Covid-19: extreme vigilance while preserving

social life

H1 2020: business and profitability strongly

resilient

- Revenue: €1,904m (+3.5%)

- EBITDAR: €453m (-5.5%)

- Net profit attributable to shareholders:

€73.0m (€79.1m restated for IFRS 16)

Real-estate portfolio of €6.25

billion

- Increase of +€233m over the half

year

- €295m in arbitrage since the beginning of

H2

Acquisition of 50% interest of Brindley

Group: ORPEA becomes no. 2 in Ireland

Regulatory News:

The ORPEA Group (Paris:ORP), world leader in long-term care

(nursing homes, post-acute and rehabilitation hospitals, mental

health hospitals, and home care services), today announces its

consolidated results (limited review in progress) for the first

half of 2020 (six months to 30 June), as approved by the Board of

Directors on 22 September 2020, as well as the acquisition of 50%

of the Irish Group, Brindley.

Management

of the Covid-19 outbreak: extreme vigilance and development of

social life

The ORPEA Group and its teams remain extremely vigilant in

managing the Covid-19 health crisis. Since the end of H1, ORPEA is

continuing to apply strict barrier measures across all sites

(wearing of masks, physical distancing, heightened hygiene

measures, etc.) while resuming social interactions within its

facilities (meals in the restaurant, family visits, events and

entertainment, etc.)

In addition to barrier measures, the Group also applies its

systematic testing policy in the event of any suspected cases or

contact cases, testing everybody present within the facility

(residents, patients and employees). In the event that one person

tests positive, certain temporary restrictions may be reintroduced

as a precautionary measure, such as dividing mealtimes at the

restaurant into small groups or limiting visits to patients’ and

residents’ rooms.

The Group’s aim is to provide a graduated response, adapted to

each facility, as close as possible to the situation on the ground,

enabling the safety and preservation of its residents’ social

interaction (families, employees, external service providers).

ORPEA implemented three procedural levels, depending on local

pandemic indicators, in order to bring appropriate solutions to

each facility:

- Procedure “Coro 1” for facility located in a department

classified as low in terms of virus circulation, with no suspected

or confirmed cases in the facility: general barrier measures; -

Procedure “Coro 2” for facility located in an epidemic zone where

the virus is actively circulating, with no suspected or confirmed

cases in the facility: additional measures such as weekly PCR test

on around a third of employees, adjustment of the frequency of

visits and of outdoor social interaction; - Procedure “Coro 3” for

facility with at least one confirmed case of COVID-19 (employee or

resident or independent contractor): alert healthcare authorities,

“zoning” of the facility.

The health situation is currently under control within the

network: the number of positive cases remains low (0.4% of

residents and patients at 15 September 2020) and more than 90% of

these positive cases are asymptomatic. More than 97% of the Group’s

facilities thus currently have no Covid-19 cases.

In order to thank them for their commitment during the health

crisis, ORPEA paid its employees a bonus, in addition to any

government bonuses received.

Moreover, in order to understand the sentiment within its teams

during this crisis, from June 2020 the Group partnered with an

international consulting firm to carry out an employees’ survey

covering approximately 22,000 members of staff in France. The main

conclusions of this survey show:

- a sense of great usefulness for 90% of employees; - close to 9

out of 10 employees consider that the protective measures

implemented were appropriate.

At the same time, a satisfaction survey regarding the management

of the public health crisis was carried out at Group level among

residents’ families, by independent external companies: 37,000

questionnaires were sent out, with a response rate of 46%. 92.5% of

those who responded said they were satisfied or very satisfied with

the information and measures introduced to ensure the safety of

residents.

ORPEA and its teams remain ready and committed to ensuring the

best possible protection of its residents, patients and employees.

The safety and quality of care of its stakeholders remain the

Group’s priority.

H1 2020

results strongly resilient

2020 half-year results are presented in accordance with IFRS

norms, including IFRS 16, in conformity with existing regulations

and recommendations.

In €m

(IFRS)

H1 2020

H1 2019

Change

Revenue

1,904.2

1,840.6

+3.5%

EBITDAR (EBITDA before rental

expenses)

453.4

479.7

-5.5%

EBITDA

439.0

464.5

-5.5%

Recurring operating profit

196.8

244.1

-19.4%

Net interest expense

-113.3

-106.3

+6.5%

Profit before tax

98.8

153.2

-35.5%

Net profit attributable to Group

shareholders

73.0

114.6

-36.3%

Revenue for H1 2020 was up +3.5% at €1,904.2 million,

driven by strong external growth, in particular in Ireland (TLC),

Latin America (SIS) and France (Sinoué), which more than offset the

limited decline of -0.9% in organic growth.

EBITDAR (EBITDA before rental expenses) was down -5.5% to

€453.4 million, representing a margin of 23.8%. The 230 bp decline

compared with H1 2019 was due to the impact of the Covid-19

pandemic, which totalled a gross amount of €147 million (loss of

business, additional costs relating to personal protective

equipment and staff bonuses). Taking into account compensation

received, net cost stood at €53 million. These compensations are

recognised in recurring operating profit, whether as an income in

“other products” for those related to loss of business, or as a

reduction in costs for those related to additional costs. in The

most affected geographical regions were Eastern Europe (due to the

temporary closure of Austrian clinics) and the Iberian Peninsula

and Latam, Spain in particular. Conversely, the France Benelux and

Central Europe regions proved resilient, with limited declines.

EBITDA fell 5.5% to €439.0 million, with a margin of

23.1% of revenue. EBITDA margin restated for IFRS 16 stood at

14.9%, taking into account external rental expenses of €169.5

million.

Recurring operating profit stood at €196.8 million

(-19.4%) after depreciation, amortisation and provisions of €242.3

million (+9.9%), reflecting the growth of the real-estate portfolio

held by the Group.

Net non-recurring gains were stable at €15.3 million, compared

with €15.4 million in H1 2019.

Net interest expense reached €113.3 million, representing a

limited increase of +6.6% despite sustained investments.

After accounting for an income tax expense of €28.3 million,

net profit attributable to Group’s shareholders fell 36.3%

to €73.0 million. Excluding IFRS 16 impacts, consolidated net

profit attributable to Group’s shareholders was €79.0 million.

These results demonstrate the Group’s excellent resilience and its

ability to maintain strong cash generation despite the

unprecedented Covid-19 pandemic.

Strong

real-estate policy combining reinforcement and

arbitrage

During H1 2020, ORPEA continued its strategy of holding

real-estate assets in the best locations, notably with the

acquisition of facilities in Dublin, Riga and the Netherlands.

At 30 June 2020, the real-estate portfolio was valued at €6,250

million1, i.e., an increase of €233 million over H1 alone, and had

a total surface area of 2.2 million sqm. The capitalisation rate

remained unchanged at 5.7%, still cautious compared with recent

market transactions on the same type of assets.

ORPEA thus now owns 49% of its facilities, compared with 47% on

30 June 2019.

The Group also started disposing of real-estate assets in July

2020, with €145 million sold to Icade and an additional €150

million currently being finalised with other investors. Boosted by

the resilience of its occupancy rates, the Group’s facilities

continue to attract many international real-estate investors under

conditions that remain very attractive. Commitments received on the

disposal programme for a portion of facilities to be delivered over

the 2020-2024 period total €2 billion.

Strengthening the financial structure

Net debt stood at €5,958 million2 at 30 June 2020, compared with

€5,535 million1 at 31 December 2019, a modest increase considering

the level of investment in both real estate and operations, notably

with the acquisition of Sinoué in France and TLC in Ireland.

The share of real-estate debt reached 87%, compared with 85% at

31 December 2019. Debt ratios restated for IFRS 16 remain well

below their covenants, with financial leverage restated for

real-estate assets of 2.8 (5.5 authorised) and restated gearing of

1.7 (2.0 authorised).

Since the beginning of 2020, and at a time when the health

crisis had a major impact on global financial markets, ORPEA has

continued to actively strengthen its financing capacity, with new

bank financing and non-banking transactions (Schuldschein and Euro

PP) totalling €344 million at the end of July. At 30 June, the

Group’s cash position stood at €902 million.

Borrowing cost stood at 2.4% at 30 June 2020, a 30 basis point

decrease compared with 2019. Net debt is still fully hedged against

the risk of an increase in interest rates.

ORPEA

becomes no. 2 in Ireland with the acquisition of 50% of Brindley

Healthcare

Following the acquisition of the TLC Group in January 2020,

ORPEA has stepped up its presence in Ireland with the acquisition

of 50% of the fourth largest national nursing home operator,

Brindley Healthcare. ORPEA has an option to buy the remaining 50%

by 2022.

Founded in 2000, Brindley Healthcare has a home care business

and operates 10 facilities (574 beds) across six counties which are

complementary to the county of Dublin where TLC operates, thus

providing ORPEA with a national platform for growth. Brindley is

recognised by the Health Authorities for its high-quality offering

implemented by a management team with more than 20 years of

experience. In 2019, the group generated revenue of almost €25

million.

ORPEA thus becomes no. 2 in Ireland, with a strong platform for

growth, combining TLC’s expertise in terms of acquisitions and

Brindley Healthcare’s know-how in terms of creating new facilities.

The Group intends to continue expanding its assets in this country

where the current offering is insufficient and an additional

10,000+ beds need to be built by 2031.

Strategy

and outlook

More than ever, the Group’s strategy remains focused on the

quality of care and services provided to its residents and

patients, as well as the safety and well-being of its employees.

ORPEA therefore continues its growth in its five geographical

regions, by favouring value-creating acquisitions and the opening

of new facilities in prime locations in major European and Latin

American towns and cities.

Since the start of H2, business has picked up significantly

across all facilities:

– at post-acute and rehabilitation hospitals and at mental

health hospitals, occupancy rates have almost returned to

pre-Covid-19 levels; – the momentum of nursing home new admissions

is also strong and occupancy rates in most countries are expected

to return to almost pre-Covid-19 levels within the next six months,

providing current health situation do not worsen.

The Group will present its new 2020 revenue target (the previous

one having been temporally withdrawn the 5th of May 2020) when

ORPEA publishes its Q3 revenue.

Yves Le

Masne, Chief Executive Officer of ORPEA, commented:

“H1 2020 was unprecedented due to the scale of the health

crisis. During this period, ORPEA has demonstrated strong

resilience thanks to the commitment of its 65,000 employees. Team

spirit combined with professionalism represent the foundations on

which the Group’s future is built.

ORPEA continues to develop its employees’ skills, in particular

through the introduction of innovative training programmes and the

creation and acquisition of training schools.

ORPEA is equipped with all the necessary resources, both human

and financial, to comfortably continue its growth and strengthen

its position as a world leader in long-term care. In that sense,

since the beginning of 2020, ORPEA has completed four structuring

acquisitions (Sinoué, Clinipsy, TLC and Brindley) which, in the

long term, will represent an additional 2,750 beds and €220 million

in revenue.”

Next press release: Q3 2020 revenue 3

November 2020 after market close

About ORPEA (www.orpea-corp.com)

Founded in 1989, ORPEA is one of the major world leaders in

long-term care, with a network of 1,028 facilities comprising

105,443 beds (21,137 of which are under construction) across 22

countries, which are divided into five geographical regions:

- France Benelux: 523 facilities/46,277 beds

(of which 4,957 are under construction) - Central Europe: 249

facilities/26,491 beds (of which 4,885 are under construction) -

Eastern Europe: 136 facilities/14,621 beds (of which 3,647 are

under construction) - Iberian Peninsula/Latin America: 119

facilities/17,914 beds (of which 7,648 are under construction) -

Rest of the world: 1 facility / 140 beds

ORPEA is listed on Euronext Paris (ISIN code: FR0000184798) and

a constituent of the SBF 120, STOXX 600 Europe, MSCI Small Cap

Europe and CAC Mid 60 indices.

Glossary:

Organic growth

Organic growth reflects the following

factors:

- The year-on-year change in the revenue of existing facilities

as a result of changes in their occupancy rates and per diem

rates

- The year-on-year change in the revenue of redeveloped

facilities or those where capacity has been increased in the

current or year-earlier period

- Revenue generated in the current period by facilities created

in the current or year-earlier period, and the change in revenue at

recently acquired facilities by comparison with the previous

equivalent period

EBITDAR

EBITDA before rents, including provisions

related to external charges and staff costs

EBITDA

Recurring operating profit before net

additions to depreciation and amortisation, including provisions

related to external charges and staff costs

Net debt

Non-current borrowings + current

borrowings - cash and short-term investments

Financial leverage restated for

real-estate assets

(Net debt - Real-estate debt)/(EBITDA -

(6% x Real-estate debt))

Restated gearing

Net debt/(Equity + Deferred taxes

available indefinitely on intangible assets)

Capitalisation rate

The real-estate capitalisation rate or the

rate of return is the ratio between the rental amount and the

building’s value

Consolidated income statement (Auditors’ review in

progress)

In €m

H1 2020

H1 2019

H1 2020 Restated for IFRS 16

H1 2019 Restated for IFRS 16

Revenue

1,904.2

1,840.6

1,904.2

1840.6

Purchases used and other external

expenses

-357.1

-338.9

-512.2

-485.8

Staff costs

-1,080.0

-986.5

-1,080.0

-986.5

Taxes other than on income

-72.3

-61.7

-72.3

-61.7

Depreciation, amortisation and charges to

provisions

-242.3

-220.4

-112.6

-98 8

Other recurring operating income and

expenses

44.3

11.0

44.3

11.0

Recurring operating profit

196.8

244.1

171.3

218.8

Other non-recurring operating income and

expenses

15.3

15.4

15.3

15.0

Operating profit

212.1

259.5

186.6

233.8

Net interest expense

-113.3

-106.3

-79.8

-73.7

Profit before tax

98.8

153.2

106.8

160.1

Income tax expense

-28.3

-42.6

-30.2

-44 1

Share in profit/(loss) of associates and

joint ventures

1.8

4.1

1.8

4.1

Net profit attributable to Group’s

shareholders

73.0

114.6

79.1

120.1

Consolidated balance sheet (Auditors’ review in

progress)

In €m

30-June-20

31-Dec-19

Non-current assets

13,031

12,440

Goodwill

1,338

1,299

Intangible assets

2,680

2,469

Property, plant and equipment and

properties under development

6,250

6,017

Right of use assets

2,387

2,334

Other non-current assets

377

321

Current assets

1,845

1,699

Cash and short-term investments

902

839

Assets held for sale

475

400

TOTAL ASSETS

15,351

14,539

Equity attributable to ORPEA’s

shareholders and deferred taxes available indefinitely

3,569

3,513

Equity attributable to ORPEA’s

shareholders

3,009

3,014

Deferred taxes available indefinitely on

operating intangible assets

561

499

Non-controlling interests

-3

-3

Non-current liabilities

9,337

8,849

Other deferred tax liabilities

508

529

Provisions for liabilities and charges

204

199

Non-current liabilities

6,301

5,859

Lease commitments

2,323

2,262

Current liabilities

1,973

1,780

o/w current financial liabilities (bridge

loans and real estate porting)

559

515

Liabilities associated with assets held

for sale

475

400

TOTAL EQUITY AND LIABILITIES

15,351

14,539

Cash flows (Auditors’ review in progress)

In €m

H1 2020

H1 2019

Net cash from operating

activities

245

244

Investments in construction projects

-168

-206

Acquisitions of real estate

-194

-174

Disposals of real estate

1

0

Net investments in operating assets

-293

-226

Net cash generated/(used) by investing

activities

-654

-606

Net cash generated/(used) by financing

activities

472

541

Change in cash over the period

63

179

Cash at end of period

902

947

-------------------------------------------------------------------------

1 Excluding the impact of €415 million in real-estate assets

held for sale as of 30 June 2020. 2 Excluding €475 million and €400

million in debt associated with assets held for sale at 30 June

2020 and 31 December 2019 respectively.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200922005865/en/

Investor Relations ORPEA Steve Grobet Finance

Corporate Secretary steve.grobet@gmail.com

Hélène de Watteville Investor Relations Officer

h.dewatteville@orpea.net

Investor Relations NewCap Dusan Oresansky Tel.:

+33 (0)1 44 71 94 94 orpea@newcap.eu

Media Relations Image 7 Laurence Heilbronn Tel.:

+33 (0)1 53 70 74 64 lheilbronn@image7.fr

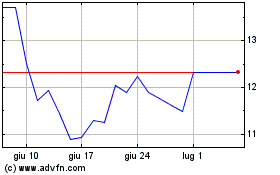

Grafico Azioni Orpea (EU:ORP)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Orpea (EU:ORP)

Storico

Da Apr 2023 a Apr 2024