Pound Weakens On Falling European Shares

29 Gennaio 2021 - 8:30AM

RTTF2

The pound fell against its major trading partners in the

European session on Friday, as concerns over retail trading frenzy

in short positions dampened risk sentiment.

Markets digest the latest Reddit's retail-trade frenzy, which

triggered outsized moves in GameStop, AMC Entertainment and other

previously beaten-down stocks.

The surge in speculative trading has prompted several e-brokers

to take steps to restrict the buying of shares on Thursday.

Robinhood and other online broker platforms eased restrictions

on select share trading, re-igniting volatility of shares.

Continued concerns over tight liquidity in China, rising

Covid-19 cases and the delays to vaccine rollouts also rattled

markets.

The pound declined to 0.8871 against the euro, after rising to a

2-day high of 0.8825 at 9:45 pm ET. If the pound falls further, it

is likely to test support around the 0.90 region.

Reversing from a high of 1.3730 seen at 5:15 pm ET, the pound

edged down to 1.3657 against the greenback. The pound is poised to

challenge support around the 1.34 mark.

After a a 2-day gain to 1.2202 at 9:45 pm ET, the pound turned

lower against the franc and was worth 1.2149. The currency may

locate support around the 1.19 mark.

In contrast, the pound jumped to 143.74 against the yen, its

highest since February 2020. The pound is seen finding resistance

around the 145.00 mark.

Looking ahead, Canada GDP data for November and industrial

product price index for December, as well as University of

Michigan's final consumer sentiment index for January and U.S.

personal income and spending data and pending home sales for

December are due out in the New York session.

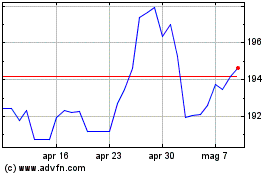

Grafico Cross Sterling vs Yen (FX:GBPJPY)

Da Mar 2024 a Apr 2024

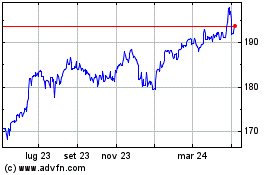

Grafico Cross Sterling vs Yen (FX:GBPJPY)

Da Apr 2023 a Apr 2024