TIDMPHSC

2 December 2019

PHSC PLC

("PHSC", the "Company", or the "Group")

Unaudited Interim Results for the six months ended 30 September 2019

GROUP CHIEF EXECUTIVE OFFICER'S STATEMENT

Financial Highlights

* Group revenue for first half of GBP2.234m, down from GBP2.897m last year.

* EBITDA of GBP175k, compared with an underlying equivalent of GBP135k at the

halfway stage last year i.e. before factoring in an exceptional gain from

property disposal.

* Earnings per share of 1.01p compared with 1.47p last year. Last year's

figure includes exceptional gain from property disposal.

* Cash of GBP688k compared with GBP583k last year.

* Net asset value (unaudited) of GBP5.3m compared to GBP5.5m last year.

* Pro-forma net asset value (unaudited) per share of 36p compared to a

current share price (mid) of 11p.

* Interim dividend declared of 0.5p per ordinary share.

Operational Highlights and Business Outlook

Compared with the halfway stage last year, EBITDA from trading activities

improved across the Group as a whole by GBP40k, aided by the Group's lower

overheads and premises related savings. This was achieved despite a decline in

product sales through our security division, caused by the trading difficulties

of the retail sector.

All businesses within the safety division contributed higher profits, with

three out of the four safety-related subsidiaries achieving higher revenues.

The forward order book is very encouraging.

Our quality systems division also reported growth in sales and increased

profits. The larger space available for public training courses, following

expansion into an adjacent unit, is starting to pay dividends with higher

delegate numbers being achieved.

Our security division saw a reduction in sales of around 45% as the customer

base, predominantly high street retailers, continued to struggle, resulting in

a loss for the first half. The effect has been mitigated to an extent by

careful cost control and a reduction in staffing levels through normal staff

turnover. After a prolonged period of low activity, the subsidiary's largest

client has recently begun to place new business, and this gives more scope for

optimism in the future. As has been previously reported, the weak Sterling

exchange rate impacts greatly on gross profit margins, as all product supplied

and installed are imported and paid for in US Dollars or Euros.

The fortunes of the Group as a whole are affected by the performance of the

security division, which presently accounts for approximately 40% of the

Group's revenues. The business is an important player in the retail sector and

has again been recognised at the annual Retail Risk Fraud Awards when it was

Highly Commended for RFID solutions (products using radio frequency

identification systems).

Dividend

Profitable trading and a healthy cash position have enabled the Board to

declare an interim dividend of 0.5p per ordinary share, to be paid on 28

February 2020 to those on the register of members on 3 January 2020.

The recommendation by the Board of any final dividend for the current financial

year will be subject to the Group's full year performance.

Cash Flow

Cash at bank on 30 September 2019 stood at GBP688k compared with GBP583k at the

same time last year.

Other than in the normal course of business and the proposed and any future

dividends that might be declared, the Board does not currently anticipate there

being any additional calls on the Company's cash.

Performance by Trading Subsidiaries

Profit/loss figures for individual subsidiaries are stated before tax and

inter-company charges (including the costs of operating the plc which are

recovered through management charges to, and dividends from, trading

subsidiaries), interest paid and received, depreciation and amortisation.

Inspection Services (UK) Limited

Invoiced sales of GBP132,613 yielding a profit of GBP35,860 (the figures for the

same period last year were GBP108,563 and GBP19,130).

Personnel Health and Safety Consultants Limited

Invoiced sales of GBP366,657 yielding a profit of GBP139,470 (the figures for the

same period last year were GBP311,111 and GBP123,846).

RSA Environmental Health Limited

Invoiced sales of GBP207,524 resulting in a profit of GBP50,488 (the figures for

the same period last year were GBP190,563 and GBP27,501).

Quality Leisure Management Limited

Invoiced sales of GBP194,295 resulting in a profit of GBP58,544 (the figures for

the same period last year were GBP218,327 and GBP46,983).

QCS International Limited

Invoiced sales of GBP397,832 yielding a profit of GBP142,102 (the figures for the

same period last year were GBP363,514 and GBP111,259).

B2BSG Systems Limited

Invoiced sales of GBP935,356 resulting in a loss of GBP56,558 (the figures for the

same period last year were GBP1,705,080 and GBP65,319 profit).

For further information please contact:

PHSC plc

Stephen King

01622 717 700

Stephen.king@phsc.co.uk

www.phsc.plc.uk

Strand Hanson Limited (Nominated Adviser) 020 7409 3494

Richard Tulloch/Eric Allan

Novum Securities Limited (Broker) 020 7399 9427

Colin Rowbury

About PHSC

PHSC plc, through its trading subsidiaries Personnel Health & Safety

Consultants Ltd, RSA Environmental Health Ltd, QCS International Ltd,

Inspection Services (UK) Ltd and Quality Leisure Management Ltd, provides a

range of health, safety, hygiene, environmental and quality systems consultancy

and training services to organisations across the UK. B2BSG Systems Ltd offer

innovative security solutions including tagging, labelling and CCTV.

The information contained within this announcement is deemed by the Company to

constitute inside information as stipulated under the Market Abuse Regulations

(EU) No. 596/2014 ("MAR").

Group Statement of Comprehensive Income Six months Six Year

ended months ended

ended

30 Sept 19 30 Sept 18 31 Mar 19

Note Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Continuing operations

Revenue 3 2,234 2,897 5,215

Cost of sales (1,101) (1,494) (2,719)

Gross profit 1,133 1,403 2,496

Administrative expenses (979) (1,298) (2,418)

Goodwill impairment 2 - - (200)

Profit on disposal of fixed assets - 166 166

Profit from operations 154 271 44

Finance income/(costs) 1 (1) (1)

Profit before taxation 155 270 43

Corporation tax expense (7) (54) (42)

Profit for the period after tax attributable

to owners of parent 3 148 216 1

Total comprehensive income attributable to 148 216 1

owners of the parent

Basic and diluted Earnings per Share for 5 1.01p 1.47p 0.005p

profit after tax from continuing

operations attributable to the equity

holders of the Group during the period

Group Statement of Financial Position 30 Sept 30 Sept 31 Mar 19

19 18

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

Non-current assets

Property, plant and equipment 4 561 453 489

Goodwill 3,478 3,678 3,478

Deferred tax asset 18 22 18

4,057 4,153 3,985

Current assets

Inventories 307 379 317

Trade and other receivables 1,069 1,404 973

Cash and cash equivalents 688 583 642

2,064 2,366 1,932

Total assets 3 6,121 6,519 5,917

Current liabilities

Trade and other payables 647 889 675

Right of use lease liability 23 - -

Current corporation tax payable 62 71 55

732 960 730

Non-current liabilities

Right of use lease liability 54 - -

Deferred taxation liabilities 46 56 46

100 56 46

Total liabilities 832 1,016 776

Net assets 5,289 5,503 5,141

Capital and reserves attributable

to equity

holders of the Group

Called up share capital 1,468 1,468 1,468

Share premium account 1,916 1,916 1,916

Capital redemption reserve 144 144 144

Merger relief reserve 134 134 134

Retained earnings 1,627 1,841 1,479

5,289 5,503 5,141

Group Statement of Changes in Equity

Share Share Capital Merger Retained

Capital Premium Redemption Relief Earnings

Reserve Reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 April 2019 1,468 1,916 144 134 1,479 5,141

Profit for the period - - - - 148 148

attributable to equity

holders

Balance at 30 September 2019 1,468 1,916 144 134 1,627 5,289

Balance at 1 April 2018 1,468 1,916 144 134 1,625 5,287

Profit for the period - - - - 216 216

attributable to equity

holders

Balance at 30 September 2018 1,468 1,916 144 134 1,841 5,503

Group Statement of Cash Flows Six Six Year

months months

ended ended ended

30 Sept 19 30 Sept 18 31 Mar 19

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Cash flows generated from operating

activities

Cash generated from operations 57 48 326

Interest paid - (1) (2)

Tax paid - - (9)

Net cash generated from operating 57 47 315

activities

Cash flows (used in)/from investing

activities

Purchase of property, plant and equipment (14) (8) (69)

Disposal of fixed assets (net of disposal 2 300 299

costs)

Interest received 1 - -

Net cash (used in)/from investing (11) 292 230

activities

Cash flows used in financing activities

Dividends paid to group shareholders - - (147)

Net cash used in financing activities - - (147)

Net increase in cash and cash equivalents 46 339 398

Cash and cash equivalents at beginning of 642 244 244

period

Cash and cash equivalents at end of 688 583 642

period

Notes to the cash flow statement

Cash generated from operations

Operating profit - continuing operations 154 271 44

Depreciation charge 21 13 38

Goodwill impairment - - 200

Profit on sale of property - (166) (162)

Loss on sale of other fixed assets 3 3 -

Decrease in inventories 10 10 73

(Increase)/decrease in trade and other (96) 165 595

receivables

(Decrease)/increase in trade and other (35) (248) (462)

payables

Cash generated from operations 57 48 326

Notes to the Financial Statements

1. Basis of preparation

These condensed consolidated financial statements are presented on the basis of

International Financial Reporting Standards (IFRS) as adopted by the European

Union and interpretations issued by the International Financial Reporting

Interpretations Committee (IFRIC) and have been prepared in accordance with the

AIM Rules for Companies and the Companies Act 2006, as applicable to companies

reporting under IFRS.

The financial information contained in this report, which has not been audited,

does not constitute statutory accounts as defined by Section 434 of the

Companies Act 2006. The Group's statutory financial statements for the year

ended 31 March 2019, prepared under IFRS have been filed with the Registrar of

Companies. The auditors' report for the 2019 financial statements was

unqualified and did not contain a statement under Section 498 (2) or (3) of the

Companies Act 2006.

Other than as set out below, the same accounting policies and methods of

computation are followed within these interim financial statements as adopted

in the most recent annual financial statements.

The Group has applied IFRS 16 with a date of initial application of 1 April

2019 using the modified retrospective approach and therefore the comparative

information has not been restated and continues to be reported under IAS 17 and

IFRIC 4. The cumulative effect of initial application is recognised in

retained earnings at 1 April 2019. The details of the change in accounting

policy are disclosed below.

Previously, the Group determined at contract inception whether an arrangement

is or contains a lease under IFRIC 4. Under IFRS 16, the Group assesses

whether a contract is or contains a lease based on the definition of a lease.

On transition to IFRS 16, the Group elected to reassess whether there is a

lease for all contracts in place on or after 1 April 2019. Contracts that were

not identified as leases under IAS 17 and IFRIC 4 were reassessed for whether

there is a lease. Therefore, the definition of a lease under IFRS 16 was

applied to contracts in place or entered into on or after 1 April 2019.

As lessee, the Group previously classified leases as operating or finance

leases based on its assessment pf whether the lease transferred significantly

all of the risks and remains incidental to ownership of the underlying asset to

the Group. Under IFRS 16, the Group recognises rights-of-use assets and

liabilities for most leases i.e. these leases are on-balance sheet.

The Group decided to apply recognition exemptions to short-term leases of

equipment and services.

At transition, lease liabilities were measured at the present value of the

remaining lease payments, discounted at a cost of capital of 5.0%.

Rights-of-use assets are measured at their carrying amount as if IFRS 16 had

been applied since the commencement date, discounted at a cost of capital of

5.0%.

At inception of a contract, the Group assesses whether a contract is, or

contains, a lease. A contract is, or contains, a lease if the contract conveys

the right to control the use of an identified asset for a period of time in

exchange for consideration. To assess whether a contract conveys the right to

control the use of an identified asset, the Group assesses whether:

* The contract involves the use of an identified assets; this may be

specified explicitly or implicitly, and should be physically distinct or

represent substantially all of the capacity of a physically distinct asset;

* The Group has the right to obtain substantially all of the economic

benefits from use of the assets throughout the period of use; and

* The Group has the right to direct the use of the asset. The Group has this

right when it has the decision-making rights that are most relevant to

changing how and for what purpose the asset is used, In rare cases where

the decision about how and for what purpose the asset is used is

predetermined, the Group has the right to direct the use of the asset if

the Group has the right to operate the asset.

On transition to IFRS 16, the Group recognised an additional GBP83,575 of

right-of-use assets and the impact of discounting was considered immaterial so

lease liabilities of GBP83,575 were also recognised. Therefore, no adjustment to

equity at 1 April 2019 was made. In the period to 30 September 2019,

depreciation of GBP6,905 was recognised in the statement of comprehensive income

in relation to right of use assets.

The information presented within these interim financial statements complies

with IAS 34 "Interim Financial Reporting". This requires the use of certain

accounting estimates and requires that management exercise judgement in the

process of applying the Group's accounting policies. The areas involving a

high degree of judgement or complexity, or areas where the assumptions and

estimates are significant to the interim financial statements are disclosed

below:

Impairment of goodwill

The Board has considered the carrying value of goodwill and although there have

been losses in certain subsidiaries in the interim period, the longer term

outlook remains stable and an impairment charge in these interim accounts is

not therefore considered necessary and will be reassessed at the year end.

2. Exceptional Administrative Expenses

30 Sept 19 30 Sept 18 31 Mar 19

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Impairment of PHSC plc's investment in - - 200

B2B Links Limited

3. Segmental Reporting

30 Sept 19 30 Sept 18 31 Mar 19

Unaudited Unaudited Audited

Revenue GBP'000 GBP'000 GBP'000

Security division: B2BSG Solutions Ltd 935 1,705 2,724

935 1,705 2,724

Health & safety division

Inspection Services (UK) Ltd 133 109 233

Personnel Health & Safety Consultants Ltd 367 311 657

Quality Leisure Management Ltd 194 218 438

RSA Environmental Health Ltd 207 191 404

901 829 1,732

Quality systems division: QCS International 398 363 759

Ltd

Total revenue 2,234 2,897 5,215

30 Sept 19 30 Sept 18 31 Mar 19

Unaudited Unaudited Audited

Profit/(loss) after taxation, before management GBP'000 GBP'000 GBP'000

charge

Security division

B2BSG Solutions Ltd (42) 62 (31)

(42) 62 (31)

Health & safety division

Inspection Services (UK) Ltd 30 17 38

Personnel Health & Safety Consultants Ltd 137 114 249

Quality Leisure Management Ltd 49 41 93

RSA Environmental Health Ltd 43 26 61

259 198 441

Quality systems division: QCS International Ltd 115 100 159

Holding company: PHSC plc (184) (156) (368)

148 204 201

Taxation adjustment (group loss relief and - 12 -

deferred tax)

Goodwill impairment - - (200)

Total Group profit after taxation 148 216 1

30 Sept 19 30 Sept 18 31 Mar 19

Unaudited Unaudited Audited

Total assets GBP'000 GBP'000 GBP'000

Security division

B2BSG Systems Ltd 602 1,112 553

602 1,112 553

Safety division

Inspection Services (UK) Ltd 218 233 193

Personnel Health & Safety Consultants 1,057 689 950

Ltd

Quality Leisure Management Ltd 320 258 326

RSA Environmental Health Limited 684 619 636

2,279 1,799 2,105

Quality division: QCS International Ltd 765 568 667

Discontinued: Adamson's Laboratory - 18 -

Services Ltd

Holding company: PHSC plc 3,249 4,146 3,366

6,895 7,643 6,691

Adjustment of goodwill (774) (1,124) (774)

Total assets 6,121 6,519 5,917

4. Property, plant and equipment

30 Sept 19 30 Sept 18 31 Mar 19

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Cost or valuation

Brought forward (as restated) 907 934 935

Additions 14 8 69

Disposals (37) (163) (181)

Carried forward 884 779 823

Depreciation

Brought forward 334 340 340

Charge 21 13 38

Disposals (32) (27) (44)

Carried forward 323 326 334

Net book value 561 453 489

5. Earnings per share

The calculation of the basic earnings per share is based on the following data.

30 Sept 19 30 Sept 18 31 Mar 19

GBP'000 GBP'000 GBP'000

Unaudited Unaudited

Earnings

Continuing activities 148 216 1

Number of shares 30 Sept 19 30 Sept 18 31 Mar 19

Weighted average number of shares 14,667,257 14,667,257 14,667,257

for the purpose of basic earnings

per share

END

(END) Dow Jones Newswires

December 02, 2019 08:00 ET (13:00 GMT)

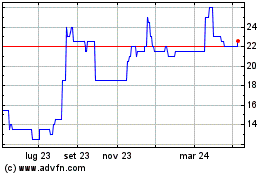

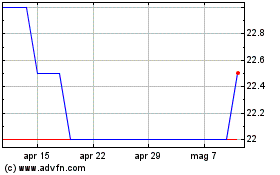

Grafico Azioni Phsc (LSE:PHSC)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Phsc (LSE:PHSC)

Storico

Da Apr 2023 a Apr 2024