Prodware: Increased Profitability in 2020

03 Marzo 2021 - 6:16PM

Business Wire

- EBITDA margin grew close to 29% of annual turnover.

- Net income: +7.4%

Regulatory News:

Prodware (Paris:ALPRO):

IFRS compliant statements

Data audited - in €M

2019

2020

Variation

Consolidated annual turnover

187.7

172.4

-8.1%

EBITDA

% of turnover

48.3

25.8%

49.8

28.9%

+3.1%

Current operating income

% of turnover

17.3

9.2%

18.9

11.0%

+9.7%

Operating income

% of turnover

17.3

9.2%

19.2

11.1%

+11.2%

Net income Group share

% of turnover

10.5

5.6%

11.3

6.6%

+7.4%

Business slowdown in 2020 under control

Prodware's turnover in 2020 declined by 8.1% within the context

of the global sanitary crisis, mainly due to the slow down of the

Integration business activity. SaaS sales continue to grow reaching

€45.0M in the same year showing a significant improvement of 15.6%

compared to the previous financial year. This recurring revenue now

represents 26.1% of Prodware's total revenues.

Seeking continued growth in profitability

EBITDA in 2020 grew by 3.1% despite a decline in turnover. It

reached €49,8M with a 28.9% margin. This was made possible

following a sharp decrease of external charges (-22.4% at €16.5 M)

and staff expenses (-14.2% at €49.8M). In line with the Group’s

strategy of preserving its financial fundamentals, Prodware decided

to sell its subsidiary in Tunisia as well as its Integration

business unit in Israel in 2020. This fully ties into its 2016-2020

strategic plan of focusing on its core business in Europe, a

geography deemed to have the most business development

potential.

The Current Operating Income, which factors in the depreciation

charges and slightly higher provisions (+€0.7M compared to 2019)

and €0.9M less in taxes, saw a relative increase of 9.7%.

Financial expenses totalled €6.4M in 2020, nearly equivalent to

2019 whereas corporate income tax increased by €1.5 M.

The Net income Group share reached €11.3M in 2020 compared to

€10.5M in the previous fiscal year showing a 7.4% increase.

A solid and sound balance sheet

Equity capital worth €155.4M as of December 31st, 2020 is

reported on Prodware’s balance sheet increasing by 7.3% compared to

December 31st, 2019.

The net debt (excluding lease liabilities under IFRS 16), comes

to €85.2M, with a debt-to-equity ratio (gearing ratio) amounting to

0,55 times the equity with a leveraged ratio based on conventional

and fixed standards reining in at 1.7x 2020 EBITDA.

Perspectives

2021- 2025 strategy: « The Place to Be and the Company to

Work With »

Partner of choice supporting companies through their digital

transformation journey (essentially those rapidly growing mid-size

companies, mid-market organizations and subsidiaries of large

Groups), Prodware will continue to reinforce its innovative

industry-specific solution development activity and Business

Consulting practice, fields of expertise that are pivotal in

supporting its customers.

In parallel, the Group will continue to develop and strengthen

its market positioning in Western Europe while remaining abreast of

new opportunities in Northern Europe, an area where Microsoft

technologies are in great demand.

Moreover, the existing company’s centres in Eastern Europe will

contribute in production capacity at a very competitive cost in

this now very global marketplace, in addition to the growth

forecast planned in its Western Europe geographies.

Finally, focusing on Human Capital Management is a top priority

– first to make sure Prodware retain and attract talent and second,

to ensure stellar Customer Relationship Management, both aspects

being essential to drive solid, profitable and sustainable

growth.

Next publication: Turnover of 1st quarter of 2021: May

19th, 2021, after market close.

About Prodware

Whether it is enabling ambitious Cloud strategies, artificial

intelligence driven decision-making solutions or more flexibility

and agility delivered by modern business applications, Prodware,

with more than 3 decades of expertise and know how is in a class of

its own.

Prodware leverages the latest technologies and technological

breakthroughs building the business processes of tomorrow across

the manufacturing, retail & distribution, professional services

and finance verticals.

The Prodware Group is a global company founded in 1989 with

regional offices in 13 countries with close to 1400 employees.

Prodware is listed on Euronext Growth in Paris generating €172.4 M

in annual revenue in 2020.

For more information www.prodwareGroup.com

EURONEXT GROWTH (ex. ALTERNEXT)

ISIN FR0010313486 - ALPRO - FTSE 972 Services informatiques

Prodware est éligible FCPI - Entreprise responsable, Prodware est

adhérent du Global Compact.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210303005797/en/

PRODWARE Stéphane Conrard Directeur financier T : 0979

999 000 investisseurs@prodware.fr

PRESSE Gilles Broquelet CAP VALUE T : 01 80 81 50 01

gbroquelet@capvalue.fr

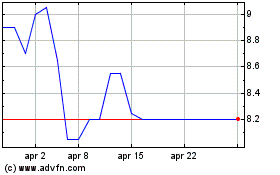

Grafico Azioni Prodware (EU:ALPRO)

Storico

Da Mar 2024 a Apr 2024

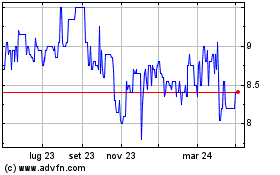

Grafico Azioni Prodware (EU:ALPRO)

Storico

Da Apr 2023 a Apr 2024