Tern PLC: Portfolio and Investments Update (910317)

12 Novembre 2019 - 8:05AM

UK Regulatory

Tern PLC (TERN)

Tern PLC: Portfolio and Investments Update

12-Nov-2019 / 07:05 GMT/BST

Dissemination of a Regulatory Announcement that contains inside information

according to REGULATION (EU) No 596/2014 (MAR), transmitted by EQS Group.

The issuer is solely responsible for the content of this announcement.

12 November 2019

Tern Plc ("Tern" or the "Company")

Portfolio and Investments Update

Tern Plc (AIM:TERN), the investment company specialising in the Internet of

Things ("IoT"), is pleased to provide an update on the activities of the

Company and its six portfolio companies since 30 June 2019, being the date

which marks Tern's half year end.

Since 30 June 2019 to date, Tern has invested GBP1.1 million in its portfolio

companies, predominantly in the form of convertible debt. The Company has

also raised a further GBP1.75 million through an equity subscription in

November 2019.

Turnover of Tern's principal portfolio companies* for the nine months ended

30 September 2019 was ahead compared to the comparable period in 2018. As is

common in early stage businesses, the majority of revenue attainment is

often delivered within the fourth quarter and our principal portfolio

companies have opportunities that, if concluded, will enable them to meet

the Company's expectation that the year-on-year turnover of principal

portfolio companies will increase by 50%. We also anticipate continued

growth in employee headcount within the principal portfolio companies* by

the year end, particularly in the light of the recent further funding of

FundamentalVR and DA.

The Company is in discussions regarding several potential new investments

although none of these are at an advanced stage of negotiation.

* Principal portfolio company growth excludes Seal Software Group Limited

and Push Technology Limited, in which Tern has a <1% holding and minimal

influence.

Device Authority Limited ("DA")

Tern holding: 56.8%

Sector: Security

Invested Since: September 2014

Tern has a 56.8% holding in DA, which specialises in IoT security. The

investor group, which Tern leads, committed a further convertible secured

loan to DA in November 2019 amounting to US$775,000, of which Tern

contributed approximately US$583,000. This is in addition to the $315,000

convertible secured loan provided to DA in September 2019, as announced on

26 September 2019. Following this investment, Tern's total convertible

secured loan note position with DA is US$3,313,650. The recent loan is

repayable on 31 March 2020, in line with all other outstanding loans. This

funding is in line with the investor group's support of the success that the

business has achieved and the continued development underway at the company.

On 31 October 2019, DA disclosed it had been accepted into the Venafi

Machine Identity and Protection Development Fund, a US$12.5 million

initiative to protect all machine identities, established by Venafi, a

leading provider of machine identity protection.

Since 30 June 2019, DA has continued to strengthen its active partner base

and on 3 September 2019, DA announced its latest KeyScaler software release

with more support for Microsoft Azure IoT and a new solution for managing

Hardware Security Modules (HSM) called "HSM Access Controller", which

delivers granular authentication and authorization controls for IoT devices

and enterprise services connecting to HSM platforms.

FVRVS Limited ("FundamentalVR")

Tern holding: 26.9%

Sector: Healthcare IoT

Invested Since: May 2018

Tern's shareholding in FundamentalVR is now 26.9% with a valuation of GBP3.0

million. FundamentalVR is a leading virtual reality ("VR") training and data

analysis technology platform. FundamentalVR's award-winning platform

combines immersive VR with cutting-edge haptics (the sense of touch) to

create realistic simulator experiences. It is a revolutionary way to allow

medical device and pharma companies to accelerate skills development for

medical practitioners with the goal of accelerating their product adoption.

FVR announced a GBP4.3 million Series A fundraise, including a GBP0.5 million

convertible loan note conversion by Tern, on 30 October 2019, at a

post-money valuation of GBP11.3 million. This fundraise was significant in

that it encompassed both financial and industry participants and resulted in

a fair value increase in Tern's investment of GBP0.6 million. FundamentalVR

has also continued to build revenue with new contracts and a strong pipeline

of new business.

Since 30 June 2019, FundamentalVR has received Continuing Professional

Development ("CPD") accreditation for its entire current portfolio of

surgical training simulations by the Royal College of Surgeons of England.

It has expanded its team including a new Vice President of Client Solutions

and Partnerships for North America and as announced with the interim results

on 25 September 2019, FundamentalVR secured significant commercial contract

(worth approximately GBP0.5 million) with a leading pharmaceutical company to

create an additional VR simulation.

InVMA Limited ("InVMA")

Holding: 50%

Sector: IoT enablement

Invested Since: September 2017

Tern has a 50% holding in InVMA, which delivers IoT products and

applications based on the industry leading PTC/Thingworx development

platform, delivering manufacturing and industrial process intelligence to

create competitive advantage for its customers.

Since 30 June 2019, InVMA has announced that it is one of the initial

companies to work on part of the Made Smarter initiative, helping customers

to implement factory optimisation. Made Smarter is a GBP20 million national

programme partnering government and industry to maximise the benefit from

increasing adoption of digital technology with match-funding, specialist

advice, student placements and leadership training.

InVMA used its PTC based product, AssetMinder(R) [1], in its initial Made

Smarter implementation, in conjunction with the UK's leading specialist

thermocouple cable manufacturer, Heatsense Cables [2](R).

Wyld Networks Limited ("Wyld Networks")

Holding: 100%

Sector: IoT enablement

Invested Since: June 2016

Wyld Networks, a company delivering secure intelligent mesh technology,

empowering resilient IoT and 5G networks and creating value for people,

places and things, is a wholly owned Tern investment.

Since 30 June 2019, Wyld Network's new CEO has joined the company and has

been driving the business forward. This is evidenced by Wyld Networks

securing a framework contract with Delta-T Devices, a world leader in the

development of sensors for the Agritech sector with an initial purchase

order valued at GBP105,000 to develop and supply Low-Power Wide-Area Network

(LPWAN) connectivity for Delta-T's state of the art soil moisture sensors.

Wyld Networks' experience in designing successful, efficient projects with

communication industry standards (LoRa, LoRaWAN, NBIoT, LTE, CatM1, BLE) and

Bluetooth makes Wyld Networks uniquely placed to deliver embedded networks

with gateways to carry data long distances at low energy.

Al Sisto, CEO of Tern, said:

"I am pleased to report on the progress Tern is making in increasing the

value of our investment portfolio, as our principal portfolio companies

continue to make progress in achieving their objectives. DA's IoT security

offering and Wyld Network's solutions continue to be recognised by industry

leaders such as Venafi and Delta-T Services, and we are very pleased to see

InVMA selected to participate in a major government backed project to help

implement technology solutions. These developments, together with the recent

news of a successfully syndicated Series A fundraise for FundamentalVR,

which attracted significant funding from both trade and institutional

players, demonstrate the positive headway that our investee companies can

make in a short period of time. We look forward to Tern and its shareholders

benefitting from their growth in the months and years ahead."

Enquiries

Tern Plc via Newgate Communications

Al Sisto/Sarah Payne

Allenby Capital Limited Tel: 0203 328 5656

(Nomad and Joint broker)

David Worlidge/Alex Brearley

Whitman Howard Tel: 020 7659 1234

(Joint broker)

Nick Lovering/Christopher Furness

Newgate Communications Tel: 020 3757 6880

Elisabeth Cowell/Megan Kovach

ISIN: GB00BFPMV798

Category Code: UPD

TIDM: TERN

LEI Code: 2138005F87SODHL9CQ36

Sequence No.: 28578

EQS News ID: 910317

End of Announcement EQS News Service

1: https://link.cockpit.eqs.com/cgi-bin/fncls.ssp?fn=redirect&url=0cbd953ec25dc356957f39609857a6cb&application_id=910317&site_id=vwd&application_name=news

2: https://link.cockpit.eqs.com/cgi-bin/fncls.ssp?fn=redirect&url=651ae43b729f66c4a84987c5c3095246&application_id=910317&site_id=vwd&application_name=news

(END) Dow Jones Newswires

November 12, 2019 02:05 ET (07:05 GMT)

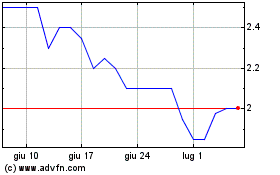

Grafico Azioni Tern (LSE:TERN)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Tern (LSE:TERN)

Storico

Da Apr 2023 a Apr 2024