TIDMOCI

RNS Number : 8458K

Oakley Capital Investments Limited

07 January 2021

7 January 2021

Oakley Capital Investments Limited

Oakley Capital Investments Limited(1) ("OCI" or the "Company")

is pleased to announce that Oakley Capital Fund II (2) ("Fund II")

portfolio company, Daisy Group ("Daisy" or "the Group"), has

reached an agreement to sell its stake in the Digital Wholesale

Solutions ("DWS") division. The transaction is subject to

regulatory approval.

OCI's share of proceeds will be c.GBP22 million following this

transaction , which represents a c.33% premium to the 30 June 2020

interim carrying value of OCI's investment in Daisy (via Fund II

and a direct loan), an uplift of c.5 pence per share to the

Company's NAV.

Part of the proceeds will repay in full OCI's outstanding

c.GBP17 million direct loan to the Group.

Note that the above figures only relate to OCI's share of the

investment in Daisy.

OCI's liquid resources available for future deployment

(including this transaction) are estimated to be GBP240

million.

Further details on the transaction can be found in the below

announcement from Oakley Capital .

The sale of the Digital Wholesale Solutions division of the

Daisy Group to Inflexion

Oakley Capital Fund II ("Fund II") portfolio company, Daisy

("Daisy" or "the Group"), has reached an agreement to sell its

stake in the Digital Wholesale Solutions ("DWS") division to

Inflexion Private Equity Partners, a U.K. based buyout and growth

capital investor, with Fund II exiting its stake in DWS in full.

Fund II will retain a c.10% stake in Daisy following the sale.

Fund II invested in Daisy in July 2015 following the Group's

acquisition of Phoenix IT Group to create the first converged IT

and unified communications company in the UK small and medium

businesses market. Oakley originally invested in the business via

Oakley Capital Private Equity L.P. ("Fund I") in 2008 and has

maintained a close relationship with the founder, Matthew Riley,

since the successful exit of Fund I's investment in 2014.

Daisy is a leading provider of tailored IT, communications and

cloud services to corporate customers of all sizes, and is

organised into four main divisions based upon the size of the end

customer: Small and Medium Businesses (customers with up to 250

employees), Digital Wholesale Solutions (customers with up to 250

employees), Daisy Corporate Services (customers with 250+

employees) and Allvotec (customers with 2000+ employees).

The sale of the DWS division to Inflexion, combined with the

retained stake in Daisy, takes the gross return on investment to

date to 1.6x MM for Fund II. Completion is subject to regulatory

approval.

- ends -

For further information please contact:

Oakley Capital Limited

+44 20 7766 6900

Steven Tredget, Investor Relations

Greenbrook Communications Limited

+44 20 7952 2000

Alex Jones / James Williams

Liberum Capital Limited (Financial Adviser & Broker)

+44 20 3100 2000

Gillian Martin / Owen Matthews

Notes:

LEI Number: 213800KW6MZUK12CQ815

(1) About Oakley Capital Investments Limited ("OCI")

OCI is a Specialist Fund Segment ("SFS") traded investment

vehicle that aims to provide shareholders with consistent long-term

capital growth in excess of the FTSE All-Share Index by providing

liquid access to private equity returns through investment in the

Oakley Funds (2) .

A video introduction to OCI is available at

https://oakleycapitalinvestments.com/videos/

(2) The Oakley Funds

Oakley Capital Private Equity L.P. and its successor funds,

Oakley Capital Private Equity II, Oakley Capital Private Equity

III, Oakley Capital IV and Oakley Capital Origin Fund are unlisted

lower-mid to mid-market private equity funds that aim to provide

investors with significant long-term capital appreciation. The

investment strategy of the Funds is to focus on buy-out

opportunities in industries with the potential for growth,

consolidation and performance improvement.

Oakley Capital, the Investment Adviser

Founded in 2002, Oakley Capital Limited has demonstrated the

repeated ability to source attractive growth assets at attractive

prices. To do this it relies on its sector and regional expertise,

its ability to tackle transaction complexity and its deal

generating entrepreneur network.

Important information

Specialist Fund Segment securities are not admitted to the

Official List of the Financial Conduct Authority. Therefore, the

Company has not been required to satisfy the eligibility criteria

for admission to listing on the Official List and is not required

to comply with the Financial Conduct Authority's Listing Rules.

The Specialist Fund Segment is intended for institutional,

professional, professionally advised and knowledgeable investors

who understand, or who have been advised of, the potential risk

from investing in companies admitted to the Specialist Fund

Segment.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DISDKABDBBKBKDK

(END) Dow Jones Newswires

January 07, 2021 02:00 ET (07:00 GMT)

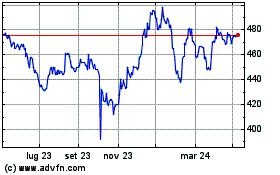

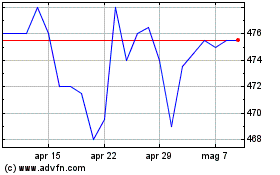

Grafico Azioni Oakley Capital Investments (LSE:OCI)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Oakley Capital Investments (LSE:OCI)

Storico

Da Apr 2023 a Apr 2024