Pound Rebounds As European Shares Rise

14 Giugno 2021 - 12:53PM

RTTF2

The pound erased its early losses against its major counterparts

during European deals on Monday, as European stocks rose on hopes

of the U.S. Federal Reserve sticking to its ultra loose monetary

policy for the foreseeable future.

Investors look ahead to this week's Fed decision for more

indications about its next moves regarding asset purchases and

interest rates.

The focus will be on Chair Jerome Powell's comments about the

strength of the economic recovery and the timing of tapering its

asset purchase program.

The pound fell earlier in the session as the U.K. government is

planning to postpone the scheduled reopening date that was set on

June 21.

Senior ministers in the UK signed off a decision to delay the

lifting of current curbs beyond June 21.

Prime Minister Boris Johnson is scheduled to affirm the delay at

a news conference later in the day.

The pound recovered to 1.4118 against the greenback and 154.99

against the yen, off its early more than a 4-week low of 1.4070 and

a 4-day low of 154.32, respectively. The pound may find resistance

around 1.425 against the greenback and 157.00 against the yen.

The pound reversed from its prior low of 1.2646 against the

franc and a session's low of 0.8606 against the euro, bouncing off

to 1.2688 and 0.8584, respectively. If the pound rises further,

1.28 and 0.84 are likely seen as its next resistance levels against

the franc and the euro, respectively.

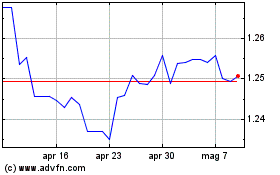

Grafico Cross Sterling vs US Dollar (FX:GBPUSD)

Da Mar 2024 a Apr 2024

Grafico Cross Sterling vs US Dollar (FX:GBPUSD)

Da Apr 2023 a Apr 2024