TIDMRR.

RNS Number : 1514F

Rolls-Royce Holdings plc

12 November 2020

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES, NEW

ZEALAND, UNITED ARAB EMIRATES, SOUTH AFRICA OR ANY OTHER

JURISDICTION WHERE THE EXTENSION OR AVAILABILITY OF THE RIGHTS

ISSUE (AND ANY OTHER TRANSACTION CONTEMPLATED THEREBY) WOULD BREACH

ANY APPLICABLE LAW OR REGULATION.

THIS ANNOUNCEMENT IS AN ADVERTISEMENT AND DOES NOT CONSTITUTE A

PROSPECTUS OR PROSPECTUS EQUIVALENT DOCUMENT. NOTHING HEREIN SHALL

CONSTITUTE AN OFFERING OF ANY SECURITIES. NOTHING IN THIS

ANNOUNCEMENT SHOULD BE INTERPRETED AS A TERM OR CONDITION OF THE

RIGHTS ISSUE. ANY DECISION TO PURCHASE, SUBSCRIBE FOR, OTHERWISE

ACQUIRE, SELL OR OTHERWISE DISPOSE OF ANY NIL PAID RIGHTS, FULLY

PAID RIGHTS OR NEW ORDINARY SHARES MUST BE MADE ONLY ON THE BASIS

OF THE INFORMATION CONTAINED IN AND INCORPORATED BY REFERENCE INTO

THE PROSPECTUS.

ROLLS-ROYCE HOLDINGS PLC

RESULT OF RUMP PLACING

12 November 2020

Following the announcement earlier today regarding valid

acceptances under the fully underwritten 10 for 3 Rights Issue

announced by Rolls-Royce Holdings plc ("Rolls-Royce" or the

"Company") on 1 October 2020, the Company confirms that BNP

Paribas, Citigroup, Goldman Sachs, HSBC, Jefferies, Morgan Stanley,

Crédit Agricole CIB, Santander, SMBC Nikko and Société Générale

(the "Underwriters") have successfully procured subscribers for all

of the 375,096,792 New Ordinary Shares for which valid acceptances

were not received, representing approximately 5.8 per cent. of the

total number of New Ordinary Shares to be issued pursuant to the

fully underwritten Rights Issue, at a price of 90 pence per New

Ordinary Share.

The net proceeds from the placing of such New Ordinary Shares

(after the deduction of the Rights Issue Price of 32 pence per New

Ordinary Share and the expenses of procuring subscribers, including

any applicable brokerage commissions and VAT which are not

recoverable) will be paid (without interest) to those Shareholders

whose rights have lapsed in accordance with the terms of the Rights

Issue, pro rata to their lapsed provisional allotments, save that

individual amounts of less than GBP5.00 will not be paid to such

persons but will be aggregated and will accrue for the benefit of

the Company.

Unless the context otherwise requires, words and expressions

defined in the combined prospectus and circular dated 1 October

2020 (the "Prospectus") shall have the same meanings in this

announcement.

LEI: 213800EC7997ZBLZJH69

For further information, please contact:

Rolls-Royce Holdings plc Media

Richard Wray

Director of External Communications

& Brand, Rolls-Royce Holdings

plc

Tel +44 (0) 7810 850055

Richard.Wray@Rolls-Royce.com

Investors

Isabel Green

Head of Investor Relations,

Rolls-Royce Holdings plc

Tel +44 (0) 7880 160976

Isabel.Green@Rolls-Royce.com

Brunswick Group Charles Pretzlik

Tel +44 7823 527191

cpretzlik@brunswickgroup.com

Caroline Daniel

Tel +44 7785 952682

cdaniel@brunswickgroup.com

Pip Green

Tel +44 7834 502589

pgreen@brunswickgroup.com

-------------------------------------

IMPORTANT NOTICES

This announcement has been issued by and is the sole

responsibility of the Company. The information contained in this

announcement is for background purposes only and does not purport

to be full or complete. No reliance may or should be placed by any

person for any purpose whatsoever on the information contained in

this announcement or on its accuracy or completeness. The

information in this announcement is subject to change without

notice.

This announcement is not a prospectus (or a prospectus

equivalent document) but an advertisement. Neither this

announcement nor anything contained in it shall form the basis of,

or be relied upon in conjunction with, any offer or commitment

whatsoever in any jurisdiction. Investors should not acquire any

Nil Paid Rights, Fully Paid Rights or New Ordinary Shares except on

the basis of the information contained in the Prospectus.

A copy of the Prospectus is available on the Company's website,

www.rolls-royce.com/investors. Neither the content of the Company's

website nor any website accessible by hyperlinks on the Company's

website is incorporated in, or forms part of, this announcement.

The Prospectus provides further details of the New Ordinary Shares,

the Nil Paid Rights and the Fully Paid Rights being offered

pursuant to the Rights Issue.

This announcement does not contain or constitute an offer for

sale or the solicitation of an offer to purchase or subscribe for

securities in the United States or any other state or jurisdiction

in which such release, publication or distribution would be

unlawful. The Nil Paid Rights, the Fully Paid Rights and the New

Ordinary Shares have not been and will not be registered under the

US Securities Act of 1933, as amended (the "Securities Act") or

under any securities laws of any state or other jurisdiction of the

United States and may not be offered, sold, pledged, taken up,

exercised, resold, renounced, transferred or delivered, directly or

indirectly, in or into the United States except pursuant to an

applicable exemption from, or in a transaction not subject to, the

registration requirements of the Securities Act and in compliance

with any applicable securities laws of any state or other

jurisdiction of the United States or other jurisdiction. There will

be no public offer of the Nil Paid Rights, the Fully Paid Rights or

the New Ordinary Shares in the United States. Subject to certain

limited exceptions, Provisional Allotment Letters have not been,

and will not be, sent to, and Nil Paid Rights have not been, and

will not be, credited to the CREST account of, any Qualifying

Shareholder with a registered address in or that is located in the

United States. None of the New Ordinary Shares, the Nil Paid

Rights, the Fully Paid Rights or the Provisional Allotment Letters,

this announcement or any other document connected with the Rights

Issue has been or will be approved or disapproved by the United

States Securities and Exchange Commission or by the securities

commissions of any state or other jurisdiction of the United States

or any other regulatory authority, nor have any of the foregoing

authorities passed upon or endorsed the merits of the offering of

the New Ordinary Shares, the Nil Paid Rights or the Fully Paid

Rights, or the accuracy or adequacy of the Provisional Allotment

Letters, this announcement or any other document connected with the

Rights Issue. Any representation to the contrary is a criminal

offence in the United States.

This announcement is for information purposes only and is not

intended to and does not constitute or form part of any offer or

invitation to purchase or subscribe for, or any solicitation to

purchase or subscribe for, Nil Paid Rights, Fully Paid Rights or

New Ordinary Shares or to take up any entitlements to Nil Paid

Rights in any jurisdiction. No offer or invitation to purchase or

subscribe for, or any solicitation to purchase or subscribe for,

Nil Paid Rights, Fully Paid Rights or New Ordinary Shares or to

take up any entitlements to Nil Paid Rights will be made in any

jurisdiction in which such an offer or solicitation is

unlawful.

The information contained in this announcement, the Prospectus

and the Provisional Allotment Letters is not for release,

publication or distribution to persons in the United States, New

Zealand, United Arab Emirates, South Africa or any other

jurisdiction where the extension or availability of the Rights

Issue (and any other transaction contemplated thereby) would breach

any applicable law or regulation, and, subject to certain

exceptions, should not be distributed, forwarded to or transmitted

in or into any jurisdiction, where to do so might constitute a

violation of local securities laws or regulations.

The distribution of this announcement, the Prospectus, the

Provisional Allotment Letter, and the offering or transfer of Nil

Paid Rights, Fully Paid Rights or New Ordinary Shares into

jurisdictions other than the United Kingdom may be restricted by

law, and, therefore, persons into whose possession this

announcement, the Prospectus, the Provisional Allotment Letter

and/or any accompanying documents comes should inform themselves

about and observe any such restrictions. Any failure to comply with

any such restrictions may constitute a violation of the securities

laws of such jurisdiction. In particular, subject to certain

exceptions, this announcement, the Prospectus and the Provisional

Allotment Letters should not be distributed, forwarded to or

transmitted in or into the United States, New Zealand, United Arab

Emirates South Africa or any other jurisdiction where the extension

or availability of the Rights Issue (and any other transaction

contemplated thereby) would breach any applicable law or

regulation. Recipients of this announcement and/or the Prospectus

should conduct their own investigation, evaluation and analysis of

the business, data and property described in this announcement

and/or the Prospectus.

This announcement does not constitute a recommendation

concerning any investor's options with respect to the Rights Issue.

The price and value of securities can go down as well as up. Past

performance is not a guide to future performance. The contents of

this announcement are not to be construed as legal, business,

financial or tax advice. Each shareholder or prospective investor

should consult his, her or its own legal adviser, business adviser,

financial adviser or tax adviser for legal, financial, business or

tax advice.

NOTICE TO ALL INVESTORS

BNP Paribas ("BNP Paribas"), Citigroup Global Markets Limited

("Citigroup"), Goldman Sachs International ("Goldman Sachs"), HSBC

Bank plc ("HSBC"), Jefferies International Limited ("Jefferies"),

Morgan Stanley & Co. International plc ("Morgan Stanley"),

Crédit Agricole Corporate and Investment Bank ("Crédit Agricole

CIB"), Banco Santander, S.A. ("Santander"), SMBC Nikko Capital

Markets Limited ("SMBC Nikko") and Société Générale ("Société

Générale", and, together with Goldman Sachs, Morgan Stanley, BNP

Paribas, Citigroup, HSBC, Jefferies, Crédit Agricole CIB, Santander

and SMBC Nikko, the "Banks") are authorised in the United Kingdom

by the Financial Conduct Authority and regulated by the Financial

Conduct Authority and, in the case of BNP Paribas, lead supervised

by the European Central Bank ("ECB") and the Autorité de Contrôle

Prudentiel et de Résolution ("ACPR") (and its London Branch is

authorised by the ECB, the ACPR and the Prudential Regulation

Authority and subject to limited regulation by the Financial

Conduct Authority and the Prudential Regulation Authority). Each of

the Banks is acting exclusively for Rolls-Royce Holdings plc in

relation to the Rights Issue and no other person in connection with

the Rights Issue and will not be responsible to anyone other than

Rolls-Royce Holdings plc for providing the protections afforded to

their respective clients nor for providing advice to any person in

relation to the Rights Issue or any matters referred to in this

announcement. Goldman Sachs is acting as Financial Adviser to the

Company and no other person in connection with this announcement

and will not be responsible to anyone other than the Company for

providing the protections afforded to clients of Goldman Sachs nor

for providing advice to any person in relation to any matters

referred to in this announcement.

None of the Banks, nor any of their respective subsidiaries,

branches or affiliates, nor any of their respective directors,

officers or employees owes or accepts any duty, liability or

responsibility whatsoever (whether direct or indirect, whether in

contract, in tort, under statute or otherwise) to any person who is

not a client of the Banks in connection with the Rights Issue, this

announcement, any statement contained herein, or otherwise.

No representation or warranty, express or implied, is or will be

made as to, or in relation to, and no responsibility or liability

is or will be accepted by the Banks, nor any of their respective

subsidiaries, branches, affiliates or agents as to, or in relation

to, the accuracy or completeness of this announcement or any other

information made available to or publicly available to any

interested party or its advisers, whether written, oral or in a

visual or electronic form, and howsoever transmitted or made

available, and any liability therefore is expressly disclaimed.

In connection with the Rights Issue, the Banks and any of their

respective affiliates, may in accordance with applicable legal and

regulatory provisions, engage in transactions in relation to the

Nil Paid Rights, the Fully Paid Rights, the New Ordinary Shares

and/or related instruments for their own account provided that the

Banks and their respective affiliates may not engage in short

selling for the purpose of hedging their commitments under the

Underwriting Agreement (subject to certain exceptions in the

Underwriting Agreement). Accordingly, references in the Prospectus

to the Nil Paid Rights, Fully Paid Rights or New Ordinary Shares

being issued, offered, subscribed, acquired, placed or otherwise

dealt in should be read as including any issue or offer to, or

subscription, acquisition, placing or dealing by, the Banks and any

of their affiliates acting in such capacity.

The Banks and their respective affiliates may enter into

financing arrangements with investors in connection with which the

Banks and any of their affiliates may from time to time acquire,

hold or dispose of New Ordinary Shares. In addition, the Banks may

also co-ordinate a sell-down in the event that any underwriting

crystallises as a result of the Rights Issue. The Banks and their

respective affiliates do not intend to disclose the extent of any

such investment or transactions otherwise than in accordance with

any legal or regulatory obligations to do so.

In the event that the Banks acquire New Shares which are not

taken up by Qualifying Shareholders, the Banks and their respective

affiliates may co-ordinate disposals of such shares in accordance

with applicable law and regulation. The Banks and their respective

affiliates do not propose to make any public disclosure in relation

to such transactions.

Greenhill & Co. International LLP ("Greenhill") is

authorised by the Financial Conduct Authority and regulated by the

Financial Conduct Authority and is acting exclusively as financial

adviser to the Company and no one else in connection with the

matters described in this announcement and will not be responsible

to anyone other than the Company for providing the protections

afforded to clients of Greenhill nor for providing advice in

connection with the matters referred to herein. Neither Greenhill

nor any of its subsidiaries, branches or affiliates, nor any of its

directors, officers or employees owes or accepts any duty,

liability or responsibility whatsoever (whether direct or indirect,

whether in contract, in tort, under statute or otherwise) to any

person who is not a client of Greenhill in connection with the

Rights Issue, this announcement, any statement contained herein, or

otherwise.

INFORMATION TO DISTRIBUTORS

Solely for the purposes of the product governance requirements

contained within: (a) EU Directive 2014/65/EU on markets in

financial instruments, as amended ("MiFID II"); (b) Articles 9 and

10 of Commission Delegated Directive (EU) 2017/593 supplementing

MiFID II; and (c) local implementing measures (together, the "MiFID

II Product Governance Requirements"), and disclaiming all and any

liability, whether arising in tort, contract or otherwise, which

any "manufacturer" (for the purposes of the MiFID II Product

Governance Requirements) may otherwise have with respect thereto,

the Nil Paid Rights, the Fully Paid Rights and the New Ordinary

Shares have been subject to a product approval process, which has

determined that they each are: (i) compatible with an end target

market of retail investors and investors who meet the criteria of

professional clients and eligible counterparties, each as defined

in MiFID II; and (ii) eligible for distribution through all

distribution channels as are permitted by MiFID II (the "Target

Market Assessment").

Notwithstanding the Target Market Assessment, Distributors

should note that: the price of the Nil Paid Rights, the Fully Paid

Rights and/or the New Ordinary Shares may decline and investors

could lose all or part of their investment; the Nil Paid Rights,

the Fully Paid Rights and the New Ordinary Shares offer no

guaranteed income and no capital protection; and an investment in

the Nil Paid Rights, the Fully Paid Rights and/or the New Ordinary

Shares is compatible only with investors who do not need a

guaranteed income or capital protection, who (either alone or in

conjunction with an appropriate financial or other adviser) are

capable of evaluating the merits and risks of such an investment

and who have sufficient resources to be able to bear any losses

that may result therefrom. The Target Market Assessment is without

prejudice to the requirements of any contractual, legal or

regulatory selling restrictions in relation to the offer.

Furthermore, it is noted that, notwithstanding the Target Market

Assessment, the Underwriters will only procure investors who meet

the criteria of professional clients and eligible counterparties.

For the avoidance of doubt, the Target Market Assessment does not

constitute: (a) an assessment of suitability or appropriateness for

the purposes of MiFID II; or (b) a recommendation to any investor

or group of investors to invest in, or purchase, or take any other

action whatsoever with respect to the Nil Paid Rights, the Fully

Paid Rights and/or the New Ordinary Shares. Each distributor is

responsible for undertaking its own target market assessment in

respect of the Nil Paid Rights, the Fully Paid Rights and/or the

New Ordinary Shares and determining appropriate distribution

channels.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROIKKBBBBBDDDDD

(END) Dow Jones Newswires

November 12, 2020 07:25 ET (12:25 GMT)

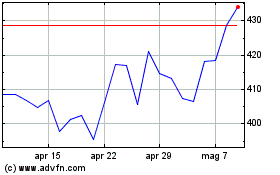

Grafico Azioni Rolls-royce (LSE:RR.)

Storico

Da Mar 2024 a Apr 2024

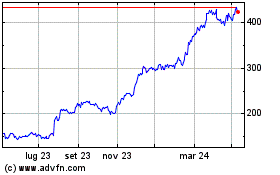

Grafico Azioni Rolls-royce (LSE:RR.)

Storico

Da Apr 2023 a Apr 2024