Philips Launches EUR1.5 Billion Share Buyback; 2Q Profit Hit by Provision -- Update

26 Luglio 2021 - 10:35AM

Dow Jones News

By Ian Walker

Koninklijke Philips NV on Monday launched a 1.5 billion euro

($1.77 billion) share buyback program as it reported a fall in

second-quarter net profit after booking a provision against a

faulty component used in some sleep and respiratory-care products,

as previously flagged.

The Dutch health-technology company made a net profit

attributable to shareholders of EUR150 million for the quarter

ended June 30, compared with EUR208 million for the same period

last year. It booked a provision of EUR250 million.

Philips said in June that it would book the provision in its

accounts and had started a recall notification for the U.S. in

relation to certain sleep and respiratory-care devices. It said at

the time that the company had identified potential health risks

related to a sound-abatement foam component in certain devices. The

majority of the affected devices are in the first-generation

DreamStation sleep and respiratory-care product family, the company

said.

The company said Monday that it was in talks with the relevant

regulatory authorities to get approval to start deploying the

repair kits and replacement devices that it is producing.

Quarterly sales rose to EUR4.23 billion from EUR3.97 billion,

missing analysts' expectations for EUR4.19 billion taken from the

company's website. On a comparable basis, sales grew 9%, beating a

company-provided consensus estimate of 7.3%.

Adjusted Ebita--a metric that strips out exceptional and other

one-off items--was EUR532 million, compared with EUR390 million a

year earlier and a company-compiled consensus of EUR519 million,

Philips said.

The company said comparable order intake fell 15% with strong

double-digit growth in the diagnosis & treatment businesses and

a fall in the connected care businesses which was mainly due to the

Covid-19 related growth in the second quarter of 2020.

Free cash flow in the quarter was EUR167 million compared with

EUR212 million for the same period last year.

Philips backed its full-year guidance, expecting to deliver

low-to-mid-single-digit comparable sales growth for 2021. The

company also said it expects to report adjusted earnings before

interest, taxes and amortization margin improvement of 60 basis

points.

Shares at 0804 GMT were down 87 European cents, or 2.1%, at

EUR39.92.

Write to Ian Walker at ian.walker@wsj.com

(END) Dow Jones Newswires

July 26, 2021 04:34 ET (08:34 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

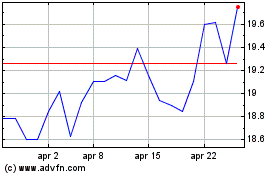

Grafico Azioni Koninklijke Philips NV (EU:PHIA)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Koninklijke Philips NV (EU:PHIA)

Storico

Da Apr 2023 a Apr 2024