Robust Footfall Levels for Mercialys Centers Since Stores Reopened on May 19, 2021 Illustrate French Consumers’ Attachment ...

31 Maggio 2021 - 6:28PM

Business Wire

Regulatory News:

Mercialys’ (Paris:MERY) shopping centers1 recorded strong

footfall growth of almost +15% from May 19 to 30, 2021 versus the

same period in 2020. It is already up to over 95% of the activity

levels seen for the same normalized period in 2019.

Virtually all stores in France have been able to open again

since May 19, 2021, after they were ordered to close by the French

government for nearly four months as part of measures to combat the

Covid-19 epidemic. The minimum space ratios put in place, although

contributing to a slower upturn in activity, and a range of health

measures are making it possible to ensure very safe conditions

today for welcoming all visitors.

Footfall figures with this reopening have been very positive

across Mercialys’ portfolio, as for the entire retail sector in

France. The appeal of physical retail is demonstrated by this

trend, which had already characterized the reopening periods in May

and November 2020. The extensive selection, its immediate

availability, the reopening of terraces and the corresponding

social contact, which was so missed during the lockdown periods,

are helping maintain this relationship between retailers, visitors

and the sites that bring them together.

Initial exchanges with retailers seem to indicate a very

positive transformation rate and a satisfactory upturn in their

sales levels.

From May 19 to 30, 2021, aggregate footfall for Mercialys’

sites1 increased by +14.9% compared with 2020, whereas footfall

levels had already previously been very sustained when the first

lockdown was lifted from May 11, 2020. This sustained performance

has enabled footfall in Mercialys’ shopping centers to already

reach more than 95% of the normalized activity seen for the same

period in 2019, outperforming the French panel2 (around 94%).

* * *

This press release is available on

www.mercialys.com

About Mercialys Mercialys is one of France’s leading real

estate companies. It is specialized in the holding, management and

transformation of retail spaces, anticipating consumer trends, on

its own behalf and for third parties. At December 31, 2020,

Mercialys had a real estate portfolio valued at Euro 3.3 billion

(including transfer taxes). Its portfolio of 2,138 leases

represents an annualized rental base of Euro 173.9 million.

Mercialys has been listed on the stock market since October 12,

2005 (ticker: MERY) and has “SIIC” real estate investment trust

(REIT) tax status. Part of the SBF 120 and Euronext Paris

Compartment B, it had 93,886,501 shares outstanding at December 31,

2020.

IMPORTANT INFORMATION This press release contains certain

forward-looking statements regarding future events, trends,

projects or targets. These forward-looking statements are subject

to identified and unidentified risks and uncertainties that could

cause actual results to differ materially from the results

anticipated in the forward-looking statements. Please refer to

Mercialys’ Universal Registration Document available at

www.mercialys.com for the year ended December 31, 2020 for more

details regarding certain factors, risks and uncertainties that

could affect Mercialys’ business. Mercialys makes no undertaking in

any form to publish updates or adjustments to these forward-looking

statements, nor to report new information, new future events or any

other circumstances that might cause these statements to be

revised.

1 Mercialys’ large centers and main convenience shopping centers

based on a constant surface area, representing over 85% of the

value of the Company’s shopping centers at December 31, 2020 2

Performance calculated based on Quantaflow’s French shopping center

panel, which enables access to daily footfall data

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210531005257/en/

Analysts / investors / media: Alexandre Leroy Tel: +33

(0)1 82 82 75 63 Email: aleroy@mercialys.com

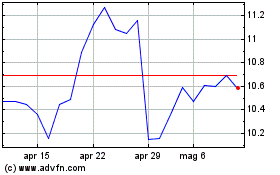

Grafico Azioni Mercialys (EU:MERY)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Mercialys (EU:MERY)

Storico

Da Apr 2023 a Apr 2024