TIDMTRY

RNS Number : 9609Z

TR Property Investment Trust PLC

27 May 2021

This announcement and the information contained herein is not

for publication, distribution or release in, or into, directly or

indirectly, the United States, Canada, Australia or Japan.

TR PROPERTY INVESTMENT TRUST PLC

Unaudited preliminary results for the year ended 31 March

2021

26 May 2021

TR Property Investment Trust plc, announces its full year

results for the year ended 31 March 2021 (unaudited).

Financial Highlights and Performance Year ended

31 March Year ended

2021 31 March %

(unaudited) 2020 Change

--------------------------------------- ------------- -------------- --------

Balance Sheet

Net asset value per share 417.97p 358.11p +16.7%

Shareholders' funds (GBP'000) 1,326,433 1,136,453 +16.7%

Shares in issue at the end of the year

(m) 317.4 317.4 +0.0%

Net debt(1,6) 16.5% 7.6%

Share Price

Share price 392.50p 317.50p +23.6%

Market capitalisation GBP1,246m GBP1,008m +23.6%

Year ended Year ended %

31 March 31 March Change

2021 (unaudited) 2020

------------------------------------- ----------------- ---------- -------

Revenue

Revenue earnings per share 12.25p 14.62p -16.2%

Dividends(2)

Interim dividend per share 5.20p 5.20p +0.0%

Final dividend per share 9.00p 8.80p +2.3%

Total dividend per share 14.20p 14.00p +1.4%

Performance: Assets and Benchmark

Net Asset Value total return (3,6) +20.7% -11.5%

Benchmark total return(6) +15.9% -14.0%

Share price total return(4,6) +28.3% -16.8%

Ongoing Charges(5,6)

Including performance fee +1,40% +0.80%

Excluding performance fee +0.65% +0.61%

Excluding performance fee and direct

property costs +0.63% +0.59%

1. Net debt is the total value of loan notes, loans (including

notional exposure to CFDs and Total Return Swap) less cash as a

proportion of net asset value.

2. Dividends per share are the dividends in respect of the

financial year ended 31 March 2021. An interim dividend of 5.20p

was paid in January 2021. A final dividend of 9.00p (2020: 8.80p)

will be paid on 4 August 2021 to shareholders on the register on 18

June 2021.

The shares will be quoted ex-dividend on 17 June 2021.

3. The NAV Total Return for the year is calculated by

reinvesting the dividends in the assets of the Company from the

relevant ex-dividend date. Dividends are deemed to be reinvested on

the ex-dividend date as this is the protocol used by the Company's

benchmark and other indices.

4. The Share Price Total Return is calculated by reinvesting the

dividends in the shares of the Company from the relevant

ex-dividend date.

5. Ongoing Charges are calculated in accordance with the AIC

methodology. The Ongoing Charges ratios provided in the Company's

Key Information Document are calculated in line with the PRIIPs

regulation which is different to the AIC methodology.

6. Considered to be an Alternative Performance Measure as

defined in the full report and accounts.

Chairman's Statement

Introduction

The start of this reporting period was very close to the recent

COVID-19 influenced nadir of global equity markets in March 2020.

Since then equity markets have been determinedly focused on the

future rather than reflecting on the more immediate economic data

and human tragedy of the pandemic. As a result, I'm able to report

healthy returns for the year with our net asset value ("NAV") total

return of 20.7%, well ahead of the benchmark total return of 15.9%.

The share price total return was even stronger at 28.3% as the

discount narrowed over the year.

Stock markets have taken great comfort from the huge amount of

central bank stimulus and state aid for both

corporates and individuals. Since November 2020, this sense of

support has been augmented by optimism following the announcements

and subsequent rollout of a range of vaccine programmes.

The crisis has forced a dramatic change in the way we work,

consume and relax. Over the last year our management team has

pondered not only the pace of these changes across a wide range of

property sectors but also their sustainability once the world

reverts to "the new normal".

Over the last quarter of the financial year under review and

into the start of the new one, we have seen very dramatic share

price movements as investors rotated from companies offering the

safety of secure income towards those offering greater risk,

particularly where the companies were trading at large discounts to

their asset value. Your manager's report will examine in more

detail how the portfolio structure has evolved through these

thematic rotations.

Revenue Results and Dividend

Earnings for the year were 12.25p per share, 16% lower than the

prior year earnings of 14.62p.

The headline earnings per share figure is slightly deceptive,

earnings before tax were 24% lower than the previous year, but a

significant tax refund and some further prior period withholding

tax recoveries reduced the revenue tax charge from an effective

rate of 11.3% in 2020 to just 1.9% for the financial year to March

2021. Further details of this are set out in the Manager's

Report.

The Board has announced a final dividend of 9.00p per share,

bringing the full year dividend to 14.20p per share (2020: 14.00p)

an overall increase of 1.4% on the prior year dividend. The Board

is conscious of the income aspirations of some of our investor base

and, although this dividend is not fully covered, the Company has

significant revenue reserves available. As long as the Board has a

reasonable expectation of income returning to previous levels in

the medium term, the Board is happy to maintain a modest level of

dividend progression.

Revenue Outlook

Within our portfolio, the manager anticipates income for the

year to March 2022 to be split into three broadly equal parts with

one third suffering a reduction and in some cases significant cuts

or even suspensions, a third with income returning to pre-pandemic

levels, and the balance offering some level of increase. We do not

expect total income levels to return to pre-COVID-19 levels within

the current financial year although we do expect an improvement

relative to 2020/21.

After allowing for the proposed dividend, revenue reserves will

still amount to 12.18p per share giving plenty of capacity for the

board to supplement the dividend again in 2021/22, providing a

return to pre-Covid levels can reasonably be anticipated in the

medium term.

Net Debt and Currencies

Gearing at the end of the year stood at 16.5% having started the

year at 7.6%. Gearing fluctuated considerably throughout the year,

ranging between around 7.6% and 17.8%, as market sentiment ebbed

and flowed. This demonstrates the benefit of the flexibility of our

borrowing structure, with a base level supported by our fixed

longer-term debt and the majority achieved through the revolving

credit facilities and exposure through contracts for difference

("CFDs").

Sterling reached a low against the Euro in September 2020 driven

by fears of a no deal Brexit and remained relatively weak until

January 2021. As the new year arrived and despite issues with

bureaucracy for goods flowing between the UK and Europe, Brexit

issues took a back seat in investors' minds as they focused on the

route to normalisation across the UK and Europe as the vaccine

programmes rolled out. The UK is clearly ahead of the curve in this

respect and Sterling strengthened steadily towards our year end in

March 2021.

Our policy is to maintain a hedged currency exposure in line

with the benchmark. Sterling represents around 27% of the

benchmark, therefore strengthening Sterling is a headwind to the

NAV.

Income is unhedged and around 66% of our income is received in

currencies other than Sterling, therefore stronger Sterling reduces

our income. Slightly more income is received in the first half of

the year than the second, so for the current year more was received

in a period when Sterling was weaker.

Discount and Share Repurchases

The prior year end fell only two weeks after the market lows

following the announcement of the global COVID-19 pandemic and the

shares started the new financial year at a discount of 11.3%. The

discount then moved around between 5% and 15% as market sentiment

changed through the roller coaster ride of lockdowns, easings and

vaccine news. The average over the year was 10.2% but closed at

6.1%. This closing of the discount over the year meant that the

share price return of 28.3% was well ahead of the NAV return.

No share buy-backs were made in the period, although the

discount was wide at various points during the year. Many of our

underlying stocks were also trading on wide discounts and our

manager focused our capital on those opportunities.

The Board

I am grateful to my Board colleagues and to the team at TR for

their support and commitment this year. We have met in person

whenever the law and common sense allowed and "virtually" when

necessary. Though small, I believe the Board has an excellent

balance and spread of skills and experience appropriate for the

Trust's objectives. With two relatively new members, and a change

in Chair, I have been keen to allow us all time to settle into our

roles. Even so, I am conscious of the term of our SID, Simon

Marrison whose independence, skills and commitment are exemplary.

He brings a unique contribution with his continental property

investment expertise that is highly valued by us all and that will

be hard to replace. Equally we always enjoy and benefit from the

introduction of a fresh and enquiring mind so we will start the

process of looking for his replacement later this year to allow an

orderly succession.

Environmental, Social and Governance Factors ('ESG')

This year we have added more information on our responsible

investment approach. For many years we have maintained a strong

position in terms of voting and engagement supported by our

significant stakes in a number of property companies. Our size in

this specialist area of the equity market has helped ensure that

our views are heard. This engagement has been augmented by the

strength of BMO's Corporate Governance team and their broader

engagement record. We fully intend to keep up and heighten pressure

on our investee companies to enhance their standards of governance

and we will be increasing our expectations on both the provision of

data and on the Social and Environmental outcomes that they

deliver. Any long term support for management will require

companies to exhibit positive momentum across relevant

measures.

Awards

The Trust was the winner in the Specialist Equities category of

the Citywire Investment Trust Awards. This is particularly pleasing

as we were in competition with Trusts specialising in a broad range

of equities and alternatives.

Outlook

The pandemic has had a dramatic impact on the world and on all

aspects of real estate. In some instances this was an acceleration

of trends that were well underway such as the structural shift to

omnichannel retailing. For others, such as increased remote

working, it has been a very fast gestation period of an embryonic

trend. Airport hotel occupancy and business travel will likely

suffer a long-term negative shift as companies embrace not only a

new generation of communication tools but also their environmental

credentials. The main common feature across these examples is the

difficulty in predicting the scale and permanency of this

evolution. What will be 'the new normal' for these asset classes is

the challenge for our management team as we look forward to the

post pandemic world. What we can be sure about is that the economic

backdrop is a world with hugely elevated levels of government debt,

ongoing central bank / governmental stimulus packages and higher

levels of domestic savings. All at a time when fixed income yields

are at historically low levels and much long duration sovereign

debt offers negative yields to redemption.

Real estate offers a substantial margin over fixed income with

the opportunity to reflect any economic recovery through rental

growth. As a real asset it also has some inflation proofing

credentials. However, as the last fifteen months has reminded us,

sentiment can often override fundamentals in liquid equity markets

and our managers will continue to focus on the assessment of

earnings sustainability and medium term growth potential.

David Watson

Chairman

26 May 2021

Manager's Report

PERFORMANCE

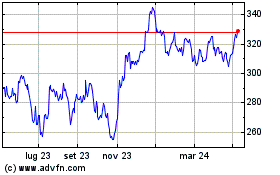

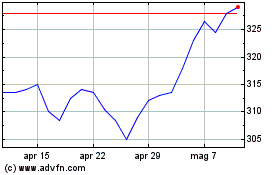

The Net Asset Value total return for the year to 31 March 2021

was 20.7%, ahead of the benchmark total return of 15.9%. At the

interim stage, I reported that Continental European property

companies had significantly outperformed their UK counterparts

(returns of 11.3% v 2.1%). The second half saw the complete

reverse. The UK's performance in the second half was so strong that

the 12 month performance of 19.1% (in GBP) outperformed Continental

Europe at 18.7% (in EUR).

The initial impact of the pandemic on European real estate

equities saw the benchmark fall 36% from the pre-Covid peak of 19th

February to the trough on 18 March 2020. Our financial year

therefore started close to these depressed levels and the steady

recovery since then is reflected in the healthy figures for the

year under review. However it is worth noting that collectively the

sector remains nearly 15% below the pre-Covid peak.

This extraordinary year has clearly been like no other and the

gulf in performance of the different real estate sectors (and their

respective listed companies) requires the same adjective. The year

can be neatly divided into pre and post the vaccine

announcement.

From March to October investors focused on owning sustainable,

pandemic proof income such as residential, supermarkets and

healthcare alongside logistics, warehousing and industrial where

the underlying tenants' businesses had remained open and in many

cases were thriving. Consumer facing sectors such as retail,

restaurants, hotel and leisure were shunned. We divide our universe

of pan European real estate companies into 26 bespoke groups and

over the 7 months from the trough on 18th March 2020 our logistics

/ industrial group returned +54% , German residential +60%,

healthcare +36% whilst UK retail fell 45% and European retail

returned just 1%. London retail also suffered falling 26% as

tourism levels (both domestic and international) collapsed.

However, from November onwards we saw a complete volte face as

investors focused on the possibility of a normalising economic

outlook post the vaccine breakthrough. In our world that meant

buying back into the consumer facing sectors. Stocks exposed to

these sectors had been standing at large discounts given the

market's expectation of further asset value declines and they

enjoyed significant price recovery. Stocks such as Hammerson and

Shaftesbury, who had both carried out emergency capital raises

(more on this later), enjoyed 100% and 85% price appreciation from

their respective (pre-vaccine announcement) capital raise

prices.

The Trust was defensively positioned as we entered the pandemic

with overweights to European PRS (private rented sector)

particularly in Germany, supermarkets (UK and Nordics), healthcare

(mainly UK) and logistics / industrial across both the UK and

Europe. These exposures drove much of the relative outperformance

from March to November.

London exposed stocks suffered particularly as office workers

have not returned (we estimate office utilisation rates at c25%

versus a Continental average of over 50%) and this combined with

the collapse in tourism (both domestic and international) has

temporarily hollowed out our global city. Our UK office exposure

was concentrated in decentralised offices through CLS and McKay

whilst we avoided London retail focused names such as Capco and

Shaftesbury as well as those businesses with short occupational

leases such as Workspace.

As the 'relief / reopening / reflation' trade gathered momentum,

I closed our underweight exposure to European shopping centres,

bought back into some Central London retail and renewed our

exposure to office markets particularly those cities with the

shorter commute times. Essentially I was still shying away from the

largest two conurbations (London and Paris) whilst adding to

smaller ones such as Madrid and Dublin and maintaining exposure to

decentralised office sectors in the UK, Sweden and Germany.

The pandemic has turned much 'on its head' and in our corner of

the equity market it was the performance of Swiss property

companies which was much weaker than history would have predicted.

Traditionally a safe haven, these stocks did not initially recover

from the March lows with investors focused on the problematic

retail exposure of the largest listed companies. We continue to be

underweight the group.

Another positive surprise has been in self-storage which

reported very steady numbers through the worst of the year. Whilst

our stock selection in the UK was correct (Safestore total return

+27% versus Big Yellow +14%), the runaway success was Shurguard,

the Continental player r eturning +48%, which we didn't own. In our

defence, the stock enjoyed strong demand from index trackers as it

entered various benchmarks midyear.

Most of 2020 was an understandably subdued period for M&A

corporate activity with one particular exception, Norwegian

offices. Entra (where we were a top 20 shareholder) was the subject

of a bidding war between two Swedish listed players, Castellum and

Samhallsbyggnadsbolaget (also known as SBB). Whilst neither

successfully gained control, the share price total return was 57%,

our most successful investment in the period.

The portfolio has some gearing. This was reduced in February and

March 2020 but has subsequently returned to pre-pandemic levels.

Why have gearing in volatile times? The Trust continues to take

advantage of its closed ended structure and holds a number of

illiquid small cap stocks. These well-run companies (even when

exposed to outperforming subsectors) often suffer from limited

investor attention, being deemed too small. As a consequence, in

rising markets they often underperform their larger brethren (in

market parlance their 'beta' is less than one). Adding some gearing

helps compensate for these lower beta names. Our experience is that

over time the underlying property fundamentals will be recognised

and, if not, then the market will take them private or merge them

together. Our physical property exposure also sits outside our

benchmark and additional gearing ensures that we are not

underexposed to equities versus our benchmark given that a

proportion of capital is invested in physical property.

OFFICES

Of all the segments of the commercial real estate landscape, the

future demand for offices remains the hardest to forecast. The two

undeniable consequences of the pandemic, for this asset class, has

been the realisation that employees of corporates of all sizes can

work remotely (for long periods) if required and secondly that the

next generation of 'best in class' office accommodation will be

utilised very differently with tenants having new priorities. Built

into these demands will be the overarching need for energy

efficiency, carbon neutrality and sustainability through the life

cycle of the building.

The take up figures for the last year (across the 15 major

cities we monitor) offers little comparative value given the

inability for businesses to physically relocate in many of these

markets from March 2020. Taking London as a case in point, Savills

reported that West End take up fell from 4.4m sq ft in 2019 to 1.7m

in 2020. Office utilisation rates through 2020 and into 2021 have

varied hugely. A broad rule of thumb was that the larger the city

(and the longer the average commute time) the lower the office

utilisation rate. Generally the smaller cities also had higher

levels of commuting by private transport or where workers were

using overground public transport. Scandinavian and Swiss cities

have seen almost normalised utilisation rates whilst London and

Paris remain sub 30%. Looking forward, what is important to us is

the amount of new space which was scheduled to complete

(construction was halted for very short periods in most markets)

and whether there are signs of demand as we move into the post

vaccine period.

Looking across Europe as a whole, the combined effect of reduced

leasing activity and construction completions led to 100bps

increase in vacancy to an average of 6.9% (BNP data). This single

statistic clearly hides a wide range of levels. Unsurprisingly,

London and Paris have experienced the greatest increases from 5% to

nearly 8% but Dublin collects the wooden spoon with vacancy

increasing to over 9%. This is a good example of a small market

where a (temporary) demand strike meets a number of large

completions and refurbishments. However the historically low levels

of vacancy in many cities prior to the pandemic have insulated most

markets, with modest downward movements in prime rents recorded

across the German Big 6, Milan, Madrid, Oslo, Amsterdam and

Stockholm.

The delivery of new office buildings has also been deferred,

particularly for tall buildings. The New London Architecture's

Annual Tall Buildings Survey recorded a 27% decline in planning

applications for buildings over 20 storeys in 2020 when compared

with 2019. We were surprised that the fall wasn't larger but 73% of

all applications were in the latter part of the year and hints at

developer confidence regarding demand for new build.

Investment demand has remained very resilient almost regardless

of short-term weakness in occupational markets. The weight of

capital seeking real assets is a theme which will recur through

this report. The rise in the long end of the curve as the reflation

theme gathers momentum is proving very damaging for fixed income

structures. High quality offices - offering large lot sizes - with

secure income delivering 3.5-4% net yield is attractive versus

negative yielding sovereign bonds. Further up the risk curve,

opportunistic capital also remains very active and listed

development specialists such as Great Portland Estates and Derwent

London have found it hard to deploy capital amidst fierce

competition.

The 2021 CBRE EMEA Investor Intentions Survey highlights London

as still the most attractive city for investment in Europe with an

estimated EUR40-45bn of global equity looking to be deployed into

the market across all types of buildings. This is the highest

figure since the survey starting tracking demand in 2012. Whilst

transaction volumes slowed last year, the first two months of 2021

(traditionally a quiet time) have seen volumes reach GBP875m

greater than the same period in 2019. Part of the London attraction

is that yields didn't compress during the Brexit uncertainty making

the city look much cheaper than other big European cities. Post the

EU-UK Trade and Cooperation Agreement we expect this gap to

narrow.

RETAIL

The MSCI / IPD data for the 12 months to March 2021 saw all

retail property capital values fall 12.8% with a serious

acceleration in the decline of shopping centre values which fell

25.5% over the last 12 months. In the interims, I commented that we

felt the valuation community were behind the times due to their

requirement to look at deal evidence. Essentially, in fast moving

markets the published figures will already be out of date. Stock

markets know this and retail landlords across the globe have been

trading at very large discounts to their (no longer valid) last

published figures.

The woes of retail are well understood. The pandemic has

accelerated trends which were well established. Reopening of

economies will see footfall return to shopping centres but the

levels of sustainable rents remain the subject of market forces. In

the UK the loss of a huge number of well known brands either

through bankruptcy or retreat has resulted in average vacancy

levels in shopping centres reaching over 15% (MSCI data).

This means the negotiation boot remains firmly on the tenants'

foot and we predict a further 15% falls in rental values. The one

area where there are clear signs of price stabilisation is in

retail warehousing. Open air with plenty of free parking, this type

of retail asset sits well in an omni-channel environment where

retailer margins are maximised through click and collect.

Affordability is the eternal watchword and whilst there are some

parks with very high rents (often fashion retailer led) the

majority will see modest declines in rental values. Occupancy cost

ratios are also not burdened by escalating service charges.

Across Europe, the picture is more nuanced. Valuers are even

more conservative than their UK counterparts and capitalisation

rates are yet to move materially. In some countries, retailers have

been given huge amounts of government support and as a result

rental delinquency is generally lower than in the UK. In addition,

many shopping centres are anchored by hypermarkets (which have

remained open) and not department stores (a UK/ US concept no

longer fit for purpose beyond a handful of tourist destinations

such as Selfridges and Galeries Lafayette). There have been lower

levels of retailer bankruptcy across Continental Europe and we put

this down to two factors: less overrenting and the UK insolvency

legislation. On this latter point, a huge number of UK retailers

have taken advantage of the CVA (company voluntary administration)

to force landlords (generally a large creditor) to accept corporate

reconstructions which unduly damage their interests. A recent High

Court ruling involving the overly indebted retailer New Look,

reinforced this tenant friendly legislation.

Investors remain very circumspect towards this asset class.

Income insecurity has resulted in investors requiring much higher

initial yields. CBRE estimate that UK prime shopping centre yields

have moved from 4.5% to 7% in the last 5 years with poorer

secondary schemes in the high teens or literally unsaleable. Retail

warehousing has bucked the depressing trend at least from an

investor perspective. Investors are increasingly confident that

they are able to measure tenant affordability and this is the key

to determining pricing. In the last couple of months we have seen

competitive bidding for a number of retail warehouse schemes,

something not seen since 2018.

DISTRIBUTION AND INDUSTRIAL

UK industrial and logistics take up hit a record 59.7m sq ft in

2020. Whilst the pandemic suppressed demand in many other parts of

the property market, it clearly stimulated logistics and business

activity which utilised industrial property. Amazon again accounted

for a sizeable (20%) portion of the activity and it was this XL

segment (250,000 + sq ft) which was the major beneficiary of the

surging online demand. The online share of retail sales rose from

19.2% in 2019 to 27.9% in 2020 hitting a new high of 36.3% in

January 2021 as we returned to lockdown. This will scale back as we

reopen but the boost to online scale and efficiency is here to

stay. Supply has responded but has been more than matched by this

demand. As a consequence, supply has fallen to 73.4m sq ft, down 6%

on the year, and this tightening has occurred in every size

bracket.

Rental growth continues to march on but there has been a

broadening of growth rates across the regions. Greater London and

the East Midlands recorded growth of over 7% whilst average rates

across the country at 3.9%. Such strong rental growth, the secure

income and the positive outlook has driven both domestic and

international buyers to pay record prices for this sector whether

it is last mile urban units, XL big boxes or terraces of well

located industrial units. Prime yields are 3.5 to 4% and even short

income is not deterring investors as evidenced by the sale of our

Bristol distribution unit at 4.5% initial yield with 3.5 years

unexpired.

The same picture of rude health is evident across Continental

Europe. According to BNP, take up increased 14% across the 6

largest European economies and vacancy rates dropped to 5.5%, their

lowest and all against a backdrop of a sharp contraction in GDP.

Again it was a surge in e-commerce and home delivery which drove

demand. Prime yields across Europe tightened 25bps in 2020,

matching the UK with no signs of decompression even as the long end

of the curve rises. Investment demand is truly global with US and

Asian institutional capital competing with more domestic long term

capital all determined to participate in this structural shift.

RESIDENTIAL

As expected the sector has remained highly resilient during the

pandemic. The majority of our investments are in German and Swedish

housing where rents are subject to state control. The remaining

exposure is Finland and the UK where rents are open-market. The

former offer greater security with rents tied to indexation whilst

the latter offers more opportunity to capture market growth but

with the commensurate risk if vacancy rises and market rents fall.

During the crisis, the security of income and very high occupancy

levels resulted in the sector retaining its popularity. German

housing has experienced price rises in virtually all its

sub-markets.

As explained earlier, Berlin remained the outlier as the State

of Berlin imposed a 5-year rent freeze (Mietendeckel). The

subsequent Constitutional Court ruling, which confirmed that rent

controls are determined at the Federal, not State level, came just

after the year end in mid-April. We are pleased with this outcome

and the share prices of both Deutsche Wohnen (4.4% of net assets)

and Phoenix Spree (2.5% of net assets) responded positively. New

construction of apartments in Berlin had all but dried up as

developers awaited the outcome of the appeal. Berlin remains the

cheapest capital city in Western Europe in which to rent an

apartment (if you can find one). The desire of a left-wing local

authority to keep it that way regardless of the side effect of

shutting out new migrants through the consequential collapse in the

supply of new homes has been suitably rebuffed.

ALTERNATIVES

This group encompasses sectors that have thrived (supermarkets,

healthcare, self-storage) in the crisis and those which have not

(student accommodation, hotels).

Share price performance was an amplified reflection of not only

the underlying property performance but also the dramatic shift in

investor sentiment. Self storage share prices have traditionally

performed poorly in slowing economic conditions as the income is

considered short term and volatile. However the pandemic has

focused investors' minds on the emerging strength of this sector

where a small group of operators (mostly listed companies) have the

financial muscle to dominate the price comparison websites. Another

emerging trend has been the increasing business usage of a product

traditionally seen as the domain of private customers. Businesses

have seen the merits of immediate, hassle free access to short or

longer term storage. The supply chain disruption during the

pandemic heightened the need for space as the mantra became 'a

little more just in case and a little less just in time'. Our self

storage group returned +46% from the low point (18th March 2020) to

the end of October. However, from November 2020 to the end of March

2021 they have collectively returned just +4.1%. A classic example

of a switch in sentiment as investors rotated away from the 'Covid

relative winners' group into the value names which had

underperformed and looked very cheap on historic metrics.

In another 'alternatives' sub-sector we experienced the complete

reverse. Student accommodation businesses suffered a collapse in

income and Unite (our only exposure) led the field in refunding

rents which was the correct PR strategy but depleted their top

line. The well documented difficulties for students through the

last two academic years and the complete inability for many

overseas students to enroll physically impacted investor sentiment

with the sub-sector falling 46% between 19th February and 18th

March 2020 and then staging a weak recovery of just +17% from then

to the end of October. Whilst this performance compares poorly with

self storage, since the beginning of November the sub-sector has

rallied 30% as the likelihood of the reopening of tertiary

education improved.

Supermarkets have continued to attract investor attention. Our

exposure is through Supermarket Income REIT (UK) and Cibus (Sweden

and Finland). Supermarket Income REIT raised a total of GBP490m in

three separate transactions through the year and now has a market

cap of over GBP900m. Cibus also raised capital (SEK 900m) in two

tranches to make further acquisitions. The larger supermarket

operators have been able to attract customers through their online

network which the hard discounters (Lidl, Aldi) are not able to

offer. Volumes and margins will normalise post the pandemic but

these operators have had the opportunity to prove the resilience of

their omni-channel model which utilises last mile distribution from

their network of stores. It is one of the few parts of the retail

landscape where physical stores are truly integral to the online

journey.

DEBT AND EQUITY MARKETS

Property companies remained busy on debt refinancings throughout

the pandemic and the huge amount of central bank support and

government stimulus ensured a healthy, liquid market where pricing

did not weaken. According to EPRA, EUR15.2bn was raised in 2019 at

an average coupon of 1.8% and 2020 saw EUR15.6bn at a cost of 1.6%.

These figures are not directly comparable as the mix of debt

offerings in each period was different but they are a clear

indicator as to the health and price stability in the debt markets.

German residential companies were again busy with Vonovia raising

EUR2.5bn in four transactions borrowing 10-year money at 1%. Later

in October, Gecina, Europe's largest office REIT raised EUR200m in

a 2034 term bond at 0.86%.

Early in the crisis, we saw a number of strong businesses

trading at premiums raise equity capital for opportunistic

expansion. This was in sectors with clear underlying demand, namely

healthcare (Assura, Aedifica, Primary Health Properties),

self-storage (Big Yellow), logistics/ industrial (LondonMetric,

Segro, VGP ), supermarkets (Supermarket Income REIT, Cibus) and

German residential (Vonovia, ADO Properties, LEG). The Autumn saw

opportunistic raises in Sweden and Norway (Balder, Klovern and

Norwegian Properties) a region which had experienced low levels of

lockdown restrictions. More recently in February and March this

year we saw renewed activity in the UK, as the vaccine rollout

improved sentiment, with raises from Target Healthcare, LXI, Tritax

Eurobox and Supermarket Income REIT again. Continental European

raises in 2021 have so far been confined to healthcare (Cofinimmo)

and student accommodation (Xior).

Post the summer we saw the beginning of an expected surge of

more defensive raises as companies finally came under cashflow and

valuation pressure. In the end it was just a handful of retail

focused names who had been mismanaging their balance sheets long

before the pandemic. Hammerson's GBP600m raise effectively

recapitalised the balance sheet with a 24 for 1 rights issue

accompanied by the (previously announced) departure of the CEO

completing the overdue C-suite shuffle of Chair, CEO and CFO. In

late October, Shaftesbury announced a GBP300m placing and open

offer. Looking back their timing was spectacularly unfortunate as

the announcement of the first vaccines came less than a fortnight

later.

These game changing announcements immediately altered

expectations and there is nowhere better to illustrate the point

than the corporate saga at Unibail-Rodamco-Westfield (URW). URW had

announced a EUR9bn 'Reset' plan comprising EUR3.5bn capital raise,

dividend cancellation and a planned EUR4bn of disposals. A group of

activist shareholders lead by Leon Bressler (the CEO of Unibail

from 1992 to 2006) launched a campaign to oppose these AGM

proposals and launch an alternative strategy which did not include

a deeply discounted capital raise. They proposed the sale of the US

(ex Westfield) portfolio and a return to their roots as an owner of

prime European shopping centres. Their timing was fortunate, with

the 10th November AGM coming just after the vaccine announcement

and the improvement in investor sentiment even for deeply indebted

businesses. Essentially convincing investors that they didn't need

to put 'good money after bad' and that the self help strategy would

succeed. They were successful in their campaign and shareholders

voted against the 'Reset' plan. This led to the departure of the

Chairman, CEO and CFO and the promotion of existing senior managers

to the Board. The share price, which had troughed at EUR35 per

share, subsequently doubled amidst the closing of short positions.

This corporate tale neatly encapsulates the dramatic change in

investor sentiment (and pricing of previously unloved businesses)

which we saw from November onwards.

INVESTMENT ACTIVITY - PROPERTY SHARES

Turnover (purchases and sales divided by two) totalled GBP468m

equating to 36% of the average net assets over the period. This was

broadly in line with last year's equivalent figure (32%) which

itself was well ahead of the year to March 2019 (20%). It has

therefore been two years of elevated portfolio rotation due to

market volatility.

The rapid reduction in leverage in February and March 2020 was

followed by a swift reinvestment in the portfolio which occurred in

April and May as share prices recovered from their March lows and

this reinvestment was boosted by our participation in the majority

of the large number of offensive capital raises as described

earlier.

Whilst a number of sought after businesses were standing at

premiums to asset value and therefore were able to raise capital

accretively, the 'Covid' world meant that another smaller cohort of

companies required emergency (defensive) capital raises. After

Hammerson's raise in September came Shaftesbury's GBP300m raise at

400p per share, a 20% discount to the undisturbed share price and

55% below where it had started 2020. We didn't own Shaftesbury

prior to the capital raise but took the opportunity to participate.

Given that part of the company's rationale for the raise was to

give comfort to their banks and secure waivers over potential

covenant breaches, one wonders if the Board would have felt so

pressurised just a few days later. The share price finished our

financial year at 641p which reflects the enormous change in

sentiment around the reopening of the economy.

Private equity continues to stalk listed property companies and

I reiterate the statement made many times in these reports over the

last decade - if the listed market persistently undervalues its

companies, private capital won't be shy about buying it. This year

we have seen various firms build positions in listed companies:

Brookfield (British Land), KKR (Great Portland Estates) and

Starwood (RDI, CA Immo). It is the latter which has been most

active with its stakes. Having acquired 30% of RDI from its South

African based parent company, it launched an agreed bid for the

remainder in February. The interesting point is that the offer

(recommended by the Board at 121p) was 20% below the last published

asset value but 30% ahead of the undisturbed share price. The board

were acknowledging two things - firstly that the asset valuation

was historic and likely to fall further and secondly that the mixed

portfolio, whilst on the road to improvement under refreshed

management, was set to trade perpetually at a discount to its asset

value. The exit price therefore looked a fair one.

The precedent has been set and other small, deeply discounted

companies should look to merge and generate improved operational

metrics for their shareholders.

The corporate activity around Entra in Norway (covered earlier)

was an important contributor to performance given our holding (2.5%

of net assets).

The interest in listed real estate continues to strengthen as we

move into the Spring with a range of existing companies taking the

opportunity to raise capital whilst their shares trade at premiums

to their asset value. This was capped in March by the first major

IPO for over 3 years. CTP, a Central European logistics

owner/developer raised EUR1bn with the founder diluting from 100%

ownership to 83%. The company has a market cap of EUR5.6bn.

INVESTMENT ACTIVITY - DIRECT PROPERTY PORTFOLIO

The physical property portfolio returned 2.8% with a capital

return of -0.7% and an income return of 3.4% for the 12 months to

March 2021. In what was a difficult year for real estate the

portfolio remained resilient with rent collection in excess of 90%

for all four quarters and with only limited concessions given to

two retail tenants.

During the period the Trust sold its freehold interest in the

Yodel Distribution Centre in North Bristol for GBP10m which

reflected a net initial yield of 4.5% and a capital value of GBP200

per sq ft. This followed the successful regearing of the lease at

the beginning of 2020. The sale was concluded at a 25% premium to

the September 2020 valuation and is 118% above the July 2014

purchase price.

The Trust also had a successful period of asset management

completing a number of leases including the letting of the vacant

restaurant unit at The Colonnades. The 3,500 sq ft unit has been

let to Happy Lamb Hot Pot on a 20 year lease. Happy Lamb is the

latest edition of a hugely successful Asian and US chain which

produces authentic Mongolian hot pot cuisine. This is their third

restaurant opening after Holborn and Birmingham. This letting

concludes a 10 year transformation of this Bayswater asset where we

have added 16,000 sq ft of new retail space (bringing exciting

brands like Graham & Green and 1 Rebel to the area) as well as

doubling the Waitrose footprint from 20,000 to 40,000 sq ft.

At Wandsworth, following the successful granting of planning in

November 2019, we have continued to work with Wandsworth Borough

Council and the Greater London Authority to deliver the complex and

detailed s.106 agreement. As anticipated this will take time.

Meanwhile, we continue to let any of units on the estate which come

vacant on short term leases. The demand for industrial space has

continued to grow over the past 12 months and central London is no

exception. New rents across the estate are in the high GBP20s per

sq ft and post the year end we have let the only vacancy to Sweaty

Betty, the highly successful UK leisure and fashion retailer.

REVENUE AND REVENUE OUTLOOK

Revenue earnings for the current year of 12.25p were 16% lower

than the prior year.

Earnings were enhanced by a tax refund and some further prior

period withholding tax recoveries which reduced the revenue tax

charge rate to only 1.9%. The most significant contribution by far

was a tax refund and interest thereon resulting from the final

settlement of our long running FII GLO claim with HMRC. The tax

refund and interest amounted to GBP1.7m, and that, together with

the ability to release some associated provisions meant an overall

contribution of 0.71p to the revenue account.

Long standing investors may recall that this claim was first

mentioned in our reports for the year ended March 2010 following a

change in UK tax law that all overseas dividend receipts were

non-taxable in the UK from 1 July 2009. There were various

challenges running through the European courts that this treatment

of overseas dividends should be applied to earlier periods. These

have ultimately had some degree of success and last year HMRC

announced that they would settle on the open computations. We

reached agreement with HMRC on our own open computations just

before the financial year end and the tax repayment has been

received.

In addition to the tax refund received we were able to reinstate

losses which had been utilised for the relevant periods. These will

now be available going forward, although use will be subject to

current restrictions.

Our underlying income over the year fell by around 24%. Some

companies cancelled dividends payable early in the financial year

in reaction to the COVID-19 pandemic, or reduced distributions and

this was documented in the Interim Report. The second half saw a

similar level of income reduction as that seen in the first half.

In addition, in the final quarter of the year some of our overseas

income was impacted by sterling strength.

The longer-term outlook is still not clear. The UK has rolled

out a successful vaccination programme and at the time of writing

the easing of restrictions is progressing along the government

roadmap timetable. This has enabled us to be a little more

confident about our UK earnings with all companies (excluding some

small cap retail focused businesses) recommencing dividends for

FY22.

There have been clear real estate winners and losers and the

portfolio remains well positioned towards those sectors which have

maintained robust earnings through the pandemic. Our exposure to

index-linked income remains high and we will see dividend increases

here alongside those names exposed to buoyant conditions such as

industrial and logistics. Other areas will remain under

pressure.

On balance we expect the income from our portfolio to increase

over the current financial year as both the UK and Continental

Europe experience strong post vaccine recoveries. However, it

should be noted that stronger sterling would reduce the income from

our overseas holdings and any reductions in gearing would also lead

to lower income.

GEARING AND DEBT

The Chairman has already commented on gearing levels and also

highlighted the benefits of our flexible borrowing structure.

This flexibility has been crucial in such a volatile year. Our

gearing oscillated in a 10% range as we responded to the dramatic

changes in market sentiment through the year. Over the period we

utilised both our revolving loan facilities and our CFD capability

in order to achieve this.

We increased the capacity on our ICBC loan facility during the

year and the remaining loans were renewed at existing levels. We

did see small increases on margins on some renewals. We also looked

at the potential to take out new or extend our longer-term debt.

Our Euro denominated loan note is due for repayment in 2026 and the

Sterling note in 2031, however the flexibility of the short- term

facilities is valuable in more volatile markets and has certainly

worked well for us in the current year.

We continue to explore new options in all markets.

OUTLOOK

As economies emerge from the grip of the pandemic, investors

have focused on assessing whether the damage (or growth) was

temporary, longer lasting or permanent. Real estate investors are

no exception and the range of premiums / discounts to net asset

values of listed companies highlights the breadth of expectations

across the property spectrum. The difficulty is that there is no

precedent for the profile of recovery in tenant demand across so

much of this asset class. Clearly existing structural shifts have

been accelerated and new ones have emerged which may prove more

permanent than the markets currently expect. All of this

uncertainty leads us to focus on income sustainability and those

markets where - if demand does return - supply is constrained.

Whilst tenant demand is hard to gauge we do benefit from a

benign financing environment. Debt markets are as accommodating as

they have ever been, even if the long end of the curve is rising.

We see no reason for margins to widen in the near term.

Inflationary pressures are building and fixed income asset values

reflect these expectations. Property offers income which is tied

either directly (index-linked) or indirectly (rental growth) to

economic expansion. Our intention is to remain focused on areas

where that income is both sustainable and where it offers

growth.

In the near term, we aim to maintain the exposure to the private

rented residential sector (particularly in Germany and Sweden) as

the market continues to undervalue not only the quality of those

earnings but also the steady growth profile. There is risk - in

Germany - that a left wing coalition government would amend the

current federal law resulting in local cities getting more control

over rents. However the rent freeze in Berlin (over the last 18

months) resulted in a reduction in the number of available

apartments as well as a slowing in the pace of new apartment

delivery. We trust that common sense will prevail over political

dogma. Elsewhere, undervalued income streams are evident in

supermarkets and in parts of the healthcare market. Alongside

index-linked sustainability we will also maintain exposure to the

greatest growth opportunities. The structural shifts in retail

behaviour are still ongoing. Evolution in the speed of delivery and

post pandemic supply chain dynamics will drive growth across the

logistics landscape from 'big box' to 'last mile'. We will continue

to own the developers where we see increases in the value of

landbanks as well as growing development margins. Investor demand

for the end product shows no sign of abating.

Office markets will remain volatile. Businesses will spend time

working out their requirements in a post pandemic world.

Interaction and collaboration will drive office usage. Tasks that

can be fulfilled without physical interaction will be timetabled

for remote working. A new balance will develop with one sure fire

certainty, the premium being attached to best in class newly built

space with complete environmental credentials. Developers will

respond to this demand and we expect an acceleration in buildings

being identified for refurbishment earlier than previously

envisaged. Obsolescence of the existing office stock will

accelerate.

Post the year end in early May, St Modwen Properties announced

that an offer of 542p per share from Blackstone, a 24% premium to

the last published NAV had the support of the board. This company

has a large strategic landbank, a high quality logistics portfolio

and a growing housebuilding unit and whilst it was trading close to

its asset value, private equity clearly feels it is undervalued.

This is a reminder, as stated in a number of previous reports, that

the depth of both equity and debt availability underpins listed

company valuations.

Marcus Phayre-Mudge

Fund Manager

26 May 2021

Investment Objective and Benchmark

The Company's Objective is to maximise shareholders' total

return by investing in the shares and securities of property

companies and property related businesses internationally and also

in investment property located in the UK.

The benchmark is the FTSE EPRA/NAREIT Developed Europe Capped

Net Total Return Index in Sterling. The index, calculated by FTSE,

is free-float based and as at 31 March 2021 had 105 constituent

companies. The index limits exposure to any one company to 10% and

reweights the other constituents pro-rata. The benchmark website

www.epra.com contains further details about the index and

performance.

Business Model

The Company's business model follows that of an externally

managed investment trust.

The Company has no employees. Its wholly non-executive Board of

Directors retains responsibility for corporate strategy; corporate

governance; risk and control assessment; the overall investment and

dividend policies; setting limits on gearing and asset allocation

and monitoring investment performance.

The Board has appointed BMO Investment Business Limited as the

Alternative Investment Fund Manager ("AIFM") with portfolio

management delegated to Thames River Capital LLP. Marcus

Phayre-Mudge acts as Fund Manager to the Company on behalf of

Thames River Capital LLP and Alban Lhonneur is Deputy Fund Manager.

George Gay is the Direct Property Manager and Joanne Elliott the

Finance Manager. They are supported by a team of equity and

portfolio analysts.

Further information in relation to the Board and the

arrangements under the Investment Management Agreement can be found

in the Report of the Directors in the full Annual Report and

Accounts.

In accordance with the Alternative Investment Fund Managers

Directive ("AIFMD"), BNP Paribas has been appointed as Depositary

to the Company. BNP Paribas also provide custodial and

administration services to the Company. Company secretarial

services are provided by Link Company Matters.

The specific terms of the Investment Management Agreement are

set out in the full Annual Report and Accounts.

Strategy and Investment Policies

The investment selection process seeks to identify well managed

companies of all sizes. The Manager generally regards future growth

and capital appreciation potential more highly than immediate yield

or discount to asset value.

Although the investment objective allows for investment on an

international basis, the benchmark is a Pan-European Index and the

majority of the investments will be located in that geographical

area. Direct property investments are located in the UK only.

As a dedicated investor in the property sector the Company

cannot offer diversification outside that sector, however, within

the portfolio there are limitations, as set out below, on the size

of individual investments held to ensure diversification within the

portfolio.

Asset allocation guidelines

The maximum holding in the stock of any one issuer or of a

single asset is limited to 15% of the portfolio at the point of

acquisition. In addition, any holdings in excess of 5% of the

portfolio must not in aggregate exceed 40% of the portfolio.

The Manager currently applies the following guidelines for asset

allocation:

UK listed equities 25 - 50%

Continental European listed

equities 45 - 75%

Direct Property - UK 0 - 20%

Other listed equities 0 - 5%

Listed bonds 0 - 5%

Unquoted investments 0 - 5%

Gearing

The Company may employ levels of gearing from time to time with

the aim of enhancing returns, subject to an overall maximum of 25%

of the portfolio value.

In certain market conditions the Manager may consider it prudent

not to employ gearing on the balance sheet at all, and to hold part

of the portfolio in cash.

The current asset allocation guideline is 10% net cash to 25%

net gearing (as a percentage of portfolio value).

Property Valuation

Investment properties are valued every six months by an external

independent valuer. Valuations of all the Group's properties as at

31 March 2021 have been carried out on a "RCIS Red Book" basis and

these valuations have been adopted in the accounts.

Allocation of costs between Revenue & Capital

On the basis of the Board's expected long-term split of returns

in the form of capital gains and income, the Group charges 75% of

annual base management fees and finance costs to capital. All

performance fees are charged to capital.

Holdings in the Investment Companies

It is the Board's current intention to hold no more than 15% of

the portfolio in listed closed-ended investment companies.

Some companies investing in commercial or residential property

are structured as listed externally managed closed-ended investment

companies and therefore form part of our investment universe.

Although this is not a model usually favoured by our Fund Manager,

some investments are made in these structures in order to access a

particular sector of the market or where the management team is

regarded as especially strong. If these companies grow and become a

larger part of our investment universe and/or new companies come to

the market in this format the Manager may wish to increase exposure

to these vehicles. If the Manager wishes to increase investment to

over 15%, the Company will make an announcement accordingly.

Key Performance Indicators

The Board assesses the performance of the Manager in meeting the

Trust's objective against the following Key Performance Indicators

("KPIs"):

KPI Board monitoring and outcome

Net Asset Value Total Return

relative to the benchmark * The Board reviews the performance in detail at each

The Directors regard the out-performance meeting and discusses the results and outlook with

of the Company's net asset the Manager.

value total return in performance

in comparison with the benchmark

as being an overall measure Outcome

of value delivered to the 1 year 5 years

shareholders' over the longer-term. ------- --------

NAV Total Return* (Annualised) 20.7% 7.7%

------- --------

Benchmark Total Return

(Annualised) 15.9% 4.3%

------- --------

* NAV Total Return is calculated by

re-investing the dividends in the assets

and the Company from the relevant ex-dividend

date. Dividends are deemed to be re-invested

on the ex-dividends date for the benchmark.

------------------------------------------------------------------

Delivering a reliable dividend

which is growing over the * The Board reviews statements on income received to

longer term date and income forecasts at each meeting.

The principal objective of

the Company is a total return Outcome

objective, however, the Fund 1 year 5 years

Manager also aims to deliver ------- --------

a reliable dividend with growth Compound Annual Dividend

over the longer term. Growth* 1.4% 11.2%

------- --------

Compound Annual RPI 1.5% 2.6%

------- --------

* The final dividend in the time series

divided by the initial dividend in the

period raised to the power of 1 divided

by the number of years in the series.

------------------------------------------------------------------

The Discount or Premium at

which the Company's shares * The Board takes powers at each AGM to buy-back and

trade compared with Net Asset issue shares. When considering the merits of share

Value buy-back or issuance, the Board looks at a number of

Whilst expectation of investment factors in addition to the short and longer-term

performance is a key driver discount or premium to NAV to assess whether action

of the share price discount would be beneficial to shareholders overall.

or premium to the Net Asset Particular attention is paid to the current market

Value of an investment trust sentiment, the potential impact of any share buy-back

over the longer-term, there activity on the liquidity of the shares and on

are periods when the discount Ongoing Charges over the longer term.

can widen. The Board is aware

of the vulnerability of a Outcome

sector-specialist trust to 1 year 5 years

a change of investor sentiment ------- --------

towards that sector, or to Average discount* 10.2% 6.3%

periods of wider market uncertainty, ------- --------

and the impact that can have Total number of shares Nil Nil

on the discount. repurchased

------- --------

* Average daily discount throughout the

period of share price to NAV with income.

Source: Bloomberg.

------------------------------------------------------------------

Level of Ongoing Charges

The Board is conscious of * Expenses are budgeted for each financial year and the

expenses and aims to deliver Board reviews regular reports on actual and forecast

a balance between excellent expenses throughout the year.

service and costs.

Outcome

The AIC definition of Ongoing 1 year 5 years

Charges includes any direct ------- --------

property costs in addition Ongoing charges excluding

to the management fees and performance fees 0.65% 0.65%

all other expenses incurred ------- --------

in running a publicly listed Ongoing charges excluding

company. As no other investment performance fees and

trusts hold part of their Direct Property Costs 0.63% 0.62%

portfolio in direct property ------- --------

(they either hold 100% of

their portfolio as property

securities or as direct property), * The ongoing charges are competitive when compared to

in addition to Ongoing Charges the peer group.

as defined by the AIC, this

statistic is shown without

direct property costs to allow

a clearer comparison of overall

administration costs with

other funds investing in securities.

The Board monitors the Ongoing

Charges, in comparison to

a range of other Investment

Trusts of similar size, both

property sector specialists

and other sector specialists.

------------------------------------------------------------------

Investment Trust Status

The Company must continue * The Board reviews financial information and forecasts

to operate in order to meet at each meeting which set out the requirements

the requirements for Section outlined in Section 1158.

1158 of the Corporation Tax

Act 2010.

* The Directors believe that the conditions and ongoing

requirements have been met in respect of the year to

31 March 2021 and that the Company will continue to

meet the requirements.

------------------------------------------------------------------

The KPIs are considered to be Alternative Performance Measures

as defined in the full annual report and accounts.

Principal and Emerging Risks and Uncertainties

In delivering long-term returns to shareholders, the Board must

also identify and monitor the risks that have been taken in order

to achieve that return. The Board has included below details of the

principal and emerging risks and uncertainties facing the Company

and the appropriate measures taken in order to mitigate these risks

as far as practicable.

The Board also considers new and emerging risks adding

appropriate monitoring and mitigation measures accordingly.

The impact of the COVID-19 pandemic, the response of financial

markets, the unknown duration of the pandemic and ongoing impact on

economies around the world together with operational changes in

response to government guidelines continues to increase some of the

risks listed below in comparison with prior years.

Risk Identified Board monitoring and mitigation

Share price performs poorly in

comparison to the underlying NAV * The Board monitors the level of discount or premium

The shares of the Company are at which the shares are trading over the short and

listed on the London Stock Exchange longer-term.

and the share price is determined

by supply and demand. The shares

may trade at a discount or premium * The Board encourages engagement with the

to the Company's underlying NAV shareholders. The Board receives reports at each

and this discount or premium may meeting on the activity of the Company's brokers, PR

fluctuate over time. agent and meetings and events attended by the Fund

Manager.

* The Company's shares are available through the BMO

share schemes and the Company participates in the

active marketing of these schemes. The shares are

also widely available on open architecture platforms

and can be held directly through the Company's

registrar.

* The Board takes the powers to buy-back and to issue

shares at each AGM.

-------------------------------------------------------------

Poor investment performance of

the portfolio relative to the * The Manager's objective is to outperform the

benchmark benchmark. The Board regularly reviews the Company's

The Company's portfolio is actively long-term strategy and investment guidelines and the

managed. In addition to investment Manager's relative positions against these.

securities the Company also invests

in commercial property and accordingly,

the portfolio may not follow or * The Management Engagement Committee reviews the

outperform the return of the benchmark Manager's performance annually. The Board has the

powers to change the Manager if deemed appropriate.

-------------------------------------------------------------

Market risk

* The Board receives and considers a regular report

Both share prices and exchange from the Manager detailing asset allocation,

rates may move rapidly and adversely investment decisions, currency exposures, gearing

impact the value of the Company's levels and rationale in relation to the prevailing

portfolio. market conditions.

Although the portfolio is diversified

across a number of geographical * The report considers the potential impact of Brexit

regions, the investment mandate and the Manager's response in positioning the

is focused on a single sector portfolio.

and therefore the portfolio will

be sensitive towards the property

sector, as well as global equity * The report considers the current and potential future

markets more generally. impact of the COVID-19 pandemic and the ongoing

implication for the property market and valuations

Property companies are subject overall and by each sector.

to many factors which can adversely

affect their investment performance,

these include the general economic

and financial environment in which

their tenants operate, interest

rates, availability of investment

and development finance and regulations

issued by governments and authorities.

Although we have now exited the

European Union the structure of

our future relationship with Continental

Europe is still evolving and there

could be an impact on occupation

across each sector.

The COVID-19 global pandemic dominated

the financial year. This has changed

the way we live and work, creating

unprecedented uncertainty regarding

the impact on economies and property

markets around the world both

in the short and longer term.

Any strengthening or weakening

of Sterling will have a direct

impact as a proportion of our

Balance Sheet is held in non-GBP

denominated currencies. The currency

exposure is maintained in line

with the benchmark and will change

over time. As at 31 March 2021,

72.1% of the Trust's exposure

lies to currencies other than

GBP.

-------------------------------------------------------------

The Company is unable to maintain

dividend growth * The Board receives and considers regular income

Lower earnings in the underlying forecasts.

portfolio putting pressure on

the Company's ability to grow

the dividend could result from * Income forecast sensitivity to changes in FX rates is

a number of factors: also monitored.

-- lower earnings and distributions

in investee companies. Companies * The Company has substantial revenue reserves which

in some property sectors continue can be drawn upon when required.

to be negatively impacted by the

COVID-pandemic. Companies in some

sectors cancelled reduced dividends * The Board will continue to monitor the impact of

during the last financial year COVID-19 and the long term implications for income

precautionary measure to protect generation.

their balance in the short term.

Although most have returned paying

dividends, some are at a lower

level than previously and others

are continuing to withhold dividends;

-- prolonged vacancies in the

direct property portfolio and

lease or rental renegotiations

as a result of COVID-19;

-- strengthening Sterling reducing

the value of overseas dividend

receipts in Sterling terms. The

Company has seen a material increase

in the level of earnings in recent

years. A significant factor in

this was the weakening of Sterling

following the Brexit decision.

Sterling strengthened in the last

quarter of the financial year.

This may continue or reverse again

in the near or medium term as

the longer term implications of

Brexit and the COVID-19 pandemic

the impact on the UK and European

economies understood. Strengthening

of Sterling would lead fall in

earnings;

-- adverse changes in the tax

treatment of dividends other income

received by the Company; and

-- changes in the timing of dividend

receipts from

investee companies.

-------------------------------------------------------------

Accounting and operational risks

Disruption or failure of systems * Third party service providers produce periodic

and processes underpinning the reports to the Board on their control environments

services provided by third parties and business continuation provisions on a regular

and the risk that these suppliers basis.

provide a sub-standard service.

The impact of the COVID-19 pandemic * The Management Engagement Committee considers the

and the operational response from performance of each of the service providers on a

the manager and service providers regular basis and considers their ongoing appointment

has been closely monitored. and terms and conditions.

* The Custodian and Depository are responsible for the

safeguarding of assets. In the event of a loss of

assets the Depository must return assets of an

identical type or corresponding amount unless able to

demonstrate that the loss was the result of an event

beyond their reasonable control.

* Monitoring the quality and timeliness of service as

service providers respond to COVID-19 regulations and

guidelines, in particular with widespread home

working and consideration of the durability of the

arrangements. Many organisations are now planning to

incorporate home working into their operational

structure as a permanent feature.

-------------------------------------------------------------

Financial risks

The Company's investment activities * Details of these risks together with the policies for

expose it to a variety of financial managing these risks are found in the Notes to the

risks which include counterparty Financial Statements in the full Annual Reports and

credit risk, liquidity risk and Accounts.

the valuation of financial instruments.

Any impact of the COVID-19 pandemic

has been considered.

-------------------------------------------------------------

Loss of Investment Trust Status

The Company has been accepted * The Investment Manager monitors the investment

by HM Revenue & Customs as an portfolio, income and proposed dividend levels to

investment trust, subject to continuing ensure that the provisions of CTA 2010 are not

to meet the relevant eligibility breached. The results are reported to the Board at

conditions. As such the Company each meeting.

is exempt from capital gains tax

on the profits realised from the

sale of investments. * The income forecasts are reviewed by the Company's

tax advisor through the year who also reports to the

Any breach of the relevant eligibility Board on the year-end tax position and reports on CTA

conditions could lead to the Company 2010 compliance.

losing investment trust status

and being subject to corporation

tax on capital gains realised

within the Company's portfolio.

-------------------------------------------------------------

Legal, regulatory and reporting

risks * The Board receives regular regulatory updates from

Failure to comply with the London the Manager, Company Secretary, legal advisors and

Stock Exchange Listing Rules and the Auditors. The Board considers these reports and

Disclosure Guidance and Transparency recommendations and takes action accordingly.

rules; failure to meet the requirements

under the Alternative Investment

Funds Directive, the provisions * The Board receives an annual report and update from

of the Companies Act 2006 and the Depository.

other UK, European and overseas

legislation affecting UK companies.

Failure to meet the required accounting * Internal checklists and review procedures are in

standards or make appropriate place at service providers.

disclosures in the Interim and

Annual Reports.

-------------------------------------------------------------

Inappropriate use of gearing

Gearing, either through the use * The Board receives regular reports from the Manager

of bank debt or through the use on the levels of gearing in the portfolio. These are

of derivatives may be utilised considered against the gearing limits set in the

from time to time. Whilst the Investment Guidelines and also in the context of

use of gearing is intended to current market conditions and sentiment. The cost of

enhance the NAV total return, debt is monitored and a balance sought between term,

it will have the opposite effect cost and flexibility.

when the return of the Company's

investment portfolio is negative

or where the cost of debt is higher

than the return from the portfolio.

-------------------------------------------------------------

Personnel changes at Investment

Manager * The Chairman conducts regular meetings with the Fund

Loss of portfolio manager or other Management team.