TIDMSBRY

RNS Number : 6218R

Sainsbury(J) PLC

01 July 2020

1 July 2020

J Sainsbury plc

First Quarter Trading Statement for the 16 weeks to 27 June

2020

Strong grocery and Argos sales performance as we help to feed

the nation

-- Grocery sales up 10.5 per cent

-- General Merchandise sales up 7.2 per cent (including Argos

sales up 10.7 per cent) and Clothing sales down 26.7 per cent

-- Digital sales more than doubled

-- Total retail sales up 8.5 per cent (excl. fuel) with

like-for-like sales up 8.2 per cent (excl. fuel)

-- Profit impact of COVID-19 expected to be more than GBP500m,

broadly offset by business rates relief and stronger grocery sales,

as previously outlined

Q1 Trading Performance

The COVID-19 pandemic continues to have a significant impact on

our business and we are guided by three clear priorities: keeping

customers and colleagues safe; helping to feed the nation and

supporting our communities and the most vulnerable in society.

At our Preliminary results announcement in April, we set out our

base case assumptions for the current financial year and we are

pleased that our sales performance to date has been ahead of those

assumptions, helped by good weather. We delivered double digit

sales growth in Grocery, ahead of the market(1) , driven by very

strong online growth. This builds on strong grocery momentum and

market share gains over the last year, as we invest to lower our

prices and improve our stores.

Our digital performance has been particularly strong, with sales

more than doubling. Our ability to quickly respond to customers

choosing to buy groceries, general merchandise and clothing online

reflects the strength and flexibility of the digital and technology

platforms we have built. From the beginning of the crisis, we chose

to prioritise elderly, disabled and vulnerable customers for

groceries online; sales grew by 87 per cent year-on-year and orders

from around 370,000 to over 650,000 per week. Nearly 50 per cent of

new groceries online customers are new Sainsbury's customers.

SmartShop, which lets customers scan their own groceries and use a

separate checkout, reached 37 per cent of sales on average and

exceeded 50 per cent in some stores(2) . We have also rolled out

our one-hour grocery delivery service Chop Chop beyond London and

it is now in 15 cities.

While all 573 Argos standalone stores were closed for the

majority of the quarter, customers could shop with Argos online for

home delivery and click and collect from Sainsbury's stores. As a

result of this, Argos performed very well, growing 10.7 per cent,

with home delivery sales up 78 per cent and click and collect sales

up 53 per cent. Lockdown measures started to ease towards the end

of the quarter and we opened 174 stores across the UK and Ireland

in phase one and will open 100 more in phase two in July.

Clothing and Fuel sales, whilst still down year on year, have

started to recover more quickly than expected and our Financial

Services business has an improved capital position versus the year

end.

Simon Roberts, Chief Executive Officer, said: "The last four

months have been extraordinary in so many ways and our colleagues

have done an amazing job adapting our business. They have worked

tirelessly to keep everyone safe, to help feed the nation and to

support our communities and the most vulnerable in society.

"Our business has changed fundamentally from four months ago. We

have more than doubled our weekly sales of online groceries in

recent weeks, SmartShop now accounts for more than half of sales in

some supermarkets and Argos sales were strong while operating as an

online-only business for almost twelve weeks. Warm weather boosted

food sales and sales in seasonal categories in Argos, but sales of

clothing and fuel and trading in city centre Convenience stores

were all significantly down year on year as a result of

lockdown.

"We have worked really hard to listen and to respond to

customers throughout the crisis. We have lowered prices on many key

products as we continue to focus on lower regular prices. Our price

position versus our competitors has improved in the quarter,

Sainsbury's key customer feedback scores are at record levels and

we have gained market share.

"The coming weeks and months will continue to be challenging for

our customers and our colleagues and we do not expect the current

strong sales growth to continue. A number of the decisions we have

made have materially increased costs but meant that we have done

the right thing for our customers and set us up well for the

future.

" Our colleagues have been exceptional and I feel incredibly

proud of the job they have done day in day out and of their

flexibility and adaptability during this crisis."

Outlook

Sales growth has remained strong throughout the first quarter,

ahead of the base case assumptions we detailed in April,

particularly at Argos. This has been helped by good weather.

Operating costs remain high, reflecting the costs of keeping

customers and colleagues safe, significantly higher online

participation, including prioritisation of elderly, disabled and

vulnerable customers, and weak sales of fuel, clothing and general

merchandise within Sainsbury's stores.

We believe it is appropriate to remain cautious about the sales

trajectory through the remainder of the year given the weather

benefit to date and a likely further weakening of consumer

spending. It remains impossible to predict the full nature, extent

and duration of the impact of COVID-19 on sales and costs. Our base

case scenario continues to underpin an expectation of broadly

unchanged Group underlying profit before tax for the full year.

Like-for-like sales growth 2019/20 2020/21

----------------------------- -------------------------------------------

Q1 Q2 Q3 Q4 Q1 (3)

--------- --------- ------- ------------ --------

Like-for-like sales (exc.

fuel) (1.6)% (0.2)% (0.7)% 1.3% 8.2%

--------- --------- ------- ------------ --------

Like-for-like sales (inc.

fuel) (1.0)% (0.4)% (1.1)% 1.3% (2.3)%

--------- --------- ------- ------------ --------

2019/20 2020/21

Total sales growth Q1 Q2 Q3 Q4 Q1

----------------------------- --------- --------- ------- ------------ --------

Grocery (0.5)% 0.6% 0.4% 2.0% 10.5%

--------- --------- ------- ------------ --------

General Merchandise (3.1)% (2.0)% (3.9)% (1.3)% 7.2%

--------- --------- ------- ------------ --------

Clothing (4.5)% 3.3% 4.4% 2.5% (26.7)%

--------- --------- ------- ------------ --------

Total Retail (excl. fuel) (1.2)% 0.1% (0.7)% 1.3% 8.5%

--------- --------- ------- ------------ --------

Total Retail (inc. fuel) (0.6)% 0.1% (0.9)% 1.9% (2.1)%

--------- --------- ------- ------------ --------

Q1 2020/21 previously Q1 2020/21 Q1 2020/21

reported Total

7 weeks to 25 9 weeks to 27 16 weeks to

Total sales growth % April June 27 June

-------------------------------------- -------------- ------------

Grocery 12% 10% 10.5%

Total General Merchandise 3% 12% 7.2%

GM (Argos) 9% 14% 10.7%

GM (Sainsbury's Supermarkets) (22%) 2% (9.3)%

Clothing (53%) (10%) (26.7)%

Total Retail excl. fuel 8% 9% 8.5%

Fuel (52%) (60%) (56.1%)

-------------------------------------- -------------- ------------

Keeping our customers and colleagues safe

Our highest priority throughout the quarter has been to keep our

customers and colleagues safe. We have made changes to all aspects

of our business to achieve this, adding material costs. This

includes:

- Providing full pay for extremely vulnerable colleagues until

at least 31 July and full pay for vulnerable colleagues and those

living with extremely vulnerable family members until 30 June

- Giving a thank you payment to 157,000 colleagues and front

line managers, equivalent to 10 per cent of pay, for the four week

period from 8 March

- Recruiting more than 25,000 colleagues to work in stores, as

drivers and in distribution centres

- Initially restricting the number of products customers could

buy in a single shop so that essential items were available to a

larger number of customers and introducing priority shopping hours

for NHS workers and elderly, disabled and vulnerable customers

- Temporarily suspending Argos two man delivery and changing

operational processes such as Groceries Online deliveries

- Installing over 40,000 Perspex screens in Sainsbury's and

Argos stores to support hygiene and social distancing

- Closing our counters and cafes to focus resource on stocking

and selling essential items and reducing opening hours and

temporarily closing some stores to safely and effectively serve

customers

- Limiting the number of customers allowed into shops at any one

time to ensure social distancing and operating one-way systems in

smaller stores

- Investing in TV, radio and print advertising to further

support in-store social distancing measures

Supporting our communities and the most vulnerable in

society

In these challenging circumstances, we have focused on ensuring

that the most vulnerable in our communities can access food and

other essential items. Highlights include:

- We have made almost four million grocery deliveries to more

than 500,000 elderly, disabled and vulnerable customers since the

start of the crisis

- Together with Sainsbury's, Argos, Habitat and Nectar

customers, we donated GBP4.1m towards vital emergency support for

vulnerable people in the UK through our partnership with Comic

Relief and Children in Need

- Donating GBP3m to Fareshare to source food to help over 5,000

frontline charities and community groups in England

- Accelerating supplier payments. We are working collaboratively

with suppliers to support them with vital cash flow where needed,

including immediate payment to at least 1,500 smaller suppliers

- Deciding not to take up the government's offer of furlough payments or delaying VAT payment

- Donating 750,000 brand new items for men, women and children

from our Tu clothing range towards local communities and charities

via Comic Relief and our existing charity network

- Extending our partnership with WH Smith to 80 stores in NHS

hospitals, which enables NHS workers to receive a 20 per cent

discount on everything they buy, making it easier for them to shop

for Sainsbury's groceries

- Introducing school meal vouchers and Volunteer Shopping Cards,

enabling others to shop on behalf of elderly, disabled and

vulnerable customers who can't shop for themselves

- Selling The Big Issue in stores and online, providing

temporary support to vendors who are currently unable to sell on

the street

Helping to feed the nation

Grocery

- Grocery sales grew by 10.5 per cent, continuing to outperform

the market(4) as customers switched to Sainsbury's

- We lowered the prices of many key products in the quarter,

improving our value relative to competitors

- Customer satisfaction scores improved significantly year on

year, leading the main grocers on social distancing scores, which

is currently a very important measure for customers

- We invested significantly in our digital offer, with Groceries

Online sales up 87 per cent year-on-year and over 650,000 orders

per week, up 75 per cent since the start of the pandemic.

Click&Collect is proving particularly popular with customers,

with sales up 13-fold compared to last year

- SmartShop participation reached 37 per cent of sales on average and exceeded 50 per cent in top-performing stores(5)

- We have rolled out Chop Chop, our 1-hour delivery service, to

41 stores, increasing our presence from one city to 15 cities

- Convenience sales were down 5 per cent, driven by very weak

sales in city centre locations where trade is heavily driven by

office workers and by the temporary closure of 26 convenience

stores in city centre locations, partially offset by very strong

sales growth in neighbourhood locations

- We have closed our fresh food counters and cafes in our

supermarkets so that colleagues can focus on keeping essential food

items on shelves. We are beginning to re-open some pizza counters

where there is significant customer demand and no equivalent

currently available in the aisle

General Merchandise

- All 573 Argos standalone stores in the UK and Republic of

Ireland were closed from 24 March in line with government guidance

around non-essential retail. Home delivery sales grew by 78 per

cent and Click and Collect sales grew by 53 per cent during the

quarter, driving total Argos sales growth of 10.7 per cent,

demonstrating the strength of our digital capabilities

- Customers were able to collect orders in 307 Argos stores in

Sainsbury's, 173 collection points in Sainsbury's supermarkets (of

which 79 were opened during the quarter) and 186 collection points

in Sainsbury's Local stores

- Favourable weather helped to drive very strong seasonal sales

in categories such as garden and outdoor toys and we were also able

to respond to very high customer demand in categories such as

personal computers, home office furniture, gaming, entertainment,

home baking and arts and crafts

- We started to re-open Argos stores in line with individual

government guidance. We currently have a total of 174 standalone

Argos stores open across UK and Ireland, with 100 more opening in

July

- In England and Wales, we are re-opening stores on a collection

and returns only basis, in areas where customers can not currently

easily access an Argos store in a Sainsbury's supermarket

- While General Merchandise sales in Sainsbury's stores

declined, the trend improved through the quarter, reflecting strong

seasonal demand and some normalisation of customer behaviour in

stores

Clothing

- Clothing sales declined in the quarter but have shown

encouraging signs of recovery during the latter half of the

quarter, helped by Tu Online sales growth of 87 per cent and

successful clearance activity. Our stock position is better than

anticipated

- Categories such as loungewear, exercise wear, nightwear and

kidswear have all performed well during the quarter

Financial Services

Our Financial Services outlook is in line with the base case

scenario we outlined with our Preliminary Results statement:

- Our capital surplus over the regulatory minimum has increased

during the quarter. At the end of May, including regulatory

buffers, the Bank had around GBP335m of surplus capital, up from

around GBP320m at year end. This reflects a decrease in our lending

balances, more than offsetting the GBP30m COVID-19-related

impairment provision increase required under IFRS9

- Liquidity has further strengthened since financial year end,

with the bank holding GBP665m additional liquidity above the

regulatory minimum, up GBP491m due to a strong savings performance

and lower lending

- Travel Money bureaux remain closed and ATM transaction

volumes, while starting to recover, remain below pre-COVID-19

levels

- Lower credit demand, along with prudent credit policy

tightening actions and a focus on supporting Sainsbury's customers,

has driven a GBP455m (eight per cent) reduction in unsecured

portfolios. Credit card spending has also reduced, although there

are early signs of recovery

- Trading in Argos has been strong, with our store card activity

supporting sales. Over 80 per cent of credit being extended on

store cards is to existing customers

- A focus on cost reduction, together with lower transactional

volumes, has reduced Q1 costs by 14 per cent year on year. We have

reviewed investment spend for 20/21 and will reduce this by one

third

- Emergency Payment Freezes are being extended to customers in

need. The percentage of customers requesting the use of these

facilities is materially lower than market average

Liquidity

- Our cash position is strong and we have chosen to fully repay

the GBP500 million we prudently borrowed under the Revolving Credit

Facility earlier in the year

Investor Relations Enquiries Media Enquiries

James Collins +44 (0) 7801 813 074 Rebecca Reilly +44 (0) 20 7695 7295

1,4 Kantar: Sainsbury's Till Roll Volume growth ahead of Total

Market and the rest of the Big 4 on a 4 week, 12 week and 52 week

basis to 14 June 2020

2,5 In handset stores

3 Temporarily closed Argos standalone stores, Sainsbury's

convenience stores, cafés and fuel kiosks have been treated as

like-for-like sales. Only permanently closed sites have been

treated as non-like-for-like. Excluding temporarily closed

Sainsbury's convenience stores, cafés and fuel kiosks from

like-for-like sales would improve Q1 like-for-like sales growth

(excl. Fuel) by 80bps to 9.0%.The additional exclusion of

temporarily closed Argos standalone stores would improve Q1

like-for-like sales growth (excl. Fuel) to 18.5%.

Notes

A. All sales figures contained in this trading statement are

stated including VAT from 2018/19 and in accordance with IFRS

15

B. Certain statements made in this announcement are

forward-looking statements. Such statements are based on current

expectations and are subject to a number of risks and uncertainties

that could cause actual events or results to differ materially from

any expected future events or results referred to in these

forward-looking statements. Unless otherwise required by applicable

law, regulation or accounting standard, we do not undertake any

obligation to update or revise any forward-looking statements,

whether as a result of new information, future developments or

otherwise

C. A conference call will take place at 08:20. To listen to the

audio webcast we recommend that you register in advance. To do so,

please visit https://www.about.sainsburys.co.uk/investors prior to

the event and follow the on-screen instructions. To view the

transcript of the conference call go to

https://www.about.sainsburys.co.uk/investors and follow the

on-screen instructions in the results, reports and presentations

section

D. Sainsbury's will announce its Interim Results for 2020/21 on

5 November 2020

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTDZGFVGGDGGZZ

(END) Dow Jones Newswires

July 01, 2020 02:00 ET (06:00 GMT)

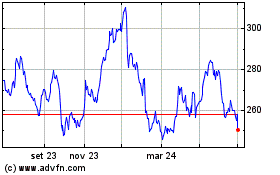

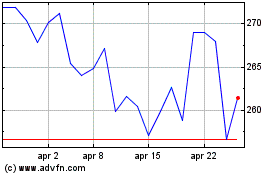

Grafico Azioni Sainsbury (j) (LSE:SBRY)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Sainsbury (j) (LSE:SBRY)

Storico

Da Apr 2023 a Apr 2024