TIDMWRKS

RNS Number : 2134S

TheWorks.co.uk PLC

12 November 2021

12 November 2021

TheWorks.co.uk plc

("The Works", the "Company" or the "Group")

Half-year trading update for the 26 weeks ended 31 October

2021

TheWorks.co.uk plc, the multi-channel value retailer of arts,

crafts, toys, books and stationery, today announces a trading

update for the 26 weeks ended 31 October 2021 (the "Period" or "H1

FY22").

Highlights

-- Trading during the Period has been stronger than expected,

with a two-year LFL(1) sales increase of 14.5% and total

two-year sales growth of 17.9%(2) .

-- The trading result reflects the increasing appeal of The

Works' proposition and the strong progress in implementing

our strategy to make the business "better not just bigger".

-- Net cash(3) of GBP17.8m at the Period end, an increase

of GBP17.0m during H1 FY22, positions the Group well,

ahead of the peak trading period.

-- Through proactive management of the supply chain and,

assuming that our strategies to secure the supply of stock

continue to be successful, stock levels are expected to

support Christmas sales.

-- The Board expects the full year result for FY22 to be

in line with its original expectations, despite incurring

higher freight costs.

Trading update

Total sales(2) for the Period increased by 17.9% compared to H1

FY20 (i.e. compared to two years ago), exceeding the Board's

expectations and demonstrating the increasing appeal of The Works'

proposition. Two-year LFL sales increased by 14.5%, with positive

growth both online and in stores. Online sales have continued to be

approximately double those in the comparable FY20 period.

The refocused strategy outlined in July 2021 included

de-emphasising new store openings in favour of profitable digital

growth and driving improvements through the existing store estate.

Good progress against these pillars has helped to deliver the

strong performance in the Period, including: improving the range

and merchandising of our core art, craft and stationery categories;

enhancing the in-store shopping experience through better space

management and making our stores easier to shop in; and continuing

to improve product availability through better stock management,

including improving our supply chain systems.

The business has also benefitted during the Period from

favourable external factors. Consumer demand has been strong,

perhaps due in part to many families taking 'staycations' in the

U.K. and we believe the convenient locations of many of our stores

helped us benefit from this. The Group also delivered a strong

'back to school' performance, and has been successful in

capitalising on the recent "fidget frenzy" trend. There are also

signs that customers are shopping early for Christmas and, whilst

the impact of this on H1 FY22 was small, we hope it is a positive

indicator that strong demand will continue into the peak Christmas

trading period.

The Works opened three new stores, closed five and relocated

four stores, trading from 526 stores at the end of H1 FY22 (4)

.

Financial position

The Group ended the Period in a strong financial position, with

net cash(3) of GBP17.8m (H1 FY21: GBP11.3m), up from GBP0.8m at the

end of FY21. This includes the effect of favourable timing

differences of approximately GBP10.0m, which are expected to unwind

during the second half of the financial year.

Outlook

The early indications of Christmas sales are positive. However,

the business is being affected by the widely reported shortages of

ocean freight and UK haulage capacity. To minimise the impact of

this, we made a conscious decision earlier in the year to secure

the supply chain, as a result of which, we expect to have the stock

we need in order to achieve our sales plans, albeit having incurred

significant additional costs.

Overall, taking into account the stronger than expected trading

during H1 FY22 and the higher freight costs and, assuming that our

strategies to ensure the availability of stock to customers in the

lead up to Christmas continue to be successful, the Board

anticipates that the full year result for FY22 will be in line with

its original expectations.

Gavin Peck, Chief Executive Officer of The Works, commented:

"It's clear from these results that our products resonated

extremely well with customers during the pandemic, helping them to

read, learn, play and craft through lockdown. Our strong sales in

recent months demonstrate that demand has been maintained and

customers continue to value our offer. It's particularly pleasing

to see that whilst our online sales continue to run at almost

double their pre-pandemic levels, store sales are also growing.

"Looking ahead, we have a fantastic range of products for our

customers this Christmas with initial demand for them already very

strong. We are cautiously optimistic about prospects for our peak

sales season and our ability to trade through the ongoing supply

chain challenges faced by the majority of our sector.

"As we celebrate our 40th year, I am proud of the business that

The Works has become and of our colleagues who work incredibly hard

to delight our customers and support one another."

Interim results notification

The interim results for H1 FY22 and an update on Christmas

trading will be announced on Friday, 21 January 2022.

Enquiries:

TheWorks.co.uk via Sanctuary

plc Counsel

Gavin Peck CEO

Steve Alldridge

CFO

Sanctuary Counsel

Ben Ullmann +44 7944 868288 theworks@sanctuarycounsel.com

Rachel Miller |

+44 7918 606667

|

(1) The like for like (LFL) sales increase has been calculated

with reference to the FY20 comparative sales figures, or

two-year LFL, because the extended periods of enforced

store closures during FY21 prevent that period from forming

the basis of meaningful comparisons.

(2) "Total sales" referred to in this statement includes VAT

and is stated prior to deducting the cost of loyalty points

which are adjusted out of the sales figure in the calculation

of statutory revenue. The 26 week comparison period in

FY20 used for the LFL and total sales calculations uses

a literal mapping of calendar weeks between H1 FY22 and

the corresponding 26 weeks two years prior. Due to the

inclusion of a 53(rd) week in the FY21 accounting period,

the H1 FY20 statutory accounting period is one week offset

from the 26 week period used in the LFL and total sales

comparisons. A reconciliation between the figures included

in this statement and the H1 FY22 statutory revenue will

be included in the Group's Interim Report to be issued

in January 2022.

(3) Net cash at bank excluding finance leases and on a non-IFRS

16 basis.

(4) In relation to one of the relocated stores, the corresponding

closure of the old store that is being relocated had not

taken place by the period end, hence the Group traded from

526 stores rather than the 525 that the gross figures would

imply.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRFDKBBDOBDKODD

(END) Dow Jones Newswires

November 12, 2021 02:20 ET (07:20 GMT)

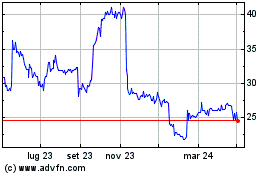

Grafico Azioni Theworks.co.uk (LSE:WRKS)

Storico

Da Mar 2024 a Apr 2024

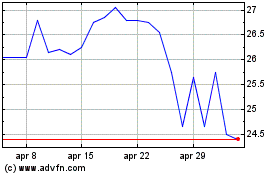

Grafico Azioni Theworks.co.uk (LSE:WRKS)

Storico

Da Apr 2023 a Apr 2024