TR Property Investment Trust PLC Post-AGM Update (3899U)

28 Luglio 2020 - 7:02PM

UK Regulatory

TIDMTRY

RNS Number : 3899U

TR Property Investment Trust PLC

28 July 2020

28 July 2020

TR Property Investment Trust plc

Post-AGM Update

As announced on 22(nd) June 2020, TRY held the AGM today as a

closed meeting in order to protect the health and safety of the

Company's shareholders and officers. The results of the voting at

the Trust's 2020 Annual General Meeting have been published

separately under RNS 3888U. In lieu of the usual AGM presentation,

the Investment Manager posted a webcast regarding the Trust's

portfolio and performance and this remains available on the

Company's website www.trproperty.com

The new financial year ending 31(st) March 2021 has started

strongly with the NAV total return rising +11.5% against a

benchmark total return of +8.1%. Disappointingly the share price

performance has risen only +7.6% (data as at 24(th) July) as the

discount to NAV has increased to a little over 14% offering a

dividend yield of 4.2% based on last year's annual dividend of

14p.

David Watson succeeded Hugh Seaborn as Chairman of the Board and

expressed his thanks to the outgoing Chair for his sage and

insightful advice and leadership of the Company and the Board.

Speaking at the AGM Hugh Seaborn observed "Whilst we are in

uncharted waters in many respects, it is important to recognise key

points made by the manager in his presentation. The Trust has

performed well as a result of its active stock selection approach

with significant exposure to Healthcare, Logistics, Industrial, PRS

and Supermarkets, all of which have performed well through the

COVID 19 crisis. Conversely the Trust remains underweight in

Central London offices and all non-food retail sectors. As we

approach the Brexit deadline, investors should also recognise that

70% of the Trusts assets are denominated in currencies other than

Sterling." At the Board meeting earlier in the day the Board noted

and reaffirmed the Chairman's comments in the 2019/20 Annual Report

that the company benefited from a healthy level of revenue reserves

(equating to approximately 14p per share) that can be used to

supplement the company's dividend payments in the event of any

short to medium term fall in earnings.

For further information please contact:

Jemima Rail

Link Company Matters

Tel: 020 7954 9797

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCUWVNRRWUBUAR

(END) Dow Jones Newswires

July 28, 2020 13:02 ET (17:02 GMT)

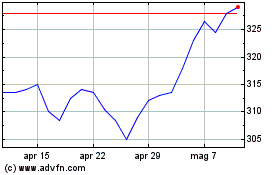

Grafico Azioni Tr Property Investment (LSE:TRY)

Storico

Da Mar 2024 a Apr 2024

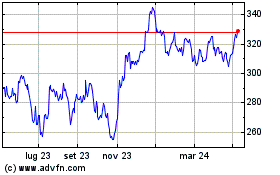

Grafico Azioni Tr Property Investment (LSE:TRY)

Storico

Da Apr 2023 a Apr 2024