TIDMRWA

RNS Number : 3185L

Robert Walters PLC

12 January 2021

12 January 2021

ROBERT WALTERS PLC

(the 'Company' or the 'Group')

Trading update for the fourth quarter ended 31 December 2020

RESILIENT PERFORMANCE.

FORWARD VISIBILITY REMAINS LIMITED

Financial and operational highlights

Gross profit (Net fee Q4 2020 Q4 2019 % change % change

income) (constant

currency*)

Group GBP71.4m GBP94.2m (24%) (26%)

---------- ---------- --------- ------------

Asia Pacific GBP30.2m GBP38.5m (21%) (23%)

---------- ---------- --------- ------------

Europe GBP21.2m GBP27.7m (24%) (27%)

---------- ---------- --------- ------------

UK GBP14.9m GBP20.7m (28%) (28%)

---------- ---------- --------- ------------

Other International GBP5.1m GBP7.3m (31%) (28%)

---------- ---------- --------- ------------

* Constant currency is calculated by applying prior period

average exchange rates to local currency results for the current

and prior years.

-- Group net fee income for the fourth quarter down 26% (24%

actual) year-on-year representing an improvement on the 34% (33%

actual) and 30% (31% actual) declines of the second and third

quarters respectively.

-- 79% (2019: 78%) of the Group's net fee income now derived

from our international operations.

-- The Group's proven ability to deliver sensible and targeted

short-term cost reduction and control measures combined with the

more positive than expected net fee income trend during the fourth

quarter means that profit for the full year is now likely to be

ahead of current market expectations.

-- Market conditions do still remain challenging however there

were signs of improvement in forward-looking indicators,

particularly in Asia Pacific, the Group's largest region.

-- Demand has remained particularly robust, throughout the

pandemic, across the specialist disciplines of technology, digital,

healthcare, supply chain and logistics.

-- The Group's end-to-end offering of permanent, contract and

interim recruitment and recruitment process outsourcing continues

to enable us to meet the varying needs of our clients and

candidates across the globe.

-- The large majority of the Group's offices are open, however

the picture is volatile and changes frequently depending on local

infection rates and government policy.

o Our pre-Covid investment in technology continues to provide a

competitive advantage with all staff continuing to work seamlessly

and productively whether in the office or remotely.

-- Group headcount now stands at 3,147 (31 December 2019:

4,027).

-- Strong balance sheet with net cash of GBP154.8m as at 31

December 2020 (31 December 2019: GBP85.8m). The Group also has a

GBP60m committed loan facility due for renewal in 2023.

Robert Walters, Chief Executive, commented:

"Once again I would like to begin by thanking all of our people

across the globe, whose wellbeing remains our number one priority,

for the incredible durability and commitment they have shown during

this most unprecedented and difficult of years. It's their drive,

passion for the business and singular focus on helping our clients

and candidates that has enabled the Group to deliver such a

resilient performance.

"Group net fee income for the full year was down 25% and whilst

market conditions still remain challenging there were signs of

improvement in forward-looking indicators during the fourth

quarter, particularly in Asia Pacific, the Group's largest region.

That said, it is important to note that the volatile nature of the

pandemic means our forward visibility remains limited evidenced by

a number of countries recently returning to versions of

lockdown.

"I am however pleased to say that the better than expected

performance in the fourth quarter, coupled with the sensible and

targeted short-term cost reduction and control measures that were

put in place at the beginning of the pandemic, means that profit

for the full year is likely to be ahead of current market

expectations."

The Group will publish its full year results for the year ended

31 December 2020 on 2 March 2021.

- Ends -

Further information

Robert Walters plc

Robert Walters, Chief Executive

Alan Bannatyne, Chief Financial

Officer +44 20 7379 3333

Williams Nicolson

Steffan Williams +44 7767 345 563

About Robert Walters Group

The Robert Walters Group is a market-leading international

specialist professional recruitment group with over 3,100 staff

spanning 31 countries. We specialise in the placement of the

highest calibre professionals across the disciplines of accountancy

and finance, banking, engineering, HR, IT, legal, sales, marketing,

secretarial and support and supply chain and procurement. Our

client base ranges from the world's leading blue-chip corporates

and financial services organisations through to SMEs and start-ups.

The Group's outsourcing division, Resource Solutions is a market

leader in recruitment process outsourcing and managed services.

www.robertwaltersgroup.com

Forward looking statements

This announcement contains certain forward-looking statements.

These statements are made by the directors in good faith based on

the information available to them at the time of their approval of

this announcement and such statements should be treated with

caution due to the inherent uncertainties, including both economic

and business risk factors, underlying any such forward-looking

information.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBBMMTMTJBTPB

(END) Dow Jones Newswires

January 12, 2021 02:00 ET (07:00 GMT)

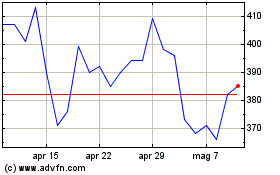

Grafico Azioni Robert Walters (LSE:RWA)

Storico

Da Mar 2024 a Apr 2024

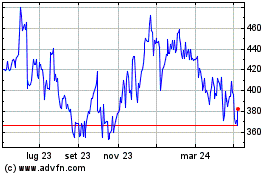

Grafico Azioni Robert Walters (LSE:RWA)

Storico

Da Apr 2023 a Apr 2024