Telstra to Hand A$1.4Bn to Shareholders on Towers Stake Sale -- Update

30 Giugno 2021 - 1:32AM

Dow Jones News

By Stuart Condie

SYDNEY--Telstra Corp. will return about 1.40 billion Australian

dollars (US$1.05 billion) to shareholders after agreeing to sell a

49% stake in its mobile towers business to a consortium including

Australia's sovereign wealth fund.

Australia's largest communications provider on Wednesday said a

consortium comprising Australia's sovereign Future Fund and two

superannuation funds--Commonwealth Superannuation Corporation and

Sunsuper--will acquire the stake in a deal valuing the unit at

A$5.9 billion.

Telstra said it expected net cash proceeds after transaction

costs of A$2.8 billion at completion in the first quarter of fiscal

2022, and that it would return about half to shareholders during

that financial year.

Chief Executive Andrew Penn said Telstra planned to give details

of the mechanism by which it would hand over the cash when it

announces its FY 2021 results in August. He said a share buyback

was among the options.

Mr. Penn said Telstra will invest about A$75 million in its

regional network, with the remaining proceeds directed toward debt

reduction.

Telstra will retain a majority stake in the unit, which is

Australia's largest mobile tower infrastructure provider with

approximately 8,200 towers.

Telstra started preparations for the stake sale in November,

when it split its operations into three businesses, later upping

this to four. The move was also seen by analysts as getting Telstra

ready to bid in the expected privatization of the government-owned

National Broadband Network.

Telstra had planned to seek investment early in its 2022

financial year, which starts on Thursday, but accelerated its plans

following an approach by the consortium.

"They recognized the value of these assets and provided a

compelling rationale to progress the transaction ahead of

schedule," Mr. Penn said.

The InfraCo Towers business will operate under a board chaired

by the Chief Executive of Telstra's infrastructure unit, Brendon

Riley. Jon Lipton, who currently heads the towers business, will be

its Chief Executive.

As well as its mobile towers infrastructure unit, Telstra has a

services unit to hold products and assets such as mobile spectrum.

It has an infrastructure unit for assets including data centers and

said in March it was carving out another for international assets

such as sub-sea cables.

Telstra shares last traded at A$3.60, up 21% since the start of

the calendar year.

Write to Stuart Condie at stuart.condie@wsj.com

(END) Dow Jones Newswires

June 29, 2021 19:20 ET (23:20 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

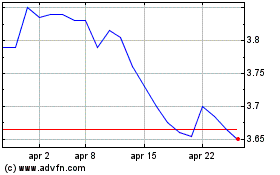

Grafico Azioni Telstra (ASX:TLS)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Telstra (ASX:TLS)

Storico

Da Apr 2023 a Apr 2024