TIDMTPX

RNS Number : 5999Q

Panoply Holdings PLC (The)

01 March 2021

This announcement contains inside information

1 March 2021

The Panoply Holdings PLC

("The Panoply", or the "Group")

Acquisition of Keep IT Simple

Expands and strengthens capabilities, enabling the Group to bid

for larger contracts

The Panoply Holdings PLC (AIM: TPX), the technology-enabled

services group focused on digital transformation, announces the

acquisition of the entire issued and to be issued share capital of

Keep IT Simple LTD ("KITS"), a provider of high value IT support

and transformation services to public and private sector clients

(the "Acquisition") for GBP26m.

The Acquisition

KITS has built a reputation in the public sector for

transforming and running live and critical services such as

payments platforms on behalf of clients including the Rural

Payments Agency and the Department for Environment, Food and Rural

Affairs ("DEFRA"). KITS typically delivers managed services, with

market-leading expertise in service integration and management,

which is seen by large organisations as the highest value-added

layer in the technology services stack.

With a proven track record, the acquisition of KITS enables the

Group to bid for ever-larger contracts across both the public and

commercial sectors. KITS enters the Group having recorded unaudited

revenues for the full year ended 31 December 2020 of GBP9.7m (

audited 18 months to 31 Dec 2019: GBP10.9m), unaudited adjusted

EBITDA and adjusted net profit before tax of GBP2.7m (audited

EBITDA 18 months to 31 Dec 2019: GBP3.3m) and with GBP30.3m of

contract backlog to be recognised between 2021 and 2024. KITS will

be integrated into the Group's technology brand, Foundry4 and is

being acquired from its sole shareholder, Grant Harris.

Following the acquisition, the Directors now expect Revenue and

Adjusted EBITDA for the year ending 31 March 2021 of not less than

GBP48.5m and GBP6.6m respectively.

The key benefits of the Acquisition include:

-- Significant expansion of The Panoply's digital transformation

capabilities for the public sector, enabling the Group to provide

an ongoing managed support service to clients. While The Panoply's

strength in technology has previously been in the discovery, alpha

and beta (user research, design, prototyping and development)

stages, KITS adds the capability to secure additional contracts

running high value, high profile services to public sector

customers, providing a complete end-to-end offering.

-- Extension of the average length of client relationship and

generation of a greater proportion of recurring revenues.

-- The Acquisition will enable the Group to bid for multi-year

projects several multiples higher in value than it can

currently.

-- Bringing another purpose-driven organisation into the Group,

supporting The Panoply in its mission to deliver Sustainable

Futures through Digital Transformation.

-- The acquisition of KITS is expected to be immediately earnings enhancing for the Group.

Neal Gandhi, Chief Executive Officer of The Panoply said:

"Following a period of strong organic growth, I am delighted to

today announce continued execution on our acquisitive strategy with

the addition of Keep IT Simple into the Group. KITS's reputation

for delivering major service transformation programmes and for

service integration and management is unparalleled. Their work at

the Rural Payments Agency, after a series of well-documented

failures by larger monolithic providers, has contributed to KITS's

reputation as a credible modern alternative providing outcomes and

value that is orders of magnitude better than past options.

Importantly, their work complements the existing strengths of the

Group, and means we are now able to offer a truly end-to-end

service to public sector clients.

"In addition, the Board and I are delighted to have found

another ethical business to join our purpose-driven Group.

Together, I am confident we can drive positive change through

technology, in a responsible way, and I look forward to seeing what

we will achieve."

Grant Harris, Chief Executive Officer of Keep IT Simple

said:

"We are very proud of the business we have built, and the value

of our work to the Public Sector. This acquisition marks a

milestone in our growth journey, as we become part of a modern,

agile and rapidly scaling Group which is set to become a key player

in our field. The support of The Panoply will fuel our ambitious

plans for expansion, as we roll out our leading capabilities to a

wider set of clients."

Consideration

Given the strong contracted pipeline backlog of GBP30.3m to be

recognised between 2021 and 2024, The Panoply has agreed to pay a

total consideration of GBP26m for the Acquisition, satisfied

through the payment of GBP 7.5 m cash and the issue of 10,277,778

new ordinary shares in The Panoply (at a price of 180p) with up to

GBP7m of the share consideration subject to claw back. In addition,

it is expected that a further GBP4.9m will be paid to the vendor of

KITS from free cash on its balance sheet on completion representing

excess cash of its normalised working capital requirements . The

purchase price will be subject to a customary adjustment based on

completion accounts.

Up to GBP7.0m of shares will be subject to a clawback in the

event that KITS does not achieve a revenue target of GBP26.8m

either during the calendar year 2022 or the calendar year 2023.

Should the revenue target not be met in either of those years,

shares with a value of up to GBP7.0m can be clawed back from the

seller with a value equal to the amount by which the actual revenue

in the calendar year 2023 is less than the revenue target.

In order to help fund the acquisition and to provide the Group

with additional resources for further acquisitions, The Panoply has

extended its revolving credit facility with HSBC (which reaches

maturity in June 2023) from GBP7.0m to GBP20.0m (the "RCF

Facility"). GBP6.0m will be drawn down at completion to fund the

acquisition, leaving a further GBP7.0m available for future

acquisitions. Within the GBP20.0m facility The Panoply can draw

down up to GBP5.0m for working capital purposes with the remainder

set aside for acquisitions. As announced on 12 June 2019, HSBC has

taken security over The Panoply and all of the Group's material

subsidiaries and their assets in connection with the RCF Facility.

The RCF Facility contains customary terms and covenants, including

financial covenants.

As at 28 February 2021, assuming all payments in connection with

the Acquisition had been made as at that date, the Group retained

cash reserves of approximately GBP3.7m with a net debt position of

GBP9.3m, meaning that net debt remains below 1.0x EBITDA based on

pro forma results.

The combination of run rate revenue, forecast organic growth and

additional banking facilities now available for acquisition mean

that the Group is well placed to hit its stated commercial target

of GBP100m run rate revenue by 31 March 2023.

Integration and strategic outlook

Having joined the Group, K ITS will sit under the Foundry4 brand

as part of the deep tech, engineering focused division of the

Group. Foundry4 helps organisations in highly regulated sectors

harness technology to solve complex challenges, focusing on

CTO/CIOs looking to enable digital transformation through the

adoption of hyper scale cloud, data analytics, AI and machine

learning and automation.

Grant Harris, CEO of KITS, will become Managing Director of a

newly formed Managed Services Division within Foundry4. The

division will be provided with additional sales and bid management,

HR and recruitment as well as finance support to facilitate further

growth.

Additional information on the acquisition

The Panoply has acquired Keep IT Simple from Grant Harris.

The consideration payable under the share purchase agreement

relating to the Acquisition (the "SPA") is GBP26.0m (plus GBP4.9m

in respect of excess cash) and comprises the following on

Completion:

(a) the allotment and issue of 10,277,778 ordinary shares in The

Panoply, with a value of GBP18.5m, calculated by reference to a

price of 180 pence to Grant Harris (the "Consideration

Shares");

(b) a payment in cash of GBP7.5m; and

(c) a payment in cash of GBP4.9m in respect of the cash

currently held on KITS's balance sheet in excess of its normalised

working capital requirements, subject to adjustment following the

determination of the actual working capital in the completion

accounts

together (the "Consideration").

The Consideration referred to in (b) above is being funded

through a combination of the RCF Facility and the Group's existing

cash reserves. The Consideration referred to in (c) above is being

funded by cash on KITS's balance sheet at completion.

All shares in The Panoply allotted and issued under the SPA

(including the shares issued as part of the Consideration) are

subject to lock-in arrangements and shares with a value of up to

GBP7,0m are subject to claw-back by The Panoply if KITS' revenues

do not meet a target of GBP26.8m in either the calendar year 2022

or the calendar year 2023.

Following the issue of the Consideration Shares, Grant Harris

will hold 10,277,778 ordinary shares in The Panoply, representing

12.87% of the then issued share capital.

Admission and total voting rights

An application has been made for the admission of the

Consideration Shares to trading on AIM which is expected to take

place on or around 4 March 2021. Following this issue, the

Company's issued share capital will comprise 79,850,906 Ordinary

Shares and this is the total number of voting rights in the

Company. There are no shares held in treasury.

This figure may be used by shareholders as the denominator for

the calculation by which they may determine if they are required to

notify their interest in, or change to their interest in, the

Company under the FCA's Disclosure Guidance and Transparency

Rules.

The person responsible for this announcement is Oliver Rigby,

CFO.

Enquiries:

The Panoply Holdings

Neal Gandhi (CEO) Via Alma PR

Oliver Rigby (CFO)

Stifel Nicolaus Europe +44 (0)207 710 7600

Limited

(Nomad and Joint Broker)

Fred Walsh

Alex Price

Dowgate Capital Limited

(Joint Broker)

James Serjeant

David Poutney

Nicholas Chambers +44 (0)203 903 7715

Alma PR panoply@almapr.co.uk

(Financial PR) +44 (0)203 405 0209

Susie Hudson

Josh Royston

Harriet Jackson

About The Panoply

The Panoply is a technology-enabled services group, built to

service clients' digital transformation needs. Founded in 2016,

with the aim of identifying and acquiring best-of-breed specialist

information technology, design and innovation consulting

businesses, the Group collaborates with its clients to deliver the

technology outcomes they're looking for at the pace that they

expect and demand.

The Group is being increasingly recognised as a leading

alternative digital transformation provider to the UK public

services sector, with c.70% of its client base representing the

public sector and c.30% representing the commercial sector.

More information is available at www.thepanoply.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQTPMTTMTMTBPB

(END) Dow Jones Newswires

March 01, 2021 02:00 ET (07:00 GMT)

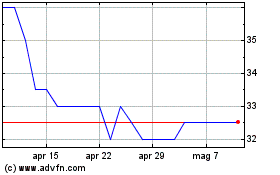

Grafico Azioni Tpximpact (LSE:TPX)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Tpximpact (LSE:TPX)

Storico

Da Apr 2023 a Apr 2024