TIDMSCE

RNS Number : 2198A

Surface Transforms PLC

28 September 2020

28 September 2020

Surface Transforms plc.

("Surface Transforms" or "the Company")

Half-year financial results for the six months ended 30 June

2020

Surface Transforms (AIM:SCE) manufacturers of carbon fibre

reinforced ceramic materials, is pleased to announce its half-year

financial results for the six months ended 30 June 2020.

Financial highlights:

- Revenue increased by 55% to GBP902k (H1-2019: GBP583k)

- Gross profit increased by 72% to GBP590k (H1-2019: GBP343k)

- Loss before tax decreased to GBP1,451k (H1-2019: GBP1,525k)

- Loss after tax increased to GBP1,175k (H1-2019: GBP837k) partially

reflecting inclusion of two R&D tax credits in the comparable prior

period ended June 2019

- Cash at 30 June 2020 was GBP2,019k (31 December 2019: GBP770k),

to which can be added GBP334k of R&D tax credit received in September

2020.

- Capital expenditure on property, plant and equipment of GBP277k

(H1-2019: GBP32k) mainly relating to the installation of OEM Production

Cell One

- Successful equity placing and oversubscribed open offer raising

GBP2,206k (net of expenses)

Sales and Operational Highlights:

- Post balance sheet date, awarded a contract with a global automotive

vehicle manufacturer (described as OEM 8) with estimated lifetime

value of approximately GBP27.5 million

- GBP5m lifetime value contract awarded from Koenigsegg on the recently

launched Gemera car

- Continuing delays on start of production (SOP) on the Aston Martin

Valkyrie car

- Continuing progress on testing with OEM 3, OEM 1 and a number

of other potential customers, some of whom have not tested Surface

Transforms products before

- Increasing dialogue with OEM's for prospective electric vehicle

(EV) projects

- Maintained production and sales throughout the Covid 19 lockdown

period

- All furnaces and machine tools in the new OEM Production Cell

One have successfully operated. Task in H2 is to balance the overall

system and demonstrate repeatable volume production

Outlook

Despite the Covid 19 lockdown, trading has been better than

expected. As a result, the Company reiterates that it now

anticipates current FY 20 revenues will be approximately

GBP2.0m.

The OEM 8 contract win increases sales expectations by over

GBP3m in 2021 and GBP8m in 2022 (and the following two years). As

recently announced, given this contract as well as the expectation

of further, as yet unspecified, contract awards, the Company is

investing in manufacturing support headcount and other costs over

the next three years, which will progressively add approximately

GBP2m to annual overheads in 2022 and thereafter.

Consequently, the Company reiterates that it is now forecasting

positive profits after tax (including receipt of the R&D tax

credit), a year earlier than previously announced, in 2021 and

positive operating profit, before interest and tax, in 2022.

The Company continues to expect to announce further contract

awards over the next six months.

Summary

During the period the Company accelerated its progress to

becoming a profitable mainstream automotive supplier of carbon

ceramic brake discs. This continued progress was achieved against

the most difficult economic and operational conditions in recent

memory.

Finally, I would like to conclude by recording the Board's

appreciation of the outstanding contribution by all members of the

team, particularly in the context of the Covid 19 pandemic. Thank

You!

David Bundred

Chairman

For enquiries, please contact:

Surface Transforms plc.

Kevin Johnson, CEO

Michael Cunningham, CFO

David Bundred, Chairman +44 151 356 2141

Zeus Capital Limited (Nominated Adviser and Joint Broker) +44 203 829 5000

David Foreman / Dan Bate/ Jordan Warburton (Corporate

Finance)

Dominic King (Corporate Broking)

finnCap Ltd (Joint-Broker) +44 20 7220 0500

Ed Frisby / Giles Rolls (Corporate Finance)

Richard Chambers (Corporate Broking)

About Surface Transforms

Surface Transforms plc. (AIM:SCE) develop and produce

carbon-ceramic material automotive brake discs. The Company is the

UK's only manufacturer of carbon-ceramic brake discs, and only one

of two mainstream carbon ceramic brake disc companies in the world,

serving customers that include major OEMs in the global automotive

markets.

The Company utilises its proprietary next generation Carbon

Ceramic Technology to create lightweight brake discs for

high-performance road and track applications for both internal

combustion engine and electric vehicles. While competitor

carbon-ceramic brake discs use discontinuous chopped carbon fibre,

Surface Transforms interweaves continuous carbon fibre to form a 3D

matrix, producing a stronger and more durable product with improved

heat conductivity compared to competitor products; this reduces the

brake system operating temperature, resulting in lighter and longer

life components with superior brake performance. These benefits are

in addition to the benefits of all carbon-ceramic brake discs vs.

iron brake discs: weight savings of up to 70%, longer product life,

consistent performance, reduced brake pad dust and corrosion

free.

For additional information please visit

www.surfacetransforms.com

Financial Review

Revenue in the period increased to GBP902k despite the Covid 19

pandemic occurring within the period. The growth was fuelled

primarily by increased retrofit sales, which held up strongly

during the pandemic. OEM sales were also higher in the period and

near OEM sales broadly flat compared with the six months to June

2019.

Gross profit increased to GBP590k (H1-2019: GBP343k) and gross

margin was 65.4% (H1-2019: 58.8%). The increase in margin was due

to both better labour productivity and purchasing of raw materials,

and is sustainable. Whilst future selling prices will fall, as

volumes increase, this will be offset by further production

efficiencies being generated as OEM Production Cell One becomes

fully operational.

Administrative expenses rose by GBP173k to GBP928k (H1-2019:

GBP755k) due in large part to some increased salary costs.

Research expenses increased by GBP149k to GBP1,212k (H1-2019:

GBP1,063k) reflecting an increase in the number of customer

projects.

The R&D tax credit reduced by GBP412k to GBP276k (H1-2019:

GBP688k) following a change in accounting policy in 2019.

Previously, the tax credit was recognised when received, but is now

accrued in the year to which the tax credit relates. This

transition led to the inclusion of two tax credits in the prior

period. It had no impact on the quantum or timing of the cash

receipt. As Surface Transforms advances into profitability, it is

worth noting that the Group has substantial tax losses carried

forward.

Within the statement of financial position, property, plant and

equipment increased by a net GBP70k to GBP5,588k (December 2019:

GBP5,518k) being capital expenditure of GBP277k in OEM Production

Cell One offset by increased depreciation of GBP207k. Receivables

fell by GBP368k to GBP950k partially reflecting the reversal of

late customer payments noted in our financial results for the seven

month period ended 31 December 2019. Within this June 2020 total,

trade debtors were GBP185k and the provision for R&D tax credit

was GBP596k, of which GBP334k was received in September 2020.

Inventories fell by GBP85k to GBP921k (December 2019: GBP1,006k).

Notwithstanding this welcome reduction, the Company still suffers

from minimum order quantities on key input materials,

disproportionate to historic sales levels; thus as sales increase,

inventories should not rise at the same rate and the ratio of

inventory to sales is therefore expected to improve.

The Company had also taken advantage of HMRC support on PAYE

time to pay to improve cash flow during the coronavirus outbreak.

At the balance sheet date, Surface Transforms had authorised excess

PAYE payments of GBP246k due. These were settled in full in

July.

In the period, the Company raised GBP2,206k after fees in an

over-subscribed equity placing and open offer.

Progress with potential OEM customers

Surface Transforms is undertaking testing on a number of

projects for OEMs, including for both existing customers and others

who have not tested our products before. The Company believes that

it is not commercially appropriate to provide further details of

these projects in advance of contract award, but does note that

whilst the Covid 19 lockdown has impacted almost all project

timings and start of production (SOP), the implications of which

have previously been disclosed, the tests are validating the

superior performance of Surface Transforms' discs across a range of

key measures.

Consequently, the Company continues to expect that it will be

able to announce further contract awards over the next six

months.

- Electric Vehicles : It is also worth noting that approximately

half of the current projects pipeline relate to electric vehicles

(EVs). Whilst the generic advantages of carbon ceramic brakes

are relevant to all our customers, irrespective of vehicle powertrain,

the weight saving of carbon ceramic discs are particularly attractive

to EV manufacturers given the weight of batteries and need for

extended range. Additionally, EV manufacturers are concerned by

the, admittedly small, but nonetheless high impact risk, of pads

sticking to grey iron discs on EVs that make little use of the

hydraulic brake - known as galvanic corrosion. Galvanic corrosion

does not happen on carbon ceramic discs.

- Aston Martin Valkyrie : This project was forecast to launch in

the period but for the customer's own reasons the SOP has been

postponed. Despite this, the Company continues to expect this

project to be a major element of Surface Transforms activity during

2021.

- OEM 8: Post balance sheet date, the Company announced that it

had been selected to be the standard fit, sole supplier of the

carbon ceramic brake disc on both axles of a new car to be manufactured

by a global automotive manufacturer (hereinafter described as

OEM 8). The contract is estimated to be worth GBP27.5m over the

lifetime of the contract from 2021 to 2024. There is also the

possibility that the contract will be extended beyond 2024.

- Koenigsegg Gemera : The Company was selected as the tier one

sole supplier of carbon ceramic discs on the Koenigsegg Gemera

supercar during the period. The contract is valued in excess of

GBP5m with SOP in mid 2022 and completing in mid 2027.

- OEM 3: This customer has a unique environmental test that the

Company has been endeavoring to pass for some time now. It is

encouraging to report that considerable progress has been made

over the last year with discussions on target models continuing.

As previously stated, the Company's generic policy is not to comment

further, prior to contract award for any of its existing OEM development

programmes. However, an exception has been made for OEM 3 given

the uniqueness of their required environmental test.

- Retrofit and Near OEM : Sales into this segment continue to form

the bedrock of current trading. In the period, progress in overseas

retrofit markets - notably EU and the US - has been most encouraging.

Additionally, the Company continues to seek out (and sometimes

is sought out by) the small niche automotive vehicle manufacturers

that we describe as "Near OEMs", frequently hardly known and often

only building a handful of cars per year. Whilst, not transformational,

our growing success in this small segment is important in providing

both road mileage experience on our products (important to the

mainstream OEMs) and, of course, short term cash generation.

Progress on Operations

Over the past three years the Company has invested over GBP6m to

increase capacity from circa GBP4m sales, in what we describe as

the small volume production cell (SVP) to an overall site capacity

of circa GBP20m sales by building what we describe as OEM

Production Cell One. The site has a footprint that will facilitate

duplications of OEM Production Cell One, with the overall

potential, in Knowsley and with further investment, of

approximately 100,000 discs. The operational task has therefore

been, and continues to be, to improve productivity and

repeatability in SVP - the initial learning curve - whilst

installing and bringing OEM Production Cell One into full operation

thus providing the capacity required for the already awarded OEM

contracts that commence in early 2021.

- Covid 19 Pandemic: The operational team has had to achieve the

dual tasks above against the background of the Covid 19 lockdown;

for example furnace supplier engineers could not visit the site

to assist in installation debugging and trouble-shooting. The priority

has, of course, been the health and well being of our staff. With

their excellent co-operation, the Knowsley plant remained operational

throughout the period, maintaining production whilst also progressing

the installation of OEM Cell Production One, even with a high number

of staff working from home. Against this background, the results,

in both the SVP and OEM Production Cell One, were outstanding and

bode well for the next stage of bringing OEM Production Cell One

into balanced repeatable production.

- Capacity and Progress with OEM Production Cell One: The recent

contract awards noted above, together with existing contracts will

utilise approximately 60% of SVP and OEM Production Cell One capacity

by early 2022. All furnaces and machine tools in the new OEM Production

Cell One have operated successfully; indeed, for cost and superior

technology reasons, some of the furnaces are currently contributing

to SVP production needs. Clearly there have been some Covid 19

related delays but not to the overall detriment of the project.

The task is now to balance overall system performance and demonstrate

repeatable volume production. The timetable on completing this

task has been tightened since the OEM 8 contract award, which has

a shorter period between nomination and SOP than Surface Transforms

has historically seen. The resultant accelerated plan includes

bringing forward some capital expenditure as well as increasing

headcount (assuming the SVP and OEM Production Cell One are operating

at capacity). As previously announced, this increased headcount

and certain other indirect overheads will progressively increase

Group costs up to a steady-state level of approximately GBP2m p.a.

in 2022 and thereafter.

Nonetheless the Board and team are confident that the tasks can

be accelerated with a repeatable optimised and balanced production

capacity available when needed in 2021 and 2022.

-------------------------------------------------------------------------

- Cost reductions: The Company continues to see continuous cost

reduction in manufacturing as a key ingredient for future success

in the automotive industry. Not least because carbon ceramic brakes

are currently an expensive item and further market size expansion

(beyond cars over GBP50k retail price ) require lower costs. Prior

to securing the Knowsley plant, the Company set itself the task

of halving the then production price. This task is achieved with

OEM Production Cell One production. However, the Company will not

rest on that laurel with the next stage already in full planning,

indeed in some areas already underway.

-------------------------------------------------------------------------

- Environment : The team at Surface Transforms is proud that its

products make a material contribution to a better planet; a longer

life product that reduces carbon emissions through weight saving

and being considerably less polluting by reducing the amount of

brake dust during braking. Our task is to ensure that our production

processes complement this product achievement. To this end we are

determined to be a good neighbour, protecting the local environment,

through constant control and measurement of emissions and have

set objectives to continuously reduce our environmental footprint.

-------------------------------------------------------------------------

Statement of Total Comprehensive Income

For the six months ended 30 June 2020

Six Months Six Months Seven Months Year

Ended Ended Ended Ended

30-Jun-20 30-Jun-19 31-Dec-19 31-Dec-19

GBP'000 GBP'000 GBP'000 GBP'000

Unaudited Unaudited Audited Unaudited

----------------------------------- ----------- ----------- ------------- ----------

Revenue 902 583 1,451 1,938

Cost of sales (312) (240) (583) (783)

----------------------------------- ----------- ----------- ------------- ----------

Gross profit 590 343 868 1,155

Other income:

Government grants* 154 - - -

Administrative expenses:

Before research and development

costs (928) (755) (1,063) (1,752)

Research and development costs (1,212) (1,063) (1,502) (2,281)

----------------------------------- -------------

Total administrative expenses (2,140) (1,818) (2,566) (4,033)

----------------------------------- ----------- ----------- ------------- ----------

Operating loss (1,396) (1,475) (1,698) (2,878)

Financial income - - 1 2

Financial expenses (55) (50) (63) (109)

----------------------------------- ----------- ----------- ------------- ----------

Loss before tax (1,451) (1,525) (1,760) (2,985)

Taxation 276 688 443 1,131

----------------------------------- ----------- ----------- ------------- ----------

Loss for the year after tax (1,175) (837) (1,317) (1,854)

Total comprehensive loss for

the year attributable to members (1,175) (837) (1,317) (1,854)

----------------------------------- ----------- ----------- ------------- ----------

Loss per ordinary share

Basic and diluted (0.82)p (0.64)p (0.97)p (1.46)p

----------------------------------- ----------- ----------- ------------- ----------

* Government grants received relate to amounts received under

the Coronavirus Job Retention Scheme

Statement of Financial Position

As at 30 June 2020

30-Jun-20 30-Jun-19 31-Dec-19

GBP'000 GBP'000 GBP'000

Unaudited Unaudited Audited

------------------------------------- ---------- ---------- ----------

Non-current assets

Property, plant and equipment 5,588 5,125 5,518

Intangibles 162 198 175

------------------------------------- ---------- ---------- ----------

5,750 5,323 5,693

Current assets

Inventories 921 1,161 1,006

Trade and other receivables 950 889 1,318

Cash and cash equivalents 2,019 1,554 770

-------------------------------------

3,89 0 3,604 3,094

------------------------------------- ---------- ---------- ----------

Total assets 9,64 0 8,927 8,787

Current liabilities

Other interest bearing loans

and borrowings (83) (13) (118)

Loans associated with right of

use assets (140) (137) (138)

Trade and other payables (798) (465) (1,028)

------------------------------------- ---------- ---------- ----------

(1,021) (615) (1,284)

Non-current liabilities

Government grants (200) (200) (200)

Loans associated with right of

use assets (1,198) (1,240) (1,207)

Other interest bearing loans

and borrowings (471) (344) (476)

-------------------------------------

(1,869) (1,784) (1,883)

------------------------------------- ---------- ---------- ----------

Total liabilities (2,890) (2,399) (3,167)

------------------------------------- ---------- ---------- ----------

Net assets 6,750 6,528 5,620

------------------------------------- ---------- ---------- ----------

Equity

Share capital 1,546 1,360 1,361

Share premium 22,733 20,704 20,712

Capital reserve 464 464 464

Retained loss (17,993) (16,000) (16,917)

-------------------------------------

Total equity attributable to

equity shareholders of the company 6,750 6,528 5,620

------------------------------------- ---------- ---------- ----------

Statement of Cash Flow

For the six months to 30 June 2020

Seven

Six Months Six Months Months Year

Ended Ended Ended Ended

30-Jun-20 30-Jun-19 31-Dec-19 31-Dec-19

GBP'000 GBP'000 GBP'000 GBP'000

Unaudited Unaudited Audited Unaudited

---------------------------------------- ------------ ------------ ---------- -----------

Cash flow from operating activities

Loss after tax for the year (1,175) (837) (1,317) (1,854)

Adjusted for:

Depreciation and amortisation charge 222 238 289 491

Equity settled share-based payment

expenses 96 67 106 161

Financial expense 55 50 63 109

Financial income - - (1) (2)

Taxation (276) (688) (442) (1,131)

---------------------------------------- ------------ ------------ ---------- -----------

(1,078) (1,170) (1,302) (2,226)

Changes in working capital

Decrease/(increase) in inventories 85 (52) 157 103

Decrease/(increase) in trade and

other receivables 368 13 (501) (415)

Increase/(decrease) in trade and

other payables (229) 77 443 640

---------------------------------------- ------------ ------------ ---------- -----------

(854) (1,132) (1,203) (1,898)

Taxation received 276 688 523 1,131

---------------------------------------- ------------ ------------ ---------- -----------

Net cash used in operating activities (578) (444) (680) (767)

---------------------------------------- ------------ ------------ ---------- -----------

Cash flows from investing activities

Acquisition of tangible and intangible

assets (277) (32) (344) (653)

Net cash used in investing activities (277) (32) (344) (653)

---------------------------------------- ------------ ------------ ---------- -----------

Cash flows from financing activities

Proceeds from issue of share capital,

net of expenses 2,206 1,793 9 1,802

Payment of finance lease liabilities (7) (29) (53) (58)

Repayment/ proceeds from long term

loans (40) (3) (25) 234

Interest received - - 1 2

Interest paid (55) (50) (63) (109)

---------------------------------------- ------------ ------------ ---------- -----------

Net cash generated from financing

activities 2,104 1,711 (131) 1,871

---------------------------------------- ------------ ------------ ---------- -----------

Net increase/ (decrease) in cash

and cash equivalents 1,249 1,235 (1,155) 451

Cash and cash equivalents at the

beginning of the period 770 319 1,925 319

---------------------------------------- ------------ ------------ ---------- -----------

Cash and cash equivalents at the

end of the period 2,019 1,554 770 770

---------------------------------------- ------------ ------------ ---------- -----------

Statement of Changes in Equity

For the six months ended 30 June 2020

Share

Share premium Capital Retained

capital account reserve loss Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- ---------------------- ---------------------- ---------------------- --------- ----------------------

Balance as at

31 December

2019 1,361 20,712 464 (16,917) 5,620

Comprehensive

income for

the year

Loss for the

period (1,175) (1,175)

--------------- ---------------------- ---------------------- ---------------------- ---------

Total

comprehensive

income

for the

period - - - (1,175) (1,175)

--------------- ---------------------- ---------------------- ---------------------- --------- ----------------------

Transactions

with owners,

recorded

directly to

equity

Shares issued

in the period 185 2,220 2,405

Cost of issue

to share

premium (199) (199)

Equity settled share based payment

transactions 99 99

--------------------------------------- ---------------------- ---------------------- ---------

Total

contributions

by and

distributions

to the owners 185 2,021 - 99 2,305

--------------- ---------------------- ---------------------- ---------------------- ---------

Balance as at

30 June 2020 1,546 22,733 464 (17,993) 6,750

--------------- ---------------------- ---------------------- ---------------------- --------- ----------------------

Statement of

changes in

equity

For the six

months ended

30 June 2019

Share

Share premium Capital Retained

capital account reserve loss Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- ---------------------- ---------------------- ---------------------- --------- ----------------------

Balance as at

31 December

2019 1,237 19,034 464 (15,227) 5,508

Comprehensive

income for

the year

Loss for the

year (837) (837)

--------------- ---------------------- ---------------------- ---------------------- ---------

Total

comprehensive

income

for the year - - - (837) (837)

--------------- ---------------------- ---------------------- ---------------------- --------- ----------------------

Transactions

with owners,

recorded

directly to

equity

Shares issued

in the year 123 1,784 1,907

Cost of issue

to share

premium (114) (114)

Equity settled share based payment

transactions 64 64

--------------------------------------- ---------------------- ---------------------- ---------

Total

contributions

by and

distributions

to the owners 123 1,670 - 64 1,857

--------------- ---------------------- ---------------------- ---------------------- ---------

Balance at 30

June 2019 1,360 20,704 464 (16,000) 6,528

--------------- ---------------------- ---------------------- ---------------------- --------- ----------------------

Statement of

changes in

equity

For the s even

month period

ended 31 Dece

mber 2019

Share

Share premium Capital Retained

capital account reserve loss Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- ---------------------- ---------------------- ---------------------- --------- ----------------------

Balance as at

31 May 2019 1,360 20,704 464 (15,706) 6,822

Comprehensive

income for

the year

Loss for the

period (1,317) (1,317)

--------------- ---------------------- ---------------------- ---------------------- ---------

Total

comprehensive

income

for the year 1,360 20,704 464 (17,023) 5,505

--------------- ---------------------- ---------------------- ---------------------- --------- ----------------------

Transactions

with owners,

recorded

directly to

equity

Share options

exercised 1 8 9

Cost of issue

off to share

premium -

Equity settled share based payment

transactions 106 106

--------------------------------------- ---------------------- ---------------------- ---------

Total

contributions

by and

distributions

to the owners 1 8 - 106 115

--------------- ---------------------- ---------------------- ---------------------- --------- ----------------------

Balance as at

31 December

2019 1,361 20,712 464 (16,917) 5,620

--------------- ---------------------- ---------------------- ---------------------- --------- ----------------------

SURFACE TRANSFORMS PLC

NOTES

1. Accounting policies

The interim financial statements are the responsibility of the

Directors and were authorised and approved by the Board of

Directors for issuance on 28 February 2020.

Basis of preparation

Surface Transforms plc is a public limited liability company

incorporated and domiciled in England & Wales. The financial

information is presented in Pounds Sterling (GBP) which is also the

functional currency. The Company's accounting reference date is 31

December.

These interim condensed financial statements are for the six

months to 30 June 2020 and have been prepared in accordance with

IAS 34, 'Interim Financial Reporting' as adopted by the EU. They do

not include all the information required for a complete set of IFRS

financial statements. However, selected explanatory notes are

included to explain events and transactions that are significant to

an understanding of the changes in the Group's financial position

and performance since the last consolidated financial statements as

at and for the seven month period ended 31 December 2019.

These interim results for the period ended 30 June 2020, which

are not audited; do not comprise statutory accounts within the

meaning of section 435 of the Companies Act 2006.

Full audited accounts of the Company in respect of the period

ended 31 December 2019, which received an unqualified audit opinion

and did not contain a statement under section 498(2) or (3)

(accounting record or returns inadequate, accounts not agreeing

with records and returns or failure to obtain necessary information

and explanations) of the Companies Act 2006 have been delivered to

the Registrar of Companies.

The accounting policies used in the preparation of the financial

information for the six months ended 30 June 2020 are in accordance

with the recognition and measurement criteria of IFRS as adopted by

the EU and are consistent with those which will be adopted in the

annual statutory financial statements for the year ending 31

December 2020.

Revenue recognition

Revenue from the sale of goods is recognised when the

significant risks and rewards of ownership of the goods have passed

to the buyer (usually on dispatch of the goods), the amount of

revenue can be measured reliably, it is probable that the economic

benefits associated with the transaction will flow to the Company

and the costs incurred or to be incurred in respect of the

transaction can be measured reliably.

Government grants

Capital grants are initially recognised as deferred income and

credited to the statement of total comprehensive income over the

life of the asset to which it relates.

Grants received under the Governments Corona virus job retention

scheme are recognised in the statement of total comprehensive

income on a systematic basis over the period in which the Company

recognises the related costs for which the grants are intended to

compensate.

Leases and right of use assets

The Company assesses whether a contract is or contains a lease

at inception of the contract. A lease conveys the right to direct

the use and obtain substantially all of the economic benefits of an

identified asset for a period of time in exchange for

consideration.

A right of use asset and corresponding lease liability are

recognised at commencement of the lease. The lease liability is

measured at the present value of the lease payments, discounted at

the rate implicit in the lease, or if that cannot be readily

determined, at the lessee's incremental borrowing rate specific to

the term, country, currency and start date of the lease.

The lease liability is subsequently measured at amortised cost

using the effective interest rate method. The right of use asset is

initially measured at cost, comprising: the initial lease

liability; any lease payments already made less any lease

incentives received; initial direct costs; and any dilapidation or

restoration costs. The right of use asset is subsequently

depreciated on a straight-line basis over the shorter of the lease

term or the useful life of the underlying asset. The right of use

asset is tested for impairment if there are any indicators of

impairment.

Leases of low value assets and short-term leases of 12 months or

less are expensed to the income statement, as are variable payments

dependent on performance or usage, 'out of contract' payments and

non-lease service components

Segmental reporting

IFRS 8 "Operating Segments" requires that the segments should be

reported on the same basis as the internal reporting information

that is provided to, and regularly reviewed by, the chief operating

decision-maker, whom the Group has identified as the CEO.

The Board has reviewed the requirements of IFRS 8, including

consideration of what results and information the CEO reviews

regularly to assess performance and allocate resources, and

concluded that all revenue falls under a single business

segment.

The Directors consider that the Group does not have separate

divisional segments as defined under IFRS 8. The CEO assesses the

commercial performance of the business based upon consolidated

revenues; margins and operating costs and assets are reviewed at a

consolidated level.

Estimates

The preparation of half-yearly financial statements requires

management to make judgments, estimates and assumptions that affect

the application of accounting policies and the reported amounts of

assets and liabilities, income and expense. Actual results may

differ from these estimates. In preparing these condensed

consolidated half-yearly financial statements, the significant

judgments made by management in applying the Group's accounting

policies and the key sources of estimation uncertainty are expected

to be the same as those that will be adopted in the annual

statutory financial statements for the year ending 31 December

2020.

Going concern

These interim financial statements have been prepared on a going

concern basis|. Whilst the Group incurred a net loss of GBP1,175k

during the period, the Group's forecasts and projections, taking

into account reasonable possible changes in trading performance,

show that the Group has sufficient financial resources, to meet the

Group's liabilities as and when they fall due for a period of

twelve months from the date of this statement.

2. Taxation

Analysis of credit in the period

Six months Six months S even Months

ended ended ended

30-Jun 30-Jun 31-Dec

2020 2019 2019

GBP'000 GBP'000 GBP'000

(unaudited) (unaudited) (audited)

UK Corporation tax

Adjustment in respect

of prior years R&D tax

allowance - 521 1 23

R&D tax allowance for

current period 276 167 3 20

276 688 4 43

------------- ------------- --------------

The effective rate of tax for the period is lower than the

standard rate of corporation tax in the UK of 20 per cent,

principally due to losses incurred by the Group.

The significant reduction in tax in the six months to 30 June

2020 is due to the fact that in the six months to 30 June 2019 the

Company changed its accounting policy to move from a cash basis for

tax to an accruals basis. The GBP688k in the six months to 30 June

2019 therefore includes both the cash receipt relating to the year

ended 30 May 2018 as well as the accrued tax credit for the six

month period.

3. Loss per share

Six months Six months Seven Months

ended ended ended

30-Jun 30-Jun 31-Dec

2020 2019 2019

(unaudited) (unaudited) (audited)

Pence Pence Pence

Loss per share:

Basic and diluted (0 .84 ) (0.64) (0.97)

------------- ------------- -------------

Loss per ordinary share is based on the Company's loss for the

financial period of GBP1,175k (30 June 2019: GBP837k loss; 31

December 2019: GBP1,317k loss). The weighted average number of

shares used in the basic calculation is 140,650,681 (31 December

2019: 136,036,376; 30 June 2019: 130,711,912).

The calculation of diluted loss per ordinary share is identical

to that used for the basic loss per ordinary share. This is because

the exercise of share options would have the effect of reducing the

loss per ordinary share and is therefore not dilutive under the

terms of International Accounting Standard 33 "Earnings per

share".

4. Segment reporting

The Company considers it offers product technology namely carbon

fibre re-enforced ceramic material which is machined into different

shapes depending on the intended purpose of the end user.

Revenue by geographical destination is analysed as follows:

Six Months Six Months Seven Months

Ended Ended Ended

30 J une 31 December

2020 30 June 2019 2019

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

United Kingdom 79 172 963

Rest of Europe 410 334 165

United States of America 372 66 251

Rest of World 41 11 72

--------------------------

902 583 1,451

-------------------------- ------------- ------------- -------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR PPUUPBUPUGBM

(END) Dow Jones Newswires

September 28, 2020 02:00 ET (06:00 GMT)

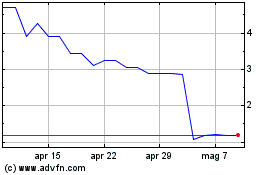

Grafico Azioni Surface Transforms (LSE:SCE)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Surface Transforms (LSE:SCE)

Storico

Da Apr 2023 a Apr 2024