattle coming from ranches with a clean environmental record, but

it is difficult for companies to guarantee there hasn't been so

called "cattle laundering" where cows spend time in illegal

pastures before moving to legal ones.

JBS didn't immediately respond to a request for comment.

Mr. Pedersen said the decision to exclude JBS is significant

because it changes the holdings of all of the firm's funds instead

of just those dedicated to sustainability.

"While our specifically [environmental, social and

governance]-focused funds would in any case avoid companies with

these types of exposure, this move is part of raising the bar for

our remaining funds, so that our wider client base can remain

comfortable with the level of sustainability risk in their

investments," he said, adding that specific ESG portfolios

currently make up around 30% of the firm's managed investments.

--Paulo Trevisani contributed to this article.

Write to Dieter Holger at dieter.holger@wsj.com;

@dieterholger

(END) Dow Jones Newswires

July 28, 2020 08:21 ET (12:21 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

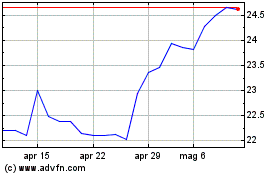

Grafico Azioni JBS ON (BOV:JBSS3)

Storico

Da Mar 2024 a Apr 2024

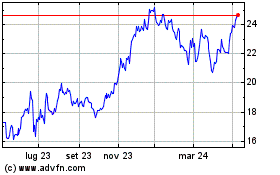

Grafico Azioni JBS ON (BOV:JBSS3)

Storico

Da Apr 2023 a Apr 2024