TIDMSCE

RNS Number : 4208J

Surface Transforms PLC

09 April 2020

THE INFORMATION COMMUNICATED WITHIN THIS ANNOUNCEMENT IS DEEMED

TO CONSTITUTE INSIDE INFORMATION AS STIPULATED UNDER THE MARKET

ABUSE REGULATIONS (EU) NO. 596/2014. UPON THE PUBLICATION OF THIS

ANNOUNCEMENT, THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE IN

THE PUBLIC DOMAIN.

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM THE

UNITED STATES, AUSTRALIA, CANADA, JAPAN, SINGAPORE, THE REPUBLIC OF

SOUTH AFRICA OR ANY OTHER JURISDICTION IN WHICH SUCH RELEASE,

PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL.

FURTHER, THIS ANNOUNCEMENT IS MADE FOR INFORMATION PURPOSES ONLY

AND DOES NOT CONSTITUTE AN OFFER TO SELL OR ISSUE OR SOLICITATION

TO BUY, SUBSCRIBE FOR OR OTHERWISE ACQUIRE SHARES IN SURFACE

TRANSFORMS PLC IN ANY JURISDICTION IN WHICH ANY SUCH OFFER OR

SOLICITATION WOULD BE UNLAWFUL.

Surface Transforms plc

("Surface Transforms " or the "Company ")

Placing raising GBP1.4 million

and

Open Offer to raise up to GBP0.3 million

Surface Transforms (AIM:SCE), manufacturers of carbon fibre

reinforced ceramic materials, is pleased to announce that Cantor

Fitzgerald Europe and finnCap Ltd, on behalf of the Company, have

successfully placed 10,806,995 new ordinary shares of 1p each in

the Company ("Ordinary Shares") (the "Placing Shares") at a price

of 13.0 pence per share (the "Issue Price"), raising gross proceeds

of approximately GBP 1.4 million pursuant to its existing authority

to issue equity for cash (the "Placing"), conditional on admission

of the Placing Shares to trading on AIM ("Placing Admission").

Cantor Fitzgerald is acting as Nominated Adviser and Joint

Broker and finnCap is acting as Joint Broker in connection with the

Placing.

In addition to the Placing, the Company intends to provide all

Qualifying Shareholders with the opportunity to subscribe for an

aggregate of up to 2,307,692 new Ordinary Shares (the "Open Offer

Shares") at the Issue Price of 13.0 pence per share, to raise up to

approximately GBP 0.3 million (before expenses), on the basis of 1

New Ordinary Share for every 58.97624813 Existing Ordinary Shares

held on the Record Date (the "Open Offer" together with the

Placing, the "Fundraising"). Shareholders subscribing for their

full entitlement under the Open Offer may also request additional

Open Offer Shares through the Excess Application Facility.

The Issue Price represents a discount of approximately 16 per

cent. to the price of 15.5 pence per existing Ordinary Share, being

the Closing Price on 8 April 2020.

Use of proceeds and reasons for the Fundraising

The net proceeds of the Placing will provide Surface Transforms

with sufficient working capital to enable it to continue operating

should COVID-19 impact the business in a material manner. The Board

has modelled various scenarios and a working capital buffer of

GBP1.3 million is sufficient even were forecast revenues to fall

approximately 50 per cent. to GBP1.6 million for the year ending 31

December 2020.

As set out in the Company's COVID-19 Update on 27 March 2020,

the Company remains operational and is manufacturing brake discs

with sufficient raw material and component inventory to continue to

do so for some months. Since the start of the year, the Company has

not yet received any cancellations or OEM deferments of

pre-contracted purchases.

In addition, the Company is extremely pleased with recent

discussions and progress made with other new OEMs as part of its

prospective contract pipeline of GBP50 million per annum during the

next five years. Since the start of the financial year, no new

nominations have been made but should one or more be awarded to

Surface Transforms, they would likely be material.

However, given the rapid and continuing spread of COVID-19,

together with the various government mitigating actions across the

globe, there can be no guarantee that future expected orders will

not be deferred or cancelled, and furthermore, currently contracted

start-of-production (SOP) dates of new OEM vehicles, could be

delayed. The Board has responded quickly to the challenges of the

COVID-19 outbreak, implementing various cash retention initiatives

including:

- Furloughing approximately 50% of the Company's employees to

reduce the Company's short-term operational cost base;

- A review of the Company's operational cost base implementing

some further variable cost reductions and payment holidays;

- Executive director remuneration being reduced by 10% for not

less than 6 months, and the non-executive directors' remuneration

being reduced by 20% for not less than 3 months;

- Cancellation of the bonus scheme for executive directors and

the senior management team for the current financial year;

- Delaying any non-essential capital expenditure; and

- Ceasing any non-essential other expenditure.

The Company has also applied for a Coronavirus Business

Interruption Loan ("CBIL") but does not yet know whether their

application has been successful. Even if the application is

successful, there can be no guarantee that the full amount of the

loan applied for will be awarded. However, given the various

actions taken and being taken by the Board, the Board is confident

the Company will have sufficient working capital to navigate a

significant reduction in revenues, even if the CBIL application is

unsuccessful.

The Placing will enable the Company to focus on fulfilling its

existing customer contracts and being nominated on new OEM cars

without distractions on the financial health of the business.

Whilst a substantial proportion of the Company's employees are

being temporarily furloughed, the Board believe that the remaining

team will be able to continue to meet the key milestones as set out

in the existing OEM long-term contracts.

The remaining group of non-furloughed senior management,

engineers and developers can continue progressing all existing

engineering on the Company's other new OEMs as part of its

prospective contract pipeline; were a greater number of staff

furloughed, the Board consider there would be a risk that current

discussions and activity with other new OEMs would curtail

considerably.

Related Party Transactions

Canaccord Genuity Wealth Management Limited, as a substantial

shareholder of the Company, is subscribing for 4,153,845 Placing

Shares, which constitutes a related party transaction under the AIM

Rules for Companies.

Mr. Richard Sneller, as a substantial shareholder of the

Company, is subscribing for 3,076,923 Placing Shares, which

constitutes a related party transaction under the AIM Rules for

Companies.

David Bundred, Richard Gledhill and Kevin D'Silva, all of whom

are directors of the Company ("Directors"), have confirmed they are

subscribing for in aggregate 1,346,153 Placing Shares, whilst Kevin

Johnson has undertaken to apply for 192,308 Open Offer Shares (the

"Directors' Participation"), which constitutes a related party

transaction under the AIM Rules for Companies.

Accordingly, only Michael Cunningham is considered to be an

independent director of the Company for the purposes of AIM Rule

13. Having consulted with the Company's nominated adviser, Michael

Cunningham considers that the terms of the Directors' Participation

as well as the participation by Canaccord Genuity Wealth Management

Limited and, Mr. Richard Sneller are fair and reasonable insofar as

shareholders are concerned.

The Directors' interests as at today and following completion of

the Fundraising are as follows:

Existing Interest Open Offer Interest

beneficial Placing in Ordinary Shares in Ordinary

interest Shares Shares after to be Shares

in Ordinary subscribed Placing applied after Open

Director Shares % for Admission % for Offer Admission(3) %(3)

David

Bundred 894,641 0.66% 115,384 1,010,025 0.69% - 1,010,025 0.68%

Kevin

Johnson 799,000 0.59% - 799,000 0.54% 192,308 991,308 0.66%

Richard

Gledhill(1) 13,431,755 9.88% 1,153,846 14,585,601 9.93% - 14,585,601 9.77%

Kevin

D'Silva(2) 1,129,295 0.83% 76,923 1,206,218 0.82% - 1,206,218 0.81%

Michael

Cunningham 100,000 0.07% - 100,000 0.07% - 100,000 0.07%

(1) Held as to 10,341,433 Ordinary Shares through his investment

vehicle Group-14 LTD

(2) Held in his SIPPs.

(3) Assuming Open Offer applications in total for the full

number of Open Offer Shares available

Admission and Total Voting Rights

The Placing Shares will, when issued, rank pari passu in all

respects with the existing Ordinary Shares of the Company.

Application will be been made for the 10,806,995 Placing Shares to

be admitted to trading on AIM and accordingly dealings are expected

to commence at 8.00 a.m. on 17 April 2020. Following Placing

Admission, the total number of voting rights in the Company will be

146,906,011 and shareholders may use this figure as the denominator

for the calculations by which they will determine if they are

required to notify their interest in, or a change to their interest

in, the Company under the FCA's Disclosure Guidance and

Transparency Rules.

Any Open Offer Shares subscribed for under the Open Offer are

expected to be admitted to trading on AIM on 4 May 2020 in

accordance with the timetable set out in this Announcement . A

further announcement in respect of the Open Offer Admission will be

made in due course.

Open Offer and posting of Circular

Alongside the Placing, the Company is pleased to announce that

it is also providing the opportunity for Qualifying Shareholders to

participate in the Open Offer to raise up to approximately GBP0.3

million gross of expenses. The circular setting out full details of

the Open Offer ("Circular") will be made available on the Company's

website at www.surfacetransforms.com and posted to shareholders on

14 April 2020.

The proposed Issue Price of 13.0 pence per Open Offer Share is

the same price as the price at which the Placing Shares are being

issued pursuant to the Placing.

Qualifying Shareholders may subscribe for Open Offer Shares in

proportion to their holding of Existing Ordinary Shares held on 8

April 2020 (the "Record Date"). Shareholders subscribing for their

full entitlement under the Open Offer may also request additional

Open Offer Shares as an Excess Entitlement, up to the total number

of Open Offer Shares available to Qualifying Shareholders under the

Open Offer.

The issue and allotment of the Open Offer Shares will not exceed

the Company's existing authorities and therefore does not require

Shareholder approval.

The Open Offer is conditional, amongst other things, on the

following:

i. completion of the Placing;

ii. the Placing Agreement not being terminated prior to Placing

Admission and becoming and being declared otherwise unconditional

in all respects; and

iii. Open Offer Admission becoming effective on or before 8.00

a.m. on 4 May 2020 (or such later date and/or time as the Company,

Cantor Fitzgerald and finnCap may agree, being no later than 15 May

2020).

Open Offer Entitlement

On, and subject to the terms and conditions of the Open Offer,

the Company invites Qualifying Shareholders to apply for their Open

Offer Entitlement of Open Offer Shares at the Issue Price. Each

Qualifying Shareholder's Open Offer Entitlement has been calculated

on the following basis:

1 Open Offer Share for every 58.97624813 Existing Ordinary

Shares held at the Record Date

Open Offer Entitlements will be rounded down to the nearest

whole number of Ordinary Shares.

Excess Application Facility

Qualifying Shareholders are also invited to apply for additional

Open Offer Shares (up to the total number of Open Offer Shares

available to Qualifying Shareholders under the Open Offer) pursuant

to an Excess Application Facility. Any Open Offer Shares not issued

to a Qualifying Shareholder pursuant to their Open Offer

Entitlement will be apportioned between those Qualifying

Shareholders who have applied under the Excess Application Facility

at the sole discretion of the Board, provided that no Qualifying

Shareholder shall be required to subscribe for more Open Offer

Shares than he or she has specified on the Application Form or

through CREST.

The Open Offer Shares will, when issued and fully paid, rank

pari passu in all respects with the Ordinary Shares in issue at

that time, including the right to receive all dividends and other

distributions declared, made or paid after the date of Open Offer

Admission.

Qualifying Shareholders should note that the Open Offer is not a

"rights issue". Invitations to apply under the Open Offer are not

transferable unless to satisfy bona fide market claims. Qualifying

non-CREST Shareholders should be aware that the Application Form is

not a negotiable document and cannot be traded. Qualifying

Shareholders should also be aware that in the Open Offer, unlike in

a rights issue, any Open Offer Shares not applied for will not be

sold in the market nor will they be placed for the benefit of

Qualifying Shareholders who do not apply for Open Offer Shares

under the Open Offer.

Settlement and dealings

Application will be made to the London Stock Exchange for Open

Offer Admission of the Open Offer Shares. It is expected that such

Open Offer Admission will become effective and that dealings will

commence at 8.00 a.m. on 4 May 2020.

Overseas Shareholders

The Open Offer Shares have not been and are not intended to be

registered or qualified for sale in any jurisdiction other than the

United Kingdom. Accordingly, unless otherwise determined by the

Company and effected by the Company in a lawful manner, the

Application Form will not be sent to Shareholders with registered

addresses in any jurisdiction other than the United Kingdom since

to do so would require compliance with the relevant securities laws

of that jurisdiction. The Company reserves the right to treat as

invalid any application or purported application for Open Offer

Shares which appears to the Company or its agents or professional

advisers to have been executed, effected or despatched in a manner

which may involve a breach of the laws or regulations of any

jurisdiction or if the Company or its agents or professional

advisers believe that the same may violate applicable legal or

regulatory requirements or if it provides an address for delivery

of share certificates for Open Offer Shares, or in the case of a

credit of Open Offer Shares in CREST, to a CREST member whose

registered address would not be in the UK.

Notwithstanding the foregoing and any other provision of the

Circular or the Application Form, the Company reserves the right to

permit any Qualifying Shareholder to apply for Open Offer Shares if

the Company, in its sole and absolute discretion, is satisfied that

the transaction in question is exempt from, or not subject to, the

legislation or regulations giving rise to the restrictions in

question.

This Announcement and the Circular together with the

accompanying Application Form, in the case of Qualifying non-CREST

Shareholders, contains the terms and conditions of the Open

Offer.

If a Qualifying Shareholder does not wish to apply for Open

Offer Shares he should not complete or return the Application Form

or send a USE message through CREST.

Qualifying non-CREST Shareholders

If you are a Qualifying non-CREST Shareholder you will receive

an Application Form which gives details of your Open Offer

Entitlement (as shown by the number of the Open Offer Shares

allocated to you). If you wish to apply for Open Offer Shares under

the Open Offer you should complete the Application Form in

accordance with the procedure for application set out in the

Circular and on the Application Form itself. The completed

Application Form, accompanied by full payment, should be returned

by post to Link Asset Services, Corporate Actions, The Registry, 34

Beckenham Road, Beckenham, Kent, BR3 4TU so as to arrive as soon as

possible and in any event no later than 11.00 a.m. on 30 April

2020.

Qualifying CREST Shareholders

Application will be made for the Open Offer Shares of Qualifying

CREST Shareholders to be admitted to CREST. It is expected that the

Open Offer Shares will be admitted to CREST on 4 May 2020.

Applications through the CREST system may only be made by the

Qualifying CREST Shareholder originally entitled or by a person

entitled by virtue of a bona fide market claim. If you are a

Qualifying CREST Shareholder, no Application Form will be sent to

you but you will receive credits to your appropriate stock account

in CREST in respect of your Open Offer Entitlements. You should

refer to the procedure for application set out in the Circular. The

relevant CREST instruction must have settled by no later than 11.00

a.m. on 30 April 2020.

Action to be taken

Open Offer

Qualifying non-CREST Shareholders wishing to apply for Open

Offer Shares must complete the Application Form in accordance with

the instructions set out in the Circular (Terms and Conditions of

the Open Offer) and on the Application Form and return it with the

appropriate payment to Link Asset Services, Corporate Actions, The

Registry, 34 Beckenham Road, Beckenham, Kent, BR3 4TU, so as to

arrive no later than 11.00 a.m. on 30 April 2020.

If you do not wish to apply for any Open Offer Shares under the

Open Offer, you should not complete or return the Application Form.

If you are a Qualifying CREST Shareholder, no Application Form will

be sent to you. Qualifying CREST Shareholders will have Open Offer

Entitlements and Excess CREST Open Offer Entitlements credited to

their stock accounts in CREST. You should refer to the procedure

for application set out in the Circular (Terms and Conditions of

the Open Offer). The relevant CREST instructions must have settled

in accordance with the instructions in the Circular by no later

than 11.00 a.m. on 30 April 2020.

Qualifying CREST Shareholders who are CREST sponsored members

should refer to their CREST sponsors regarding the action to be

taken in connection with this Announcement, the Circular and the

Open Offer.

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

Record Date for the Open Offer Close of Business on 8 April

2020

Announcement of the Placing and 9 A pril 2020

Open Offer

Publication of Circular and Application 14 April 2020

Form

Ex entitlement date for the Open 8.00 a.m. on 1 5 April

Offer 2020

Open Offer Entitlements and Excess as soon as possible after

CREST Open Offer Entitlements credited 8.00 a.m. on 16 April 2020

to stock accounts of Qualifying

CREST Shareholders

Placing Admission and commencement 8 .00 a.m. on 17 April

of dealings in Placing Shares commence 2020

Recommended latest time for requesting 4.30 p.m. on 24 April 2020

withdrawal of Open Offer Entitlements

and Excess CREST Open Offer Entitlements

from CREST

Latest time for depositing Open 3.00 p.m. on 27 April 2020

Offer Entitlements and Excess CREST

Open Offer Entitlements in to CREST

Latest time and date for splitting 3.00 p.m. on 28 April 2020

of Application Forms (to satisfy

bona fide market claims only)

Latest time and date for receipt 11.00 a.m. on 30 April 2020

of completed Application Forms and

payment in full under the Open Offer

and settlement of relevant CREST

instructions (as appropriate)

Announce result of Open Offer 30 April 2020

Open Offer Admission and commencement 8.00 a.m. on 4 May 2020

of dealings in O pen Offer Shares

commence

CREST members' accounts credited as soon as possible after

in respect of Open Offer Shares 8.00 a.m. on 4 May 2020

in uncertificated form

Dispatch of definitive share certificates 11 May 2020

for the Open Offer Shares in certificates

form

David Bundred, Chairman of Surface Transforms, commented:

"The Fundraising provides the Company with sufficient working

capital to withstand a number of downside scenarios we have

modelled regarding disruptions resulting from COVID-19. The

strengthened balance sheet de-risks the business, and comes at an

exciting time in the Company's development."

"We are pleased that current shareholders continue to support

our strategy to become a series production supplier of carbon

ceramic brake discs to the larger volume OEM automotive

market."

For further information, please contact:

Surface Transforms plc

Kevin Johnson, CEO +44 151 356 2141

Michael Cunningham CFO

David Bundred, Chairman

Cantor Fitzgerald Europe (Nomad & Joint Broker)

David Foreman, Michael Boot, Adam Dawes (Corporate Finance) +44

20 7894 7000

Caspar Shand Kydd, Maisie Atkinson (Sales)

finnCap Ltd (Joint Broker)

Richard Chambers (ECM) +44 20 7220 0500

Ed Frisby, Giles Rolls (Corporate Finance)

David Bundred - PDMR Notification Form

Notification of a Transaction pursuant to Article 19(1) of Regulation

(EU) No. 596/2014

1 Details of the person discharging managerial responsibilities/person

closely associated

-------------------------------------------------------------------------------

a. Name David Bundred

------------------------------------------ -----------------------------------

2 Reason for notification

------------------------------------------ -----------------------------------

a. Position/Status Non-Executive Chairman

------------------------------------------ -----------------------------------

b. Initial notification/ Initial Notification

Amendment

------------------------------------------ -----------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-------------------------------------------------------------------------------

a. Name Surface Transforms plc

------------------------------------------ -----------------------------------

b. LEI 213800GQHNJPE5O8XO79

------------------------------------------ -----------------------------------

4 Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions have

been conducted

-------------------------------------------------------------------------------

a. Description of Ordinary Shares of 1p each

the financial

instrument, type GB0002892528

of instrument

Identification

Code

------------------------------------------ -----------------------------------

b. Nature of the Purchase of ordinary shares

transaction

------------------------------------------ -----------------------------------

c. Price(s) and volume(s) Price(s) Volume(s)

------------------------------------------ --------------- --------------

GBP0.13 115,384

----------------------------------------------------------------- --------------

d. Aggregated information

- Aggregated Volume 115,384

- Price GBP 0.13

------------------------------------------ -----------------------------------

e. Date of the transaction 15 April 2020

------------------------------------------ -----------------------------------

f. Place of the transaction AIM

------------------------------------------ -----------------------------------

Richard Gledhill- PDMR Notification Form

Notification of a Transaction pursuant to Article 19(1) of Regulation

(EU) No. 596/2014

1 Details of the person discharging managerial responsibilities/person

closely associated

-------------------------------------------------------------------------------

a. Name Richard Gledhill

------------------------------------------ -----------------------------------

2 Reason for notification

------------------------------------------ -----------------------------------

a. Position/Status Non-Executive Director

------------------------------------------ -----------------------------------

b. Initial notification/ Initial Notification

Amendment

------------------------------------------ -----------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-------------------------------------------------------------------------------

a. Name Surface Transforms plc

------------------------------------------ -----------------------------------

b. LEI 213800GQHNJPE5O8XO79

------------------------------------------ -----------------------------------

4 Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions have

been conducted

-------------------------------------------------------------------------------

a. Description of Ordinary Shares of 1p each

the financial

instrument, type GB0002892528

of instrument

Identification

Code

------------------------------------------ -----------------------------------

b. Nature of the Purchase of ordinary shares

transaction

------------------------------------------ -----------------------------------

c. Price(s) and volume(s) Price(s) Volume(s)

------------------------------------------ --------------- --------------

GBP0.13 1,153,846

----------------------------------------------------------------- --------------

d. Aggregated information

- Aggregated Volume 1,153,846

- Price GBP0.13

------------------------------------------ -----------------------------------

e. Date of the transaction 15 April 2020

------------------------------------------ -----------------------------------

f. Place of the transaction AIM

------------------------------------------ -----------------------------------

Kevin D'Silva - PDMR Notification Form

Notification of a Transaction pursuant to Article 19(1) of Regulation

(EU) No. 596/2014

1 Details of the person discharging managerial responsibilities/person

closely associated

-------------------------------------------------------------------------------

a. Name Kevin D'Silva

------------------------------------------ -----------------------------------

2 Reason for notification

------------------------------------------ -----------------------------------

a. Position/Status Non-Executive Director

------------------------------------------ -----------------------------------

b. Initial notification/ Initial Notification

Amendment

------------------------------------------ -----------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-------------------------------------------------------------------------------

a. Name Surface Transforms plc

------------------------------------------ -----------------------------------

b. LEI 213800GQHNJPE5O8XO79

------------------------------------------ -----------------------------------

4 Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions have

been conducted

-------------------------------------------------------------------------------

a. Description of Ordinary Shares of 1p each

the financial

instrument, type GB0002892528

of instrument

Identification

Code

------------------------------------------ -----------------------------------

b. Nature of the Purchase of ordinary shares

transaction

------------------------------------------ -----------------------------------

c. Price(s) and volume(s) Price(s) Volume(s)

------------------------------------------ --------------- --------------

GBP0.13 76,923

----------------------------------------------------------------- --------------

d. Aggregated information

- Aggregated Volume 76,923

- Price GBP0.13

------------------------------------------ -----------------------------------

e. Date of the transaction 15 April 2020

------------------------------------------ -----------------------------------

f. Place of the transaction AIM

------------------------------------------ -----------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IOESSIFDUESSEIL

(END) Dow Jones Newswires

April 09, 2020 10:00 ET (14:00 GMT)

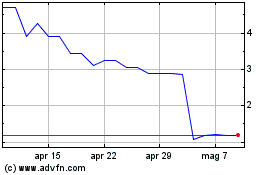

Grafico Azioni Surface Transforms (LSE:SCE)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Surface Transforms (LSE:SCE)

Storico

Da Apr 2023 a Apr 2024