Some Brewers Hate Lockdowns More Than Others -- Heard on the Street

31 Ottobre 2020 - 3:29PM

Dow Jones News

By Carol Ryan

Three of the world's largest brewers had good news about the

global beer market this week. Further progress depends on bars and

restaurants staying open, though, and things don't look positive in

Europe.

Budweiser's owner Anheuser-Busch InBev, Heineken and Carlsberg

all beat analyst expectations for the amount of beer sold over the

summer, according to third-quarter results. AB InBev and Carlsberg

are also recovering profits faster than anticipated. Heineken made

less progress on margins, but the company's new boss plans to cut

costs.

The general picture is that demand for beer is resilient. Once

lockdown restrictions were lifted, consumers returned to bars and

restaurants, albeit cautiously. They drank at home with gusto,

especially in the U.S. Brazil was another bright spot -- AB InBev

shifted 25% more beer in the quarter than this time last year.

Government subsidies in the South American country put cash in

consumers' pockets and would continue to do so for the rest of the

year.

Big brewers have done a good job adapting to the massive shift

toward beer drinking at home. In this battleground, the largest

players appear to be edging out smaller rivals.

Nielsen data shows that AB InBev and Heineken are both gaining

market share in the U.S., while Molson Coors and Boston Beer are

slipping. The picture is similar in Europe and probably reflects

more powerful supply chains that can meet supermarkets' thirst for

stock. Big companies also have more funds to invest in

e-commerce.

The outlook for the fourth quarter is less rosy, especially for

companies that do a lot of business in Europe. Bars and restaurants

across France shut on Friday after President Emmanuel Macron

announced a month of lockdowns to arrest a second wave of Covid-19

cases. In Germany, they will close from Monday. In Italy, they must

now shut their doors by 6 p.m. and in Spain there is a national

curfew after 11 p.m.

Heineken, which sells 34% of its total beer volume in Western

Europe, according to Jefferies, will be hit hard. Carlsberg does

even more business in the region. AB InBev, the global leader, has

low exposure at 5% of beer sold.

Unfortunately, some of the business that will be lost is high

quality. Sales made in European bars and restaurants are more

profitable than purchases in grocery stores. Even if home drinkers

do pick up the slack, margins won't recover until social venues do.

AB InBev is fortunate that supermarkets sales are almost as

lucrative as bar deliveries in the U.S. -- its most important

market -- but this isn't the case in other places where the company

has a big presence, such as Brazil.

Home drinkers are salvaging sales this year for the world's

mega-brewers. The fate of hard-pressed bars and restaurants in

regions like Europe will decide what happens to their bottom

lines.

Write to Carol Ryan at carol.ryan@wsj.com

(END) Dow Jones Newswires

October 31, 2020 10:14 ET (14:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

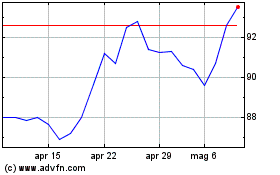

Grafico Azioni Heineken (EU:HEIA)

Storico

Da Mar 2024 a Apr 2024

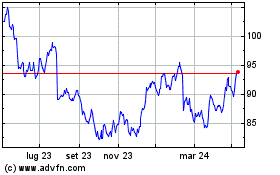

Grafico Azioni Heineken (EU:HEIA)

Storico

Da Apr 2023 a Apr 2024