TIDMPFP

RNS Number : 4484R

Pathfinder Minerals Plc

30 June 2020

30 June 2020

Pathfinder Minerals Plc

("Pathfinder" the "Company" or the "Group")

Final Results for the Year Ended 31 December 2019

CHAIRMAN'S STATEMENT

INTRODUCTION

Considerable progress was made during 2019 across several areas

which significantly enhanced Pathfinder's ability and positioning

to regain an interest in Mining Concession no. 4623C in Mozambique

(the "Licence").

The Company engaged new consultants to provide assistance in

pursuing completion of a transaction in respect of the Licence;

agreement on a proposed transaction was reached between Pathfinder

and General Jacinto Veloso who, with his family interests, owns 50

per cent of the entity to which the Licence is currently registered

(the balance being owned by a Hong Kong registered entity); a

revised independent Scoping Study was published resulting in a near

doubling of the Net Present Value attributable to the Licence;

non-binding financing proposals to facilitate a deal and fund

subsequent development of the Licence were received; additional

working capital was brought into the Company; and a leadership

change was implemented.

Subsequent to the period end, Pathfinder was notified that the

Mozambique Supreme Court had rejected the Company's application for

recognition of a judgment by the English High Court (the "English

Judgment") which gave certain declarations to the effect that

Pathfinder's subsidiary, IM Minerals Limited, validly acquired its

shareholding in Companhia Mineira de Naburi S.A.R.L., which

previously held the Licence. This outcome has no bearing on the

English Judgment, which remains in force. While disappointing in

the context of a legal strategy to regain an interest in the

Licence, a negotiated outcome was, and continues to be, the focus

of all parties, including the Veloso family which appears to remain

committed to working towards a commercial resolution that avoids

further protracted delays from legal proceedings.

REVIEW OF ACTIVITY FOR THE PERIOD

Progress towards a potential transaction in respect of the

Licence

On 11 February 2019, the Company announced that it had engaged

Africa Focus Group Limited, a Hong Kong-based company with a

Johannesburg consultancy office specialising in mergers and

acquisitions in southern Africa, to provide assistance to the

Company in pursuing completion of a transaction with the owners of

Pathfinder Moçambique S.A (the current Licence holder) pursuant to

which Pathfinder, or a wholly owned subsidiary of Pathfinder, would

re-establish an interest in the Licence.

On 10 April 2019, the Company announced that it was evaluating

multiple transaction structures, taking into account commercial and

regulatory factors, through which the Company could hold its

interest in the Licence and deliver value for shareholders and that

the principle of a proposed transaction had been agreed between

Path nder and General Jacinto Veloso.

In parallel, the Board commenced discussions with regards to

potential funding strategies (including through partnerships or

debt provision) to facilitate a transaction and finance further

development of the Licence.

Revised independent Scoping Study on the Licence

On 10 April 2019, Pathfinder announced the results of a revised

Scoping Study on the Licence prepared by independent technical

consultant, 2M Mineral Services Limited, which included a revision

of the capital and operating costs and pricing assumptions that

were presented in the original URS/Scott Wilson 2011 scoping study

report. This revision resulted in an estimated pre-tax net present

value ("NPV") at a 10 per cent discount rate of US$1.05 billion;

with projected annual revenues of US$323 million over a mine life

of 30 years. The project internal rate of return ("IRR") is

expected to be approximately 25 per cent. The revised ndings

represented a near doubling of the previously reported equivalent

NPV and an increase of 6.1 per cent in the project IRR.

Leadership changes

On 3 June 2019, the Company announced the appointment of John

Taylor as CEO; on 23 July 2019, the Company announced the

resignation of Simon Farrell as a non-executive director; and, on 2

August 2019, the Company announced the appointment of Dennis

Edmonds as a non-executive director. The new appointments prompted

a review of the Company's strategy and a renewed focus and effort

on negotiations in Mozambique.

The review included a detailed analysis of the different routes

available to Pathfinder to restore an interest in the Licence and

to fund its further development within the context of the Company's

access to capital. Throughout the year, and early into 2020,

wide-ranging meetings were held in South Africa and Mozambique with

representatives of Pathfinder Moçambique S.A., the Company's

Mozambique legal advisers, representatives of the UK Government in

Mozambique, and prospective funding partners.

New funds for working capital

A total of GBP335,000 was raised during the period through cash

subscriptions for 14,909,091 shares in aggregate. A further

GBP239,000 was taken in by the Company during the period as a

result of the exercise of warrants to subscribe for, in aggregate,

15,624,792 shares. New funds provided necessary general working

capital.

Subsequent to period end, the Company completed two new

financings. The first was a convertible loan note for GBP175,000

(announced on 3 April 2020); and the second, an equity fundraising

to issue 38,461,538 new shares for gross proceeds of GBP250,000

(announced on 28 May 2020), which completed on 3 June 2020. Please

refer to both announcements for further details of the

financings.

FINANCIAL RESULTS AND CURRENT FINANCIAL POSITION

In addition to the above-mentioned shares issued in respect of

the cash subscriptions and warrant exercises, during the period the

Company issued 13,293,927 shares to some former directors and a

current director to settle in aggregate GBP309,000 of accrued cash

liabilities. The Company has made a submission to HMRC for the

calculated PAYE on these settlements amounting to GBP139,000 which

was incorrectly not paid at the time. The Company will look to

recover these amounts from the former directors in the coming

period.

The financial statements of the Pathfinder Group for the twelve

months ended 31 December 2019 follow later in this report. The

Income Statement shows a loss of 652,000 (2018 - GBP645,000). The

board reorganisation during the year has resulted in a reduction in

remuneration from GBP195,000 (2018) to GBP121,000 this reporting

period.

The Group's Statement of Financial Position shows net assets at

31 December 2019 of GBP381,000 (31 December 2018 - GBP244,000). The

assets are held largely in the form of cash deposits and

receivables. The Company's cash position as at 25 June 2020 stands

at GBP283,000, which includes the first tranche of the convertible

loan note.

OUTLOOK

The Company remains focused on a negotiated, commercial

resolution to achieve a return of an interest in the Licence. The

recent fundraisings have given the Board the flexibility to

accelerate these efforts in the short term and it is the Board's

intention to intensify negotiations in-person with all relevant

parties in Mozambique as soon as COVID-19 restrictions permit them

to safely do so.

The Board maintains its view that a positive outcome is both

achievable and would be transformational for the Company in

recovering value. We thank all shareholders for their continued

support and look forward to updating them with developments in the

future.

ON BEHALF OF THE BOARD:

Sir H C Bellingham - Chairman

29 June 2020

FINANCIAL STATEMENTS

Consolidated Statement of Comprehensive Income for the Year

Ended 31 December 2019

2019 2018

GBP'000 GBP'000

CONTINUI NG OP ERATIONS

Re v e nue - -

Ad ministrati ve exp e

ns es (652) (645)

OPE R ATING LOSS (652) (645)

Finance income - -

LOSS B EFORE INCOME TAX (652) (645)

Income tax - -

LOSS FOR THE Y EAR (652) (645)

Total comprehensive lo

ss for the year attributable

to:

Equity holders of the pare

nt (652) (645)

Loss p e r s hare from

continuing operations

in p e nce p er s hare:

Basic ( 0.22) ( 0.26)

Dilut ed ( 0.22) ( 0.26)

Consolidated Statement of Financial Position for the Year Ended

31 December 2019

Year ended Year ended

31 December 31 December

2019 2018

GBP'000 GBP'000

NON-CURRENT ASSETS

Property, plant and equipment - -

Investments - -

CURRENT ASSETS

Trade and other receivables 222 192

Cash and cash equivalents 158 52

TOTAL ASSETS 380 244

EQUITY AND LIABILITIES

Capital and reserves attributable

to equity holders of the

Company:

Share capital 18,504 18,458

Share premium 13,307 12,431

Other reserves 45 25

Accumulated deficit (31,762) (31,110)

TOTAL EQUITY 94 (196)

CURRENT LIABILITIES

Trade and other payables 286 440

TOTAL LIABILITIES 286 440

TOTAL EQUITY AND LIABILITIES 380 244

Consolidated Statement of Changes in Equity for the Year Ended

31 December 2019

Called Share Other Accumulated Total

up share premium reserves deficit equity

capital

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 January

2018 18,416 11,997 - (30,465) (52)

------------------------- ---------- --------- ---------- ------------ --------

Changes in equity

Loss for the year (645) (645)

Total comprehensive

loss for the year (645) (645)

------------------------- ---------- --------- ---------- ------------ --------

Issue of share capital 42 439 481

Cost of share issue (5) (5)

Share based payments 25 25

Total transactions with

owners 42 434 25 - 501

------------------------- ---------- --------- ---------- ------------ --------

Balance at 31 December

2018 18,458 12,431 25 (31,110) (196)

------------------------- ---------- --------- ---------- ------------ --------

Changes in equity

Loss for the year (652) (652)

Total comprehensive

loss for the year (652) (652)

------------------------- ---------- --------- ---------- ------------ --------

Issue of share capital 46 876 922

Cost of share issue -

Share based payments 20 20

Total transactions with

owners 46 876 20 - 942

------------------------- ---------- --------- ---------- ------------ --------

Balance at 31 December

2019 18,504 13,307 45 (31,762) 94

------------------------- ---------- --------- ---------- ------------ --------

Consolidated Statement of Cash Flows for the Year E nded 31

Decem ber 2019

Year ended Year ended

31 December 31 December

2019 2018

GBP'000 GBP'000

Cash flows from operating

activities

Operating loss (652) (645)

Adjustments for:

Share-based payments 20 106

Services settled in shares 52

Foreign exchange movement 3 (2)

Net cash flow from operating

activities before changes

in working capital (577) (541)

Changes in working capital:

(Increase)/Decrease in

trade and other receivables (30) (136)

Increase/(Decrease) in

trade and other payables 139 86

Net cash flow used in operating

activities 109 (50)

Cash flow from investing

activities

Interest received

Net cash flow from investing

activities

Cash flow from financing

activities

Proceeds arising as a result

of the issue of ordinary

shares 574 400

Costs related to issue

of ordinary share capital (5)

Interest paid

Net cash flow from financing

activities 574 395

Net increase in cash and

cash equivalents in the

year 106 (196)

Cash and cash equivalents

at beginning of the year 52 248

------------- -------------

Cash and cash equivalents

at end of the year 158 52

------------- -------------

T he financial statem e nts we re appro ved by the Board of

Directors on 29 J une 2020 and w ere signed on its b e half by:

Dennis Edmonds - Director

NOTES

1. TRADE AND OTHER RECEIVABLES

Group Parent Company

2019 2018 2019 2018

GBP'000 GBP'000 GBP'000 GBP'000

Current:

Other debtors 165 109 165 109

VAT 4 4 4 4

Prepayments and accrued

income 53 79 53 79

--------------------- -------- -------- --------

222

222 222 192 222 192

--------------------- -------- -------- --------

2. TRADE AND OTHER PAYABLES

Group Parent Company

2019 2018 2019 2018

GBP'000 GBP'000 GBP'000 GBP'000

Current:

Trade creditors 34 29 34 29

Social security and other

taxes 196 - 196 -

Other creditors 43 401 43 401

Accruals and deferred income 13 10 13 10

-------- -------- -------- --------

286 440 286 440

-------- -------- -------- --------

3. ANNUAL REPORT AND ACCOUNTS

Copies of the Annual Report and Accounts, together with a notice

convening an annual general meeting, are being posted to

shareholders today and will be available within the Investor

Relations section of the Company's website

www.pathfinderminerals.com .

Enquiries:

Pathfinder Minerals Plc

Dennis Edmonds, Chief Executive Officer

Tel. +44 (0)20 7390 0234

Strand Hanson Limited (Nominated & Financial Adviser and

Broker)

James Spinney / Ritchie Balmer / Jack Botros

Tel. +44 (0)20 7409 3494

Vigo Communications (Public Relations)

Ben Simons / Simon Woods

Tel. +44 (0)20 7390 0234

Email. pathfinderminerals@vigocomms.com

Novum Securities Limited (Corporate Broker)

Colin Rowbury / Jon Belliss

Tel. +44 (0)20 7399 9400

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ("MAR").

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR KKCBQKBKBKAB

(END) Dow Jones Newswires

June 30, 2020 02:00 ET (06:00 GMT)

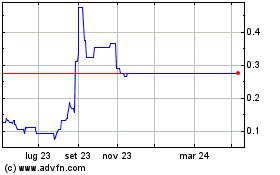

Grafico Azioni Pathfinder Minerals (LSE:PFP)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Pathfinder Minerals (LSE:PFP)

Storico

Da Apr 2023 a Apr 2024