Schneider Electric 1st Half Profit Fell; Guidance Reinstated

29 Luglio 2020 - 8:29AM

Dow Jones News

By Giulia Petroni

Schneider Electric SE said Wednesday that net profit fell in the

first half of the year and re-established its full-year

targets.

The French energy-management group's net profit in the period

ended June 30 came in at 775 million euros ($908 million), down

from EUR993 million in the previous-year period.

Revenues decreased 10.5% organically on year to EUR11.58

billion.

Schneider Electric said it reinstated guidance for the full year

and now expects revenue to fall between 7% to 10% organically, and

adjusted earnings before interest, taxes and amortization margin to

fall by between 50 basis points and 90bps organically.

Goals for the medium term were reiterated, with organic revenue

growth of between 3% to 6% on average, adjusted Ebita margin at

around 17% by 2022, and free cash flow around EUR3 billion on

average.

It also re-established its share buyback program but said it

will continue to act consciously as it expects uncertainties to

continue in the second half of the year.

The company said it remains committed to its portfolio

optimization for disposals of revenue of between EUR1.5 billion to

EUR2 billion. The timeline, however, will likely be delayed by one

year due to the current crisis.

Write to Giulia Petroni at giulia.petroni@wsj.com

(END) Dow Jones Newswires

July 29, 2020 02:14 ET (06:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

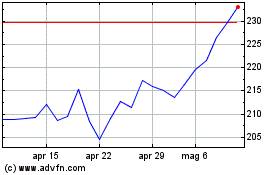

Grafico Azioni Schneider Electric (EU:SU)

Storico

Da Mar 2024 a Apr 2024

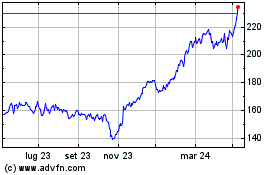

Grafico Azioni Schneider Electric (EU:SU)

Storico

Da Apr 2023 a Apr 2024