TIDMSCE

RNS Number : 2934M

Surface Transforms PLC

20 January 2021

20 January 2021

THIS ANNOUNCEMENT, AND THE INFORMATION CONTAINED HEREIN, IS NOT

FOR PUBLICATION, RELEASE OR DISTRIBUTION, DIRECTLY OR INDIRECTLY,

IN WHOLE OR IN PART, IN OR INTO OR FROM THE UNITED STATES,

AUSTRALIA, NEW ZEALAND, CANADA, JAPAN, THE REPUBLIC OF SOUTH AFRICA

OR ANY OTHER JURISDICTION IN WHICH IT WOULD BE UNLAWFUL TO DO

SO.

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED BY

THE COMPANY TO CONSTITUTE INSIDE INFORMATION STIPULATED UNDER THE

MARKET ABUSE REGULATION (EU) NO. 596/2014 ("MAR"). UPON THE

PUBLICATION OF THIS ANNOUNCEMENT VIA THE REGULATORY INFORMATION

SERVICE, THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE IN THE

PUBLIC DOMAIN.

Surface Transforms plc.

("Surface Transforms" or the "Company")

Result of Placing and Subscription

and proposed Open Offer

Notice of General Meeting

Surface Transforms (AIM: SCE), manufacturers of carbon fibre

reinforced ceramic automotive brake discs, is pleased to announce

that further to the Company's announcement released at

approximately 5.30 p.m. on 19 January 2021 ("Launch Announcement"),

the Bookbuild has closed and the Company has conditionally raised

gross proceeds of GBP18.0 million, through the successful placing

of 35,750,000 Placing Shares and 250,000 Subscription Shares at the

Issue Price of 50 pence per Ordinary Share.

The Placing Shares and Subscription Shares represent

approximately 23.2 per cent. of the Company's Existing Ordinary

Shares. The Issue Price represents a discount of approximately 5.7%

to the closing price on 5 January 2021 following the Company's

Trading Update announced on that date, and 11.0 per cent. to the

volume weighted average price of 56.3263 pence per Ordinary Share

for the period from 5 to 19 January 2021 being the period following

the Company's last Trading Update to the date of the Launch

Announcement. The Issue Price also represents a discount of

approximately 17.0 per cent. to the closing mid-market price per

Ordinary Share of 60.5 pence on 19 January, being the date of the

Launch Announcement.

In addition to the Placing and Subscription, the Company intends

to provide all Qualifying Shareholders with the opportunity to

subscribe for an aggregate of up to 4,000,000 Open Offer Shares at

the Issue Price, to raise up to approximately GBP 2.0 million

(before expenses), on the basis of 1 Open Offer Share for every

38.72957975 Existing Ordinary Shares held on the Record Date.

Qualifying Shareholders subscribing for their full entitlement

under the Open Offer may also request additional Open Offer Shares

through an excess application facility (the "Excess Application

Facility").

The Placing, Subscription and Open Offer are conditional upon,

inter alia, the passing of the Resolutions at the General Meeting

and upon the Placing Agreement becoming unconditional in all

respects. The Placing is not conditional on the Open Offer

proceeding or on any minimum take-up under the Open Offer.

David Bundred, Chairman of Surface Transforms commented:

"We are delighted with the success of this Placing which now

enables us to proceed with building OEM Production Cell Two and

thus removing this impediment in winning target business with OEM 8

and OEM 9. In addition, it is most encouraging to welcome a number

of new institutional investors, as well as receiving significant

ongoing support from our existing institutional shareholders.

We are also pleased to be announcing the Open Offer, again

demonstrating our determination that our smaller, early stage,

retail investors should continue to have the opportunity to

participate in the increasing success of the Company as we

mature."

Reasons for the Fundraising and use of proceeds

As set out in the Launch Announcement, the Company is very

pleased with recent discussions and progress made with other new

OEMs to build upon its current contract expected revenue pipeline

of GBP43 million(1). Since the start of the financial year, no new

nominations have been made but should one or more be awarded to

Surface Transforms, the Board considers that they would likely be

material.

With regard to potential contracts, OEM 8 and OEM 9 operate

quite differently to Surface Transforms' other existing OEM

customers, including requiring a more compressed 12-15 month (not

24 month) period between contract award and start of production.

Given the compressed start of production timelines required by OEM

8 and OEM 9, the Board consider it sensible to build capacity ahead

of any such contract awards.

It is possible that neither OEM 8 nor OEM 9 will award any new

contract to the Company. However, continued progress with OEM 1,

OEM 3 (also covering OEM 4), OEM 6 and three new potential OEM

customers are progressing well with numerous new vehicle launches

being targeted for 2024. Indeed, the prospective contract pipeline

has the potential to utilise the entire production capacity of

Knowsley by 2024. Accordingly, the Board are confident that

production capacity of a new OEM Production Cell Two will be

required in due course, regardless of new contracts being awarded

by either or both OEM 8 or OEM 9 to the Company.

(1) This is based on the directors' expectations and their

understanding of the relevant OEM's production plan and estimated

demand for discs.

Use of proceeds

Net proceeds of the Placing and Subscription are circa GBP17.0

million. The construction cost of OEM Production Cell Two is

approximately GBP9.2 million. A further GBP0.7 million is to be

allocated for machinery improvements to OEM Production Cell

One.

Forecast increased production will require additional investment

in working capital. The balance of the net proceeds will therefore

be allocated for future general working capital requirements and

together with the Open Offer, to the extent it is taken up, provide

further working capital headroom, as well as the flexibility to

respond quickly to other opportunities or requirements that present

themselves, such as incremental capital expenditure improvements

and ad hoc projects.

Related Party Transactions

The Directors' interests as at today and following completion of

the Fundraising are as follows:

Interest%

Existing in Ordinary Open Offer

beneficial Subscription Shares Shares Interest

interest Shares after Placing to be in Ordinary

in Ordinary subscribed and Subscription applied Shares after

Director Shares % for Admission for Admission(4) % (4)

David Bundred

(1) 1,310,025 0.8% 50,000 1,360,025 0.7% - 1,360,025 0.7%

Kevin Johnson 991,308 0.6% - 991,308 0.5% - 991,308 0.5%

Richard Gledhill

(2) 14,813,346 9.6% 200,000 15,013,346 7.9% - 15,013,346 7.7%

Kevin D'Silva

(3) 1,260,315 0.8% - 1,260,315 0.7% - 1,260,315 0.6%

Michael Cunningham 120,000 0.1% - 120,000 0.1% - 120,000 0.1%

(1) Including 516,122 Ordinary Shares held in SIPPs of connected parties

(2) Held as to 11,670,628 Ordinary Shares through his investment vehicle Group-14 LTD

(3) Held in his SIPPs

(4) Assuming Open Offer applications in total for the full

number of Open Offer Shares available

David Bundred, Chairman of the Company and Richard Gledhill,

non-executive director of the Company, and/or persons connected

with each of them have conditionally subscribed for an aggregate of

250,000 Subscription Shares, which constitutes a related party

transaction under the AIM Rules.

Mr. Richard Sneller, as a substantial shareholder of the

Company, is subscribing for 4,133,786 Placing Shares, which

constitutes a related party transaction under the AIM Rules for

Companies.

Unicorn Asset Management Limited, as a substantial shareholder

of the Company, is subscribing for 1,035,715 Placing Shares, which

constitutes a related party transaction under the AIM Rules for

Companies.

Canaccord Genuity Wealth Management Limited, as a substantial

shareholder of the Company, is subscribing for 2,755,958 Placing

Shares, which constitutes a related party transaction under the AIM

Rules for Companies.

Accordingly, Kevin Johnson, Michael Cunningham and Kevin D'Silva

are considered to be independent directors of the Company for the

purposes of AIM Rule 13. Having consulted with the Company's

nominated adviser, Kevin Johnson, Michael Cunningham and Kevin

D'Silva consider that the terms of the Directors' Participation is

fair and reasonable insofar as Shareholders are concerned.

In the case of participation by Mr. Richard Sneller, Unicorn

Asset Management Limited and Canaccord Genuity Wealth Management

Limited, all the Directors are considered to be independent for the

purposes of AIM Rule 13. Having consulted with the Company's

nominated adviser, the Directors also consider that the terms of

the participation in the Placing by Mr. Richard Sneller, Unicorn

Asset Management Limited and Canaccord Genuity Wealth Management

Limited is fair and reasonable insofar as Shareholders are

concerned.

Posting of Circular

The Company will post a Circular to Shareholders later today,

containing a Notice of General Meeting, proxy form and full details

of the Open Offer including the Open Offer application form. The

Circular will also be available on the Company's website at

www.surfacetransforms.co.uk

Investor presentation

The Company will provide a live presentation to investors and

any other interested parties on via Hardman & Co's platform at

4:00 p.m. on 25 January 2021. Interested parties can register for

the presentation at

https://zoom.us/webinar/register/WN_7OKl7yGVTFaK-e_y89aTbg

Surface Transforms is committed to ensuring that there are

appropriate communication structures for all its Shareholders.

Questions can be submitted in advance as well as during the event

via the "Ask a Question" function. Although management may not be

in a position to answer every question received, they will address

the most prominent ones within the confines of information already

disclosed to the market. Responses to questions from the live

presentation will be published at the earliest opportunity on the

Company's website.

General Meeting

The Fundraising is conditional upon, inter alia, the passing of

the Resolutions. The General Meeting will be held at Image Business

Park, Acornfield Road, Knowsley Industrial Estate, Liverpool, L33

7UF at 10.00 a.m. on 8 February 2021.

Pursuant to the Stay at Home Order introduced by the UK

Government on 6 January 2021 to manage the Covid-19 virus

(coronavirus), public gatherings of more than two people and

non-essential travel are currently prohibited. The Company will

therefore convene the General Meeting with the minimum quorum of

two Shareholders necessary to conduct the meeting, being the

Company's Chief Executive, Kevin Johnson (acting as Chairman) and

the Company's Finance Director, Michael Cunningham. All other

Shareholders must not seek to attend the General Meeting in

person.

Irrevocable commitments

The Directors (or persons connected with the Directors within

the meaning of sections 252 - 255 of the Act), who in aggregate

hold 18,494,994 Ordinary Shares, representing approximately 11.9

per cent. of the Existing Ordinary Shares of the Company, have

irrevocably undertaken to vote in favour of the Resolutions at the

General Meeting and not to subscribe for any of the Open Offer

Shares.

Expected timetable of principal events

Record Date for the Open Offer Close of Business on 19

January 2021

Publication of Circular and Application 20 January 2021

Form

Ex entitlement date for the Open 8.00 a.m. on 21 January

Offer 2021

Open Offer Entitlements and Excess as soon as possible after

CREST Open Offer Entitlements credited 8.00 a.m. on 21 January

to stock accounts of Qualifying CREST 2021

Shareholders

Recommended latest time for requesting 4.30 p.m. on 1 February

withdrawal of Open Offer Entitlements 2021

and Excess CREST Open Offer Entitlements

from CREST

Latest time for depositing Open Offer 3.00 p.m. on 2 February

Entitlements and Excess CREST Open 2021

Offer Entitlements in to CREST

Latest time and date for splitting 3.00 p.m. on 3 February

of Application Forms (to satisfy 2021

bona fide market claims only)

Latest time and date for receipt 10:00 a.m. on 4 February

of proxy forms for General Meeting 2021

Latest time and date for receipt 11.00 a.m. on 5 February

of completed Application Forms and 2021

payment in full under the Open Offer

and settlement of relevant

CREST instructions (as appropriate)

Announce result of Open Offer by 8 February 2021

General Meeting 10:00 a.m. on 8 February

2021

First Admission and commencement 8.00 a.m. on 9 February

of dealings in EIS/VCT Placing Shares 2021

CREST members' accounts credited as soon as possible after

in respect of EIS/VCT Placing Shares 8.00 a.m. on 9 February

in uncertificated form 2021

Second Admission and commencement 8.00 a.m. on 10 February

of dealings in Placing Shares (excluding 2021

EIS/VCT Placing Shares), Subscription

Shares and Open Offer Shares

CREST members' accounts credited as soon as possible after

in respect of Placing Shares (excluding 8.00 a.m. on 10 February

EIS/VCT Placing Shares), Subscription 2021

Shares and Open Offer Shares in uncertificated

form

Dispatch of definitive share certificates 17 February 2021

for the Open Offer Shares in certificated

form

Open Offer

In order to provide all Qualifying Shareholders with an

opportunity to participate, the Company is conducting an Open Offer

providing those shareholders the opportunity to subscribe at the

Issue Price for an aggregate of 4,000,000 Open Offer Shares. This

allows Qualifying Shareholders to participate on a pre-emptive

basis whilst providing the Company with the flexibility to raise

additional equity capital to further improve its financial

position.

Qualifying Shareholders are being offered the opportunity to

apply for additional Open Offer Shares in excess of their pro rata

entitlements to the extent that other Qualifying Shareholders do

not take up their entitlements in full. Qualifying Shareholders

with nil basic entitlement will still be eligible to apply for Open

Offer Shares under the Excess Application Facility. In the event

applications exceed the maximum number of Open Offer Shares

available, the Company will decide on the basis for allocation. The

Open Offer Shares will not be placed subject to clawback nor have

they been underwritten. Consequently, there may be fewer than

4,000,000 Open Offer Shares issued pursuant to the Open Offer.

The Directors believe that upon First Admission, the gross

assets of the Company will exceed the maximum limit set out within

the qualifying rules for EIS and VCT. Accordingly, the Open Offer

Shares will not rank as "eligible shares" for the purposes of EIS,

nor will they be capable of being a "qualifying holding" for the

purposes of investment by VCTs.

The Open Offer is conditional, amongst other things, on the

following:

i. approval of the Resolutions at the General Meeting;

ii. completion of the Placing;

iii. the Placing Agreement not being terminated prior to Second

Admission and becoming and being declared otherwise unconditional

in all respects; and

iv. Second Admission becoming effective on or before 8.00 a.m.

on 10 February 2021 (or such later date and/or time as the Company,

Zeus Capital and finnCap may agree, being no later than 26 February

2021).

Open Offer Entitlement

On, and subject to the terms and conditions of the Open Offer,

the Company invites Qualifying Shareholders to apply for their Open

Offer Entitlement of Open Offer Shares at the Issue Price. Each

Qualifying Shareholder's Open Offer Entitlement has been calculated

on the following basis:

1 Open Offer Share for every 38.72957975 Existing Ordinary Shares held at the Record Date

Open Offer Entitlements will be rounded down to the nearest

whole number of Ordinary Shares.

Excess Application Facility

Qualifying Shareholders are also invited to apply for additional

Open Offer Shares (up to the total number of Open Offer Shares

available to Qualifying Shareholders under the Open Offer) pursuant

to an Excess Application Facility. Any Open Offer Shares not issued

to a Qualifying Shareholder pursuant to their Open Offer

Entitlement will be apportioned between those Qualifying

Shareholders who have applied under the Excess Application Facility

at the sole discretion of the Board, provided that no Qualifying

Shareholder shall be required to subscribe for more Open Offer

Shares than he or she has specified on the Application Form or

through CREST. Qualifying Shareholders with nil basic entitlement

will still be eligible to apply for Open Offer Shares under the

Excess Application Facility.

The Open Offer Shares will, when issued and fully paid, rank

pari passu in all respects with the Ordinary Shares in issue at

that time, including the right to receive all dividends and other

distributions declared, made or paid after the date of Second

Admission.

Qualifying Shareholders should note that the Open Offer is not a

"rights issue". Invitations to apply under the Open Offer are not

transferable unless to satisfy bona fide market claims. Qualifying

non-CREST Shareholders should be aware that the Application Form is

not a negotiable document and cannot be traded. Qualifying

Shareholders should also be aware that in the Open Offer, unlike in

a rights issue, any Open Offer Shares not applied for will not be

sold in the market nor will they be placed for the benefit of

Qualifying Shareholders who do not apply for Open Offer Shares

under the Open Offer.

Settlement and dealings

Application will be made to the London Stock Exchange for

admission of the Open Offer Shares. It is expected that Second

Admission will become effective and that dealings will commence at

8.00 a.m. on 10 February 2021.

Overseas Shareholders

The Open Offer Shares have not been and are not intended to be

registered or qualified for sale in any jurisdiction other than the

United Kingdom. Accordingly, unless otherwise determined by the

Company and effected by the Company in a lawful manner, the

Application Form will not be sent to Shareholders with registered

addresses in any jurisdiction other than the United Kingdom since

to do so would require compliance with the relevant securities laws

of that jurisdiction. The Company reserves the right to treat as

invalid any application or purported application for Open Offer

Shares which appears to the Company or its agents or professional

advisers to have been executed, effected or despatched in a manner

which may involve a breach of the laws or regulations of any

jurisdiction or if the Company or its agents or professional

advisers believe that the same may violate applicable legal or

regulatory requirements or if it provides an address for delivery

of share certificates for Open Offer Shares, or in the case of a

credit of Open Offer Shares in CREST, to a CREST member whose

registered address would not be in the UK.

Notwithstanding the foregoing and any other provision of the

Circular or the Application Form, the Company reserves the right to

permit any Qualifying Shareholder to apply for Open Offer Shares if

the Company, in its sole and absolute discretion, is satisfied that

the transaction in question is exempt from, or not subject to, the

legislation or regulations giving rise to the restrictions in

question.

This Announcement and the Circular together with the

accompanying Application Form, in the case of Qualifying non-CREST

Shareholders, contains the terms and conditions of the Open

Offer.

If a Qualifying Shareholder does not wish to apply for Open

Offer Shares he should not complete or return the Application Form

or send a USE message through CREST.

Qualifying non-CREST Shareholders

If you are a Qualifying non-CREST Shareholder you will receive

an Application Form which gives details of your Open Offer

Entitlement (as shown by the number of the Open Offer Shares

allocated to you). If you wish to apply for Open Offer Shares under

the Open Offer you should complete the Application Form in

accordance with the procedure for application set out in the

Circular and on the Application Form itself. The completed

Application Form, accompanied by full payment, should be returned

by post to Link Group, Corporate Actions, The Registry, 34

Beckenham Road, Beckenham, Kent, BR3 4TU so as to arrive as soon as

possible and in any event no later than 11.00 a.m. on 5 February

2021.

Qualifying CREST Shareholders

Application will be made for the Open Offer Shares of Qualifying

CREST Shareholders to be admitted to CREST. It is expected that the

Open Offer Shares will be admitted to CREST on 10 February 2021.

Applications through the CREST system may only be made by the

Qualifying CREST Shareholder originally entitled or by a person

entitled by virtue of a bona fide market claim. If you are a

Qualifying CREST Shareholder, no Application Form will be sent to

you but you will receive credits to your appropriate stock account

in CREST in respect of your Open Offer Entitlements. You should

refer to the procedure for application set out in the Circular. The

relevant CREST instruction must have settled by no later than 11.00

a.m. on 5 February 2021.

Action to be taken

Open Offer

Qualifying non-CREST Shareholders wishing to apply for Open

Offer Shares must complete the Application Form in accordance with

the instructions set out in the Circular (Terms and Conditions of

the Open Offer) and on the Application Form and return it with the

appropriate payment to Link Group, Corporate Actions, The Registry,

34 Beckenham Road, Beckenham, Kent, BR3 4TU, so as to arrive no

later than 11.00 a.m. on 5 February 2021.

If you do not wish to apply for any Open Offer Shares under the

Open Offer, you should not complete or return the Application Form.

If you are a Qualifying CREST Shareholder, no Application Form will

be sent to you. Qualifying CREST Shareholders will have Open Offer

Entitlements and Excess CREST Open Offer Entitlements credited to

their stock accounts in CREST. You should refer to the procedure

for application set out in the Circular (Terms and Conditions of

the Open Offer). The relevant CREST instructions must have settled

in accordance with the instructions in the Circular by no later

than 11.00 a.m. on 5 February 2021.

Qualifying CREST Shareholders who are CREST sponsored members

should refer to their CREST sponsors regarding the action to be

taken in connection with this Announcement, the Circular and the

Open Offer.

Important information

This Announcement is for information purposes only and does not

itself constitute an offer or invitation to underwrite, subscribe

for or otherwise acquire or dispose of any securities in the

Company and does not constitute investment advice.

Neither this Announcement nor any copy of it may be taken or

transmitted, published or distributed, directly or indirectly, in

or into the United States of America, its territories and

possessions, any state of the United States and the District of

Columbia (the "United States"), Australia, New Zealand, Canada,

Japan or the Republic of South Africa or to any persons in any of

those jurisdictions or any other jurisdiction where to do so would

constitute a violation of the relevant securities laws of such

jurisdiction. Any failure to comply with this restriction may

constitute a violation of the securities laws of the United States,

Australia, New Zealand, Canada, Japan or the Republic of South

Africa. The distribution of this Announcement in other

jurisdictions may be restricted by law and persons into whose

possession this Announcement comes should inform themselves about,

and observe any such restrictions.

Any failure to comply with these restrictions may constitute a

violation of the securities laws of any such jurisdiction. Neither

this Announcement nor any part of it nor the fact of its

distribution shall form the basis of or be relied on in connection

with or act as an inducement to enter into any contract or

commitment whatsoever.

In particular, the Placing Shares have not been and will not be

registered under the US Securities Act, or under the securities

laws or with any securities regulatory authority of any state or

other jurisdiction of the United States, and accordingly the

Placing Shares may not be offered, sold, pledged or transferred,

directly or indirectly, in, into or within the United States except

pursuant to an exemption from the registration requirements of the

US Securities Act and the securities laws of any relevant state or

other jurisdiction of the United States. There is no intention to

register any portion of the Placing in the United States or to

conduct a public offering of securities in the United States or

elsewhere.

Zeus Capital is authorised and regulated in the United Kingdom

by the FCA and is acting as nominated adviser and joint bookrunner

to the Company in respect of the Placing. finnCap Limited is

authorised and regulated in the United Kingdom by the FCA and is

acting as joint bookrunner to the Company in respect of the

Placing. Each of Zeus Capital and finnCap is acting for the Company

and for no-one else in connection with the Placing, and will not be

treating any other person as its client in relation thereto, and

will not be responsible for providing the regulatory protections

afforded to its customers nor for providing advice in connection

with the Placing or any other matters referred to herein and apart

from the responsibilities and liabilities (if any) imposed on Zeus

Capital or finnCap, as the case may be, by FSMA, any liability

therefor is expressly disclaimed. Any other person in receipt of

this Announcement should seek their own independent legal,

investment and tax advice as they see fit.

Forward-looking statements

This Announcement contains statements about the Group and the

Enlarged Group that are or may be deemed to be "forward-looking

statements".

All statements, other than statements of historical facts,

included in this Announcement may be forward-looking statements.

Without limitation, any statements preceded or followed by, or that

include, the words "targets", "plans", "believes", "expects",

"aims", "intends", "will", "may", "should", "anticipates",

"estimates", "projects", "would", "could", "continue" or words or

terms of similar substance or the negative thereof, are

forward-looking statements. Forward-looking statements include,

without limitation, statements relating to the following: (i)

future capital expenditures, expenses, revenues, earnings,

synergies, economic performance, indebtedness, financial condition,

dividend policy, losses and future prospects and (ii) business and

management strategies and the expansion and growth of the

operations of the Group and the Enlarged Group.

These forward-looking statements are not guarantees of future

performance. These forward-looking statements involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of any such person, or

industry results, to be materially different from any results,

performance or achievements expressed or implied by such

forward-looking statements. These forward-looking statements are

based on numerous assumptions regarding the present and future

business strategies of such persons and the environment in which

each will operate in the future. Investors should not place undue

reliance on such forward-looking statements and, save as is

required by law or regulation (including to meet the requirements

of the AIM Rules for Companies, the Prospectus Rules, the FSMA

and/or MAR), does not undertake any obligation to update publicly

or revise any forward-looking statements (including to reflect any

change in expectations with regard thereto or any change in events,

conditions or circumstances on which any such statement is based).

All subsequent oral or written forward-looking statements

attributed to the Company, the Group or any persons acting on

their behalf are expressly qualified in their entirety by the

cautionary statement above. All forward-looking statements

contained in this Announcement are based on information available

to the Directors of the Company at the date of this Announcement,

unless some other time is specified in relation to them, and the

posting or receipt of this Announcement shall not give rise to any

implication that there has been no change in the facts set forth

herein since such date.

T he person responsible for arranging the release of this

Announcement on behalf of the Company is Michael Cunningham,

Finance Director.

Unless expressly defined in this announcement, capitalised terms

shall have the meanings as defined in the Launch Announcement.

For further information, please contact:

Surface Transforms plc. +44 151 356 2141

David Bundred, Chairman

Kevin Johnson, CEO

Michael Cunningham, CFO

Zeus Capital Limited (Nominated Adviser and Joint Broker) +44 203 829 5000

David Foreman / Dan Bate/ Jordan Warburton (Corporate

Finance)

Dominic King (Corporate Broking)

finnCap Ltd (Joint-Broker) +44 20 7220 0500

Ed Frisby / Giles Rolls (Corporate Finance)

Richard Chambers (ECM)

For additional information please visit

www.surfacetransforms.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROIPPUAUGUPGURU

(END) Dow Jones Newswires

January 20, 2021 03:09 ET (08:09 GMT)

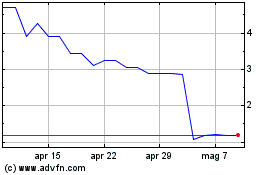

Grafico Azioni Surface Transforms (LSE:SCE)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Surface Transforms (LSE:SCE)

Storico

Da Apr 2023 a Apr 2024