TIDMTCAP

RNS Number : 5003A

TP ICAP PLC

29 September 2020

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

FOR IMMEDIATE RELEASE

29 September 2020

TP ICAP PLC

Discussions regarding the proposed acquisition of Liquidnet

TP ICAP plc ("TP ICAP" or the "Company" and, together with its

subsidiaries, the "Group") announces that it is in advanced

discussions relating to the proposed acquisition of the entire

issued share capital of Liquidnet Holdings, Inc. ("Liquidnet" and,

together with its subsidiaries and the Group, the "Enlarged Group")

for a total consideration of between US$600m and US$700m comprising

approximately US$550m upfront, deferred non-contingent

consideration of US$50m and an earn-out of up to US$100m (the

"Potential Acquisition").

Liquidnet is a premier brand, technology-driven, global

electronic trading network:

-- A trusted specialist in Equities dark trading, with a growing

Fixed Income presence and an advanced data science capability

within its Investment Analytics division;

-- Liquidnet's equity offering includes a leading agency-only

block trading platform that provides institutional investors with a

broad range of innovative execution solutions, algorithmic and

quantitative models, liquidity-sourcing techniques in both dark and

lit markets and advanced analytics to help maximise

performance;

-- Anchored by one of the world's largest pools of buyside

liquidity, Liquidnet operates across 45 markets worldwide via a

network of more than 1,000 asset management and hedge fund

clients(1) , who collectively manage US$33trn in equity and fixed

income assets(2) ;

-- Built over a 20-year period, Liquidnet's electronic trading

network is well embedded into institutional workflows, including

its signature institutional desktop trading applications and via

integrations with major order/execution management systems.

Strategic rationale

The Board of TP ICAP (the "Board") believes the strategic

rationale for the Potential Acquisition is built upon:

1) Global integrated buyside customer base and connectivity:

Liquidnet has been a trusted partner to buyside clients for two

decades, building up comprehensive workflow connectivity to a

network of more than 1,000 buyside institutions(1) . Liquidnet has

already proven its ability to leverage its network and

relationships to enter new market segments. Since 2015, when

Liquidnet launched its Fixed Income offering, it has built a

network of more than 500 active asset management clients(1) . TP

ICAP believes there is clear potential to build further,

complementing Liquidnet's strengths and shared unconflicted

agency-only model with its own product expertise, dealer

relationships, and connectivity;

2) Addressable growth opportunities, arising from the combined

strengths of Liquidnet and TP ICAP:

o Dealer-to-client ("D2C") Credit trading: The market structure

for trading Credit products has evolved significantly in recent

years, in response to changes in regulation and other market

trends. In particular, D2C electronic Credit trading has been

growing rapidly. Liquidnet has already built an impressive global

network of more than 500 buyside institutions(1) , with execution

protocols focussed mainly on large-size client-to-client trading of

corporate bonds. TP ICAP expects to use its Credit market

expertise, its established relationships with the global dealer

community, and Liquidnet's existing capabilities, to expand the

Liquidnet offering to include a range of D2C tools and protocols.

In a growing market segment, TP ICAP expects the Enlarged Group to

present a highly attractive offering to market participants;

o D2C Rates trading: In the Rates market, over-the-counter

("OTC") trading represents an increasing share of interest rate

derivative trading, and the rate of electronification in the D2C

segment is growing particularly rapidly. TP ICAP believes it can

create a powerful competitor in the growing D2C electronic trading

arena;

o Data & Analytics product and customer opportunities : TP

ICAP already offers market participants one of the largest and

richest OTC datasets available globally. Liquidnet's Investment

Analytics team and artificial intelligence and machine-learning

tools are expected to complement and enhance TP ICAP's product

development and service capabilities. TP ICAP's global sales team

expects to present useful tools and products (such as the recently

launched Bond Evaluated Pricing service) to the Liquidnet client

base, accelerating penetration of the buyside market for data and

analytics.

The Potential Acquisition would be expected to transform TP

ICAP's revenue growth profile, with almost half of the Enlarged

Group's revenue coming from higher-growth businesses and the

Enlarged Group's revenue growth profile expected to increase from

low single digit to mid-single digit over the medium-term.

Liquidnet would also be expected to contribute to a c.300bps

improvement in underlying operating margin, leading the Enlarged

Group to a 20%+ operating margin over the medium-term. In order to

achieve this margin improvement, TP ICAP expects a c.GBP25-30m

incremental investment spend on Liquidnet in the 12-24 months post

completion of the Potential Acquisition ("Completion"). Further,

based on TP ICAP's closing share price on the day prior to this

announcement(3) , the Potential Acquisition is expected to be

broadly earnings neutral in Year 2, and meaningfully accretive in

Year 3.

In the 12 months to 30 June 2020(4) , Liquidnet generated US$64m

(GBP50m) of adjusted EBITDA(5) on US$339m (GBP264m) of revenue.

Financing the Potential Acquisition

TP ICAP intends to fund the Potential Acquisition as

follows:

i. US$100m in cash to be paid on Completion, to be funded using

TP ICAP's existing debt facilities;

ii. Approximately US$450m in cash, to be funded by way of:

a. An initial 19.9% cashbox placing(6) on announcement of the

entry into the Potential Acquisition, to be paid to Liquidnet

stockholders on Completion; and

b. A further non-pre-emptive placing closer to or shortly after

Completion, but with the amount payable as consideration to be

adjusted for the performance of TP ICAP's shares between

announcement and Completion, to be paid shortly after

Completion;

iii. US$50m of senior unsecured loan notes issued on Completion

to certain stockholders in Liquidnet, repayable in cash on the

third anniversary of Completion; and

iv. An earn-out of up to a maximum of US$100m in cash, linked to

the cumulative revenues generated solely by Liquidnet's Equities

business in the three years ending 31 December 2023.

Conditions to Completion

The Potential Acquisition would be conditional upon, inter alia,

the approval of TP ICAP shareholders, completion of the previously

announced Redomiciliation (as defined below) and regulatory

clearances, as well as other customary conditions.

There can be no certainty that discussions between the Company

and Liquidnet will lead to any agreement nor can there be any

certainty as to the timing or terms of any transaction regarding

the Potential Acquisition. The terms of any transaction remain

subject to approval by the Board and the Board will only proceed

with a transaction in circumstances and on such terms it believes

align with TP ICAP's strategy and are determined by the Board to be

in the best interests of TP ICAP and its shareholders.

Dividends

The Board declared an interim dividend of 5.6 pence per share to

be paid on 6 November 2020 and, if the Potential Acquisition is

approved by shareholders, the Board intends to pay 50% of the

GBP94m dividend currently anticipated in respect of the year ending

31 December 2020. From the year ending 31 December 2021 onwards, TP

ICAP intends to target a dividend cover of approximately 2x

underlying earnings over the medium-term.

Current trading

As stated in the Group's interim results announcement, July

trading activity had slowed down and was materially lower than 2019

levels, in line with activity levels in the wider market.

Whilst September trading activity has started to normalise, in

order to deliver the Group's previously stated guidance of

low-single digit revenue growth in 2020 the Group remains reliant

on higher market volatility and trading activity in the fourth

quarter, which the Group expects will be driven in part by the US

elections.

Update on redomiciliation

On 23 December 2019, TP ICAP announced its intention to

reorganise the Group's international corporate structure by the

introduction of a new holding company in Jersey by means of a

Court-approved scheme of arrangement (the "Redomiciliation"). A

separate circular and prospectus in connection with the

Redomiciliation are expected to be published later this year. The

Redomiciliation is expected to complete in Q1 2021.

Notes

(1) As of Q2 2020

(2) As of 30 September 2018, excluding APAC

(3) TP ICAP closing share price of 278p, 28 September 2020

(4) US GAAP accounting standard. GBP:USD FX rate 1:1.284, 28

September 2020

(5) Adjusted EBITDA (non-GAAP metric) excludes equity based

compensation and other non-recurring fees totalling $17m

(6) Principal shareholders have been consulted in advance of

this announcement and the placing is expected to be made on a soft

pre-emptive basis

Enquiries

For further information, please contact:

TP ICAP plc

Al Alevizakos (Head of Investor

Relations) +44 (0) 799 991 2672

Richard Newman (Head of Marketing

&

Communications) +44 (0) 746 903 9307

William Baldwin-Charles (Director

of Media

Relations) +44 (0) 783 452 4833

Maitland/AMO (Financial PR)

Neil Bennett / Andy Donald +44 (0) 207 379 5151

The person responsible for arranging and authorising the release

of this announcement is Richard Cordeschi, Group Company Secretary

of TP ICAP.

Summary information on TP ICAP

TP ICAP brings together buyers and sellers in global financial,

energy and commodities markets. It is one of the world's largest

wholesale market intermediaries, with a portfolio of businesses

that provide broking services, data & analytics and market

intelligence, trusted by clients around the world. It operates from

offices in 26 countries, supporting award-winning brokers with

market-leading technology.

www.tpicap.com

Appendix I - Additional financial information on Liquidnet

$m 2018 2019 LTM Jun-20

============================== ===== ===== ==========

Operating Revenues 341.5 302.2 339.2

============================== ===== ===== ==========

Reported EBITDA 82.2 31.0 46.9

(+) Equity-based Compensation 7.7 8.3 14.6

(+) Dual Occupancy Expense 6.5 1.6 0.4

(+/-) Other (0.4) 2.1 2.1

------------------------------ ----- ----- ----------

Adjusted EBITDA 96.0 43.0 64.0

============================== ===== ===== ==========

Note: Financials based on US GAAP. This statement may be subject

to amendment by TP ICAP when based on TP ICAP financial statements

under IFRS and/or IFRS-consistent accounting policies adopted by TP

ICAP in its own internal Group statements.

Forward looking statements

This announcement may contain statements that are, or may be

deemed to be, forward-looking statements. Forward-looking

statements are statements that are not historical facts and may be

identified by words such as "believes", "expects", "anticipates",

"intends", "estimates", "will", "may", "could", "would",

"continues", "should" and similar expressions or, in each case,

their negative terms. Forward-looking statements include statements

regarding objectives, goals, strategies, outlook and growth

prospects; future plans, events or performance and potential for

future growth; liquidity, capital resources and capital

expenditures; economic outlook and industry trends; developments of

TP ICAP's or Liquidnet's markets; and the strength of TP ICAP's

and/or Liquidnet's competitors. These forward-looking statements

reflect, at the time made, TP ICAP's beliefs, intentions and

current expectations concerning, among other things, the benefits

or synergies resulting from the Proposed Acquisition, as well as TP

ICAP's and the Enlarged Group's results of operations, financial

condition, liquidity, prospects, growth, and strategies.

Although TP ICAP believes that these assumptions were reasonable

when made, the assumptions underlying these forward-looking

statements are inherently subject to significant known and unknown

risks, uncertainties, contingencies and other important factors

regarding TP ICAP's or the Enlarged Group's present and future

business strategies and the environment in which TP ICAP and/or the

Enlarged Group will operate in the future. No representation is

made that any of these forward-looking statements or forecasts will

come to pass or that any forecast result will be achieved. Undue

influence should not be placed on any forward-looking statement.

Potential investors should not rely on such forward-looking

statements in making their investment decisions. No representation

or warranty is made as to the achievement or reasonableness of, and

no reliance should be placed on, such forward-looking statements.

Forward-looking statements speak only as of the date they are made

and cannot be relied upon as a guide to future performance. Save as

required by law or regulation, TP ICAP disclaims any obligation or

undertaking to release publicly any updates or revisions to any

forward-looking statements in this announcement that may occur due

to any change in its expectations or to reflect events or

circumstances after the date of this announcement. No statement in

this announcement is intended to be nor may be construed as a

profit forecast.

NOTHING IN THIS announcement CONSTITUTES AN OFFER TO SELL OR THE

SOLICITATION OF AN OFFER TO SELL ANY SECURITIES IN THE UNITED

STATES OR ANY OTHER JURISDICTION. NO SECURITIES HAVE BEEN OR WILL

BE REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR WITH

ANY SECURITIES REGULATORY AUTHORITY OF ANY STATE OF THE UNITED

STATES.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQEAXNNAEKEEFA

(END) Dow Jones Newswires

September 29, 2020 13:26 ET (17:26 GMT)

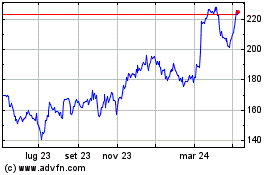

Grafico Azioni Tp Icap (LSE:TCAP)

Storico

Da Mar 2024 a Apr 2024

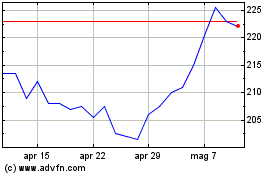

Grafico Azioni Tp Icap (LSE:TCAP)

Storico

Da Apr 2023 a Apr 2024