Prologis 2Q FFO Top Expectations; Revenue Falls

19 Luglio 2021 - 2:36PM

Dow Jones News

By Matt Grossman

Prologis Inc. Monday logged funds from operations that slightly

outpaced Wall Street analysts' expectations for its second-quarter

results, although revenue fell.

The San Francisco-based industrial-property landlord posted

earnings attributable to shareholders of 81 cents a share, up from

54 cents a share in 2020's second quarter. Net earnings

attributable to shareholders rose to $599 million, from $405

million in the year-ago period.

Core funds from operations attributable to shareholders, a

measure of operating performance, was $1.01 a share. Analysts

surveyed by FactSet were anticipating funds from operations of 99

cents a share.

Revenue was $1.15 billion, compared with $1.27 billion a year

earlier. Analysts had forecast revenue of $1.01 billion. Rental

revenues grew to $1.02 billion, from $945 million a year earlier.

Strategic-capital revenues declined $129 million, from $321

million.

Average occupancy in Prologis' owned and managed portfolio rose

by 60 basis points sequentially to 96%. The company commenced

leases on 49 million square feet of real estate.

Write to Matt Grossman at matt.grossman@wsj.com

(END) Dow Jones Newswires

July 19, 2021 08:36 ET (12:36 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

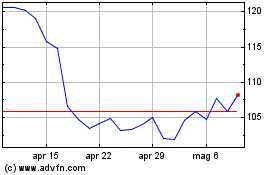

Grafico Azioni Prologis (NYSE:PLD)

Storico

Da Mar 2024 a Apr 2024

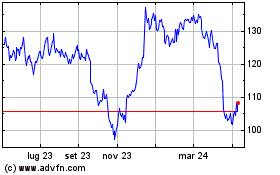

Grafico Azioni Prologis (NYSE:PLD)

Storico

Da Apr 2023 a Apr 2024