Parrot: 2020 FIRST-HALF EARNINGS

| |

PRESS RELEASEParis, July 31, 2020, 7am CET |

2020 FIRST-HALF

EARNINGS

- Impact of the health crisis on sales trends and

earnings

- Continuity of operations and roadmap respected despite

the pandemic

- ANAFI USA launched in June: extremely high-performance

and secure drone designed in France and built in the

US

- Continued progress to further strengthen the strategy

for professionals, businesses and institutions

2020 first-half business

Business for the first half of 2020 was marked

by the context of the health and economic crisis spreading around

the world and a roadmap designed to support sales development over

the second half of the year. These factors are reflected in

consolidated revenues of €26.5m, down 33% from the first half of

2019 (-23% in Q1 2020, -42% in Q2 2020), with a marked contraction

in sales from mid-March linked to the closure of non-essential

stores and the transport restrictions. The slowdown in commercial

activity primarily concerns hardware (drones and sensors), while

software sales - which are fully online - have been more

resilient.

From the start of March 2020, all of the Group’s

business units rolled out various health measures and set up the

majority of staff to work from home, with all the infrastructures

and systems in place, ensuring the continuity of operations, while

protecting the teams. Furlough measures were introduced from April

focused on support staff and have not affected research and

development capabilities. The Group has not experienced any

difficulties with access to components or production, and has been

able to adapt to the restrictions on movement. At end-July, the

Group is still widely encouraging staff to work from home and its

teams remain firmly focused on implementing the roadmap in terms of

R&D, as well as commercial operations and development in the

Defense and Security sector.

During this period, Parrot notably continued to

professionalize its ANAFI offering, launching the ANAFI USA at the

start of June1. This new drone, offering a combination of advanced

features and sensors, is built to meet the demands of first

responders, firefighters, search-and-rescue teams, security

agencies, construction and inspection professionals. Developed in

France and built in the US, it is aligned with the highest security

and traceability standards and offers a high-performance, reliable

and highly secure solution for diverse market operators

(institutions, businesses, pro pilots).

Alongside this, the Group is moving forward with

its efforts to provide solutions (drones and software) for armed

forces and security services (police, fire services, etc.). For the

SRR program with the United States Department of Defense, which

Parrot Drones has been working on for the past 15 months, the

results initially expected for this summer could be put back to the

autumn.

The extension of the range of commercial

products and solutions is being supported by a dedicated strategy

to meet the specific needs of these clients and a growing number of

initiatives to facilitate drone integration within software and

services used by these professionals. The SDK (Software Development

Kit) Program, launched in 2019 to create an ecosystem of

professional applications, is leading to the first technological

and commercial partnerships with major market operators specialized

in airspace management or drone fleet deployment for businesses,

such as Kittyhawk, Skyward and Dronesense. Pix4D’s software

solutions are tailored to the specific demands of the core target

industries (agriculture, inspection, security and defense) and

further strengthened to meet the needs of large businesses

(Pix4Dengine, Pix4DCloud). These advances are also enabling the

Group to take part in a growing number of calls for tenders, as

well as working groups looking at changes to the regulatory

framework.

2020 first-half earnings

|

€m and % of revenues |

|

H1 2020 |

H1 2019 |

Change |

|

Revenues |

|

26.5 |

39.7 |

-33% |

|

- Of which, Parrot Drones |

|

8.1 |

16.6 |

-51% |

|

- Of which, Pix4D |

|

10.8 |

10.7 |

+1% |

|

- Of which, senseFly |

|

5.3 |

8.1 |

-35% |

|

- Of which, Micasense |

|

2.8 |

4.3 |

-35% |

|

- Of which, Airinov (1) |

|

-- |

0.7 |

-- |

|

Gross margin |

|

19.3 |

25.2 |

-23% |

|

% of revenues |

|

72.8% |

63.6% |

|

|

Income from ordinary operations |

|

-20.9 |

-13.0 |

-61% |

|

% of revenues |

|

-78.9% |

-32.7% |

|

|

EBIT |

|

-20.9 |

-13.2 |

-58% |

|

% of revenues |

|

-79.1% |

-33.2% |

|

|

Net income (Group share) |

|

-22.1 |

-13.8 |

-60% |

|

% of revenues |

|

83.6% |

-34.9% |

|

(1) Subsidiary closed in 2019.

For the first half of 2020, the gross

margin represents 73% of revenues (versus 64% in H1 2019),

linked to the ramping up of the dedicated offers and solutions for

professionals and the continued reduction in consumer product

sales.

Current operating expenditure

came to €40.1m for the first half of this year, compared with

€38.3m for the same period in 2019, with this increase allocated

almost exclusively to R&D (launch of ANAFI USA, Pix4Dreact and

Pix4DSurvey) and the ongoing innovation strategy. The change in

other cost items reflects a lower level of sales and marketing

costs (-21%) and production costs (-12%) linked to the health

measures and the product portfolio’s realignment around

professional targets. In the current context, the Group is

maintaining strict control over costs and is activating support

measures locally (furlough and payment holidays in France, furlough

and government-backed loans in Switzerland and Germany), for a

total amount (savings / assistance and in a smaller portion payment

delays) of around €2.3m for the first half of this year, taking

into account the maintenance of operations for the Group’s various

business units. At June 30, 2020, the Group's

workforce (permanent and fixed-term contracts)

represented 539 people (545 at December 31, 2019), in addition to

79 external contractors (75 at December 31, 2019).

After -€0.5m of financial income and expenses

and a -€0.4m share of income from associates, consolidated

net income (Group share) represents -€22.1m, compared with

-€13.8m for the first half of 2019.

Changes in the cash position and balance

sheet at June 30, 2020

At June 30, 2020, net cash represents

€105.1m.

Taking into account EBITDA of -€21.2m (versus

-€17.3 in H1 2019), net cash consumption for the first half of the

year came to €19.8m, with a +€1.0m change in working capital

requirements. It reflects a slight increase in inventories (+5%)

and a significant reduction in trade receivables (-39%) and trade

payables (-28%) in relation with the slowdown of sales and

purchases.

Outlook for 2020

In 2019, the Group turned its situation around

and freed up additional flexibility to continue moving forward with

its strategy for innovation and expansion on its key markets: 3D

Mapping, Geomatics, Inspection, Precision Farming and Security.

In 2020, on a market for commercial drones and

solutions whose short-term development is still difficult to

estimate, the Group notably expects to make progress with its

projects in the Defense and Security sector, while continuing to

roll out a sales strategy targeting professionals, businesses, key

accounts and governments.

With regard to the coronavirus crisis, the Group

has not at this stage encountered any significant issues in terms

of sourcing supplies, production or operations. The majority of the

Group’s employees are still working remotely, where possible with

all the systems infrastructures in place, ensuring the continuity

of the business, while protecting the teams. The Group remains

focused on moving forward with its projects in 2020 and vigilant

concerning the potential impact of the health measures on their

finalization.

The Group does not expect activity to pick up

again over the second half of the year, as certain markets,

including the agricultural sector, benefit from stronger

seasonality at the start of the year. Now positioned on commercial

applications, the Group’s sales are still dependent on clients’

investment decisions and the activity of its distribution

networks.

The Parrot Group has €105.1m of net cash at June

30 and it has further strengthened its budgetary discipline to

adapt to the current situation. In an uncertain economic

environment, this financing capacity will enable the Group to

continue developing its positions on professional markets.

Next financial date

- 2020 third-quarter revenues: November 18, 2020, before start of

trading.

ABOUT

PARROT

Founded in 1994 by Henri Seydoux, Parrot is

today the leading European group in the fast-growing industry of

drones. Visionary, at the forefront of innovation, Parrot is

positioned across the entire value chain, from equipment to

services and software. Its micro-drones, well known for their high

performance and ease of use, address the needs of consumers as well

as professionals. The Group also has a portfolio of outstanding

companies and interests in commercial drones, covering equipment,

software and services. Its expert capabilities are focused

primarily on three vertical markets: (i) Agriculture, (ii) 3D

Mapping, Surveying and Inspection, and (iii) Defense and

Security.

The Parrot Group designs and engineers its

products in Europe, mainly in France and Switzerland. It currently

employs over 500 people worldwide and makes the majority of its

sales outside of France. Parrot, headquartered in Paris, has been

listed since 2006 on Euronext Paris (FR0004038263 - PARRO).

Financial information is available on http://corporate.parrot.com.

For more information visit: www.parrot.com and its subsidiaries

www.pix4d.com, www.sensefly.com, www.micasense.com.

CONTACTS

|

Investors, analysts, financial media Marie Calleux

- T. : +33(0) 1 48 03 60 60parrot@calyptus.net |

Consumer

and tech media Cecilia Hage - T. : +33(0) 1 48 03 60

60 cecilia.hage@parrot.com |

APPENDICES

The accounts for the first half of the year 2020

were reviewed by the Board of Directors on July 29, 2020. The

statutory auditors have completed the limited review procedures on

the condensed consolidated accounts at June 30, 2020. The limited

review report will be issued once the procedures required for it to

be issued have been finalized.

BREAKDOWN OF REVENUES BY BUSINESS UNIT

AND BUSINESS LINE

|

€m and % of revenues |

Q1 2020 |

Q2 2020 |

H1 2020 |

H1 2019(3) |

Change |

| Parrot

Drones (microdrones) |

3.2 |

23% |

4.9 |

39% |

8.1 |

31% |

16.6 |

42% |

-51% |

| Of

which, legacy consumer products(1) |

0.5 |

4% |

0.5 |

4% |

1.0 |

4% |

3.6 |

9% |

-72% |

| Pix4D

(software) |

6.1 |

44% |

4.7 |

38% |

10.8 |

41% |

10.7 |

27% |

1% |

| senseFly

(drones and sensors) |

3.5 |

25% |

1.8 |

14% |

5.3 |

20% |

8.1 |

20% |

-35% |

| MicaSense

(sensors and services) |

1.4 |

10% |

1.4 |

11% |

2.8 |

10% |

4.3 |

11% |

-36% |

|

Parrot SA |

0 |

0% |

0.1 |

1% |

0.1 |

1% |

0.7 |

2% |

-81% |

|

Intragroup eliminations |

-0.3 |

-2% |

-0.4 |

-3% |

-0.7 |

-3% |

-1.3 |

-3% |

-48% |

|

PARROT GROUP TOTAL |

13.8 |

|

12.6 |

|

26.5 |

|

39.7 |

|

-33% |

|

DRONE TOTAL (2) |

13.4 |

97% |

11.9 |

94% |

25.3 |

96% |

36.1 |

91% |

-30% |

(1) Legacy consumer products: previous drone

ranges (Bebop, Disco, Mini Drones), automotive products (car kit,

plug & play) and connected devices. (2) “Drone total” is an

alternative performance indicator to measure the impact of

strategic decisions; for the periods presented, it is determined by

deducting from the Group’s total revenues the activities that are

at the end of their lives or have been shut down, i.e. Parrot

Drones’ legacy consumer products, Airinov’s revenues and

Airsupport’s revenues.(3) The Group’s total revenues in 2019

include Airinov, which no longer made a contribution in 2020 after

this company was shut down.

CONSOLIDATED INCOME

STATEMENT

|

IFRS in €m and % of revenues |

H1 2020 |

H1 2019 |

|

Revenues |

26.5 |

39.7 |

| Cost of

sales |

(7.2) |

(14.4) |

|

Gross margin |

19.3 |

25.2 |

|

% of revenues |

72.8% |

63.6% |

|

R&D costs |

(21.3) |

(17.1) |

|

% of revenues |

(80.7%) |

(43.1%) |

|

Sales and marketing costs |

(8.7) |

(11.1) |

|

% of revenues |

(33.0%) |

(28.0%) |

|

Administrative costs and overheads |

(6.9) |

(6.6) |

|

% of revenues |

(26.3%) |

(16.6%) |

|

Production and quality costs |

(3.1) |

(3.4) |

|

% of revenues |

(11.7%) |

(8.6%) |

|

Income from ordinary operations |

(20.9) |

(13.0) |

|

% of revenues |

(78.9%) |

(32.7%) |

|

Other operating income and expenses |

(0.05) |

(0.2) |

|

EBIT |

(20.9) |

(13.2) |

|

% of revenues |

(79.1%) |

(33.2%) |

|

Financial income and expenses |

(0.6) |

0.0 |

|

Share in income from associates |

(0.4) |

(0.3) |

|

Corporate income tax |

(0.2) |

(0.2) |

|

Net income |

(22.2) |

(13.8) |

|

Minority interests |

(0.06) |

0.06 |

|

Net income (Group share) |

(22.1) |

(13.8) |

|

% of revenues |

(83.6%) |

(34.9%) |

CONSOLIDATED BALANCE SHEET

|

ASSETS - IFRS, €m |

Jun 30, 2020 |

Dec 31, 2019 |

|

Non-current assets |

20.5 |

20.9 |

|

Goodwill |

- |

- |

|

Other intangible assets |

0.4 |

0.4 |

|

Property, plant and equipment |

2.2 |

2.2 |

|

Right of use |

6.7 |

6.6 |

|

Investments in associates |

5.1 |

5.6 |

|

Financial assets |

4.6 |

4.4 |

|

Non-current lease receivables |

1.2 |

1.6 |

|

Deferred tax assets |

0.2 |

0.2 |

|

Current assets |

145.5 |

168.2 |

|

Inventories |

14.0 |

13.3 |

|

Trade receivables |

6.3 |

10.3 |

|

Tax receivables |

6.7 |

6.0 |

|

Other receivables |

10.9 |

11.2 |

|

Current lease receivables |

0.8 |

0.7 |

|

Other current financial assets |

- |

- |

|

Cash and cash equivalents |

106.9 |

126.6 |

|

TOTAL ASSETS |

166.0 |

189.1 |

|

Shareholders’ equity |

117.8 |

139.5 |

|

Share capital |

4.6 |

4.6 |

|

Additional paid-in capital |

331.7 |

331.7 |

|

Reserves excluding earnings for the period |

(203.5) |

(174.3) |

|

Earnings for the period - Group share |

(22.1) |

(29.6) |

|

Exchange gains or losses |

6.6 |

6.3 |

|

Equity attributable to shareholders |

117.3 |

138.7 |

|

Minority interests |

0.5 |

0.5 |

|

Non-current liabilities |

11.0 |

10.9 |

|

Non-current financial liabilities |

1.6 |

1.5 |

|

Non-current lease liabilities |

5.4 |

5.7 |

|

Provisions for pensions and other employee benefits |

0.9 |

0.9 |

|

Deferred tax liabilities |

0.0 |

0.0 |

|

Other non-current provisions |

1.0 |

0.1 |

|

Other non-current liabilities |

2.9 |

2.6 |

|

Current liabilities |

36.4 |

38.9 |

|

Current financial liabilities |

0.2 |

- |

|

Current lease liabilities |

3.4 |

3.4 |

|

Current provisions |

4.5 |

5.2 |

|

Trade payables |

11.7 |

16.3 |

|

Current tax liabilities |

0.1 |

0.0 |

|

Other current liabilities |

16.5 |

14.0 |

|

TOTAL SHAREHOLDERS’ EQUITY AND LIABILITIES |

166.0 |

189.1 |

CASH-FLOW STATEMENT

|

IFRS (€m) |

Jun 30, 2020 |

Dec 31, 2019 |

|

Operating cash flow |

|

|

|

Earnings for the period from continuing operations |

(22.2) |

(29.6) |

|

Share in income from associates |

0.4 |

0.6 |

|

Depreciation and amortization |

2.5 |

(10.5) |

|

Capital gains and losses on disposals |

(0.0) |

1.0 |

|

Tax expense |

0.2 |

0.4 |

|

Cost of share-based payments |

0.5 |

1.5 |

|

Net finance costs |

0.1 |

0.1 |

|

Cash flow from operations before net finance costs and

tax |

(18.5) |

(36.5) |

|

Change in working capital requirements |

1.0 |

3.7 |

|

Tax paid |

(0.2) |

0.5 |

|

Cash flow from operating activities (A) |

(17.7) |

(33.2) |

|

Investing cash flow |

|

|

|

Acquisition of property. plant and equipment and intangible

assets |

(0.8) |

(1.4) |

|

Acquisition of subsidiaries. net of cash acquired |

- |

(1.0) |

|

Acquisition of long-term financial investments |

(0.3) |

(0.5) |

|

Disposal of property. plant and equipment and intangible

assets |

0.0 |

0.1 |

|

Disposal of subsidiaries. net of cash divested |

- |

- |

|

Disposal of investments in associates |

- |

- |

|

Disposal of long-term financial investments |

0.4 |

0.5 |

|

Cash flow from investment activities (B) |

(0.6) |

(2.2) |

|

Financing cash flow |

|

|

|

Equity contributions |

0.0 |

0.0 |

|

Receipts linked to new loans |

0.7 |

0.0 |

|

Cash invested for over 3 months |

- |

(0.3) |

|

Net finance costs |

(0.1) |

(0.1) |

|

Repayment of short-term financial debt (net) |

(2.4) |

(0.2) |

|

Sales / (Purchases) of treasury stock (4) |

- |

0.0 |

|

Cash flow from financing activities (C) |

(1.8) |

(0.5) |

|

Net change in cash position (D = A+B+C) |

(20.1) |

(35.9) |

|

Impact of change in exchange rates |

0.4 |

0.7 |

|

Impact of changes in accounting principles |

- |

- |

|

Cash and cash equivalents at start of period |

126.6 |

161.5 |

|

Cash and cash equivalents at end of period |

106.9 |

126.3 |

***

([1])

https://s3.eu-central-1.amazonaws.com/corporate.parrot.com/files/s3fs-public/2020-06/Parrot-ANAFI-USA_PressRelease_US.pdf

- Parrot_CP_T2-2020_20200731_EN_DEF

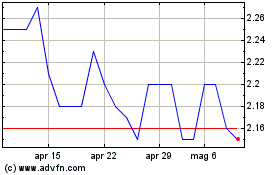

Grafico Azioni Parrot (EU:PARRO)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Parrot (EU:PARRO)

Storico

Da Apr 2023 a Apr 2024