-3.9% organic decrease in Sales (-8.9%

reported) -2.4% organic decline in PRO1 (-10.8%

reported)

Regulatory News:

Pernod Ricard (Paris:RI):

H1 FY21 Sales and Results Press release - Paris, 11

February 2021

SALES

Sales for H1 FY21 totalled €4,985m, with an organic

decline of -3.9% (-8.9% reported), with an unfavourable FX

impact linked mainly to Euro appreciation vs. USD and Emerging

market currencies.

H1 FY21 Sales declined but Q2 improved vs. Q1. For H1

FY21, the trends were:

- Americas +2%: good growth in most domestic markets, with

particular dynamism in USA (+5%), but significant decline in Travel

Retail

- Asia-RoW -6%: double-digit growth in China (+13%),

Turkey, Korea and Pacific, and return to growth in India in Q2: +2%

(India H1 -6%), but Covid-related declines in certain Asian markets

and Travel Retail

- Europe -5%: continued very strong growth in Germany, UK,

Russia and Poland, more than offset by Covid impact in Spain,

France, Ireland and Travel Retail

- Sales excluding Travel Retail grew +1%.

Strategic International Brands declined due to Travel Retail and

On-Trade exposure but Specialty Brands performed very

strongly:

- Strategic International Brands -6%: solid growth of

Malibu, Jameson and The Glenlivet, but overall category impacted by

Travel Retail exposure. Martell and Scotch growing in domestic

markets

- Strategic Local Brands -4%: mainly driven by Seagram’s

Indian whiskies and Seagram’s Gin in Spain

- Specialty Brands +22%: continued very dynamic

development of Lillet, Malfy, Aberlour, American whiskeys

(Jefferson’s, TX, Rabbit Hole and Smooth Ambler), Avion and

Redbreast

- Strategic Wines +3%: solid growth thanks mainly to Campo

Viejo and Brancott Estate.

Pernod Ricard gained or held share in key markets,

notably in Europe, despite the On-trade disruption. Dynamic

portfolio management continued, with Innovation in strong

growth (+10%.)

Q2 Sales were €2,750m, with -2.4% organic decline, but

improving vs. Q1 Sales (-5.6%), thanks in particular to better

trends in China and India.

RESULTS

H1 FY21 Profit from Recurring Operations declined -2.4%

organically, with an organic margin improvement of +51bps,

thanks to dynamic management of resources and favourable

phasing:

- Gross margin contracting -108bps, driven by:

- Soft pricing, with fewer price increases and on solid

comparison basis (H1 FY20 +2% on Strategic Brands, benefiting from

FY19 Martell price increases)

- Adverse mix primarily linked to decline in Travel

Retail

- Higher Cost of Goods mainly from continued agave cost

pressures and lower fixed cost absorption, offsetting Operational

Excellence initiatives

- A&P: +132bps, resulting from purpose-based

investment, with strong reduction in markets and channels with

subdued demand, and favourable phasing (ratio of c. 16% expected

for FY21, with strong double-digit increase in H2)

- Structure costs: improving +27bps, reflecting dynamic

management of resources and FY20 reorganisations

- Strong negative FX impact on PRO -€155m due to USD and

Emerging market currency depreciation vs. Euro. A significant

negative FX impact is also expected for full-year FY21.

The H1 FY21 corporate income tax rate on recurring items

was 23.4% vs. 24.2% for H1 FY20, due to a reduction in the

French tax rate and geographical mix.

Group share of Net PRO was €1,087m, -11% reported vs. H1

FY20 and the Group share of Net profit €966m, -6% reported,

reflecting decline in Profit from Recurring Operations partially

offset by lower non-recurring items.

Earnings Per Share were -9%, reflecting decline in PRO and

positive impact of FY20 Share buy-back.

FREE CASH FLOW AND DEBT

Recurring Free Cash Flow was very strong at €995m. The

decline in Profit from Recurring Operations was offset by a

significant improvement in operating Working Capital

Requirement (inventory normalisation and payables rebuilding

vs. June, leading to very strong cash conversion2 at 79%),

a lower increase in strategic inventories and broadly

stable capital expenditure.

The average Cost of debt stood at 3.2% vs. 3.7% in H1

FY20, thanks to successful US Dollar bond debt refinancing.

Net debt decreased by €443m vs. 30 June 2020 to

€7,980m. The Net Debt/EBITDA ratio at average rates3 was

3.4x at 31 December 2020.

SUSTAINABILITY &

RESPONSIBILITY

Pernod Ricard continued to drive its 2030 Sustainability &

Responsibility roadmap, with progress in each of the 4 pillars

(Nurturing Terroir, Circular Making, Valuing People and Responsible

Hosting.) Significant achievements were attained in particular

regarding packaging: all single-use Point-of-Sales plastic will

be removed from June 2021.

Alexandre Ricard, Chairman and Chief Executive Officer,

stated,

“We are particularly encouraged by our Must-win domestic markets

returning to growth in H1 FY21. The first half confirms the

long-term sustainability and underlying strength of our

business.

Despite an uncertain and volatile environment, with disruption

in the On-trade and a prolonged downturn in Travel Retail, we

anticipate organic Sales growth for full-year FY21, thanks in

particular to our dynamic performance in domestic Must-win markets

USA, China and India.

We will continue to implement our strategy, in particular

accelerating our digital transformation, while dynamically managing

resources. Thanks to our solid fundamentals, our teams and our

brand portfolio, I am confident that Pernod Ricard will emerge from

this crisis stronger.

I would like to take this opportunity to praise our teams, whose

engagement and performance are exemplary in these very challenging

times, and to express our support to our On-trade and Travel Retail

partners who continue to be impacted by the pandemic.”

All growth data specified in this press release refers to

organic growth (at constant FX and Group structure), unless

otherwise stated. Data may be subject to rounding.

A detailed presentation of H1 FY21 Sales and Results can be

downloaded from our website: www.pernod-ricard.com

Limited review procedures have been carried out by the Statutory

Auditors on the condensed half-yearly consolidated financial

statements. The Statutory Auditors’ Review Report on the

Half-yearly Financial Information is being issued.

Definitions and reconciliation of non-IFRS measures to IFRS

measures

Pernod Ricard’s management process is based on the following

non-IFRS measures which are chosen for planning and reporting. The

Group’s management believes these measures provide valuable

additional information for users of the financial statements in

understanding the Group’s performance. These non-IFRS measures

should be considered as complementary to the comparable IFRS

measures and reported movements therein.

Organic growth

Organic growth is calculated after excluding the impacts of

exchange rate movements and acquisitions and disposals.

Exchange rates impact is calculated by translating the current

year results at the prior year’s exchange rates.

For acquisitions in the current year, the post-acquisition

results are excluded from the organic movement calculations. For

acquisitions in the prior year, post-acquisition results are

included in the prior year but are included in the organic movement

calculation from the anniversary of the acquisition date in the

current year.

Where a business, brand, brand distribution right or agency

agreement was disposed of, or terminated, in the prior year, the

Group, in the organic movement calculations, excludes the results

for that business from the prior year. For disposals or

terminations in the current year, the Group excludes the results

for that business from the prior year from the date of the disposal

or termination.

This measure enables to focus on the performance of the business

which is common to both years and which represents those measures

that local managers are most directly able to influence.

Profit from recurring

operations

Profit from recurring operations corresponds to the operating

profit excluding other non-current operating income and

expenses.

About Pernod Ricard

Pernod Ricard is the No.2 worldwide producer of wines and

spirits with consolidated sales of €8,448 million in FY20. Created

in 1975 by the merger of Ricard and Pernod, the Group has developed

through organic growth and acquisitions: Seagram (2001), Allied

Domecq (2005) and Vin&Sprit (2008). Pernod Ricard, which owns

16 of the Top 100 Spirits Brands, holds one of the most prestigious

and comprehensive brand portfolios in the industry, including:

Absolut Vodka, Ricard pastis, Ballantine’s, Chivas Regal, Royal

Salute, and The Glenlivet Scotch whiskies, Jameson Irish whiskey,

Martell cognac, Havana Club rum, Beefeater gin, Malibu liqueur,

Mumm and Perrier-Jouët champagnes, as well Jacob’s Creek, Brancott

Estate, Campo Viejo, and Kenwood wines. Pernod Ricard’s brands are

distributed across 160+ markets and by its own salesforce in 73

markets. The Group’s decentralised organisation empowers its 19,000

employees to be true on-the-ground ambassadors of its vision of

“Créateurs de Convivialité.” As reaffirmed by the Group’s strategic

plan, “Transform and Accelerate,” deployed in 2018, Pernod Ricard’s

strategy focuses on investing in long-term, profitable growth for

all stakeholders. The Group remains true to its three founding

values: entrepreneurial spirit, mutual trust, and a strong sense of

ethics, as illustrated by the 2030 Sustainability and

Responsibility roadmap supporting the United Nations Sustainable

Development Goals (SDGs), “Good times from a good place.” In

recognition of Pernod Ricard’s strong commitment to sustainable

development and responsible consumption, it has received a Gold

rating from Ecovadis. Pernod Ricard is also a United Nation’s

Global Compact LEAD company.

Pernod Ricard is listed on Euronext (Ticker: RI; ISIN Code:

FR0000120693) and is part of the CAC 40 and Eurostoxx 50

indices.

Appendices

Emerging Markets

Asia-Rest of World Americas Europe Algeria

Malaysia Argentina Albania Angola Mongolia Bolivia Armenia Cambodia

Morocco Brazil Azerbaijan Cameroon Mozambique Caribbean Belarus

China Namibia Chile Bosnia Congo Nigeria Colombia Bulgaria Egypt

Persian Gulf Costa Rica Croatia Ethiopia Philippines Cuba Georgia

Gabon Senegal Dominican Republic Hungary Ghana South Africa Ecuador

Kazakhstan India Sri Lanka Guatemala Kosovo Indonesia Syria

Honduras Latvia Iraq Tanzania Mexico Lithuania Ivory Coast Thailand

Panama Macedonia Jordan Tunisia Paraguay Moldova Kenya Turkey Peru

Montenegro Laos Uganda Puerto Rico Poland Lebanon Vietnam Uruguay

Romania Madagascar Zambia Venezuela Russia Serbia Ukraine

Strategic International Brands’ organic Sales growth

VolumesH1 FY21 Organic Sales growthH1 FY21

Volumes Price/mix (in 9Lcs millions)

Absolut

5.6

-12%

-11%

-1%

Chivas Regal

2.1

-16%

-20%

4%

Ballantine's

4.2

-12%

-5%

-7%

Ricard

2.3

-5%

-4%

-1%

Jameson

4.7

3%

2%

1%

Havana Club

2.4

-9%

-2%

-6%

Malibu

2.5

26%

26%

0%

Beefeater

1.6

-20%

-20%

0%

Martell

1.5

-3%

-6%

3%

The Glenlivet

0.7

2%

0%

2%

Royal Salute

0.1

-28%

-32%

5%

Mumm

0.5

-5%

-2%

-3%

Perrier-Jouët

0.2

-19%

-17%

-2%

Strategic International Brands

28.3

-6%

-5%

-1%

Sales Analysis by Period and Region

Net Sales(€ millions) H1 FY20 H1 FY21

Change Organic Growth Group Structure Forex

impact Americas

1,461

26.7%

1,402

28.1%

(59)

-4%

22

2%

47

3%

(128)

-9%

Asia / Rest of World

2,415

44.1%

2,127

42.7%

(288)

-12%

(148)

-6%

1

0%

(140)

-6%

Europe

1,598

29.2%

1,456

29.2%

(142)

-9%

(83)

-5%

(8)

0%

(52)

-3%

World

5,474

100.0%

4,985

100.0%

(489)

-9%

(209)

-4%

40

1%

(320)

-6%

Net Sales(€ millions) Q2 FY20 Q2 FY21

Change Organic Growth Group Structure Forex

impact Americas

788

26.3%

729

26.5%

(59)

-7%

(10)

-1%

27

3%

(76)

-10%

Asia / Rest of World

1,299

43.4%

1,209

44.0%

(90)

-7%

(11)

-1%

0

0%

(79)

-6%

Europe

904

30.2%

811

29.5%

(93)

-10%

(50)

-6%

(5)

-1%

(37)

-4%

World

2,991

100.0%

2,750

100.0%

(241)

-8%

(71)

-2%

22

1%

(192)

-6%

Net Sales(€ millions) Q1 FY20 Q1 FY21

Change Organic Growth Group Structure Forex

impact Americas

674

27.1%

673

30.1%

(0)

0%

32

5%

20

3%

(52)

-8%

Asia / Rest of World

1,116

44.9%

918

41.0%

(198)

-18%

(138)

-12%

1

0%

(61)

-5%

Europe

694

27.9%

645

28.8%

(49)

-7%

(32)

-5%

(2)

0%

(14)

-2%

World

2,483

100.0%

2,236

100.0%

(248)

-10%

(138)

-6%

18

1%

(128)

-5%

Note: Bulk Spirits are allocated by Region according to the

Regions’ weight in the Group

Summary Consolidated Income Statement

(€ millions) H1 FY20 H1 FY21 Change

Net sales

5,474

4,985

-9%

Gross Margin after logistics costs

3,419

3,021

-12%

Advertising and promotion expenses

(842)

(706)

-16%

Contribution after A&P expenditure

2,577

2,315

-10%

Structure costs

(789)

(721)

-9%

Profit from recurring operations

1,788

1,595

-11%

Financial income/(expense) from recurring operations

(164)

(151)

-8%

Corporate income tax on items from recurring operations

(392)

(337)

-14%

Net profit from discontinued operations, non-controlling interests

and share of net income from associates

(15)

(20)

30%

Group share of net profit from recurring operations

1,216

1,087

-11%

Other operating income & expenses

(152)

(61)

NA Financial income/(expense) from non-recurring operations

(1)

(103)

NA Corporate income tax on items from non recurring operations

(31)

44

NA

Group share of net profit

1,032

966

-6%

Non-controlling interests

14

18

26%

Net profit

1,046

984

-6%

Profit from Recurring Operations by Region

Segment Reporting World (€

millions) H1 FY20 H1 FY21 Change

Organic Growth Group Structure Forex impact

Net sales (Excl. T&D)

5,474

100.0%

4,985

100.0%

(489)

-9%

(209)

-3.9%

40

1%

(320)

-6%

Gross margin after logistics costs

3,419

62.5%

3,021

60.6%

(398)

-12%

(188)

-5.5%

17

0%

(227)

-7%

Advertising & promotion

(842)

15.4%

(706)

14.2%

136

-16%

101

-12.1%

(5)

1%

40

-5%

Contribution after A&P

2,577

47.1%

2,315

46.4%

(261)

-10%

(87)

-3.4%

12

0%

(187)

-7%

Profit from recurring operations

1,788

32.7%

1,595

32.0%

(193)

-11%

(42)

-2.4%

4

0%

(155)

-9%

Americas (€ millions) H1 FY20

H1 FY21 Change Organic Growth Group

Structure Forex impact Net sales (Excl. T&D)

1,461

100.0%

1,402

100.0%

(59)

-4%

22

2%

47

3%

(128)

-9%

Gross margin after logistics costs

986

67.5%

909

64.8%

(77)

-8%

3

0%

22

2%

(103)

-10%

Advertising & promotion

(285)

19.5%

(250)

17.8%

35

-12%

18

-6%

(4)

2%

21

-8%

Contribution after A&P

701

48.0%

659

47.0%

(43)

-6%

21

3%

18

3%

(81)

-12%

Profit from recurring operations

486

33.3%

459

32.7%

(27)

-6%

27

5%

11

2%

(65)

-13%

Asia / Rest of the World (€ millions)

H1 FY20 H1 FY21 Change Organic Growth

Group Structure Forex impact Net sales (Excl.

T&D)

2,415

100.0%

2,127

100.0%

(288)

-12%

(148)

-6%

1

0%

(140)

-6%

Gross margin after logistics costs

1,442

59.7%

1,232

57.9%

(211)

-15%

(120)

-8%

(3)

0%

(87)

-6%

Advertising & promotion

(341)

14.1%

(291)

13.7%

50

-15%

35

-10%

0

0%

15

-4%

Contribution after A&P

1,101

45.6%

940

44.2%

(161)

-15%

(86)

-8%

(3)

0%

(72)

-7%

Profit from recurring operations

833

34.5%

674

31.7%

(159)

-19%

(95)

-11%

(4)

0%

(60)

-7%

Europe (€ millions) H1 FY20

H1 FY21 Change Organic Growth Group

Structure Forex impact Net sales (Excl. T&D)

1,598

100.0%

1,456

100.0%

(142)

-9%

(83)

-5%

(8)

0%

(52)

-3%

Gross margin after logistics costs

991

62.0%

881

60.5%

(110)

-11%

(71)

-7%

(2)

0%

(37)

-4%

Advertising & promotion

(216)

13.5%

(164)

11.3%

52

-24%

49

-23%

(1)

0%

3

-2%

Contribution after A&P

775

48.5%

717

49.2%

(58)

-7%

(22)

-3%

(2)

0%

(34)

-4%

Profit from recurring operations

468

29.3%

461

31.7%

(7)

-1%

26

5%

(3)

-1%

(30)

-6%

Note: Bulk Spirits are allocated by Region according to the

Regions’ weight in the Group

Foreign Exchange Impact

Forex impact H1 FY21(€ millions) Average rates

evolution On Net Sales On Profit from Recurring

Operations H1 FY20 H1 FY21 % US dollar USD

1.11

1.18

6.5%

(79)

(40)

Russian rouble RUB

71.19

88.61

24.5%

(33)

(24)

Turkish Lira TRL

6.36

8.94

40.5%

(20)

(20)

Indian rupee INR

78.59

87.48

11.3%

(59)

(18)

Chinese yuan CNY

7.80

7.99

2.5%

(17)

(12)

Pound sterling GBP

0.88

0.90

2.6%

(5)

4

Other

(106)

(46)

Total

(320)

(155)

Sensitivity of profit and debt to EUR/USD exchange

rate

Estimated impact of a 1% appreciation of the USD

Impact

on the income statement(1) (€ millions) Profit from

recurring operations +10 Financial expenses

(2)

Pre-tax profit from recurring operations +9

Impact on the balance sheet (€

millions) Increase/(decrease) in net debt +38

(1) Full-year effect

Balance Sheet

Assets 30/06/2020 12/31/2020 (€

millions) (Net book value) Non-current assets

Intangible assets and goodwill

16,576

15,953

Tangible assets and other assets

3,699

3,867

Deferred tax assets

1,678

1,578

Total non-current assets

21,953

21,398

Current assets Inventories

6,167

6,139

aged work-in-progress

5,084

5,135

non-aged work-in-progress

76

72

other inventories

1,006

932

Receivables (*)

906

1,829

Trade receivables

862

1,758

Other trade receivables

44

70

Other current assets

323

299

Other operating current assets

317

293

Tangible/intangible current assets

6

5

Tax receivable

142

133

Cash and cash equivalents and current derivatives

1,947

1,964

Total current assets

9,485

10,363

Assets held for sale

87

11

Total assets

31,525

31,772

(*) after disposals of receivables of:

513

750

Liabilities and shareholders’ equity

30/06/2020 12/31/2020 (€ millions)

Group Shareholders’ equity

13,968

14,435

Non-controlling interests

243

244

of which profit attributable to non-controlling interests

21

18

Total Shareholders’ equity

14,211

14,679

Non-current provisions and deferred tax liabilities

3,511

3,424

Bonds non-current

8,599

8,680

Lease liabilities - non current

433

409

Non-current financial liabilities and derivative instruments

192

82

Total non-current liabilities

12,735

12,595

Current provisions

222

187

Operating payables

1,877

2,345

Other operating payables

1,016

753

of which other operating payables

633

704

of which tangible/intangible current payables

383

49

Tax payable

232

349

Bonds - current

723

237

Lease liabilities - current

88

103

Current financial liabilities and derivatives

404

523

Total current liabilities

4,563

4,497

Liabilities held for sale

16

0

Total liabilities and shareholders' equity

31,525

31,772

Analysis of Working Capital Requirement

(€ millions) June2019 December2019

June2020 December2020 H1 FY20 WC change* H1

FY21 WC change* Aged work in progress

4,788

5,047

5,084

5,135

123

67

Advances to suppliers for wine and ageing spirits

12

13

19

10

1

(8)

Payables on wine and ageing spirits

(105)

(182)

(108)

(161)

(77)

(47)

Net aged work in progress

4,695

4,878

4,995

4,984

47

11

Trade receivables before factoring/securitization

1,842

2,928

1,375

2,508

1,070

1,173

Advances from customers

(24)

(17)

(38)

(18)

7

19

Other receivables

338

340

343

354

(20)

27

Other inventories

889

923

1,006

932

15

(62)

Non-aged work in progress

79

76

76

72

(3)

(2)

Trade payables and other

(2,717)

(2,951)

(2,364)

(2,870)

(206)

(554)

Gross operating working capital

405

1,299

398

978

864

601

Factoring/Securitization impact

(674)

(827)

(513)

(750)

(143)

(246)

Net Operating Working Capital

(269)

472

(115)

227

721

355

Net Working Capital

4,427

5,350

4,879

5,211

768

366

* at average rates Of which recurring variation

763

350

Of which non recurring variation

5

16

Net Debt

(€ millions) 30/06/2020 12/31/2020

Current Non-current Total Current

Non-current Total Bonds

723

8,599

9,322

237

8,680

8,917

Syndicated loan

-

-

-

-

-

-

Commercial paper

299

-

299

232

-

232

Other loans and long-term debts

81

192

273

275

82

357

Other financial liabilities

380

192

572

507

82

589

Gross Financial debt

1,103

8,791

9,894

744

8,762

9,506

Fair value hedge derivatives – assets

(3)

(40)

(44)

-

(30)

(30)

Fair value hedge derivatives – liabilities

-

-

-

-

-

-

Fair value hedge derivatives

(3)

(40)

(44)

-

(30)

(30)

Net investment hedge derivatives – assets

-

(13)

(13)

-

(53)

(53)

Net investment hedge derivatives – liabilities

-

-

-

-

-

-

Net investment hedge derivatives

-

(13)

(13)

-

(53)

(53)

FINANCIAL DEBT AFTER HEDGING

1,100

8,737

9,837

744

8,679

9,423

Cash and cash equivalents

(1,935)

-

(1,935)

(1,955)

-

(1,955)

NET FINANCIAL DEBT EXCLUDING LEASE DEBT

(835)

8,737

7,902

(1,212)

8,679

7,468

Lease Debt

88

433

522

103

409

513

NET FINANCIAL DEBT

(747)

9,171

8,424

(1,108)

9,089

7,980

Change in Net Debt

(€ millions)

12/31/2019

12/31/2020

Operating profit

1,636

1,534

Depreciation and amortisation

174

179

Net change in impairment of goodwill, PPE and intangible assets

8

6

Net change in provisions

75

(31)

Changes in fair value on commercial derivatives, biological assets

and investments

(3)

(5)

Net (gain)/loss on disposal of assets

(7)

2

Share-based payments

21

15

Self-financing capacity before interest and tax

1,903

1,699

Decrease / (increase) in working capital requirements

(768)

(364)

Net interest and tax payments

(401)

(347)

Net acquisitions of non financial assets and others

(164)

(153)

Free Cash Flow

570

835

of which recurring Free Cash Flow

627

995

Net acquitions of financial assets and activities and others

(540)

(33)

Dividends paid

(843)

(699)

(Acquisition) / Disposal of treasury shares and others

(228)

(25)

Decrease / (increase) in net debt (before currency translation

adjustments)

(1,041)

78

Foreign currency translation adjustment

(36)

406

Non cash impact on lease liabilities

(531)

(40)

Decrease / (increase) in net debt (after currency translation

adjustments and IFRS 16 non cash impacts)

(1,608)

443

Initial net debt

(6,620)

(8,424)

Final net debt

(8,228)

(7,980)

Net Debt Maturity at 31 December 2020

€ billions

[Missing charts are available on the original document and on

www.pernod-ricard.com]

Strong liquidity position at c. €5,3bn as of 31st

December, of which €3.4bn undrawn credit lines

Gross debt after hedging at 31st December 2020 (excluding lease

liabilities):

- 5% floating rate and 95% fixed rate

- 58% in EUR and 41% in USD

FY21 maturity includes US$201m reimbursed at maturity on 26th

January 2021

Bond details at 31 December 2020

Currency

Par value

Coupon

Issue date

Maturity date

EUR

€ 500 m

1.875%

9/28/2015

9/28/2023

€ 1,500 m o/w:

€ 500 m

0.000%

10/24/2019

10/24/2023

€ 500 m

0.500%

10/24/2027

€ 500 m

0.875%

10/24/2031

€ 650 m

2.125%

9/29/2014

9/27/2024

€ 1,500 m o/w:

4/1/2020

€ 750 m

1.125%

4/7/2025

€ 750 m

1.750%

4/8/2030

€ 500 m o/w:

4/27/2020

€ 250 m

1.125%

4/7/2025

€ 250 m

1.750%

4/8/2030

€ 600 m

1.500%

5/17/2016

5/18/2026

USD

$ 201 m

Libor 6m + spread

1/26/2016

1/26/2021

$ 1,650 m o/w:

1/12/2012

$ 800 m

4.250%

7/15/2022

$ 850 m

5.500%

1/15/2042

$ 600 m

3.250%

6/8/2016

6/8/2026

$ 2,000 m o/w:

€ 600 m

1.250%

10/1/2020

4/1/2028

€ 900 m

1.625%

4/1/2031

€ 500 m

2.750%

10/1/2050

Note: US$201m reimbursed at maturity on 26th January 2021

Net Debt / EBITDA ratio evolution

Closing rate

Average rate(1)

EUR/USD rate Jun FY20 -> Dec FY21

1.12 -> 1.23

1.11 -> 1.14

Ratio at 30/06/2020

3.2

3.2

EBITDA & cash generation excl. Group structure effect(2) and

forex impacts

0.0

0.0

Group structure(2) and forex impacts

0.1

0.2

Ratio at 31/12/2020

3.3

3.4 (3)

(1) Last-twelve-month rate (2) Including IFRS16 impact (3)

Syndicated credit leverage ratio restated from IFRS16 is 3.3

Diluted Earnings Per Share (EPS) calculation

(x 1,000)

H1 FY20

H1 FY21

Number of shares in issue at end of period

265,422

261,877

Weighted average number of shares in issue (pro rata temporis)

265,422

262,315

Weighted average number of treasury shares (pro rata temporis)

(1,462)

(1,654)

Dilutive impact of stock options and performance shares

1,303

816

Number of shares used in diluted EPS calculation

265,263

261,478

(€ millions and €/share)

H1 FY20

H1 FY21

reported

△

Group share of net profit from

recurring operations

1,216

1,087

-10.6%

Diluted net earnings per share from recurring operations

4.58

4.16

-9.3%

Upcoming Communications

Date1

Event

9 March 2021, 3pm CET

North America conference call

22 April 2021, 9am CET

Q3 FY21 Sales conference call

25 May 2021, 3pm CET

Sustainability & Responsibility

conference call

22 June 2021

Asia conference call

1 The above dates are indicative and are liable to change

1 PRO: Profit from Recurring Operations 2 Recurring Operating

Cash Flow / PRO 3 Based on average EUR/USD rates: 1.14 in calendar

year 2020

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210210006042/en/

Julia Massies / VP, Financial Communications & Investor

Relations +33 (0) 1 70 93 17 03 Charly Montet / Investor Relations

Manager +33 (0) 1 70 93 17 13 Alison Donohoe / Press Relations

Manager +33 (0) 1 70 93 16 23 Emmanuel Vouin / Press Relations

Manager +33 (0) 1 70 93 16 34

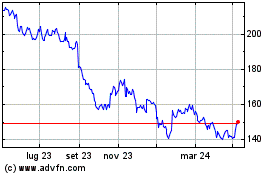

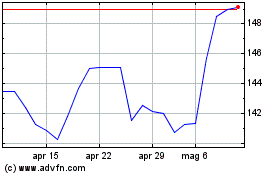

Grafico Azioni Pernod Ricard (EU:RI)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Pernod Ricard (EU:RI)

Storico

Da Apr 2023 a Apr 2024