SoftBank Plans to Seek Buyers for About $20 Billion of its T-Mobile Shares

18 Maggio 2020 - 11:42PM

Dow Jones News

By Cara Lombardo and Liz Hoffman

SoftBank Group Corp. plans to seek buyers for about $20 billion

of its shares in T-Mobile US Inc. as the Japanese technology

conglomerate takes steps to pare a years-long investment in the

U.S. mobile-phone sector.

Banks including Morgan Stanley and Goldman Sachs Group Inc. are

working to round up investors for what would be one of the largest

stock trades in market history, according to people familiar with

the matter.

SoftBank owns roughly 25% of T-Mobile after the U.S. cellphone

giant's recent merger with SoftBank-controlled Sprint. Another 44%

is owned by T-Mobile's longtime parent, Deutsche Telekom AG, with

the rest trading publicly. T-Mobile, the third-largest U.S.

wireless company, has a market value of more than $125 billion.

Under the planned multipart deal, Deutsche Telekom would secure

the right to buy T-Mobile shares in the future to bring its

ownership stake above 50%, which The Wall Street Journal reported

on early Monday. In turn, SoftBank would be released from

agreements that would have barred it from selling most of its

T-Mobile shares for years, according to some of the people.

There's no guarantee SoftBank will go forward with the sale, or

that there will be enough investor demand at a price the Japanese

company finds attractive.

(END) Dow Jones Newswires

May 18, 2020 17:27 ET (21:27 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

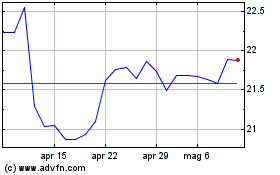

Grafico Azioni Deutsche Telekom (TG:DTE)

Storico

Da Mar 2024 a Apr 2024

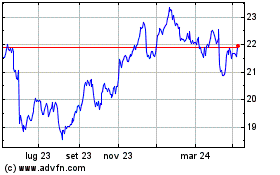

Grafico Azioni Deutsche Telekom (TG:DTE)

Storico

Da Apr 2023 a Apr 2024