TIDMPIRI

RNS Number : 6777U

Pires Investments PLC

31 July 2020

31 July 2020

Pires Investments PLC

("Pires" or the "Company")

Unaudited interim results for the six months ended 30 April

2020

Pires Investments plc (AIM: PIRI), the investment company

focused on next generation technology, is pleased to announce its

unaudited interim results for the six-month period ended 30 April

2020.

Highlights

-- Investment of GBP1.1 million in Sure Valley Ventures ("SVV")

-- Return of EUR803,000 achieved from the sale of Artomatix, one

of the companies within the SVV portfolio, representing a 60%

return on the initial SVV investment

-- Placing to raise gross proceeds of GBP1.06 million from both

new and existing investors to support the Company's technology

strategy

-- Direct investment of EUR250,000 in Getvisibility, an

artificial intelligence data management and security company

-- Increase in value of other portfolio investments, such as VR

Education Holdings plc (AIM: VRE) and Admix

-- New SVV investments made during the period, including Buymie,

the artificial intelligence based same day grocery delivery company

and Getvisibility, as well as a follow-on investment in Admix which

has developed a programmatic monetisation platform for gaming and

other entertainment developers

-- Cash at period end was GBP0.4 million , increasing to a current figure of GBP1.1 million

Chairman's Statement

The six-month period to 30 April 2020 was extremely busy for

Pires. In November 2019, the Company invested GBP1.1 million to

acquire a 13% interest in SVV, a venture capital fund focused on

investing in the software technology sector with a specific focus

on artificial intelligence ("AI"), the internet of things ("IoT")

and augmented and virtual reality ("AR/VR"). SVV has a portfolio of

12 investee companies at different stages of development spanning

these sectors. The details of the portfolio companies are set out

below:

Artificial intelligence

Getvisibility An artificial intelligence security company

addressing the substantial problem faced by

corporations in storing, sorting, accessing

and protecting data.

------------------------------------------------------

Nova Leah An artificial intelligence cyber-security

assessment and protection platform for connected

medical devices.

------------------------------------------------------

Buymie An artificial intelligence-based same day

grocery delivery company.

------------------------------------------------------

Internet of things

------------------------------------------------------

Wia Provides a platform solution for smart buildings,

helping people get back to work post Covid-19.

------------------------------------------------------

Cameramatics Platform enabling transport fleet managers

to reduce risk, increase driver safety and

comply with growing industry governance and

compliance.

------------------------------------------------------

Ambisense Provides sensors and an analysis platform

to allow real-time gas and environmental monitoring.

------------------------------------------------------

AR/VR

------------------------------------------------------

VR Education A virtual reality company which has transformed

how training and education are delivered and

consumed globally.

------------------------------------------------------

Admix A platform enabling the monetisation of interactive

programmatic brand placements in, for example,

video games.

------------------------------------------------------

Warducks A game development studio known for the production

of leading games and is soon to launch an

AR game that could be the next Pokémon

Go.

------------------------------------------------------

VividQ A deep tech software company which has developed

a framework for real-time 3D holographic displays

for use in heads-up displays and AR headsets

and glasses.

------------------------------------------------------

Volograms A reality capture and volumetric video company.

------------------------------------------------------

Other

------------------------------------------------------

NDRC Arclabs Fund Accelerator to source and develop start-up

opportunities for potential SVV investment.

------------------------------------------------------

This portfolio provides Pires with exposure to some key,

cutting-edge and rapidly growing technology sectors.

The investment in SVV has already prov ed to be successful for

Pires with a realisation and a cash distribution being achieved

soon after the investment, as a result of the sale of one of the

portfolio companies, Artomatix. This company uses AI software

technology that can substantially reduce the cost of creation for

animated films, video games and other applications. Artomatix was

sold at a valuation some 500% of the price of the original

investment in the company. Additionally, a number of the portfolio

companies have increased in value during the period. This

revaluation is principally based on subsequent funding rounds which

have taken place at higher valuations than at the time of the

initial investment.

Pires also made a direct investment of EUR250,000 in

Getvisibility, an artificial intelligence security company

addressing the substantial and increasing problem faced by

corporations in storing, sorting, accessing and protecting

data.

Further progress has also continued to be made since the period

end. Following the progress made by VR Education, which is listed

on AIM, SVV realised the value of its original investment through

the partial disposal of its holding, thereby returning around

GBP65,000 to the Company. This is the second cash realisation to be

made from the Company's investment in SVV in the seven months since

the initial investment. SVV has retained the balance of its holding

in VR Education and this company's share price , has also increased

further since the period end. In addition, the valuation of Buymie

has increased by some 200% since the original investment in April

2020, as part of a second round of investment of EUR5.8 million

into this company, in which SVV participated. Furthermore, SVV has

recently made a new investment in Volograms Limited, a company

whose technology enables consumers to create their own immersive AR

and VR content for use in apps, social media and VR headsets with a

particular application in the mobile VR market which is expected to

grow significantly.

For the period under review, the Company reported a loss before

taxation of GBP427,068 (six months ended 30 April 2019: profit

before taxation of GBP659,048) and net assets of GBP3,078,269 as at

the period end (31 October 2019: GBP2,564,582). The profit or loss

for the Company takes into account unrealised gains/losses in the

portfolio of quoted equity investments which are marked to market

which substantially explains the recent profit volatility, plus any

return from and adjustment to the carrying value of our unlisted

investments, which now comprise much the greater part of our

portfolio and are almost all in the technology sector. During the

period, the Company's residual holding in Eco (Atlantic Oil &

Gas) Limited ("Eco"), which has now been substantially disposed of,

reduced in value compared to the significant profits realised in

previous periods. Meanwhile, gains were made from the Company's

technology investments, principally driven by the sale of Artomatix

which has provided a 60% return on Pires original investment in

SVV. As at the period end, over 90% of the Company's net asset

value comprised cash, placing proceeds and technology-related

investments.

Although the Company's net assets have increased over the

period, we do not believe that this fairly represents the Company's

financial potential, given the scope for significant valuation

uplift of the companies within the portfolio. This is clearly

demonstrated by the gains, both realised and unrealised, that have

been achieved to date from the portfolio. Furthermore, it is worth

reiterating that realisations that are achieved within the SVV

portfolio result in cash distributions to the Company and are not

retained within the fund.

During the period, the Company undertook a placing to raise

gross proceeds of GBP1.06 million from both existing and new

investors, including the well-known technology investor Chris

Akers. All the cash from the placing was received post the period

end.

With regard to Covid-19, we have been fortunate in our ability

to be trading as normal. Furthermore, based on respected VC market

research firm Dealroom, who have evaluated the effect of the

pandemic on various industries, we firmly believe that the

investments we have made are well positioned against this backdrop.

Our investment strategy is focused on high-tech businesses with

significant potential for accelerated growth across sectors such as

AI, IoT and AR/VR . We remain encouraged by the progress made to

date by each of our portfolio companies and the outlook for the

respective sectors in which they operate.

In summary, our investment in the technology sector have already

proven to have been successful, with a substantial amount of our

original investment already having been returned to the Company.

Going forward, the Company is very well positioned to become a

leading next generation technology investment company with an

interest in a portfolio of high-growth technology companies that

have the potential for significant growth.

Peter Redmond

Chairman

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

Enquiries:

Pires Investments plc

Peter Redmond, Chairman Tel: +44 (0) 20 3368 8961

Nicholas Lee, Director

Nominated Adviser

Cairn Financial Advisers LLP Tel: +44 (0) 20 7213 0880

Liam Murray/Ludovico Lazzaretti

Joint broker

Peterhouse Capital Limited Tel: +44 (0) 20 7469 0935

Lucy Williams/Duncan Vasey

Joint broker

Mirabaud Securities Limited Tel: +44 (0) 20 3167 7221

Peter Krens

Financial media and PR

Yellow Jersey Tel: +44 (0) 20 3004 9512

Sarah Hollins

Henry Wilkinson

Annabel Atkins

UNAUDITED STATEMENT OF COMPREHENSIVE INCOME

for the six months ended 30 April 2020

Unaudited Unaudited Audited

6 months 6 months Year

ended ended Ended

30-Apr 30-Apr 31-Oct

2020 2019 2019

Continuing activities GBP GBP GBP

Notes

Revenue

Investment income - - -

Other income 327 291 1,368

Total revenue 327 291 1,368

(Losses) / Gains on investments

held at fair value through profit

or loss (261,023) 764,994 1,151,997

Operating expenses (166,046) (106,237) (287,855)

----------- ---------- -------------

Operating profit from continuing

activities (427,068) 659,048 865,510

Profit before taxation from

continuing activities (427,068) 659,048 865,510

Tax - - -

Profit for the period from continuing

activities (427,068) 659,048 865,510

----------- ---------- -------------

Profit for the period and total

comprehensive income attributable

to equity holders of the Company (427,068) 659,048 865,510

=========== ========== =============

Basic (loss)/ profit per share 3

Equity holders

Basic and diluted (0.64)p 1.46p 1.64p

UNAUDITED STATEMENT OF FINANCIAL POSITION

As at 30 April 2020

Unaudited Unaudited Audited

As at As at As at

30-Apr 30-Apr 31-Oct

2020 2019 2019

GBP GBP GBP

Notes

NON-CURRENT ASSETS

Property, plant - - -

and equipment

Investment in subsidiaries 1 1 1

TOTAL NON CURRENT

ASSETS 1 1 1

CURRENT ASSETS

Investments 1,683,989 1,477,056 1,165,409

Trade and other

receivables 1,030,584 15,876 11,307

Cash and cash equivalents 400,168 932,864 1,426,799

------------- ------------- -------------

TOTAL CURRENT ASSETS 3,114,741 2,425,796 2,603,315

------------- ------------- -------------

TOTAL ASSETS 3,114,742 2,425,797 2,603,616

============= ============= =============

EQUITY

Called up share

capital 11,996,156 11,996,156 11,996,156

Shares to be issued 132,500 - -

Share premium account 4,249,081 4,249,081 4,249,081

Share premium account 808,255 - -

for shares to be

issued

Retained earnings (14,272,390) (14,051,784) (13,845,322)

Capital redemption

reserve 164,667 164,667 164,667

------------- ------------- -------------

TOTAL EQUITY 4 3,078,269 2,358,120 2,564,582

LIABILITIES

CURRENT LIABILITIES

Trade and other

payables 36,473 67,677 38,934

------------- ------------- -------------

TOTAL LIABILITIES

AND CURRENT LIABILITIES 36,473 67,677 38,934

TOTAL EQUITY AND

LIABILITIES 3,114,742 2,425,797 2,603,516

============= ============= =============

UNAUDITED CASH FLOW STATEMENT

For the six months ended 30 April 2020

Unaudited Unaudited Audited

6 months 6 months Year ended

ended ended ended

30-Apr 30-Apr 31-Oct

2020 2019 2019

GBP GBP GBP

Cash flows from operating

activities (427,068) 659,048 865,510

Depreciation - - -

Realised (gain) on disposal

of investments (284,081) (120,060) (419,198)

Fair value movement in

investments 545,430 (644,934) (732,799)

Finance income (327) (291) (1,368)

(Increase)/decrease in

receivables (1,019,277) (4,519) 50

Increase/(decrease) in

payables (2,461) (71,618) (100,361)

Net cash absorbed by

operating activities (1,187,783) (182,374) (388,166)

Cash flows from investing

activities

Payments to acquire investments (1,699,909) - -

Proceeds of sale of investments 919,980 317,464 1,106,114

Finance income received 327 291 1,368

Net cash from investing

activities (779,602) 317,755 1,017,482

Cash flows from financing

activities

Proceeds receivable from

shares to be issued 940,755 749,455 749,455

Net cash from financing

activities 940,755 749,455 749,455

Net increase/(decrease)

in cash and cash equivalents

during the period (1,026,631) 884,836 1,378,771

Cash and cash equivalents

at beginning of the period 1,426,799 48,028 48,028

Cash and cash equivalents

at end of the period 400,168 932,864 1,426,799

Notes to the Unaudited Interim Report

1. GENERAL INFORMATION

Pires Investments plc (the "Company") is a company domiciled in

England whose registered office address is 9(th) Floor, 107

Cheapside, London EC3V 6DN. The condensed interim financial

statements of the Company for the six months ended 30 April 2020 is

that of the Company only.

The condensed interim financial statements do not constitute

statutory accounts as defined in Section 434 of the Companies Act

2006.

The financial information for the year ended 31 October 2019 has

been extracted from the statutory accounts for that period which

were prepared in accordance with International Financial Reporting

Standards ("IFRS"). The auditors' report on the statutory accounts

was unqualified. A copy of those financial statements has been

filed with the Registrar of Companies.

The financial information for the six months ended 30 April 2019

and 2020 was also prepared in accordance with IFRS.

The condensed interim financial statements do not include all of

the information required for full annual financial statements.

The condensed interim financial statements were authorised for

issue on 30 July 2020.

2. BASIS OF ACCOUNTING

The financial statements are unaudited and have been prepared on

the historical cost basis in accordance with International

Financial Reporting Standards as adopted by the EU ("IFRS") using

the same accounting policies and methods of computation as were

used in the annual financial statements for the year ended 31

October 2019. As permitted, the interim report has been prepared in

accordance with the AIM rules for Companies and is not compliant in

all respects with IAS 34 Interim Financial Statements. The

condensed interim financial statements do not include all the

information required for full annual financial statements and hence

cannot be construed as in full compliance with IFRS.

3. PROFIT / LOSS PER SHARE

The calculation of the basic loss per share is based on the

following data:

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

30-Apr 30-Apr 31-Oct

2020 2019 2019

GBP GBP GBP

(Loss)/ Profit on continuing activities

after tax (427,068) 659,048 865,510

Basic and fully diluted

Basic and fully diluted earnings per share have been computed

based on the following data:

Number of shares

Weighted average number of ordinary

shares for the period 66,472,465 45,238,999 52,900,940

Basic earnings per share from

continuing activities (p) (0.64) 1.46 1.64

There were no dilutive instruments that would give rise to diluted

earnings per share.

4. STATEMENT OF CHANGES IN EQUITY

Share Capital Shares to Share Premium Capital Retained Earnings Total

be issued Redemption

Reserve

GBP GBP GBP GBP GBP GBP

At 1 November

2018 11,914,727 - 3,581,055 164,667 (14,710,832) 949,617

Issue of Share

Capital 81,429 668,026 749,455

Profit for the

6 months ended

30 April 2019 - - - - 659,048 659,048

----------

At 30 April

2019 11,996,156 - 4,249,081 164,667 (14,051,784) 2,358,120

Profit for the

6 months ended

31 October 2019 - - - - 206,462 206,462

----------

At 31 October

2019 11,996,156 - 4,249,081 164,667 (13,845,322) 2,564,582

Shares to be

issued - 940,755 - - - 940,755

Loss for the

6 months ended

30 April 2020 - - - - (427,068) (427,068)

----------

At 30 April

2020 11,996,156 940,755 4,249,081 164,667 (14,272,390) 3,078,269

============= ---------- ============= =========== ================= =========

5. DISTRIBUTION OF INTERIM REPORT

Copies of the Interim Report for the six months ended 30 April

2020 are available on the Company's website,

www.piresinvestments.com .

Caution regarding forward looking statements

Certain statements in this announcement, are, or may be deemed

to be, forward looking statements. Forward looking statements are

identi ed by their use of terms and phrases such as "believe",

"could", "should" "envisage", "estimate", "intend", "may", "plan",

"potentially", "expect", "will" or the negative of those,

variations or comparable expressions, including references to

assumptions. These forward-looking statements are not based on

historical facts but rather on the Directors' current expectations

and assumptions regarding the Company's future growth, results of

operations, performance, future capital and other expenditures

(including the amount, nature and sources of funding thereof),

competitive advantages, business prospects and opportunities. Such

forward looking statements re ect the Directors' current beliefs

and assumptions and are based on information currently available to

the Directors.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR SDLFMSESSEIW

(END) Dow Jones Newswires

July 31, 2020 02:00 ET (06:00 GMT)

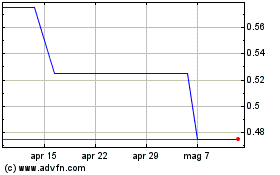

Grafico Azioni Mindflair (LSE:MFAI)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Mindflair (LSE:MFAI)

Storico

Da Apr 2023 a Apr 2024