Stock Futures Edge Up, Pointing to Flat Week for Dow

24 Dicembre 2020 - 11:40AM

Dow Jones News

By Caitlin Ostroff

U.S. stock futures edged higher Thursday, suggesting that the

Dow Jones Industrial Average may end the holiday-shortened week on

a flat note.

Futures tied to the Dow ticked up 0.2%. The blue-chips index

slipped almost 0.2% this week through the Wednesday close. Futures

linked to the S&P 500 gained 0.2%, while those on the

technology-focused Nasdaq-100 index edged up 0.1%.

Markets will close early Christmas Eve, with the New York Stock

Exchange and Nasdaq scheduled to end trading at 1 p.m. ET. U.S. and

European markets will be closed Friday for Christmas

celebrations.

Investors have been focused on a swath of issues this week,

including the prospects for additional fiscal support for the

economy and signs of the rebound faltering. Elevated coronavirus

infection levels and a new variant of Covid-19 that emerged in the

U.K. have prompted concerns that there may be additional lockdown

measures in the winter months, weighing on market sentiment.

"The market is so on edge at the moment. People are worried

about more lockdowns, more travel restrictions," said Altaf Kassam,

head of investment strategy for State Street Global Advisors in

Europe. "This will continue to bounce the market around."

Bets that a fresh fiscal-stimulus package would offer support to

families and small businesses in coming days have come into

question after President Trump vetoed a $740.5 billion

defense-policy bill on Wednesday and demanded last-minute changes

to coronavirus-relief legislation. His unexpected criticism of the

bill has prompted another standoff between the White House and

Capitol Hill. Mr. Trump hasn't yet said if he will veto the aid

package.

Weak recent economic data has bolstered hopes among investors

that an agreement will be reached on the aid package. Data released

Wednesday showed that household spending dropped for the first time

in seven months and layoffs remained elevated as a surge in virus

cases weighed on economic recovery.

"The market is definitely expecting an aid package to go

through," said Mr. Kassam.

In bond marks, the yield on the 10-year Treasury note ticked

down to 0.948%, from 0.953% Wednesday. Yields fall when bond prices

rise.

Overseas, the pan-continental Stoxx Europe 600 edged up 0.2%,

with markets in Germany and Italy shut until Monday.

The British pound rose 0.7% against the dollar, and 0.6% against

the euro, as the U.K. and the European Union drew closer to a

post-Brexit trade deal. Investors have said they would welcome

greater clarity over trade relations. The U.K.'s stocks benchmark,

the FTSE 100 index, ticked up 0.1%.

Sterling has rallied in recent days as investors expected that a

deal would be reached. "The market already had this as the base

case," said Andreas Steno Larsen, global foreign-exchange and

fixed-income strategist at Nordea Markets. "I don't think anyone

really believed in the cliff-edge scenario."

Most major stock indexes in Asia closed higher. South Korea's

Kospi gained 1.7%, while Japan's Nikkei 225 advanced 0.5%. China's

Shanghai Composite dropped 0.6%.

Write to Caitlin Ostroff at caitlin.ostroff@wsj.com

(END) Dow Jones Newswires

December 24, 2020 05:25 ET (10:25 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

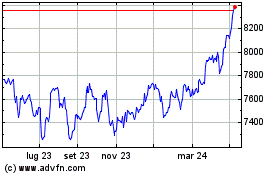

Grafico Indice FTSE 100

Da Mar 2024 a Apr 2024

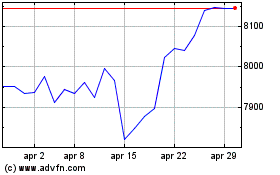

Grafico Indice FTSE 100

Da Apr 2023 a Apr 2024