TIDMTPX

RNS Number : 2840Y

Panoply Holdings PLC (The)

08 September 2020

8 September 2020

The Panoply Holdings PLC

("The Panoply", or the "Group")

Amendment to Share Purchase Agreements

The Panoply (AIM: TPX), the technology-enabled services group

focused on digital transformation, announces that the Group has

entered into various agreements to amend the terms of a number of

its historical share purchase agreements ("SPA"). The details of

these amendments are set out below.

In line with the Group's strategy, as announced in its recent

Annual Report, to consolidate its end-to-end propositions under two

full stack brands, The Panoply has agreed to accelerate the end of

the earn-out periods in respect of FutureGov and Ameo with a view

facilitating full integration into the Group. Ameo is becoming part

of FutureGov, supercharging its change delivery and opening new

doors within local and central Government for even bigger impact.

Ameo supports its clients through full stack change delivery to

build the best outcomes for citizens with long term impact. Both

Ameo and FutureGov continue to trade strongly in line with

expectations.

The result of these changes, together with the other amendments

detailed below, is to increase the total deferred consideration now

known to be payable by The Panoply to GBP 20,835,794 . The maximum

further shares to be issued as a result of this consideration is

26,395,283, which reduces to 18,719,658 assuming the share price

remained constant at 130p, being the closing mid market price on

the day prior to this announcement.

SPA for the acquisition of the entire issued share capital of

FutureGov Ltd ("FG") dated 11 June 2019 (the "FG SPA")

The parties to the FG SPA have agreed that the FG sellers will

receive deferred earn-out consideration equal to a fixed amount of

GBP1,249,290 in respect of the 12 month period ending on 31 March

2021.

The FG SPA has been amended so that this amount is to be paid in

substitution for amounts that were previously to have been

determined by a calculation that was predominantly based on FG's

EBITDA performance for the period to 31 March 2021 (" FG Reference

Period " ). Otherwise the terms of the original FG SPA are not

substantially changed, including in respect of the proportion of

consideration payable as ordinary shares in the Panoply (96%) ("

Panoply Shares ") and cash (4%).

Further, the number of Panoply Shares to be issued and allotted

continues to be calculated by dividing the earn-out price payable

by the greater of 83.125 pence and the volume-weighted average

mid-market price ("VWAP") over the 30 business days prior to the

issue of the relevant Panoply Shares. The timing of the issue and

allotment of these Panoply Shares also remains unchanged, being in

four tranches following the publication of the accounts of the

Panoply for the relevant FG Reference Period.

The cash element of the deferred earn-out consideration, being

GBP121,136.40, will be paid by the Panoply within 10 business days

of this announcement.

SPA for the acquisition of the entire issued share capital of

AMEO Professional Services Limited ("Ameo") dated 10 March 2020

(the "Ameo SPA")

The parties to the Ameo SPA have agreed that the Ameo sellers

will receive deferred earn-out consideration equal to fixed amounts

of:

1. GBP416,460 in respect of the 17 month period ending on 31 March 2021 and;

2. GBP889,710 in respect of the 12 month period ending on 31 March 2022.

The Ameo SPA has been amended so that these amounts are to be

paid in substitution for amounts that were previously to have been

determined by a calculation that was predominantly based on Ameo's

EBITDA performance for each of these periods (each an " Ameo

Reference Period "). Otherwise the terms of the Ameo SPA are not

substantially changed and the number of Panoply Shares to be issued

and allotted remains calculated by dividing the earn-out price

payable by the greater of 82 pence and the VWAP over the 30

business days prior to the issue of the relevant Panoply Shares.

The timing of the issue and allotment of these Panoply Shares also

remains unchanged, being in one tranche following the publication

of the Panoply's accounts for the relevant Ameo Reference

Period.

SPA for the acquisition of the entire issued share capital of

Greenshoot Labs Limited ("GSL") dated 11 February 2019 (the "GSL

SPA")

The parties to the GSL SPA have agreed that the GSL sellers will

receive deferred earn-out consideration equal to a fixed amount of

GBP500,000 in respect of the 12 month period ending on 31 March

2020 (the " First GSL Reference Period " ), in substitution for an

amount that would have been previously determined by a calculation

predominantly based on GSL's EBITDA performance for the First GSL

Reference Period. This is to reflect the value of GSL's revenue

growth during the period.

The calculation for the amount of deferred earn-out

consideration in respect of the 12 month period ending on 31 March

2021 (the " Second GSL Reference Period ") will remain based on the

financial performance of GSL for the Second GSL Reference Period.

In addition, the GSL deferred earn-out consideration remains

payable by the Panoply by the issue of the relevant number of

Panoply Shares (calculated in accordance with the GSL SPA) in one

tranche following the publication of the Panoply's accounts for the

First and Second GSL Reference Period (as applicable).

SPA for the acquisition of the entire issued share capital of

Deeson Group Holdings Limited ("DGHL") dated 18 December 2018 (the

"DGHL SPA")

The maximum total amount of consideration that can be payable

under the DGHL SPA has been increased to GBP4,580,000 . This a

reflection of the strong financial performance of DGHL.

Agreement between Neal Gandhi and Maxine Tolfrey

Neal Gandhi ("NG") has entered into an agreement (the "

Agreement" ) with Maxine Tolfrey (" MT" ) in relation to MT's

rights and obligations pursuant to the share purchase agreement for

the acquisition of the entire issued share capital of Questers

dated 11 May 2018 (the " Questers SPA " ).

Pursuant to the Agreement, MT has agreed that she will transfer

to NG any further consideration she may receive pursuant to the

Questers SPA. The Agreement has been entered into in compliance

with the divorce settlement between NG and MT.

Related party transactions

The entry into the amendment agreements with the shareholders of

FG, Ameo, GSL and DGHL each constitute related party transactions

under the AIM Rules for Companies. The Directors of The Panoply

(who are all independent in relation to these matters), having

consulted with Stifel, consider that the terms of those various

amendment agreements are fair and reasonable insofar as the Group's

shareholders are concerned.

Enquiries:

The Panoply Holdings

Neal Gandhi (CEO) Via Alma PR

Oliver Rigby (CFO)

Stifel Nicolaus Europe +44 (0)207 710 7600

Limited

(Nomad and Broker)

Fred Walsh

Alex Price

Alma PR panoply@almapr.co.uk

(Financial PR) +44(0)203 405 0209

Susie Hudson

Josh Royston

Harriet Jackson

About The Panoply

The Panoply is a digitally native technology services company,

built to service clients' digital transformation needs. Founded in

2016, with the aim of identifying and acquiring best-of-breed

specialist information technology, design and innovation consulting

businesses, the Group collaborates with its clients to deliver the

technology outcomes they're looking for at the pace that they

expect and demand.

The Group is being increasingly recognised as a leading

alternative digital transformation provider to the UK public

services sector, with c. 70% of its client base representing the

public sector and c. 30% representing the commercial sector.

More information is available at www.thepanoply.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

AGREAANXEENEEAA

(END) Dow Jones Newswires

September 08, 2020 02:01 ET (06:01 GMT)

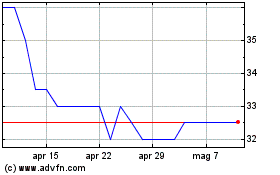

Grafico Azioni Tpximpact (LSE:TPX)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Tpximpact (LSE:TPX)

Storico

Da Apr 2023 a Apr 2024