Pendragon PLC PENDRAGON PLC INTERIM MANAGEMENT STATEMENT (8441C)

22 Ottobre 2020 - 8:00AM

UK Regulatory

TIDMPDG

RNS Number : 8441C

Pendragon PLC

22 October 2020

PENDRAGON PLC INTERIM MANAGEMENT STATEMENT

(ISSUED 22 October 2020)

This Interim Management Statement for Pendragon PLC covers the

period from 1 July 2020 to 30 September 2020. Unless otherwise

stated, figures quoted in this statement are for the three months

ended 30 September 2020.

-- Underlying Profit Before Tax of GBP27.3m - an increase of

GBP24.3m, (+810%), vs. Q3 2019 (GBP3.0m)

-- Like-for-like Group Revenue down 1.2% (-13.8% total reported)

-- Like-for-like Group Gross Profit up 9.8% (-2.4% total reported)

-- Like-for-like Operating Costs & Interest down 9.3% (-23.4% total reported)

The Group delivered a very strong Quarter 3 performance, with

underlying profit before tax of GBP27.3m. The profit in the quarter

has almost entirely offset the losses incurred during the first

half as a result of Covid-19, with the year to date underlying loss

before tax reduced to just GBP3.6m (H1 FY20 -GBP31.0m).

The Franchised UK Motor division performed ahead of our

expectations in the quarter, with performance driven by the actions

taken over the past 12 months to address stock profiles, improve

profit per unit, close underperforming stores and reduce the

overall cost base of the Group. The result was also supported by a

strong market for used vehicle residual values over the quarter.

Performance at Car Store continued to improve, with a 10.1% used

gross margin and an operating profit of GBP1.0m. Pinewood and PVM

also continued to perform well, with PVM in particular benefitting

from higher than expected disposals from the ending of leases that

were extended during H1 as a result of Covid-19, supported by

strong residual values.

Group New vehicle revenue was down 1.2% on a like-for-like basis

(total reported down 11.2%) in the quarter, broadly in line with

the overall market which was down 0.5%. Within this however,

Pendragon was ahead of the market in the brands that it represents,

which were down 6.0% over the same period. New Gross margins were

higher year-on-year at 6.9% (Q3 FY19: 6.3%), resulting in a

like-for-like increase in gross profit of 15.3%.

Group used vehicle revenue was flat on a like-for-like basis

(total reported down 16.7%), whilst like-for-like gross profit was

up 25.9% (total reported up 13.1%), resulting in a significantly

improved used gross margin of 9.6% (Q3 FY19: 7.3%) and reflecting

the ongoing focus on maintaining the right profile of used vehicle

stock, and gross profit per unit.

Overall gross profit for the Group was up 9.8% on a

like-for-like basis (total reported down 2.4%), with a gross margin

of 12.5% (Q3 FY19: 11.1%).

In addition to the improved gross margin performance, the

combined impact of the Group's cost reduction programmes and store

closures resulted in a like for like cost reduction of 9.2% in the

quarter and a total reported cost reduction of 24.7%.

Closing net debt at the end of September was GBP26.9m (HY20:

GBP46.0m) as a result of the Group's strong operating performance

in the quarter, combined with a continued timing benefit from

certain items, such as VAT deferrals, as previously described.

Outlook

We remain cautious about the outlook for Q4 given the ongoing

levels of macro-economic uncertainty and therefore are not

reinstating guidance for FY20 at this point.

Bill Berman, Chief Executive of Pendragon PLC, commented:

"I would like to thank all our associates who have shown great

professionalism in responding to the changing operating environment

during the period and their hard work has been absolutely critical

to our success. We are very pleased with the performance during the

quarter, which benefitted from the changes we have made to the

strategy and to the operating model over the past year. I am

confident the business is well positioned to deliver the best

result possible for the remaining months of FY20, which remain

unpredictable, and beyond, and our focus remains firmly on the

successful delivery of our long-term strategy".

Enquiries

===========

Henry Wallers Headland 07876 562436

Jack Gault Headland 07799 089357

=============== =========== ==============

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBRBDGLBDDGGB

(END) Dow Jones Newswires

October 22, 2020 02:00 ET (06:00 GMT)

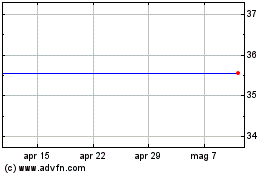

Grafico Azioni Pendragon (LSE:PDG)

Storico

Da Mar 2024 a Apr 2024

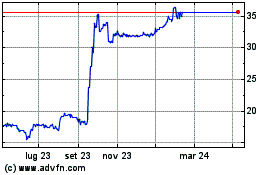

Grafico Azioni Pendragon (LSE:PDG)

Storico

Da Apr 2023 a Apr 2024