Pound Weakens Amid Brexit Worries

02 Dicembre 2020 - 8:36AM

RTTF2

The pound lost ground against its key counterparts in European

deals on Wednesday, as fears over a no-deal Brexit intensified

after EU chief negotiator Michel Barnier reportedly told EU

ambassadors there may be a no-deal outcome.

As British and European Union officials race to strike a

post-Brexit trade deal before the start of next week, Barnier said

that a deal hangs in the balance and a no-deal Brexit cannot be

ruled out.

EU states reportedly told Barnier not to rush into a deal under

the pressure of the December 31 timetable.

The U.K. government said it will not extend transition period

with the EU as talks remain deadlocked on issues related to

fishing, governance rules and dispute resolution.

Brexit worries overshadowed news that the UK had approved the

Pfizer-BioNTech COVID-19 vaccine, will be rolled out from next

week.

U.S. President-elect Joe Biden told the New York Times he'd

leave the phase-one trade deal with China in place while he

conducts a full review of the policy toward China in consultation

with traditional allies in Asia and Europe.

The pound fell to 139.53 against the yen, from near a 3-month

high of 140.45 hit at 2:45 am ET. The pound is likely to challenge

support around the 138.00 level.

The pound depreciated to 1.1995 versus the franc, its lowest

since November 13. If the pound falls further, it may find support

around the 1.14 level.

The pound weakened to more than a 3-week low of 0.9045 against

the euro, after having advanced to 0.8983 at 5:00 pm ET. Next key

support for the pound is seen around the 0.92 mark.

Data from Destatis showed that German retail sales grew more

than expected in October.

Retail sales increased 2.6 percent on a monthly basis, reversing

a 1.9 percent drop in September. Sales were expected to climb only

1.2 percent.

The U.K. currency edged down to 1.3335 against the dollar, after

rising to 1.3441 at 2:45 am ET. The pound is poised to find support

near the 1.30 level.

Looking ahead, U.S. ADP private payrolls data for November is

scheduled for release at 8:15 am ET.

Federal Reserve Chair Jerome Powell testifies on the CARES Act

before the House Financial Services Committee in Washington DC at

10:00 am ET.

The Federal Reserve's Beige book report will be released in the

New York session.

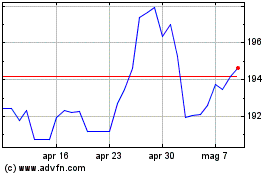

Grafico Cross Sterling vs Yen (FX:GBPJPY)

Da Mar 2024 a Apr 2024

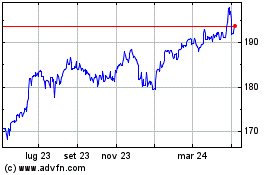

Grafico Cross Sterling vs Yen (FX:GBPJPY)

Da Apr 2023 a Apr 2024