Sherborne Investors (Guernsey)C Ltd Holding(s) in Company (7173S)

08 Novembre 2019 - 8:00AM

UK Regulatory

TIDMSIGC

RNS Number : 7173S

Sherborne Investors (Guernsey)C Ltd

08 November 2019

TR-1: Standard form for notification of major holdings

NOTIFICATION OF MAJOR HOLDINGS (to be sent to the relevant issuer

and to the FCA in Microsoft Word format if possible)(i)

1a. Identity of the issuer or the Sherborne Investors (Guernsey) C

underlying issuer of existing shares Limited

to which voting rights are attached(ii)

:

--------------------------------------------

1b. Please indicate if the issuer is a non-UK issuer (please mark

with an "X" if appropriate)

Non-UK issuer X

------------------------------------------

2. Reason for the notification (please mark the appropriate box or

boxes with an "X")

An acquisition or disposal of voting rights X

------------------------------------------

An acquisition or disposal of financial instruments

------------------------------------------

An event changing the breakdown of voting rights

------------------------------------------

Other (please specify)(iii) :

------------------------------------------

3. Details of person subject to the notification obligation(iv)

Name (i) Edward Bramson

(ii) Stephen Welker

(iii) Sherborne Investors Management

GP, LLC

(iv) Sherborne Investors Management

LP

City and country of registered office 135 East 57th Street

(if applicable) Floor 32

New York, NY 10022

United States of America

4. Full name of shareholder(s) (if different from 3.)(v)

Name (i) Whistle Investors II LLC, as

a counterparty to the investment

management agreement with Sherborne

Investors Management LP

(ii) Whistle Investment Partners

LLC, as a counterparty to the investment

management agreement with Sherborne

Investors Management LP

--------------------------------------------

City and country of registered office Whistle Investors II LLC and Whistle

(if applicable) Investment Partners LLC:

c/o Corporation Service Company

251 Little Falls Drive

Wilmington, DE 19808

United States of America

--------------------------------------------

5. Date on which the threshold was 6 November 2019

crossed or reached(vi) :

6. Date on which issuer notified 8 November 2019

(DD/MM/YYYY):

-------------------------------------------------------

7. Total positions of person(s) subject to the notification obligation

% of voting % of voting rights Total of both Total number

rights attached through financial in % (8.A + of voting rights

to shares (total instruments 8.B) of issuer(vii)

of 8. A) (total of 8.B

1 + 8.B 2)

------------------ ------------------- -------------- ------------------

Resulting situation

on the date

on which threshold

was crossed

or reached 6.54% 6.54% 700,000,000

------------------ ------------------- -------------- ------------------

Position of

previous notification

(if

applicable) 3.57% 3.57%

------------------ ------------------- -------------- ------------------

8. Notified details of the resulting situation on the date on which

the threshold was crossed or reached(viii)

A: Voting rights attached to shares

Class/type of Number of voting rights(ix) % of voting rights

shares

ISIN code (if

possible)

Direct Indirect Direct Indirect

(Art 9 of Directive (Art 10 of (Art 9 of Directive (Art 10 of

2004/109/EC) Directive 2004/109/EC) 2004/109/EC) Directive

(DTR5.1) (DTR5.2.1) (DTR5.1) 2004/109/EC)

(DTR5.2.1)

------------------------

GG00BZ3C3B94 45,800,000 6.54%

--------------------- ------------------------ --------------------- --------------

SUBTOTAL 8. A 45,800,000 6.54%

----------------------------------------------- -------------------------------------

B 1: Financial Instruments according to Art. 13(1)(a) of Directive

2004/109/EC (DTR5.3.1.1 (a))

Type of financial Expiration Exercise/ Number of voting % of voting

instrument date(x) Conversion Period(xi) rights that may rights

be acquired if the

instrument is

exercised/converted

----------- ------------------------- ---------------------------------- ------------

SUBTOTAL 8. B

1

------------------------- ---------------------------------- ------------

B 2: Financial Instruments with similar economic effect according to

Art. 13(1)(b) of Directive 2004/109/EC (DTR5.3.1.1 (b))

Type of financial Expiration Exercise/ Physical or Number of % of voting

instrument date(x) Conversion cash voting rights rights

Period (xi) settlement(xii)

------------- ----------------------- ------------------- ---------------

SUBTOTAL 8.B.2

------------------- ---------------

9. Information in relation to the person subject to the notification

obligation (please mark the

applicable box with an "X")

Person subject to the notification obligation is not controlled

by any natural person or legal entity and does not control any

other undertaking(s) holding directly or indirectly an interest

in the (underlying) issuer(xiii)

Full chain of controlled undertakings through which the voting X

rights and/or the

financial instruments are effectively held starting with the

ultimate controlling natural person or legal entity(xiv) (please

add additional rows as necessary)

Name(xv) % of voting rights % of voting rights Total of both if

if it equals or through financial it equals or is

is higher than instruments if higher than the

the notifiable it equals or is notifiable threshold

threshold higher than the

notifiable threshold

---------------------- ------------------------ ----------------------

Edward Bramson N/A N/A 6.54%

---------------------- ------------------------ ----------------------

Stephen Welker N/A N/A 6.54%

---------------------- ------------------------ ----------------------

Sherborne Investors

Management GP,

LLC N/A N/A 6.54%

---------------------- ------------------------ ----------------------

Sherborne Investors

Management LP N/A N/A 6.54%

---------------------- ------------------------ ----------------------

10. In case of proxy voting, please identify:

Name of the proxy holder N/A

------------------------------------------------

The number and % of voting rights N/A

held

------------------------------------------------

The date until which the voting rights N/A

will be held

------------------------------------------------

11. Additional information(xvi)

Place of completion London

Date of completion 6 November 2019

----------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

HOLBRBPTMBTMBJL

(END) Dow Jones Newswires

November 08, 2019 02:00 ET (07:00 GMT)

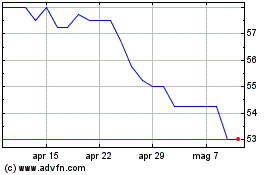

Grafico Azioni Sherborne Investors (gue... (LSE:SIGC)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Sherborne Investors (gue... (LSE:SIGC)

Storico

Da Apr 2023 a Apr 2024