Pernod Ricard: FY21 Guidance Updated1 to Reflect Greater Than Expected Bus. Dynamism: Profit From Recurring Operations Organ...

23 Giugno 2021 - 7:30AM

Business Wire

Regulatory News:

Following an excellent Q3, marking the return to organic Sales

growth in 9M FY21, Pernod Ricard (Paris:RI) had shared, on April

22nd 2021, its guidance of organic growth in Profit from Recurring

Operations for FY21 of c. +10% with, in particular, the following

assumptions for the rest of fiscal year:

- Sales acceleration, thanks to continued business recovery, with

On-trade gradually reopening but Travel Retail still very

subdued

- Dynamic resource management, with strong reinvestment where

efficient (A&P expected at c. 16% ratio for FY21)

- Organic operating leverage thanks to dynamic top-line and

Structure cost discipline.

The pace of recovery is proving stronger than anticipated. The

Off-trade continues to be resilient while On-trade demand is

accelerating as restrictions are progressively lifted.

Resource management remains dynamic, with strong reinvestment to

capture current and future growth opportunities, including A&P

at c. 16% of Sales.

Thanks to this dynamism, Pernod Ricard now expects an organic

growth in Profit from Recurring Operations for FY21 of c. +16%2. As

a result, FY21 PRO should, in organic terms, be broadly in line

with that of FY19, albeit with Sales still impacted by restrictions

in the On-trade and Travel Retail, and Structure costs not yet at

their normative levels.

All growth data specified in this press release refers to

organic growth (at constant FX and Group structure), unless

otherwise stated. Data may be subject to rounding.

Definitions and reconciliation of non-IFRS measures to IFRS

measures

Pernod Ricard’s management process is based on the following

non-IFRS measures which are chosen for planning and reporting. The

Group’s management believes these measures provide valuable

additional information for users of the financial statements in

understanding the Group’s performance. These non-IFRS measures

should be considered as complementary to the comparable IFRS

measures and reported movements therein.

Organic growth

Organic growth is calculated after excluding the impacts of

exchange rate movements and acquisitions and disposals.

Exchange rates impact is calculated by translating the current

year results at the prior year’s exchange rates.

For acquisitions in the current year, the post-acquisition

results are excluded from the organic movement calculations. For

acquisitions in the prior year, post-acquisition results are

included in the prior year but are included in the organic movement

calculation from the anniversary of the acquisition date in the

current year.

Where a business, brand, brand distribution right or agency

agreement was disposed of, or terminated, in the prior year, the

Group, in the organic movement calculations, excludes the results

for that business from the prior year. For disposals or

terminations in the current year, the Group excludes the results

for that business from the prior year from the date of the disposal

or termination.

This measure enables to focus on the performance of the business

which is common to both years and which represents those measures

that local managers are most directly able to influence.

About Pernod Ricard

Pernod Ricard is the No.2 worldwide producer of wines and

spirits with consolidated sales of €8,448 million in FY20. Created

in 1975 by the merger of Ricard and Pernod, the Group has developed

through organic growth and acquisitions: Seagram (2001), Allied

Domecq (2005) and Vin&Sprit (2008). Pernod Ricard, which owns

16 of the Top 100 Spirits Brands, holds one of the most prestigious

and comprehensive brand portfolios in the industry, including:

Absolut Vodka, Ricard pastis, Ballantine’s, Chivas Regal, Royal

Salute, and The Glenlivet Scotch whiskies, Jameson Irish whiskey,

Martell cognac, Havana Club rum, Beefeater gin, Malibu liqueur,

Mumm and Perrier-Jouët champagnes, as well Jacob’s Creek, Brancott

Estate, Campo Viejo, and Kenwood wines. Pernod Ricard’s brands are

distributed across 160+ markets and by its own salesforce in 73

markets. The Group’s decentralised organisation empowers its 19,000

employees to be true on-the-ground ambassadors of its vision of

“Créateurs de Convivialité.” As reaffirmed by the Group’s strategic

plan, “Transform and Accelerate,” deployed in 2018, Pernod Ricard’s

strategy focuses on investing in long-term, profitable growth for

all stakeholders. The Group remains true to its three founding

values: entrepreneurial spirit, mutual trust, and a strong sense of

ethics, as illustrated by the 2030 Sustainability and

Responsibility roadmap supporting the United Nations Sustainable

Development Goals (SDGs), “Good times from a good place.” In

recognition of Pernod Ricard’s strong commitment to sustainable

development and responsible consumption, it has received a Gold

rating from Ecovadis. Pernod Ricard is also a United Nation’s

Global Compact LEAD company.

Pernod Ricard is listed on Euronext (Ticker: RI; ISIN Code:

FR0000120693) and is part of the CAC 40 and Eurostoxx 50

indices.

1 Guidance given to market on 22 April 2021 at the 9M Sales

release of organic growth in Profit from Recurring Operations of c.

+10%.

2 A negative FX impact of c. -€270m on Profit from Recurring

Operations is expected for FY21.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210622006093/en/

Julia Massies / VP, Financial Communications & Investor

Relations +33 (0) 1 70 93 17 03 Charly Montet / Investor Relations

Manager +33 (0) 1 70 93 17 13 Emmanuel Vouin / Head of External

Engagement +33 (0) 1 70 93 16 34

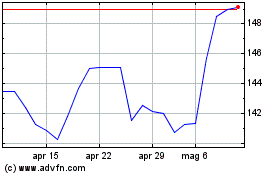

Grafico Azioni Pernod Ricard (EU:RI)

Storico

Da Mar 2024 a Apr 2024

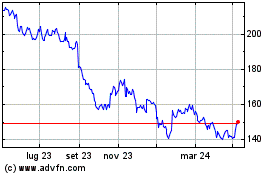

Grafico Azioni Pernod Ricard (EU:RI)

Storico

Da Apr 2023 a Apr 2024