Smith & Nephew Targets Consistent 4%-6% Organic Revenue Growth by 2024, Share Buybacks

16 Dicembre 2021 - 1:49PM

Dow Jones News

By Ian Walker

Smith & Nephew PLC said Thursday that it is targeting 4%-6%

consistent organic revenue growth by 2024 and set a new commitment

to return surplus capital to shareholders through regular share

buybacks.

The U.K. medical-technology company said that it expects to buy

back between $250 million and $300 million of shares next year.

S&N said it plans to maintain higher investment in

innovation to drive organic growth and continue buying new

technologies, while expanding in higher growth segments.

The company also said it plans to rebuild its trading margin and

has set a target of at least 21% by 2024 with further improvements

thereafter. It is maintaining a progressive dividend policy.

"Smith+Nephew is at an inflection point, with a clear ambition

and strategy for growth... With financial discipline we will

continue to invest in the business to take advantage of the

opportunities we see, while also driving shareholder returns,"

Chief Executive Roland Diggelmann said.

Shares at 1207 GMT were up 21.0 pence, or 1.8%, at 1,223.0

pence.

Write to Ian Walker at ian.walker@wsj.com

(END) Dow Jones Newswires

December 16, 2021 07:34 ET (12:34 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

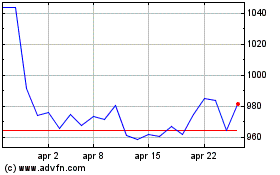

Grafico Azioni Smith & Nephew (LSE:SN.)

Storico

Da Mar 2024 a Apr 2024

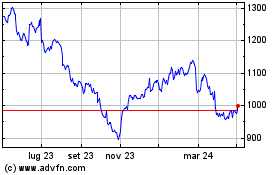

Grafico Azioni Smith & Nephew (LSE:SN.)

Storico

Da Apr 2023 a Apr 2024