Secure Trust Bank PLC Trading Statement (9751Q)

24 Giugno 2020 - 5:25PM

UK Regulatory

TIDMSTB

RNS Number : 9751Q

Secure Trust Bank PLC

24 June 2020

PRESS RELEASE

Secure Trust Bank PLC

LEI: 213800CXIBLC2TMIGI76

24 June 2020

For immediate release

SECURE TRUST BANK PLC

2020 Annual General Meeting Trading Update

Following the Annual General Meeting of Secure Trust Bank PLC

(the 'Bank' or 'STB' or 'Group') held earlier today, the Board of

STB provides an update on trading in the first five months of the

year, which follows the first quarter update provided with the 2019

Annual Results on 7 May 2020.

Having entered 2020 aspiring to deliver double digit profit

growth for the third successive year, the Group was on track to

deliver this objective until the onset of the COVID-19 outbreak and

UK lockdown in late March.

In response to the outbreak, the Group swiftly implemented

contingency plans focussed on the wellbeing of its workforce,

supporting its customers and business partners, managing risks,

safeguarding capital and maintaining operations. Despite the

significant challenges created by lockdown, the Group has continued

to operate effectively throughout the period. The Board would like

to thank the whole STB team for their resilience and dedication

during this difficult time.

While the Group has continued to trade profitably during the

period, the lockdown has led to significantly reduced new lending

volumes written in April and May, particularly in motor finance,

invoice finance and real estate finance. Noting the majority of our

retail finance business is online the Group is well placed to

continue supporting existing retailer relationships, with volumes

running around 50% of normal levels. Support has also been provided

to SME customers, where appropriate, via government loan schemes.

As a result, and as previously disclosed, the Bank's short duration

balance sheet has been contracting since April and the Group

expects this to continue for the foreseeable future. This

contraction, and the Group's profitable trading during the first

five months of 2020, have resulted in stronger capital and

liquidity ratios relative to the position at the end of 2019.

The recent partial easing of the lockdown has resulted in

increased demand for consumer finance in recent weeks, particularly

in motor finance where used car prices appear to have hardened.

Whether this is due to pent up demand or a more sustained trend

remains to be seen and the volume of motor finance business written

by the Group remains low. Activity levels in retail finance have

risen and will rise due to the relaxation of the social distancing

requirements and the imminent launch of 2020-2021 season ticket

sales by Premier League clubs. Demand for SME lending is subdued,

which may be linked to take up of the government loan schemes.

The Government, Bank of England and financial regulators are

supporting the economy to an unprecedented degree. This is

supporting the credit quality of UK consumers and businesses but it

will take time for the longer term effects of this to emerge,

especially given there are very clear risks of a marked increase in

unemployment and business insolvencies as support schemes close.

These factors will be important considerations influencing the

IFRS9 impairment charge at the half year which will incorporate

more subjectivity than in normal conditions. The Group remains

focused on stringent cost management given reduced levels of

activity in some parts of the business. The heightened levels of

uncertainty are also informing the Group's credit risk appetite,

which is expected to remain cautious for some time.

Despite the prevailing uncertainty, the Group's healthy capital

and liquidity positions, flexible business model and short duration

loan portfolio make it well placed to navigate the current

crisis.

--ENDS-

Enquiries:

Secure Trust Bank PLC

Paul Lynam, Chief Executive Officer

Tel: 0121 693 9100

About the Company:

Secure Trust Bank is an established, well--funded and

capitalised UK retail bank with a 68 year trading track record.

Secure Trust Bank operates principally from its head office in

Solihull, West Midlands, and had 1,017 employees (full-- time

equivalent) as at 31 December 2019. The Group's diversified lending

portfolio currently focuses on two sectors:

(i) Business Finance through its Real Estate Finance, Asset

Finance and Commercial Finance divisions,

(ii) Consumer Finance through its Motor Finance, Retail Finance,

Debt Management and Consumer Mortgages divisions

As at 31 December 2019 the Group's loans and advances to

customers totalled GBP2,450.1 million, customer deposits totalled

GBP2,020.3 million and the Group's total customer base was well

over 1.5 million.

Secure Trust Bank PLC is authorised by the Prudential Regulation

Authority and regulated by the Financial Conduct Authority and the

Prudential Regulation Authority.

Secure Trust Bank, PLC, One Arleston Way, Solihull, B90 4LH.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTZZGZVKDFGGZM

(END) Dow Jones Newswires

June 24, 2020 11:25 ET (15:25 GMT)

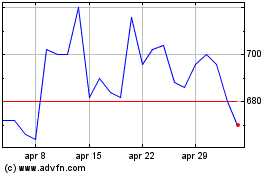

Grafico Azioni Secure Trust Bank (LSE:STB)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Secure Trust Bank (LSE:STB)

Storico

Da Apr 2023 a Apr 2024