UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rules 13a-16 or 15d-16 under

the Securities Exchange Act of 1934

Dated May 28, 2021

Commission File Number: 001-10086

VODAFONE GROUP

PUBLIC LIMITED COMPANY

(Translation of registrant’s name into English)

VODAFONE HOUSE, THE CONNECTION, NEWBURY, BERKSHIRE, RG14 2FN, ENGLAND

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes o No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .

This Report on Form 6-K contains a Stock Exchange Announcement dated 28 May 2021 entitled ‘PUBLICATION OF THE 2021 ANNUAL REPORT’.

RNS Number : 2334A

Vodafone Group Plc

28 May 2021

28 May 2021

Vodafone Group Plc (‘Vodafone’ or the ‘Company’)

Publication of the 2021 Annual Report

Vodafone has today published on the Company’s website its Annual Report for the year ended 31 March 2021 (the ‘2021 Annual Report’). The 2021 Annual Report is available at vodafone.com/ar2021.

In compliance with Listing Rule 9.6.1 of the UK Financial Conduct Authority (‘FCA’), the 2021 Annual Report will in due course be available for inspection at data.fca.org.uk/#/nsm/nationalstoragemechanism

In accordance with FCA’s Disclosure Guidance and Transparency Rule 6.3.5, the Appendix to this announcement contains a description of the principal risks and uncertainties affecting the Group, related party transactions and a responsibility statement.

A condensed set of Vodafone’s financial statements and information on important events that have occurred during the financial year ended 31 March 2021 and their impact on the financial statements were included in Vodafone’s final results announcement released on 18 May 2021. That information, together with the information set out below, which is extracted from the 2021 Annual Report, constitute the material required by Disclosure Guidance and Transparency Rule 6.3.5 which is required to be communicated to the media in full unedited text through a Regulatory Information Service. This announcement is not a substitute for reading the full 2021 Annual Report. Page and note references in the text below refer to page numbers in the 2021 Annual Report and notes to the financial statements.

APPENDIX

PRINCIPAL RISK FACTORS AND UNCERTAINTIES

A description of the principal risks and uncertainties that the Company faces is extracted from pages 53 to 61 of the 2021 Annual Report.

Managing uncertainty in our business

Managing risks and uncertainty is an integral part of successfully delivering on our strategic objectives. We have embedded a global risk management framework which aims to ensure consistency and the right level of oversight is provided across both Group entities and our local markets.

Identifying our risks

All local markets and Group entities identify and assess risks which could affect the local strategy and operations. A consolidated list of these risks is then presented to a selection of Group senior leaders and executives, alongside the outputs from an external environment scan and specialised risk focus groups. Applying a Group-wide perspective, these executives evaluate and determine our top risks and which emerging risks warrant further exploration. The proposed principal risks, emerging risks and risk watchlist are defined and agreed by our Executive Committee (‘ExCo’) before being submitted to the Audit and Risk Committee and the Board for the final challenge and approval.

Managing our risks

During the risk evaluation phase, we assign each of our risks to a category (strategic, technological, operational or financial — see next page) and identify the source of the threat (internal or external). This approach enables a better understanding of how we should treat the risk and ensure the right level of oversight and assurance is provided. The assigned executive risk owners are accountable for confirming adequate controls are in place and that the necessary treatment plans are

implemented to bring the risk within an acceptable tolerance. We continue to monitor the status of risk treatment strategies across the year and hold in-depth reviews of our risks.

For each of the principal risks, we also develop severe but plausible scenarios which provide additional insights into possible threats and enable a better risk treatment strategy. Scenarios are also used for the purpose of assessing our viability.

Read more about our viability statement on page 61.

Risk categorisation and interdependencies

We continue to consider risks both individually and collectively in order to fully understand our risk landscape. By analysing the correlation between risks, we can identify those that have the potential to impact or increase other risks and therefore are weighted appropriately. This exercise informs our scenario analysis, particularly the combined scenario used in the Long-Term Viability Statement.

Read more about our viability statement on page 61.

Strategic - The influence of stakeholders and industry players on our business and our response to them:

A Geo-political risk in the supply chain

B Adverse political and regulatory measures

C Market disruption

D Disintermediation and failure to innovate

Financial - Our financial status, standing and continued growth:

E Global economic disruption

Technological - The network, IT systems and platforms that support our business and the data they hold:

F Cyber threat and information security

G Technology failures

Operational - The ability to achieve our optimal business model:

H Strategic transformation

I Legal and regulatory compliance

J IT transformation

Our principal risks

Cyber threat and information security

Risk owner: Group Technology Officer

Change in risk profile: Stable

Our strategy: Best connectivity products & services, Outstanding digital experiences, Social contract shaping digital society.

Description:

An external cyber-attack, insider threat or supplier breach could cause service interruption or the loss of confidential data. Cyber threats could lead to major customer, financial, reputational and regulatory impacts.

Mitigation activities:

We have a risk-based approach to managing cyber security. We actively identify risks and threats, design layers of control and implement controls across all parts of the Company. The approach balances controls that prevent the majority of attacks, detect events and respond quickly to reduce harm.

Target tolerance:

Security underpins our company purpose to enable connectivity in society and maintain our customers’ trust. A breach with material adverse customer, reputation, financial or regulatory impact is outside our risk tolerance. We will never be fully immune to cyber-attacks, however, layers of effective controls will reduce the likelihood and impact.

Scenario:

Each year we model a severe but plausible scenario. These have included attacks on core infrastructure, a bulk data breach and loss of major customer facing systems. We perform regular cyber crisis simulations with senior management in our markets and Group functions using a tailored set of scenarios.

Emerging threats:

Cyber risk is constantly evolving in line with technological and geo-political developments. We anticipate threats will continue from existing sources, but also evolve in areas such as 5G, IoT, vendor software integrity, quantum computing and the use of AI and machine learning.

Read more about cyber security on pages 45-47.

Geo-political risk in supply chain

Risk owner: Group External Affairs Director

Change in risk profile: Stable

Our strategy: Leading innovation in digital services, Social contract shaping digital society, Leading gigabit networks

Description:

Our operation is dependent on a wide range of global suppliers. Disruption to our supply chain could mean that we are unable to execute our strategic plans, resulting in increased cost, reduced choice and network quality.

Mitigation activities:

Partial mitigation can be achieved through close monitoring of the political situation around key suppliers, engagement with governments, experts and equipment vendors. This enables Vodafone to respond accordingly and to ensure compliance with the latest regulations, economic sanctions and trade rulings. Broader issues of international politics which strongly influence the level of risk are, and will remain, outside Vodafone’s control.

Target tolerance:

The existence of a broader range of scale suppliers of key equipment. A multi-vendor strategy in place across our markets to mitigate against supply chain disruption.

Scenario:

Disruption to our supply chain due to geo-political decisions affecting our ability to select or continue to use equipment from specific vendors or decisions that affect trade and supply chains.

Emerging threats:

We operate in a global environment where political landscape changes could influence our operations. The increasing political tension between the US and China shows no sign of easing and this presents a potentially significant risk to our supply chain and customer base.

Adverse political and regulatory measures

Risk owner: Group External Affairs Director and Chief Financial Officer

Change in risk profile: Decrease

Our strategy: Best connectivity products & services, Leading innovation in digital services, Outstanding digital experiences, Simplified & most efficient operator, Social contract shaping digital society, Leading gigabit networks.

Description:

Adverse political and regulatory measures impacting our strategy could result in increased costs, create a competitive disadvantage or have negative impact on our return on capital employed.

Mitigation activities:

We actively address issues openly with policy makers and regulatory authorities to find mutually acceptable ways forward. As a last resort we uphold our rights through legal means.

Target tolerance:

To have strategies that are based on common objectives with political, policy and regulatory stakeholders to reduce the risk that our business could be undermined by unpredictable and disproportionate political and regulatory environments and interventions.

Scenario:

Exposure to additional liabilities by regulatory authorities or if tax laws were to adversely change in the markets in which we operate.

Emerging threats:

Regulation is becoming geographically diverse with increases in protectionist behaviours and fragmented regulation. Additionally, governments could seek to recover the costs of the COVID-19 pandemic through tax increases.

Strategic transformation

Risk owner: Group Technology Officer and Group Chief Commercial Officer

Change in risk profile: Stable

Our strategy: Best connectivity products & services, Leading innovation in digital services, Outstanding digital experiences, Simplified & most efficient operator, Leading gigabit networks.

Description:

Failure to execute our strategy as described on pages 18 to 20 including on organisational transformation and portfolio activity (such as integrations, mergers or separations) could result in loss of business value and additional cost

Mitigation activities:

We have specialist teams executing and monitoring our organisational transformation and portfolio activities. We also have robust governance structures in place to protect the Group’s interests.

Target tolerance:

We are executing our programmes effectively to maximise synergies/benefits realisation; optimising cost and increasing speed of delivery, while ensuring our core organisation and cultural values remains safeguarded throughout.

Scenario:

The inability to achieve the expected benefit through transformation activities whilst evolving to the new generation connectivity and digital services provider for Europe & Africa.

Emerging threats:

The increased pace of change in the organisation means we have to maintain the required culture and skillset to support our transformational initiatives. Externally, as customer behaviours and their preferences change, we might have to accelerate or adapt our transformation programmes.

Global economic disruption

Risk owner: Chief Financial Officer

Change in risk profile: Decrease

Our strategy: Best connectivity products & services, Leading innovation in digital services, Outstanding digital experiences, Social contract shaping digital society, Leading gigabit networks.

Description:

A global economic crisis could result in reduced telco spend from businesses and consumers, as well as limit our access to financial markets and availability of liquidity, increasing our cost of capital and limiting debt financing options.

Mitigation activities:

We have a relatively resilient business model. Our offers are competitive in the markets in which we operate. We are supporting our business customers’ efficiencies through our innovative products. We have a long average life of debt which minimises refinancing requirements, and the vast majority of our interest costs are fixed.

Target tolerance:

Conservative management of the balance sheet to avoid potential consequences of unstable economic conditions. Access to sufficient liquidity at favourable terms.

Scenario:

A severe contraction in economic activity leads to lower cash flow generation for the Group and disruption in global financial markets impacts our ability to refinance debt obligations as they fall due.

Emerging threats:

Because this is an externally driven risk, the threat environment is continually changing.

External factors such as the COVID-19 pandemic or a potential sovereign debt crisis could have future impacts on economic activity across our markets. The financial markets are currently experiencing high levels of volatility and sovereign debts levels have reached record levels. These could lead to a significant change in the availably and cost of financing.

Technology failures

Risk owner: Chief Technology Officer

Change in risk profile: Decrease

Our strategy: Best connectivity products & services, Leading innovation in digital services, Outstanding digital experiences, Simplified & most efficient operator, Leading gigabit networks.

Description:

Network, system or platform outages resulting from internal or external events could lead to reduced customer satisfaction, reputational damage and/or regulatory penalties.

Mitigation activities:

Unique recovery targets are set for critical assets to limit the impact of service outages. A global policy supports these targets with requisite controls to provide effective resilience.

Target tolerance:

Our customer promise is based on reliable availability of our network; therefore, the recovery of key mobile, fixed, IT services and platforms must be fast and robust.

Scenario:

We have a low tolerance to network, IT or platform disruptions which cause significant impact to our customers.

Emerging threats:

Potential impact of an increase in extreme weather events caused by climate change may increase the likelihood or frequency of technology failure.

New assets inherited from acquired businesses may not be aligned to our target resilience level which may increase the likelihood of a technology failure.

Market disruption

Risk owner: Group Chief Commercial Officer

Change in risk profile: Stable

Our strategy: Best connectivity products & services, Leading innovation in digital services, Social contract shaping digital society, Simplified & most efficient operator, Leading gigabit networks.

Description:

New telecoms entering the market could lead to significant price competition and lower margins.

Mitigation activities:

We closely monitor the competitive environment in all markets and react appropriately to both consumer and business needs. We have launched ‘second’ brands in a number of markets to compete more effectively and efficiently in the value segment. Alongside our speed-tiered, unlimited data plans, we are now competing effectively across all segments of the markets in which we operate.

Additionally, we evolve our offers and adopt agile commercial models to mitigate competitive risks using simple, targeted offers, smart pricing models and differentiated customer experience.

Target tolerance:

Our tolerance focus is on the loss of market value or market share or margin resulting from competitor pricing or new market entrants.

Scenario:

Aggressive pricing, accelerated customer losses to MVNO (Mobile Virtual Network Operator) and disruptive new market entrants in key European markets result in greater customer churn and pricing pressures impacting our financial position.

Emerging threats:

Emerging threats depend on individual market structures and the competitive landscape.

Disintermediation and failure to innovate

Risk owner: Group Chief Commercial Officer

Change in risk profile: Stable

Our strategy: Best connectivity products & services, Leading innovation in digital services, Outstanding digital experiences, Social contract shaping digital society, Simplified & most efficient operator, Leading gigabit networks.

Description:

Failure in product innovation or ineffective response to threats from emerging technology or disruptive business models could lead to a loss of customer relevance, market share and new/existing revenue streams.

Mitigation activities:

We continually strive to introduce innovative propositions and services, which enable us to deepen customer engagement. We are focused on simplifying our product portfolio, improving our operating model and processes, and accelerating our digital transformation, in order to offer the best customer experience.

Target tolerance:

Offer a superior customer experience and continually improve our offering through a wide range of innovative products and services. We also develop innovative new products and explore new growth areas to continue to meet our customers’ needs.

Scenario:

Large technology players invest on products impacting our customer relationships, cannibalising existing revenues and limiting future growth opportunities in digital services in Vodafone Business.

Emerging threats:

Emerging risks span both Consumer and Business segments. In the Consumer segment, growing choice of communication solutions could threatening our core, while streaming services could threatening our TV business. In the Business segment, large technology players could attempt to move up further along the telecommunication sectors value chain.

Legal and regulatory compliance

Risk owner: Group General Counsel and Company Secretary

Change in risk profile: Stable

Our strategy: Leading innovation in digital services, Social contract shaping digital society.

Description:

Failure to comply with laws and regulations could lead to a loss of trust, financial penalties and/or suspension of our licence to operate.

Mitigation activities:

We have subject matter experts and a robust policy and control compliance framework.

We train our employees in ‘Doing What’s Right’. These training and awareness programmes set out our ethical culture across the organisation and assist employees to understand their role in ensuring compliance.

Target tolerance:

We seek to comply with all applicable laws and regulations in all our markets.

Scenario:

Breaches of legal compliance could lead to reputational damage, investigation costs, fines and/or personal sanctions.

Emerging threats:

Changes to our operating model could require us to adapt our compliance and risk processes. In addition, ongoing changes to workplace dynamics and demographics may challenge our control environment.

Read more about our Code of Conduct and Speak Up policy on page 43.

IT transformation

Risk owner: Group Technology Officer

Change in risk profile: Stable

Our strategy: Best connectivity products & services, Leading innovation in digital services, Outstanding digital experiences, Simplified & most efficient operator.

Description:

Failure to design and execute IT transformation of our legacy estate could lead to business loss, customer dissatisfaction or reputational exposure.

Mitigation activities:

Through the assessment of the design and operating effectiveness of the controls, we identify the relevant risks for the IT programmes to determine whether they are being effectively mitigated. Where gaps are identified, recommendations for mitigation are raised and followed up to make sure programmes are effectively de-risked.

Target tolerance:

Deliver IT transformation programmes with the correct mix of efficient systems, relevant skills and digital expertise in alignment with the original planned spend, timelines and business benefits.

Scenario:

Failure to deliver business benefits causes cost escalation, budget overruns and increased customer dissatisfaction which could negatively impact our financial performance.

Emerging threats:

Long implementation timelines of transformation programmes and rapidly changing market conditions pose a risk that programme original scope and objectives might not be valid to achieve the expected business benefits defined at the outset of the programme. Ongoing changes to the organisation strategy might also have an impact on transformation programmes which might need to adjust scope and objectives therefore increasing the risk of time and cost overruns.

Key changes to our principal risks:

· The Adverse political and regulatory measures risk has reduced, as we continue to build relationships with governments and key stakeholders through our social contract. However, against the backdrop of COVID-19, we continue to monitor for any changes in tax regulation.

· The Technology failures risk has reduced as more of our markets achieve the set recovery targets.

· The Global economic disruption risk has reduced due to telecommunications proving resilient during the COVID-19 pandemic. We anticipate a similar trend for FY22. However, the full effect of this risk could be delayed, and the risk might increase over a longer time horizon.

· We have split the IT transformation risk from our Digital transformation risk.

· We anticipate additional changes to risk exposure as we become a new generation connectivity and digital services provider for Europe & Africa. For this reason, we have expanded the Strategic transformation risk to include all portfolio related changes (integration, mergers, separations) including the transformation to our operating model.

· We have renamed the Disintermediation risk to include ‘failure to innovate’ to focus on our success to innovate as well as external disintermediation threats.

Watchlist risks

Our watchlist risk process enables us to monitor material risks to Vodafone Group which fall outside of our top 10 principal risks list. These include, but are not limited to:

EMF (Electromagnetic Field)

This risk can be broken down into three areas:

· failure to comply with national legislation or international guidelines set by the International Commission on Non-Ionizing Radiation Protection (‘ICNIRP’) as it applies to EMF, or failure to meet policy requirements;

· the risk arising from concerted campaigns or negative community sentiment towards location or installation of radio base stations, resulting in planning delays; and

· changes in the radio technology we use or the body of credible scientific evidence which may impact either of the two risks above.

We have an established governance for EMF risk management (a Group leadership team that reports to the Board, and a network of EMF leaders across all markets). The EMF task group, which was set up in FY20 to focus on assessing and reporting on the impact of 5G on EMF, has merged with the Group leadership team. The Group leadership team continues to update the Executive Committee twice a year on the impact of EMF restrictions in those markets with limits that do not align

with international, science-based guidelines, as well as coordinating engagement with policy makers relating to 5G and EMF and assessing the impact of social media campaigns on public concern.

Vodafone continues to advocate for national EMF regulations to be harmonised with international guidelines. The 2020 updated guidelines from ICNIRP confirmed that there are no adverse effects on human health from 5G frequencies if exposure is within their guidelines. Vodafone always operates its mobile networks strictly within national regulations, which are typically based on, or go beyond, ICNIRP’s guidelines, and we regularly monitor our operations in each country to meet those regulations.

Read more about EMF on page 49

Brexit

The EU-UK Trade and Cooperation Agreement, which came into effect on 1 January 2021, provides greater clarity on the trading relationship between the UK and the EU. Vodafone’s cross-functional steering committee established early in the Brexit process identified risks and produced a comprehensive mitigation plan. Since the signing of the agreement, any outstanding risks have been managed by operational teams. The impact of the agreement, and any legal challenges to elements of the agreement, continue to be monitored, with further mitigations put in place where necessary.

Emerging risks

We face a number of uncertainties where an emerging risk may potentially impact us in the longer term. In some cases, there may be insufficient information to understand the likely scale, impact or velocity of the risk. We also might not be able to fully define a mitigation plan until we have a better understanding of the threat.

We continue to identify new emerging risk trends, using the input from analysis of the external environmental as well as internal participation from key stakeholders.

Using the identified emerging risks, we evaluate the impact and the effect it would have on our organisation (including the changes to our principal risks). The sub-set of our latest emerging risks are:

· Additional regulations or investor pressure brought on by Environmental, Social and Governance (‘ESG’) requirements;

· Depopulation of city centres;

· Ageing population; and

· Next-generation digitalisation.

Strengthening our framework

Over the course of the year, we have:

· Continued to improve our process for the identification and assessment of emerging risks;

· Further enhanced the process of collecting key risk indicators and monitoring early-warning signals in both the internal and external environment;

· Continued to align with the TCFD recommendations for climate-related risks and opportunities; and

· Defined a more dynamic approach to risk identification, assessment and escalation.

TCFD disclosure

We recognise that climate change poses a number of physical (i.e. caused by the increased frequency and severity of extreme weather events) and transition-related (i.e. economic, technology or regulatory challenges related to moving to a greener economy) risks and opportunities for our business. As part of our commitment to operate ethically and sustainably, we are dedicated to understanding climate-related risks and opportunities and embedding responses to these into our business

strategy and operations. We are aligning internal processes with the recommendations of the Task Force on Climate-related Financial Disclosures (‘TCFD’). The summarised progress is detailed in this section as we aim to be fully aligned by 2022.

More in-depth information on our work to date on climate-related risks and opportunities, as well as further plans as we continue the TCFD programme can be found in our first standalone TCFD report.

Click to read our TCFD report: investors.vodafone.com/tcfd

Governance

The Group External Affairs Director, a member of the Group Executive Committee, is the executive-level sponsor for the Planet agenda as part of our purpose-led strategy (pages 38-40) and has overall accountability for the climate change action within the Group. This includes providing updates to the Board on the progress towards our climate-related goals. In addition, at the 2020 AGM shareholders approved the current Remuneration Policy which incorporates our environmental, social and governance (‘ESG’) priorities in the executive long-term incentive plan. For FY21, this measure included a specific greenhouse gas reduction ambition linked to our 2025 target of reducing our emissions by 50% from the FY17 baseline. More details can be found in the Directors’ Remuneration Report on pages 82-103. Further details on how TCFD is managed at Group and in key markets are available in our TCFD Report.

Strategy

This year, we have made progress in understanding the current and potential climate-related impacts on our business, strategy, and financial planning.

We have adopted three scenarios in line with the Bank of England’s reference climate scenarios as outlined in their consultation document released in December 2019. This year, we conducted the required assessments to quantify the business impacts of all material climate-related risks under each scenario and over different time horizons to better understand the financial impact on our business.

To continue our TCFD programme, we will use the outputs of the scenario analysis to assist us in either adjusting or introducing policies, as well as considering the available opportunities. We continue to review each material climate-related risk and opportunity and build mitigation strategies to improve the resilience across our infrastructure portfolio and our key markets.

Risk management

We have continued to align the climate-related risk management process with the global risk management framework. The following data sources were used for this year’s process:

· Climate-change publications and data;

· Relevant literature on the potential impacts of climate change on the ICT sector;

· Guidance from TCFD on potential risks and opportunities; and

· CDP (formerly Carbon Disclosure Project) data and disclosures from other companies in the ICT sector.

We evaluated the materiality of the identified risks and opportunities by assessing their likelihood and impact using our global risk management framework. This process helped us determine the relative significance of the climate-related risks in relation to other risks. We are currently working to further embed applicable climate-related risks, controls and monitoring metrics into our risk management framework using our emerging risks process.

Metrics and targets

We use a wide variety of metrics to measure climate-related current and potential impact. We have been measuring and reporting on energy and carbon emissions since 2001. In addition, we have set a number of ambitious targets to manage climate-related risks and reduce our impact on the environment, such as reaching ‘net zero’ emissions across our full value chain by 2040 and purchasing 100% renewable electricity in Europe by July 2021, and all markets by 2025. We constantly review whether any additional metrics and key risk indicators can be identified to measure and manage climate-related risks, and track and act on the opportunities resulting from the impact of climate change.

Material risks and opportunities

Physical risks:

· Damage to infrastructure caused by increasing frequency and severity of extreme weather events, including wildfires, flooding, storms

· Damage to infrastructure caused by sea level rise

· Interruption or reduction in the quality of our wireless services due to increased precipitation

Transition risks:

· Changing consumer preferences impacting our revenues and market share

· Increasing energy consumption due to increased global temperatures

· Changing cost of carbon impacting costs to meet Vodafone’s net zero target

· Increasing risk of litigation around climate action

· Increase in carbon taxation

· Changes in regulation over infrastructure efficiency

Opportunities:

· Change in market valuation as a result of changing investor expectations with regard to climate change and Vodafone’s ESG performance

· Change in the availability and cost of capital impacted by sustainability performance

· Increasing consumer attractiveness and ability to meet net zero targets through increased energy efficiency of products and services

COVID-19

The vital role telecommunications companies play in society has become more evident during the COVID-19 pandemic. Telecommunications services are critical in enabling people to work remotely, allowing businesses to remain operational, supporting emergency services and government responses, and providing access to online education. Through our infrastructure, we have kept people and societies connected.

We have closely monitored the evolution of COVID-19 as it has continued to impact different countries to varying degrees over time and adapted our risk profile as required. We continue to maintain close contact with local health authorities and government agencies in all of our geographies, so that we minimise the risk to Vodafone, our operations and employees.

Governance

During the early stages of the pandemic, we initiated our response to this crisis by invoking the Group’s crisis management process. This process enabled us to prepare a number of planning scenarios based on a range of assumptions and potential outcomes. A Crisis Steering Committee (‘Steerco’) continues to meet with representatives from the Group and our local markets. The Steerco receives updates and feedback on measures implemented locally, collects best practice, and assesses the adequacy of the Vodafone response as we monitor changes in the virus patterns and the impact it has on our operations.

Impact on our principal risks

We do not consider the COVID-19 pandemic as an individual risk but rather monitor how the pandemic amplifies our principal, emerging and operational risks see pages 54-58.

Using this approach, we are able to manage the ‘domino effect’ of different risk types while identifying both the negative and positive impacts on our operations. As shown on page 54, we assign each of our risks to a category (strategic, technological, operational and financial) which allows us to prioritise and provide the required assurance. The section below summarises the impact the pandemic had on the different risk categories.

Strategic

Given the nature of the telecommunications industry and the important role communication services have played during the pandemic, external stakeholders have focused more on our sector during the COVID-19 pandemic. We have continued to build stronger relationships and partnerships through our social contract with our stakeholders, industry players and governments when managing strategic risks.

Read more about social contracts on page 19

We continue to monitor external impacts caused by the COVID-19 pandemic. For example we monitor potential adverse changes in regulations or further scrutiny by regulatory authorities which could lead to higher taxes as governments address the potential budget deficit following the pandemic.

More positively, we have seen an increase in consumers and business customers adopting more data services such as video conferencing and video on demand streaming.

Financial

The COVID-19 pandemic has caused significant volatility in the financial markets. This can affect both our access to capital markets and the cost of debt. However, the telecommunications industry has not been as severely impacted. We anticipate a delayed impact as inflation rises due to an expected increase in spending, once countries begin to exit lock-downs. These inflation expectations can drive interest rates higher, which can make long-term borrowing more expensive.

Commercially, the biggest impact was related to our roaming and visitor revenue, however, we expect this to recover as vaccinations programmes are successful and travel restrictions are lifted. We anticipate that as furlough and other government support schemes start to be withdrawn, there might be a decrease in our customers’ spending power.

Technological

We have seen a significant increase in data usage during the pandemic and therefore, we have focused on our capacity management processes. Additionally, some of our local markets operate critical national infrastructure which was increasingly needed during the pandemic, and we made sure that we implemented mitigations to better support our infrastructure.

With travel restrictions implemented in most countries, we were not always able to perform physical site visits for business continuity or to test our EMF exposure and therefore ran either robust desktop exercises or used new innovative ways to remotely evaluate our sites.

Read more about EMF operating model on page 49

All organisations have seen an increase in the number of phishing cyber security attacks as cyber criminals attempted to exploit the uncertainty of the pandemic.

Read more about cyber security on page 46

At the start of the crisis, telecommunications companies were exposed to unsubstantiated and misinformed allegations linking COVID-19 to our 5G rollout plan. This incited some vandalism to network equipment affecting our ability to service some of our customers.

Read more about EMF on page 49

Operational

We prioritised the safety and wellbeing of our people, ensuring that we had the business continuity plans in place to operate while most of our people moved to working from home.

Read more about our people wellbeing and safety on page 48

Additionally, to lessen the potential burden on our suppliers, we have implemented controls to assist them through our COVID-19 payment relief policy.

Read more about the supporting of small businesses on page 41

Due to lock-down, social distancing and COVID-19 related restrictions, our ability to physically serve our customers was restricted. We have accelerated and increased our digital transformation projects providing a better customer experience and to capture opportunities as consumer confidence and markets rebound.

Conclusion

To be better prepared for future events such as the COVID-19 pandemic, we have updated our risk process. This approach, which runs parallel to our principal risk process, allows for a quicker identification of threats and risks. The process provides better visibility to our internal stakeholders and more oversight and governance across our risks. We continue to monitor the risks and threats arising from COVID-19 and similar events.

Long Term Viability Statement

The preparation of the LTVS includes an assessment of the Group’s long-term prospects in addition to an assessment of the ability to meet future commitments and liabilities as they fall due over the three-year review period.

Assessment of viability

Vodafone continues to adopt a three-year period to assess the Group’s viability, a period in which we believe our principal risks tend to develop. This time horizon is also in line with the structure of long-term management incentives and the outputs from the long range business planning cycle.

For 2021, as a result of the increased pressures on the global financial markets due to the COVID-19 pandemic, we conducted financial stress testing and sensitivity analysis, considering revenues at risk as well as the impact of our response plan to the crisis.

The assessment of the viability started with the available headroom as of 31 March 2021 and considered the plans and projections prepared as part of the forecasting cycle, which include the Group’s cash flows, planned commitments, required funding and other key financial ratios. We also assumed that debt refinance will remain available in all plausible market conditions.

Finally, we estimated impact of severe but plausible scenarios for all of our principal and emerging risks on the three-year plan and, in addition, stress tested a combined scenario taking into account the risk interdependencies as defined on the diagram on page 54, where the following risks were modelled as materialising in parallel over the three-year period:

Cyber threat and information security: An external cyber-attack exploits vulnerabilities and leads to a GDPR fine.

Geo-political risk in supply chain: International and political decisions may affect our supply chain and restrict our ability to use critical suppliers.

Global economic disruption: A global economic crisis could result in reduced telco spend from businesses and consumers, as well as limit our access to financial markets and availability of liquidity.

Disintermediation and failure to innovate: A continued and interrupted growth of technology giants and new entrants could impact our business revenue and overall financial performance.

Assessment of long-term prospects

Each year the Board conducts a strategy session, reviewing the internal and external environment as well as significant threats and opportunities to the sustainable creation of long-term shareholder value (note that known emerging threats related to each principal risk are described in pages 54-57).

Read more about mega trends on pages 10-11

As an input to the strategy discussion, the Board considers the principal risks that are longer term in nature, (including Adverse political and regulatory measures, Market disruption and Disintermediation and failure to innovate) with the focus on identifying underlying opportunities and setting the Group’s future strategy. The output from this session is reflected in the strategic section of the Annual Report (pages 8-11), which provides a view of the Group’s long-term prospects.

Conclusions

The Board assessed the prospects and viability of the Group in accordance with provision 31 of the UK Corporate Governance Code, considering the Group’s strategy and business model, and the principal risks to the Group’s future performance, solvency, liquidity and reputation. The assessment takes into account possible mitigating actions available to management were any risk or combination of risks materialise.

Cash and cash equivalents available of €5.8bn page 168 as of 31 March 2021, along with options available to reduce cash outgoings over the period considered, provide the Group with sufficient positive headroom in all scenarios tested. Reverse stress testing on revenue and EBITDA over the review period confirmed that the Group has sufficient headroom available to face uncertainty. The Board deemed the stress test conducted to be adequate and therefore confirm that they have a reasonable expectation that the Group will remain in operation and be able to meet its liabilities as they fall due up to 31 March 2024.

RELATED PARTY TRANSACTIONS

The Group has a number of related parties including joint arrangements and associates, pension schemes and Directors and Executive Committee members (see note 12 “Investments in associates and joint arrangements”, note 25 “Post employment benefits” and note 23 “Directors and key management compensation”).

Transactions with joint arrangements and associates

Related party transactions with the Group’s joint arrangements and associates primarily comprise fees for the use of products and services including network airtime and access charges, fees for the provision of network infrastructure and cash pooling arrangements. No related party transactions have been entered into during the year which might reasonably affect any decisions made by the users of these consolidated financial statements except as disclosed below.

|

|

|

2021

|

|

2020

|

|

2019

|

|

|

|

|

€m

|

|

€m

|

|

€m

|

|

|

Sales of goods and services to associates

|

|

14

|

|

32

|

|

27

|

|

|

Purchase of goods and services from associates

|

|

5

|

|

4

|

|

3

|

|

|

Sales of goods and services to joint arrangements

|

|

203

|

|

305

|

|

242

|

|

|

Purchase of goods and services from joint arrangements

|

|

109

|

|

97

|

|

192

|

|

|

Net interest income receivable from joint arrangements 1

|

|

65

|

|

71

|

|

96

|

|

|

Net interest expense payable to joint arrangements1,2

|

|

56

|

|

—

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

Trade balances owed:

|

|

|

|

|

|

|

|

|

by associates

|

|

3

|

|

4

|

|

1

|

|

|

to associates

|

|

5

|

|

4

|

|

3

|

|

|

by joint arrangements

|

|

88

|

|

157

|

|

193

|

|

|

to joint arrangements

|

|

31

|

|

37

|

|

25

|

|

|

Other balances owed by associates

|

|

56

|

|

—

|

|

—

|

|

|

Other balances owed by joint arrangements1

|

|

955

|

|

1,083

|

|

997

|

|

|

Other balances owed to joint arrangements 2

|

|

1,575

|

|

2,017

|

|

169

|

|

Notes:

1 Amounts arise primarily through VodafoneZiggo, TPG Telecom Limited and INWIT S.p.A.. Interest is paid in line with market rates.

2 Amounts for years ended 31 March 2021 and 2020 are primarily in relation to leases of tower space from INWIT S.p.A.

Dividends received from associates and joint ventures are disclosed in the consolidated statement of cash flows.

Transactions with Directors other than compensation

During the three years ended 31 March 2021 and as of 18 May 2021, no Director nor any other executive officer, nor any associate of any Director or any other executive officer, was indebted to the Company. During the three years ended 31 March 2021 and as of 18 May 2021, the Company has not been a party to any other material transaction, or proposed transactions, in which any member of the key management personnel (including Directors, any other executive officer, senior manager, any spouse or relative of any of the foregoing or any relative of such spouse) had or was to have a direct or indirect material interest.

DIRECTORS’ RESPONSIBILITY STATEMENT

As set out above, this statement is repeated here solely for the purposes of complying with Disclosure Guidance and Transparency Rule 6.3.5. This statement relates to and is extracted from the 2021 Annual Report.

Responsibility is for the full 2021 Annual Report not the extracted information presented in this announcement and the final results announcement.

Each of the Directors, whose names and functions are listed on pages 67 and 68, confirms that, to the best of his or her knowledge:

— the consolidated financial statements, prepared in accordance with International Accounting Standards in conformity with the requirements of the UK Companies Act 2006, International Financial Reporting Standards (‘IFRS’) adopted pursuant to Regulation (EC) No 1606/2002 as it applies in the European Union and IFRS as issued by the International Accounting Standards Board (‘IASB’), give a true and fair view of the assets, liabilities, financial position and profit of the Group;

— the parent company financial statements, prepared in accordance with United Kingdom generally accepted accounting practice, give a true and fair view of the assets, liabilities, financial position and profit of the Company; and

— the Strategic Report includes a fair review of the development and performance of the business and the position of the Group, together with a description and robust assessment of the principal risks and uncertainties that it faces.

The Directors are also responsible under section 172 of the Companies Act 2006 to promote the success of the Company for the benefit of its members as a whole and in doing so have regard for the needs of wider society and stakeholders, including customers, consistent with the Group’s core and sustainable business objectives.

Having taken advice from the Audit and Risk Committee, the Board considers the Annual Report, taken as a whole, is fair, balanced and understandable and that it provides the information necessary for shareholders to assess the Company’s position and performance, business model and strategy.

Neither the Company nor the Directors accepts any liability to any person in relation to the Annual Report except to the extent that such liability could arise under English law. Accordingly, any liability to a person who has demonstrated reliance on any untrue or misleading statement or omission shall be determined in accordance with section 90A and schedule 10A of the Financial Services and Markets Act 2000.

By Order of the Board

Rosemary Martin

Group General Counsel and Company Secretary

28 May 2021

This document contains “forward-looking statements” within the meaning of the US Private Securities Litigation Reform Act of 1995 with respect to the Group’s financial condition, results of operations and businesses, and certain of the Group’s plans and objectives. Forward-looking statements are sometimes, but not always, identified by their use of a date in the future or such words as “will”, “anticipates”, “aims”, “could”, “may”, “should”, “expects”, “believes”, “intends”, “plans” or “targets”. By their nature, forward-looking statements are inherently predictive, speculative and involve risk and uncertainty because they relate to events and depend on circumstances that will occur in the future. There are a number of factors that could cause actual results and developments to differ materially from those expressed or implied by these forward-looking statements. A review of the reasons why actual results and developments may differ materially from the expectations disclosed or implied within forward-looking statements can be found under “Forward-looking statements” and “Risk management” in the Group’s annual report for the financial year ended 31 March 2021. The annual report can be found on the Group’s website (vodafone.com/ar2021). All subsequent written or oral forward-looking statements attributable to the Company or any member of the Group or any persons acting on their behalf are expressly qualified in their entirety by the factors referred to above. No assurances can be given that the forward-looking statements in this document will be realised. Subject to compliance with applicable law and regulations, Vodafone does not intend to update these forward-looking statements and does not undertake any obligation to do so.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorised.

|

|

|

|

VODAFONE GROUP

|

|

|

|

|

PUBLIC LIMITED COMPANY

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

Dated: May 28, 2021

|

|

By:

|

/s/ R E S MARTIN

|

|

|

|

|

Name: Rosemary E S Martin

|

|

|

|

|

Title: Group General Counsel and Company Secretary

|

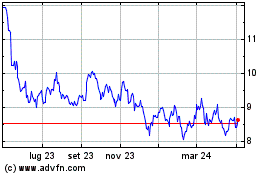

Grafico Azioni Vodafone (NASDAQ:VOD)

Storico

Da Mar 2024 a Apr 2024

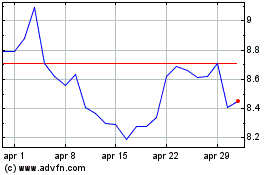

Grafico Azioni Vodafone (NASDAQ:VOD)

Storico

Da Apr 2023 a Apr 2024