Siemens Energy Targets Profitability Increase in Post-Spinoff Strategy

01 Settembre 2020 - 1:04PM

Dow Jones News

By Giulia Petroni

Siemens Energy laid out its post-spinoff strategy on Tuesday,

saying it aims to increase profitability and focus on portfolio

adjustments while shifting toward sustainability.

The energy company, which is due to debut on the stock market

this month, said management aims to achieve an adjusted earnings

before interest, taxes and amortization margin before special items

of between 6.5% and 8.5% for fiscal 2023.

Siemens Energy's owner Siemens AG is spinning off 55% of the

energy business, which includes its gas and power operations as

well as its 67% stake in wind-turbine maker Siemens Gamesa

Renewable Energy SA. Siemens will retain a 35.1% stake in Siemens

Energy.

In the first phase of its strategy, the company said it will

focus on the gas and power segment, in order to have "a leaner cost

structure, optimized logistics, centralized purchasing and the

reduction of non-conformance costs."

Project selection will also be one of the main focuses, as the

company is currently evaluating initiatives that target more than

300 million euros ($357.7 million) of annual gross global cost

savings. These add up to the already-announced EUR1 billion saving

target until fiscal 2023, compared to fiscal 2018 levels.

In fiscal 2019, Siemens Energy's revenue amounted to EUR28.8

billion.

Write to Giulia Petroni at giulia.petroni@wsj.com

(END) Dow Jones Newswires

September 01, 2020 06:49 ET (10:49 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

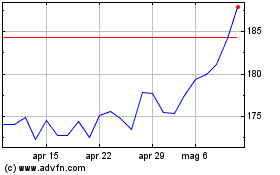

Grafico Azioni Siemens (TG:SIE)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Siemens (TG:SIE)

Storico

Da Apr 2023 a Apr 2024