TIDMSERE

RNS Number : 0475F

Schroder Eur Real Est Inv Trust PLC

05 March 2020

5 March 2020

ANNOUNCEMENT OF NAV AND DIVIDEND

-Portfolio valuation gain underpins NAV uplift-

Schroder European Real Estate Investment Trust plc ("SERE" or

the "Company"), the company investing in European growth cities,

today announces its unaudited net asset value ("NAV") for 31

December 2019, together with its first interim dividend for the

year ending 30 September 2020:

- Unaudited NAV as at 31 December 2019 of EUR184.0 million or

137.6 cents per share, an uplift of 1.0% over the quarter;

- NAV total return of 2.4% over the quarter and 5.9% over the last 12 months;

- Portfolio valuation, net of capex, increased by 1.1% over the quarter to EUR246.3 million;

- A first interim dividend of 1.85 euro cents per share will be

paid for the year ending 30 September 2020, in line with the target

dividend stated at IPO of an annualised rate of 5.5% on the IPO

issue price;

- Significant asset management successes, including:

-- In Hamburg, the Company has secured a new tenant on a five

year lease, for an additional 670 sqm of space; and

-- Lease renewals agreed with two existing tenants at St Cloud,

Paris, covering 3,150 sqm of floor space, at rents above the

previous level paid.

Jeff O'Dwyer, of Schroder Real Estate Investment Management

Limited, commented:

"Our strategy of investing in a diversified real estate

portfolio in winning cities such as Paris, Berlin, Hamburg and

Frankfurt has again supported an uplift in NAV and portfolio

valuation and a stable and attractive dividend. We are making good

progress on the planning, design and financing for the

re-development of our largest asset in Boulogne-Billancourt, Paris.

Successful completion will deliver profitable growth for the

Company and will improve the building's sustainability credentials

and income quality."

Net Asset Value

The table below provides a breakdown of the movement in NAV

during the reporting period:

EURm(1) Cps(2) %(3)

Brought forward NAV as at 1 October 2019 182.1 136.2

Unrealised gain in valuation of the property

portfolio 3.6 2.7 2.0

Capital expenditure (0.9) (0.7) (0.5)

EPRA earnings 2.2 1.7 1.2

Non-cash items (0.5) (0.4) (0.3)

Dividend paid (2.5) (1.9) (1.4)

NAV as at 31 December 2019 184.0 137.6 1.0

(1) Management reviews the performance of the Company

principally on a proportionally consolidated basis. As a result,

figures quoted in this table include the Company's share of joint

ventures on a line-by-line basis and exclude non-controlling

interests in the Company's subsidiaries.

(2) Based on 133,734,686 shares

(3) % change based on starting NAV 1 October 2019

Interim dividend

The first interim dividend of 1.85 euro cents per share for the

year ending 30 September 2020 represents an annualised rate of 5.5%

based on the Euro IPO issue price of 137 euro cents per share. This

is in line with the Company's target dividend, which is based on

paying a dividend based on the longer term sustainable rental

income expected to be generated from the portfolio. Based on the

GBP IPO issue price of 100 pence per share the annualised yield is

6.4% (based on FX rates as at 31 December 2019).

The dividend is 88% covered from income received during the

quarter. As previously noted, we expect dividend cover to reduce

whilst we undertake asset management activity across the portfolio,

the most significant of which is the refurbishment of our Paris

office property Boulogne-Billancourt. These initiatives are

expected to improve the longer term income profile of the Company

and its dividend cover.

The interim dividend payment will be made on Tuesday, 14 April

2020 to shareholders on the register on the record date of Friday,

27 March 2020. In South Africa, the last day to trade will be

Tuesday, 24 March 2020 and the ex-dividend date will be Wednesday,

25 March 2020. In the UK, the last day to trade will be Wednesday,

25 March 2020 and the ex-dividend date will be Thursday, 26 March

2020.

The interim dividend will be paid in GBP to shareholders on the

UK register and Rand to shareholders on the South African register.

The exchange rate for determining the interim dividend paid in Rand

will be confirmed by way of an announcement on Monday, 9 March

2020. UK shareholders are able to make an election to receive

dividends in Euro rather than GBP should that be preferred. The

form for applying for such election can be obtained from the

Company's UK registrars (Equiniti Limited) and any such election

must be received by the Company no later than Friday, 27 March

2020. The exchange rate for determining the interim dividend paid

in GBP will be confirmed following the election cut off date by way

of an announcement on Monday, 30 March 2020.

Shares cannot be moved between the South African register and

the UK register between Monday, 9 March 2020 and Friday, 27 March

2020, both days inclusive. Shares may not be dematerialised or

rematerialised in South Africa between Wednesday, 25 March 2020 and

Friday, 27 March 2020, both days inclusive.

The Company has a total of 133,734,686 shares in issue on the

date of this announcement. The dividend will be distributed by the

Company (UK tax registration number 21696 04839) and is regarded as

a foreign dividend for shareholders on the South African register.

In respect of South African shareholders, dividend tax will be

withheld from the amount of the dividend noted above at the rate of

20% unless the shareholder qualifies for the exemption. Further

dividend tax information for South African shareholders will be

included in the exchange rate announcement to be made on Monday, 9

March 2020.

Property portfolio

As at 31 December 2019, the Company owned 13 properties located

in growth cities of Continental Europe, independently valued at

EUR246.3 million at a blended net initial yield of 5.9%. Over the

quarter, the portfolio value, net of capex, increased by 1.1%. The

portfolio generated a net property rental income of EUR3.9 million,

representing an ungeared quarterly property income return of 1.6%

(equating to 6.7% on an annualised basis).

The annual contracted rent is EUR17.4 million, with an average

unexpired lease term to first break and expiry of 5.0 years and 6.3

years.

The country and sector allocations for the portfolio as at 31

December 2019 are set out in the table below:

Country Allocation Sector Allocation

France 44% Office 47%

Germany 30% Retail 26%

Netherlands 17% Industrial 19%

Spain 9% Mixed 8%

Total 100% Total 100%

Asset Management update

During the period the Company completed the following key asset

management initiatives:

- At its Paris office investment Boulogne-Billancourt, where the

Company has signed a conditional long term lease commitment with

the existing tenant Alten, progress has been made with planning,

detailed design and debt financing. Initial planning approval has

been received, with final planning confirmation expected in April

following the statutory consultation period. A fixed price

construction contract is expected to be finalised during Q2 2020,

with the main works starting from June 2020 and expected to last c.

18 months. The intention is for the Company to fund this project

using debt, which would take the overall gearing level to circa 35%

LTV (net of cash), within its stated range. The Company is engaged

in positive discussions with several lenders, with a view to

finalising loan terms in Q2 2020.

- In Hamburg, the Company has secured a new tenant, world

leading food delivery specialist Takeaway, on a five-year lease,

for an additional 670 sqm of space, on the ground floor. In total,

2,892 sqm (60%) of the City BKK space has been leased, at a 17%

premium to the target rent, with positive discussions ongoing with

potential tenants for the remaining three floors.

- At its St.Cloud office asset in Paris, the Company has agreed

a new six-year lease with Outscale, an existing tenant, for c.

2,500 sqm across floors six, seven and eight, commencing in April

2020. Previously occupying c. 1,695 sqm, the new rent is 15% above

the previous rent. A new lease has also been agreed with another

existing tenant, Institute Curie, who currently occupy the ground

floor, for 531 sqm of office space on level one, on a three-year

term.

E nquiries:

Duncan Owen/Jeff O'Dwyer

Schroder Real Estate Investment Management Limited Tel: 020 7658 6000

Ria Vavakis

Schroder Investment Management Limited Tel: 020 7658 2371

Dido Laurimore/Richard Gotla/Methuselah Tanyanyiwa Tel: 020 3727 1000

FTI Consulting

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCFLFLDVLISIII

(END) Dow Jones Newswires

March 05, 2020 02:00 ET (07:00 GMT)

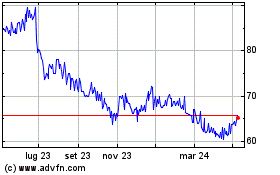

Grafico Azioni Schroder European Real E... (LSE:SERE)

Storico

Da Mar 2024 a Apr 2024

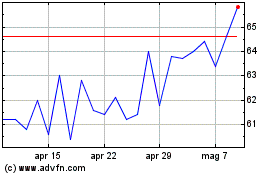

Grafico Azioni Schroder European Real E... (LSE:SERE)

Storico

Da Apr 2023 a Apr 2024