Starling Chief Executive Won't Budge on IPO Pledge -- Financial News

01 Dicembre 2020 - 2:35PM

Dow Jones News

By Emily Nicolle and Ryan Weeks

Of Financial News

Starling Bank chief executive Anne Boden has been steadfast in

her resolve never to put the fintech firm up for sale, as she

continues to angle toward an eventual IPO for the bank.

Reports emerged over the weekend that traditional banking

stalwarts JPMorgan Chase & Co. and Lloyds Banking Group PLC

have "expressed interest" in acquiring Starling, which a

spokesperson for the startup quickly dismissed.

Exactly what these "expressions of interest" amount to is

unclear from the reports in question, but Ms. Boden poured more

cold water on the claims while speaking with Financial News at a

conference Monday.

The Starling founder reiterated that she had no interest in

taking up any past, present or future offers.

"Big banks taking interest in Starling is not new," she said.

"I've always said that I didn't do this to sell to a big bank, and

nothing's changed. We still have our sights on an IPO."

Ms. Boden also said this wasn't the first time she'd been

approached by a U.S. bank about signing a deal, with the rumors

having suggested JPMorgan was interested in acquiring Starling as

part of plans to set up a consumer bank in the U.K.

Lloyds, meanwhile, was reported by the Times to be after

Starling's technology. Ms. Boden believes this to be the young

bank's main appeal for traditional lenders considering a bid for

its business, particularly now that Starling has reported its first

profitable month since it gained a bank license in 2016.

"People are looking at Starling and thinking, you know, wow,

they built their own technology. They took a really, really

difficult route. They decided to get a banking license, pursue the

right customer base, to build the right technology, and now it's

paying off. I'm very excited about that."

While Lloyds didn't respond to a request for comment on the

report, the person in charge of transforming its retail efforts

Stephen Noakes said the lender has set aside roughly 3 billion

pounds ($4 billion) for investing in the lender's strategy. A

spokesperson for JPMorgan declined to comment.

Ms. Boden has always positioned Starling as a rival to the banks

on the high street, despite constant comparisons to its digital

peers Monzo and Revolut. But in recent months, that rhetoric has

changed in favor of emphasizing Starling's appeal as a technology

company--perhaps in an effort to boost the bank's price tag as it

attempts to secure $200 million from investors.

So what part of the FTSE index might Starling fall under if it

goes public? Technology with the likes of Micro Focus international

PLC and Softcat PLC, or finance alongside its reported suitors?

"I think in future, all banks will end up being considered far

more as a technology stock," Ms. Boden said. "I think that banks

are not glamorous at the moment. I think investors look at banks

and think they're very, very hard work. Technology has all the

glamour at present."

"But I'm a realist. The only way you can make money and actually

have a sustainable business is if you're a bank, and you have the

best technology in the world. And that is what we set out to do,

and that's what we're doing."

However, don't expect anything concrete on an IPO to appear from

Starling any time soon. Ms. Boden wouldn't be drawn on a potential

timeframe for a listing, nor how the bank's (undisclosed) private

valuation might be altered by becoming profitable.

"We don't need to raise [to cover] our operating costs now. If

we did have to raise--and I'm not saying that we're raising--it

would be to grow our balance sheet and our European operations.

Once you're profitable, you know, hopefully our profits will cover

all our costs and we don't need to raise further just to keep

going, which gives us a huge amount of independence."

Website: www.fnlondon.com

(END) Dow Jones Newswires

December 01, 2020 08:20 ET (13:20 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

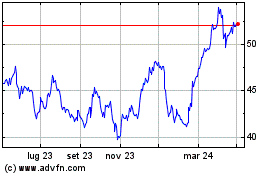

Grafico Azioni Lloyds Banking (LSE:LLOY)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Lloyds Banking (LSE:LLOY)

Storico

Da Apr 2023 a Apr 2024