TIDMTPX

RNS Number : 6899F

Panoply Holdings PLC (The)

11 March 2020

This announcement contains inside information

11 March 2020

The Panoply Holdings PLC

("The Panoply", or the "Group")

Acquisition of Ameo

Strengthening and diversifying the Group's Public Sector

offering

The Panoply Holdings PLC, a digitally native technology services

group, announces the acquisition of the entire issued share capital

of Ameo Professional Services Ltd (" Ameo "), a consultancy

specialising in delivering business change, with a strong focus on

the public sector (the " Acquisition ").

Ameo has been working with businesses for over 10 years seeking

to deliver long-lasting, cost-effective change across a wide range

of areas, from financial reporting and process design to digital

innovation. Public sector work is expected to represent over 90% of

revenues for the current financial year and, s ince being formed,

Ameo has worked with over 100 clients. Ameo's ethos is to seek to

work as a partner with its clients in order to develop sustainable

solutions and improve the skills of its clients' teams.

The Board believes that the Acquisition will bring additional

and complementary capabilities to the Group's public sector

offering, as well as extending its reach into this key market. The

strategy and change delivery capability of Ameo, alongside the

organisational and service design capability of FutureGov, and the

backing of The Panoply's first-in-class technology businesses

provides the basis for targeting and winning increasingly large

digital transformation projects in the UK public sector.

Ameo's extensive public sector experience includes:

* in local government, Ameo's longest standing market,

the delivery of more than 400 projects to deliver

positive change for c ouncils. Recent examples

include supporting the Local Government

Reorganisation for Dorset Council and the development

and delivery of a new Council Operating Model for

Warwickshire County Council;

* in healthcare, devel oping multi-agency healthcare

partnerships and supporting initiatives in fields

such as operational improvement, procurement and

service integration. Ameo has delivered projects to

NHS Trusts, Clinical Commissioning Groups (CCGs) and

health system partnerships;

* across the wider public sector, working with devolved

assemblies, regional bodies and emergency service

providers.

In addition, Ameo also has considerable experience delivering

projects across other sectors such as higher education, energy and

utilities, and various industries within the private sector.

Ameo is a debt free, cash generative and cash positive business.

In the year ended 30 October 2019 it reported unaudited revenues of

GBP6.9m, and a normalised profit before tax of GBP1.0m(1) .

The Panoply is paying an effective purchase price of GBP7.0m for

the Acquisition, to be satisfied though the payment of circa

GBP2.2m cash and the issue of 5,853,658 new ordinary shares in The

Panoply. I n addition, Ameo has cash in excess of normalised

working capital requirements and so an additional cash payment of

GBP1.3m will also be paid to the vendors at Completion in excess of

the GBP7.0m.

As at 10 March 2020, assuming all payments in connection with

the Acquisition had been made as at that date, the Group retained

cash reserves of approximately GBP4m and a net debt position of

GBP1m.

(1) Normalised in respect of salaries, additional required hires

and audit costs

Neal Gandhi, Chief Executive Officer of The Panoply, said:

"Our focus is to deliver positive, sustainable change in the UK

public sector and Ameo's stellar track record of work in central

and local government, healthcare and higher education broadens our

capability to achieve this goal for our clients. Ultimately, this

Acquisition increases our relevance and puts us in a stronger

position to target and win larger, more strategic engagements at

the heart of the UK public sector.

"With this Acquisition, public services revenues now account for

approximately 70% on a proforma basis, giving us additional scale

in the sector and adding to the breadth of skills that we can now

offer clients.

"The public sector needs to continue on its digital

transformation journey with urgency, encouraging staff to embrace

modern ways of working and speeding up the adoption of cloud

platforms. As an agile native, cloud only organisation, The Panoply

is able to cater to this need and the addition of Ameo to our Group

will support us in addressing this pressing demand. Together we

look forward to leading the way for our clients across public, not

for profit and commercial sectors."

Ben Ward, Director of Ameo, said:

"Over the past decade we've built a highly knowledgeable team

capable of delivering change across a range of industries and

sectors. We recognise The Panoply as a group which complements our

approach to seeking to deliver projects that are empowering and

transformational.

"The collaborative culture fostered within the Group will take

us to the next stage in our evolution by expanding our existing

service capabilities and expertise to br ing new leading-edge

solutions to our clients' challenges, particularly across service

redesign, robotic process automation and Applied AI. We are excited

to begin work as part of the Group and to take advantage of the

many opportunities this collective strength brings."

Additional information on the acquisition

The Panoply has acquired Ameo from Ben Ward, Fiona Ward and

Michael Dearing.

The consideration payable under the share purchase agreement

relating to the Acquisition (the "SPA") is set at GBP8.3m and

comprises the following on Completion:

* the allotment and issue of 5,853,658 ordinary shares

in the Panoply, with a value of GBP4.8m, calculated

by reference to a price of 82 pence to the sellers

(the "Initial Panoply Shares");

* a payment in cash of GBP2.2m; and

* a payment in cash of GBP1.3m in respect of the cash

currently held on Ameo's balance sheet in excess of

its normalised working capital requirements,

together (the "Initial Consideration").

The cash element of the Initial Consideration is being funded

through a combination of the Group's RCF Facility with HSBC, the

Group's existing cash reserves and the excess cash of GBP1.3m

acquired as part of the Acquisition.

Subject to the future EBITDA performance of Ameo (based on

EBITDA) during the 17 month period 1 November 2019 to 31 March 2021

(set in order to align with The Panoply's year-end) and 12 month

period from 1 April 2021 to 31 March 2022, in addition to the

Initial Consideration, the selling shareholders of Ameo will be

entitled to receive deferred earn-out consideration, which will be

payable by the allotment and issue of shares in The Panoply ("

Panoply Shares ") following the agreement of the relevant EBITDA

calculations and publication of the Group's results relating to

those financial periods. The number of Panoply Shares to be

allotted and issued shall be calculated by dividing the earn-out

price payable by a price per share in The Panoply which is the

greater of 82 pence and the volume-weighted average mid-market

price (VWAP) over the 30 business days prior to the issue of the

relevant Panoply Shares. Any Panoply Shares allotted and issued by

way of deferred consideration will be allotted and issued in one

tranche following the publication of the Group's results for the

relevant period.

The total consideration payable by The Panoply in respect of the

Acquisition is capped at a maximum of GBP10.5m which includes the

reimbursement payment of GBP1.3m meaning that the effective cap is

GBP9.2m.

All Panoply Shares allotted and issued under the SPA (including

the shares issued as part of the Initial Consideration) are subject

to customary lock-in arrangements and subject to claw-back by The

Panoply if AMEO's EBITDA decreases over the 2 year earn-out

period.

Admission and total voting rights

An application has been made for the admission of the Initial

Panoply Shares to trading on AIM which is expected to take place on

or before 17 March 2020. Following this issue, the Company's issued

share capital will comprise 55,052,267 Ordinary Shares and this is

the total number of voting rights in the Company. There are no

shares held in treasury.

This figure may be used by shareholders as the denominator for

the calculation by which they may determine if they are required to

notify their interest in, or change to their interest in, the

Company under the FCA's Disclosure Guidance and Transparency

Rules.

Enquiries:

The Panoply Holdings

Neal Gandhi (CEO) Via Alma PR

Oliver Rigby (CFO)

Stifel Nicolaus Europe Limited +44 (0)207 710 7600

(Nomad and Broker)

Fred Walsh

Alex Price

Alma PR panoply@almapr.co.uk

(Financial PR) +44(0)203 405 0209

Susie Hudson

Josh Royston

Kieran Breheny

The person responsible for making this announcement is Oliver

Rigby, CFO.

About The Panoply

The Panoply is a digitally native technology services company,

built to service clients' digital transformation needs. Founded in

2016, with the aim of identifying and acquiring best-of-breed

specialist information technology, design and innovation consulting

businesses across Europe, the Group collaborates with its clients

to deliver the technology outcomes they're looking for at the pace

that they expect and demand.

More information is available at www.thepanoply.com

About Ameo:

Ameo works with private and public sector businesses to deliver

lasting and meaningful change. It works alongside business,

deploying the right resources and the best advice to ensure

programmes are delivered effectively, efficiently and in a manner

that fits the business's culture.

More information is available at www.ameogroup.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ACQJMMMTMTABTPM

(END) Dow Jones Newswires

March 11, 2020 03:00 ET (07:00 GMT)

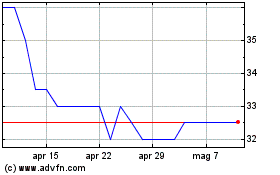

Grafico Azioni Tpximpact (LSE:TPX)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Tpximpact (LSE:TPX)

Storico

Da Apr 2023 a Apr 2024