TIDMRC2

RNS Number : 8682W

Reconstruction Capital II Ltd

21 August 2020

21 August 2020

Reconstruction Capital II Limited (the "Company")

Interim Unaudited Financial Statements

for the six months ended 30 June 2020

Reconstruction Capital II Limited ("RC2", the "Company" or the

"Group"), a closed-end investment company incorporated in the

Cayman Islands admitted to trading on the AIM market of the London

Stock Exchange, today announces its results for the six months

ended 30 June 2020.

Copies of the company's interim financial statements will today

be posted to shareholders. The interim report is also available on

the Company's website http://www. reconstructioncapital2.com/.

Financial highlights

On 30 June 2020, Reconstruction Capital II Limited ("RC2") had a

total unaudited net asset value ("NAV") of EUR19.5m or EUR0.1428

per share, which represents a 1.52% fall since the beginning of the

year.

As at 30 June 2020, RC2 had cash and cash equivalents of

approximately EUR10,000 while its subsidiary, RC2 (Cyprus) Ltd, had

cash and cash equivalents of EUR68,000. Additionally, RC2 (Cyprus)

Ltd had loan receivables from Telecredit and Mamaia Resort Hotels

of EUR 1.5m. As at 30 June 2020, RC2 had sundry liabilities of

EUR137,000.

Operational highlights

The Romanian and Bulgarian governments took timely measures to

contain the spread of COVID-19 when the numbers of cases and

fatalities were still relatively low compared to Western Europe.

Although these measures, which were stricter in Romania, seemed to

have suppressed the pandemic, once the restrictions in both

countries were gradually lifted in mid-May, the number of cases has

been rising to worrying levels with Romania and Bulgaria posting

two of the highest rates of new cases in South-East Europe. At the

end of July, Romania and Bulgaria were reporting 100 and 70

COVID-19 active cases per 100,000 inhabitants, respectively,

compared to 22 and 19 active cases at the end of May.

The Policolor Group's January-June 2020 sales results were up

3.4% year-on-year at EUR 31.2m, albeit 13.9% below budget. Sales of

coatings were badly affected by the COVID-19 pandemic and related

lockdown restrictions during April, but sales of both coatings and

resins have since recovered, making up some of the lost ground.

Over the first half of 2020, the Policolor Group generated a

recurring EBITDA (excluding revenues and expenses allocated to the

real estate division) of EUR 2m, in line with the budget, helped by

production efficiencies and operating cost savings.

Both Mamaia and Telecredit's operations have been badly affected

by the COVID-19 pandemic, and both management teams have prepared

revised budgets to reflect the estimated impact of the pandemic on

their respective businesses this year.

Following the finalization of the second phase of the renovation

works on its public areas, and due to the Romanian authorities

re-allowing open air restaurants to operate, the Mamaia hotel

re-opened at the beginning of June. However, it is still not

allowed to use its indoor restaurants, and is forced to restrict

its food and beverage service to its outdoor terrace, where social

distancing rules limit the number of customers. Management's

revised 2020 budget for the Hotel envisages total revenues of EUR

2.0m instead of an originally planned EUR 3.2m, and a net loss of

EUR -0.24m instead of an original estimated net profit of EUR

0.18m. In April, RC2 provided a EUR 0.3m loan to the Hotel to help

finalize its planned renovation works. The loan was fully drawn by

the end of May.

Telecredit deployed EUR 3.7m in financing products to small and

medium sized enterprises in the first semester, generating an

Operating Loss before Depreciation of EUR 0.2m due to increased

provisions expenses, reflecting the difficulties small and

medium-sized companies are currently facing due to the pandemic.

The revised 2020 budget prepared by management anticipates a net

loss of EUR 0.39m compared to an original estimated net profit of

EUR 0.06m, due to lower financing volumes generating lower interest

revenues (EUR 0.8m as opposed to an initial EUR 1m) and

significantly higher provisions on SME lending (EUR 0.2m as opposed

to an initial EUR 0.1m). The company reimbursed EUR 0.3m of the EUR

1.5m loan RC2 provided to Telecredit in the second half of

2019.

For further information, please contact:

Reconstruction Capital II Limited

Cornelia Oancea / Anca Moraru

Tel: +40 21 316 76 80

Grant Thornton UK LLP

(Nominated Adviser)

Philip Secrett

Tel: +44 (0) 20 7383 5100

finnCap Limited

(Broker)

William Marle / Giles Rolls

Tel: +44 20 7220 0500

ADVISER'S REPORT

For the six months ended 30 June 2020

On 30 June 2020, Reconstruction Capital II Limited ("RC2") had a total

unaudited net asset value ("NAV") of

EUR19.5m or EUR0.1428 per share, which represents a 1.52% fall since

the beginning of the year.

The Romanian and Bulgarian governments took timely measures to contain

the spread of COVID-19 when the numbers of cases and fatalities were

still relatively low compared to Western Europe. Although these measures,

which were stricter in Romania, seemed to have suppressed the pandemic,

once the restrictions in both countries were gradually lifted in mid-May,

the number of cases has been rising to worrying levels with Romania

and Bulgaria posting two of the highest rates of new cases in South-East

Europe. At the end of July, Romania and Bulgaria were reporting 100

and 70 COVID-19 active cases per 100,000 inhabitants, respectively,

compared to 22 and 19 active cases at the end of May.

The Policolor Group's January-June 2020 sales results were up 3.4%

year-on-year at EUR 31.2m, albeit 13.9% below budget. Sales of coatings

were badly affected by the COVID-19 pandemic and related lockdown

restrictions during April, but sales of both coatings and resins have

since recovered, making up some of the lost ground. Over the first

half of 2020, the Policolor Group generated a recurring EBITDA (excluding

revenues and expenses allocated to the real estate division) of EUR

2m, in line with the budget, helped by production efficiencies and

operating cost savings.

Both Mamaia and Telecredit's operations have been badly affected by

the COVID-19 pandemic, and both management teams have prepared revised

budgets to reflect the estimated impact of the pandemic on their respective

businesses this year.

Following the finalization of the second phase of the renovation works

on its public areas, and due to the Romanian authorities re-allowing

open air restaurants to operate, the Mamaia hotel re-opened at the

beginning of June. However, it is still not allowed to use its indoor

restaurants, and is forced to restrict its food and beverage service

to its outdoor terrace, where social distancing rules limit the number

of customers. Management's revised 2020 budget for the Hotel envisages

total revenues of EUR 2.0m instead of an originally planned EUR 3.2m,

and a net loss of EUR -0.24m instead of an original estimated net

profit of EUR 0.18m. In April, RC2 provided a EUR 0.3m loan to the

Hotel to help finalize its planned renovation works. The loan was

fully drawn by the end of May.

Telecredit deployed EUR 3.7m in financing products to small and medium

sized enterprises in the first semester, generating an Operating Loss

before Depreciation of EUR 0.2m due to increased provisions expenses,

reflecting the difficulties small and medium-sized companies are currently

facing due to the pandemic. The revised 2020 budget prepared by management

anticipates a net loss of EUR 0.39m compared to an original estimated

net profit of EUR 0.06m, due to lower financing volumes generating

lower interest revenues (EUR 0.8m as opposed to an initial

EUR 1m) and significantly higher provisions on SME lending (EUR 0.2m

as opposed to an initial EUR 0.1m). The company reimbursed EUR0.3m

of the EUR1.5m loan RC2 provided to Telecredit in the second half

of 2019.

As at 30 June 2020, RC2 had cash and cash equivalents of approximately

EUR10,000 while its subsidiary, RC2 (Cyprus) Ltd, had cash and cash

equivalents of EUR68,000. Additionally, RC2 (Cyprus) Ltd had loan

receivables from Telecredit and Mamaia Resort Hotels of EUR 1.5m.

As at 30 June 2020, RC2 had sundry liabilities of

EUR137,000.

New Europe Capital SRL

STATEMENT OF COMPREHENSIVE INCOME

For the six months ended 30 June 2020

Investment Income 30 June 30 June 30 December

2020 2019 2019

EUR EUR EUR

Unaudited Unaudited Audited

Fair value loss on financial

assets at fair value through

profit or loss (2,113,199) (2,162,241) (14,482,512)

Interest Income 2,131,097 2,151,033 4,319,475

------------ ------------ -------------

Net Investment profit/loss 17,898 (11,208) (10,163,037)

------------ ------------ -------------

Expenses

Operating expenses (315,688) (443,456) (845,572)

Financial income - 255 255

------------ ------------ -------------

Total expenses (315,688) (443,201) (845,317)

------------ ------------ -------------

Loss for the period/year (297,790) (454,409) (11,008,354)

------------ ------------ -------------

Other comprehensive income - - -

------------ ------------ -------------

Total comprehensive loss for

the period/year attributable

to owners (297,790) (454,409) (11,008,354)

============ ============ =============

Earnings Per Share attributable

to the owners of the Company

Basic and diluted earnings per

share (0.0022) (0.0033) (0.0806)

STATEMENT OF FINANCIAL POSITION

As at 30 June 2020

30 June 30 June 31 December

2020 2019 2019

EUR EUR EUR

Unaudited Unaudited Audited

ASSETS

Non-current assets

Financial assets at

fair value through profit

or loss 19,509,494 30,293,424 19,651,596

-------------- -------------- --------------

Total non-current assets 19,509,494 30,293,424 19,651,596

-------------- -------------- --------------

Current assets

Trade and other receivables 13,585 14,299 16,673

Cash and cash equivalents 10,200 100,964 65,887

-------------- -------------- --------------

Total current assets 23,785 115,263 82,560

-------------- -------------- --------------

TOTAL ASSETS 19,533,279 30,408,687 19,734,156

-------------- -------------- --------------

LIABILITIES

Current liabilities

Trade and other payables 134,275 109,949 37,362

TOTAL LIABILITIES 134,275 109,949 37,362

-------------- -------------- --------------

NET ASSETS 19,399,004 30,298,738 19,696,794

-------------- -------------- --------------

EQUITY ATTRIBUTABLE TO OWNERS

Share capital 1,358,569 1,362,569 1,358,569

Share premium 109,206,779 109,250,778 109,206,779

Accumulated deficit (91,166,344) (80,314,609) (90,868,554)

-------------- -------------- --------------

TOTAL EQUITY 19,399,004 30,298,738 19,696,794

-------------- -------------- --------------

Net Asset Value per share

Basic and diluted net asset

value per share 0.1428 0.2224 0.1450

-------------- -------------- --------------

STATEMENT OF CHANGES IN EQUITY

For the six months ended 30 June 2020

Retained

Share (deficit)/

Share capital premium EUR earnings Total EUR

EUR EUR

Balance at 1 January 2019 1,403,324 109,862,098 (79,860,200) 31,405,222

Loss for the period - - (454,409) (454,409)

Other comprehensive income - - - -

-------------- ---------------

Total comprehensive loss

for the period

- - (454,409) (454,409)

-------------- ---------------

Repurchase and

cancellation of own shares

(40,755) (611,320) - (652,075)

-------------- ---------------

Transactions with owners

(40,755) (611,320) - (652,075)

-------------- ---------------

Balance at 30 June 2019

1,362,569 109,250,778 (80,314,609) 30,298,738

-------------- ---------------

Loss for the period - - (10,553,945) (10,553,945)

Other comprehensive income - - - -

-------------- ---------------

Total comprehensive loss

for the period

- - (10,553,945) (10,553,945)

-------------- ---------------

Repurchase and

cancellation of own shares

(4,000) (44,000) - (48,000)

-------------- ---------------

Transactions with owners

(4,000) (44,000) - (48,000)

-------------- ---------------

Balance at 31 December

2019 1,358,569 109,206,779 (90,868,554) 19,696,794

-------------- ---------------

Loss for the period - - (297,790) (297,790)

Other comprehensive income - - - -

-------------- ---------------

Total comprehensive loss

for the period

- - (297,790) (297,790)

-------------- ---------------

- -

Repurchase and cancellation

of own shares

- -

-------------- ---------------

- -

Transactions with owners -

-

-------------- ---------------

Balance at 30 June 2020

1,358,569 109,206,779 (91,166,344) 19,399,004

-------------- ---------------

CASH FLOW STATEMENT

For the six months ended 30 June 2020

30 June 30 June 31 December

2020 2019 2019

EUR EUR EUR

Unaudited Unaudited Audited

Cash flows from operating

activities

Loss before taxation (297,790) (454,409) (11,008,354)

Adjustments for:

Fair value loss on financial

assets at fair value

through profit or loss 2,113,199 2,162,241 14,482,512

Interest income (2,131,097) (2,151,033) (4,319,475)

Net gain on foreign exchange - (255) (255)

--------------- --------------- ---------------

Net cash outflow before changes

in working capital (315,688) (443,456) (845,572)

Decrease in trade and other

receivables 3,088 6,712 4,338

Increase/(decrease) in trade

and other payables 96,913 14,348 (58,233)

Purchase of financial assets - (133,602) (133,603)

Disposals and repayments

of financial assets 160,000 310,000 800,000

--------------- --------------- ---------------

Net cash used in operating

activities (55,687) (245,998) (233,070)

--------------- --------------- ---------------

Cash flows from financing

activities

Payments to purchase own

shares - (1,000,657) (1,048,662)

Redemptions of B shares - (132,941) (132,941)

--------------- --------------- ---------------

Net cash flow used in financing

activities - (1,133,598) (1,181,603)

--------------- --------------- ---------------

Net decrease in cash and

cash equivalents before currency

adjustment (55,687) (1,379,596) (1,414,673)

Effects of exchange rate

differences on cash and

cash equivalents - 255 255

--------------- --------------- ---------------

Net decrease in cash and

cash equivalents after currency

adjustment (55,687) (1,379,341) (1,414,418)

Cash and cash equivalents

at the beginning of the

period/year 65,887 1,480,305 1,480,305

--------------- --------------- ---------------

Cash and cash equivalents

at the end of the period/year 10,200 100,964 65,887

--------------- --------------- ---------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR EAAPFASKEEFA

(END) Dow Jones Newswires

August 21, 2020 09:00 ET (13:00 GMT)

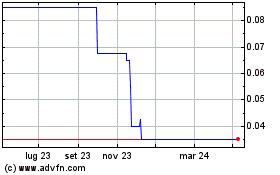

Grafico Azioni Reconstruction Capital Ii (LSE:RC2)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Reconstruction Capital Ii (LSE:RC2)

Storico

Da Apr 2023 a Apr 2024