This Is How Cardax Is Set To Become A Top DEX On The Cardano Ecosystem

25 Gennaio 2022 - 11:57AM

NEWSBTC

Cardano and its ecosystem have been implementing major improvements

since Q4, 2020, and across 2021. Its users, stake pool delegators,

and the company behind its development Input-Output Global (IOG),

under the leadership of Charles Hoskinson, have been particularly

focused on expanding Cardano’s smart contract capabilities. Thus,

the successful implementation of three Hard Fork Combinator (HFC)

events, dubbed “Allegra”, “Mary”, and “Alonzo” have opened an

endless field of possibilities for Cardano. Cardax, a decentralized

exchange and automated market maker (AMM), built for this network

is one of the many projects seeking to leverage Cardano’s new

capabilities as the ecosystem moves to fulfill a vision of

decentralization, financial inclusion, and sustainability.

Supported by the Cardano community via the ecosystem’s crowdfunding

program Project Catalyst, Cardax is one of the AMM on this network

aiming to provide its users with a secure and reliable product. On

Ethereum, hackers have taken millions from users by leveraging

security flaws. The AMM on this network will fully support

Cardano’s native token capabilities by allowing its users to trade

with these digital assets, to trade with different native tokens in

a single transaction and become liquidity providers with the

Extended Automated Market Maker (EAMM) protocol. These features

make Cardax a more efficient, cost-efficient, and secure product

set to compete with Uniswap, SushiSwap, PancakeSwap, and other AMMs

in the industry as it will offer users unique functionalities. This

will include the capacity to trade via Cardano’s Yoroi wallet, and

liquidity provides the ability to earn fees collected on the

platform. Why Cardax Is A One-Of-A-Kind Platform For The DeFi

Sector Another unique characteristic about this platform is its

hybrid model that will combine the benefits of an AMM and an order

book, such as the one used in traditional exchanges, to enable

trading. The end-user will be able to benefit from these dual

models by leveraging efficient slippage and minimizing the risk of

impermanent loss. This is how Cardax will provide a practical

solution to the most common issues present in almost every AMM

currently operating in the DeFi sector. At the same time, projects

building on the Cardano ecosystem will be able to access a native

market for their tokens and boost their adoptions levels. The DEX

is being created in collaboration with Well-Typed, a top Haskell

consultancy led by Duncan Coutts, and Mlabs, a Haskell, Rust,

Blockchain & AI consultancy firm. It has also partnered with

Tweag, a software innovation lab that concentrates on Haskell

development for finance platforms and applications. In 2022, Cardax

will attempt to deploy its own native stablecoin to facilitate

trading. Post-launch, the developers of this AMM will focus on

working on its second iteration with even more features and

functionalities. As Cardano aims to become a fully decentralized

and self-governor ecosystem, Cardax will be managed by its

community. All CDX holders, the native token for this platform,

will have a voice and say about the project’s future development.

The Cardano network and its developments have a strong community

and persistent detractors. The latter claimed the blockchain has

taken “too long” in deploying smart contracts, but loyal users have

stayed due to its clear vision, roadmap, its security, and projects

such as Cardax that could support the digital economy of the

future.

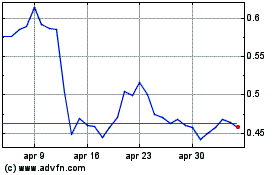

Grafico Azioni Cardano (COIN:ADAUSD)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Cardano (COIN:ADAUSD)

Storico

Da Apr 2023 a Apr 2024