TIDMTST

RNS Number : 1397Y

Touchstar PLC

07 September 2020

7 September 2020

Touchstar plc

Interim results for the

Six months ended 30 June 2020

The Board of Touchstar plc ( (AIM:TST) 'Touchstar' , the

'Company' or 'the Group'), suppliers of mobile data computing

solutions and managed services to a variety of industrial sectors,

is pleased to announce its interim results for the six months ended

30 June 2020.

This announcement includes inside information as defined in

Article 7 of the Market Abuse Regulation No. 596/2014 and is

disclosed in accordance with the Company's obligations under

Article 17 of those obligations.

Key Financials:

30 June 30 June

2020 2019

* Revenues GBP3,178,000 GBP3,635,000

* Continuing operations revenue GBP3,178,000 GBP3,369,000

* Operating profit/(loss) GBP139,000 GBP(518,000)

* Trading profit/ (loss) before exceptional items* GBP139,000 GBP(215,000)

* Profit/(loss) after tax GBP150,000 GBP(357,000)

* EPS - Basic 1.77p (4.21)p

* EPS - Adjusted * 1.77p (0.63)p

* Cash/ (Overdraft) GBP1,464,000 GBP(204,000)

* Refer to note 3 for further details

Commenting on the results, Ian Martin, Chairman of Touchstar,

said:

" Touchstar came into 2020 with momentum from a strong order

book, clear strategic plans and a solid balance sheet. In the six

months ended 30 June 2020 we have had to demonstrate resilience

under crisis conditions. It is a real achievement that Touchstar

traded profitably, generated cash, supported customers and most

importantly looked after staff in a period of a global pandemic and

the largest economic contraction in a generation - these are not

normal times.

"We continue to outperform the road map we put in place in

February to navigate the business through until 2022.

"Our motivation is not just to be a survivor of this crisis, the

ambition is to emerge with solid finances, improved products, all

our talent and renewed energy - we remain on track."

For further information, please contact:

Touchstar plc www.touchstarplc.com

Ian Martin 0161 874 5050

Mark Hardy 0161 874 5050

WH Ireland - Nominated Adviser & Broker www.whirelandcb.com

Corporate Finance - Mike Coe/Chris Savidge 0117 945 3472

Corporate Broking - Jasper Berry

Information on Touchstar plc can be seen at:

www.touchstarplc.com

CHAIRMAN'S INTERIM STATEMENT 2020

Touchstar came into 2020 with momentum from a strong order book,

clear strategic plans and a solid balance sheet. In the six months

ended 30 June 2020 we have had to demonstrate resilience under

crisis conditions. It is a real achievement that Touchstar traded

profitably, generated cash, supported customers and most

importantly looked after staff in a period of a global pandemic and

the largest economic contraction in a generation - these are not

normal times.

This has been a tough time for us all. It has not been easy,

there have been many sleepless nights as we have tried to do what's

best for the Company, its staff and customers. Crucially,

management anticipated the scale and magnitude of the issues that

were coming. Putting in place that roadmap before the crisis

unfolded proved invaluable, it has maintained confidence and

enabled Touchstar to deliver a good financial performance whilst

preserving the long-term potential of the business.

We are still vigilant. No doubt at some point the world will

recover. Our expectation is that will not be anytime soon. Covid-19

("C-19") is not going away, it will continue to disturb society and

erode confidence. The UK economy is deeply scarred, with much of

that damage yet to manifest itself. We retain the cautious

disposition that has served us so well since February; we remain

focused upon looking after staff, customers and cash.

On behalf of all shareholders I would like to thank all my

colleagues at Touchstar for what was achieved in the first six

months of this year. We had to adapt the business very quickly. It

is only through the personal sacrifice and the phenomenal

collective effort across the company at all levels that this was

achieved - sometimes compressing weeks of work into days - again,

thanks it is greatly appreciated.

Financial Performance

At the start of the year Touchstar plc was defensively

positioned with cash in the bank, no net debt, a lowered cost base

and a strong order book. Throughout the C-19 crisis the Group

worked flat out to complete orders, ship to clients and invoice so

that orders could be turned into cash; however C-19 undoubtedly

caused disruption to the business and slowed our forward

momentum.

Continuing operations revenue for the six months ended 30 June

2020 declined by 5.7% to GBP3,178,000 (six months ended 30 June

2019 ("H1 2019"): GBP3,369,000). This was a creditable result in

the circumstances. Naturally, the sales process was hampered by the

impacts of the C-19 crisis as customer behavior evolved and we all

adapted to a changing environment and different ways of doing

business.

As we have previously highlighted 70% of our revenue is

generated from sectors deemed as "essential" during the UK

lockdown. This resilience was demonstrated by our largest business

which is in the Fuel Delivery market and our Warehousing &

Logistics business - both areas increased revenue over the

equivalent period last year. Access Control and Podstar, which are

more exposed to the less essential sectors of the economy, were

negatively impacted. The reduction in revenue in these areas was

predominately due to our inability to complete installations as

customers restricted movement on their sites, or in some cases went

into lockdown for three months. The majority of these orders have

been deferred, not lost.

Margins reduced to 50.1% (H1 2019: 51.9%) which reflects the

product mix of the revenue in this period, with a particularly

sizable hardware deal in the period which generated a lower margin

than our software products.

Touchstar was profitable, we achieved an operating profit of

GBP139,000 (H1 2019: loss GBP518,000). On an after-tax basis the

profit was GBP150,000 compared to a loss of GBP357,000 in the six

months ended 30 June 2019. This translated into EPS of 1.77p (H1

2019: (4.21)p). A substantial turnaround for the business.

We entered 2020 as a more streamlined business with a

significantly reduced cost base. As mentioned earlier, management

was proactive in putting in place a plan to navigate through the

C-19 crisis. This enabled us to participate in and gain assistance

from many of the "self-help' schemes made available by the UK

Government. The access to Government support, internal "self-help"

measures and the benefits of the prior year restructuring meant

costs were dramatically reduced and cash flow strengthened.

Cash controls measures included:

-- the Company drawing on the support of the Coronavirus Job

Retention Scheme (CJRS) which enabled us to retain all our

employees with 95% of those furloughed now already back in full

employment;

-- all employees earning over the UK Government's rate of pay

for furloughed staff reducing their salaries to GBP3,000 a month

for the period of lockdown;

-- Non-Executive directors drawing no salary for period of the lockdown;

-- all but essential expenditure being frozen or eliminated; and

-- rent reductions being secured for offices over the period of lockdown

Both direct and indirect expenses were reduced by GBP808,000 in

the period, of which some GBP450,000 relates to "one off self-help"

measures and GBP358,000 is the reoccurring benefit of last year's

restructuring.

We enhanced short term cashflow further by use of other

Government business support schemes. In this period, we took

advantage by:

-- a deferral of one quarter VAT until 31(st) March 2021 which totalled GBP157,000;

-- deferring payment of PAYE and NI liabilities totalling GBP114,000 (now settled); and

-- successfully securing a GBP150,000 Coronavirus Business Interruption Loan (CBIL's)

The cash less overdraft position improved by GBP610,000 over the

half year to GBP1,464,000. This compared to GBP850,000 at the start

of 2020 (H1 2019: Overdrawn GBP(204,000)).

This is an impressive outcome and is testament to our culture of

placing great importance on cash management together with the cash

generative nature of our business which contributed GBP339,000 of

free cash in the period.

2020 Outlook

We have been encouraged by the continued level of engagement of

our customers, it is not business as normal, but even those sectors

hit hardest in the crisis are returning. We have always retained

the ability to operate under social distancing guidelines and

continue to ship orders effectively. The order book which stood at

GBP519,000 on the 30 June 2020. Since the period end new orders

have continued to be secured and the order book remains at a stable

level.

It remains very difficult to predict the outlook and the exact

performance of the business. We recognise the possibility of

further lockdowns either nationally or regionally. The consistent

message we have given is that we do not expect normalisation of

trading until 2022. After prior economic shocks it has taken about

18 to 24 months for confidence to fully return.

Touchstar is well prepared to deal with the challenges we face.

Our expectation is that the second half of 2020 will be weaker than

the first six months of 2020. It will take us a while to regain

some of the momentum we lost in those "missing" three months of

lockdown. A typical new sale has a lead time of about six months.

Many of the "self-help" benefits will not repeat in the second half

of this year and the short-term improvements to cashflow from the

various Government schemes will reverse over the coming months.

We continue to outperform the road map we put in place in

February to navigate the business through until 2022. The Board at

that point not only considered the effects of the initial damage

caused by the C-19 crisis and resulting economic downturn, but also

the working capital requirements of an economic recovery to ensure

sufficient liquidity was in place. We remain comfortable with the

assumptions on which we built this plan.

Touchstar is well positioned, the events in 2020 have only

accelerated the trend to digitalise business and move to an

e-commerce model. Our customers typically facilitate the completion

of on-line transactions, using Touchstar to enable data to be

captured, moved and used - this is potentially a valuable place to

be situated.

Our motivation is not just to be a survivor of this crisis, the

ambition is to emerge with solid finances, improved products, all

our talent retained and with renewed energy - we remain on

track.

I Martin

Executive Chairman

4 September 2020

Unaudited consolidated income statement

for the six months ended 30 June 2020

Six months ended 30 June Year ended 31 December

2020 2019 2019

GBP'000 GBP'000 GBP'000

------------------------------------- ------------------ ----------------------- -----------------------

Revenue 3,178 3,635 7,119

Cost of sales (1,587) (1,748) (3,277)

-------------------------------------- ------------------ ----------------------- --------------------------

Gross profit 1,591 1,887 3,842

Distribution costs (21) (26) (55)

Administrative expenses (1,544) (2,076) (4,591)

Other operating income (note 5) 113 - -

Operating profit/(loss) before

exceptional items 139 (215) (392)

Exceptional costs - (303) (412)

-------------------------------------- ------------------ ----------------------- --------------------------

Operating profit/(loss) 139 (518) (804)

Finance costs (9) (9) (25)

-------------------------------------- ------------------ ----------------------- --------------------------

Profit/(loss) before income tax 130 (527) (829)

Income tax credit (note 6) 20 170 328

-------------------------------------- ------------------ ----------------------- --------------------------

Profit/(loss) for the period

attributable to the owners of the

parent 150 (357) (501)

------------------ ----------------------- --------------------------

Profit/(loss) per ordinary share (pence) attributable to owners of the parent

during the period:

Pence per share Pence per share Pence per share

Profit/(loss) per share - Basic 1.77p (4.21)p (5.91)p

Profit/(loss) per share - Adjusted

(note 6) 1.77p (0.63)p (1.05)p

Unaudited consolidated statement of changes in equity

for the six months ended 30 June 2020

Retained

earnings/

Share premium (accumulated Total

Share capital account losses) equity

GBP'000 GBP'000 GBP'000 GBP'000

------------------------- -------------- -------------- -------------- --------

For the six months ended 30 June 2020

Balance at 31 December

2019 424 1,119 348 1,891

Profit for the period - - 150 150

Balance at 30 June 2020 424 1,119 498 2,041

------------------------- -------------- -------------- -------------- --------

For the six months ended 30 June 2019

Balance at 1 January 2019 424 1,119 849 2,392

Loss for the period - - (357) (357)

Balance at 30 June 2019 424 1,119 492 2,035

--------------------------- ---- ------ ------ ------

For the year ended 31 December 2019

Balance at 1 January 2019 424 1,119 849 2,392

Loss for the year - - (501) (501)

Balance at 31 December

2019 424 1,119 348 1,891

--------------------------- ---- ------ ------ ------

Unaudited consolidated statement of financial position

at 30 June 2020

30 June 30 June 31 December

2020 2019 2019

GBP'000 GBP'000 GBP'000

------------------------------- -------- -------- ------------

Non-current assets

Intangible assets 1,375 1,429 1,499

Property, plant and equipment 141 199 175

Right of use asset 430 643 522

Deferred tax assets 111 157 111

-------------------------------- -------- -------- ------------

2,057 2,428 2,307

------------------------------- -------- -------- ------------

Current assets

Inventories 920 1,161 891

Trade and other receivables 1,276 1,895 1,317

Current tax recoverable 38 656 344

Cash and cash equivalents 2,416 1,839 3,143

-------------------------------- -------- -------- ------------

4,650 5,551 5,695

------------------------------- -------- -------- ------------

Total assets 6,707 7,979 8,002

-------------------------------- -------- -------- ------------

Current liabilities

Trade and other payables 1,530 1,743 1,465

Contract liabilities 1,090 1,071 1,322

Borrowings 952 2,043 2,293

Lease liabilities 131 160 171

-------------------------------- -------- -------- ------------

3,703 5,017 5,251

------------------------------- -------- -------- ------------

Non-current liabilities

Deferred tax liabilities 234 269 234

Contract liabilities 223 139 208

Borrowings 150 - -

Lease liabilities 356 519 418

-------------------------------- -------- -------- ------------

963 927 860

------------------------------- -------- -------- ------------

Total liabilities 4,666 5,944 6,111

-------------------------------- -------- -------- ------------

Unaudited consolidated statement of financial position

at 30 June 2020 (continued)

30 June 30 June 31 December

2020 2019 2019

GBP'000 GBP'000 GBP'000

Capital and reserves attributable

to owners of the parent

Share capital 424 424 424

Share premium account 1,119 1,119 1,119

Profit and loss account 498 492 348

------------------------------------ -------- -------------- ------------

Total equity 2,041 2,035 1,891

------------------------------------ -------- -------------- ------------

Total equity and liabilities 6,707 7,979 8,002

------------------------------------ -------- -------------- ------------

Unaudited consolidated cash flow statement

for the six months ended 30 June 2020

30 June 2020 30 June 31 December

2019 2019

GBP'000 GBP'000 GBP'000

------------------------------------------------- -------------- ------------

Cash flows from operating activities

Operating profit/(loss) 139 (518) (804)

Depreciation 108 118 264

Amortisation 299 242 498

Development loss on disposal - - 29

Gain on disposal of PPE - - (10)

Net effect of capitalised leases - 61 68

Movement in:

Inventories (28) 51 319

Trade and other receivables 41 - 647

Trade and other payables (153) (29) (36)

------------------------------------------ ------ -------------- --------------

Cash generated (used in)/from operating

activities 406 (75) 975

Interest paid (9) (9) (25)

Corporation tax received 326 - 481

------------------------------------------ ------ -------------- --------------

Net cash generated /from/ (used

in) operating activities 723 (84) 1,431

------------------------------------------ ------ -------------- --------------

Cash flows from investing activities

Purchase of intangible assets (175) (319) (674)

Purchase of property, plant and

equipment (2) (14) (26)

Proceeds from sale of property,

plant & equipment - - 10

Net cash used in investing activities (177) (333) (690)

------------------------------------------ ------ -------------- --------------

Cash flows from financing activities

Principal elements of lease payments (58) (83) (187)

Lease concessions - non-cash change (24) - -

in lease liabilities

CIBLs loan 150 - -

------------------------------------------ ------ -------------- --------------

Net cash generated from / (used

in) financing activities 68 (83) (187)

------------------------------------------ ------ -------------- --------------

Net increase/ (decrease) in cash

and cash equivalents 614 (500) 554

Cash and cash equivalents at start

of the year 850 296 296

------------------------------------------ ------ -------------- --------------

Cash and cash equivalents at end

of the year 1,464 (204) 850

------------------------------------------ ------ -------------- --------------

Cash and cash equivalents

Cash at bank and in hand 2,416 1,839 3,143

Less: bank overdraft (included

within borrowings) (952) (2,043) (2,293)

Net cash/ (debt) 1,464 (204) 850

------------------------------------------ ------ -------------- --------------

Notes to the interim report and accounts

for the six months ended 30 June 2020

1. General information

Touchstar plc is a public company limited by share capital

incorporated and domiciled in the United Kingdom. The Company has

its listing on AIM. The address of its registered office is 1

George Square, Glasgow, G2 1AL.

2. Status of interim report and accounts

The financial information comprises the consolidated interim

balance sheet as at 30 June 2020, 30 June 2019 and the year ended

31 December 2019 along with related consolidated interim statements

of income and cash flows for the six months to 30 June 2020 and 30

June 2019 and year ended 31 December 2019 of Touchstar plc

(hereinafter referred to as 'financial information').

This financial information for the half year ended 30 June 2020

has neither been audited nor reviewed and does not comprise

statutory accounts within the meaning of the section 434 of the

Companies Act 2006. This financial information was approved by the

Board on 4September 2020.

The figures for the year ended 31 December 2019 have been

extracted from the audited annual report and accounts that have

been delivered to the Registrar of Companies. The auditors,

Haysmacintyre LLP, reported on those accounts under section 495 of

the Companies Act 2006. Their report was unqualified and did not

contain a statement under section 498 of that Act.

3. Basis of preparation

The interim report and accounts have been prepared, in

accordance with IAS 34 Interim Financial Reporting, using

accounting policies to be applied in the annual report and accounts

for the year ended 31 December 2020. These are consistent with

those included in the previously published annual report and

accounts for the year ended 31 December 2019, which have been

prepared in accordance with IFRS as adopted by the European

Union.

Non - GAAP financial measures

For the purposes of this interim announcement and annual report

and accounts, the Group uses alternative non-Generally Accepted

Accounting Practice ('non-GAAP') financial measures which are not

defined within IFRS. The Directors use the measures in order to

assess the underlying operational performance of the Group and as

such, these measures are important and should be considered

alongside the IFRS measures.

The following non-GAAP measure referred to in the interim

announcement relates to Trading profit.

'Trading profit/(loss)' is separately disclosed, being defined

as operating profit/(loss) adjusted to exclude restructuring costs

along with other non-recurring costs such as onerous leases and

associated costs on the early vacation of a property relating to

Onboard retail. These exceptional costs related to items which the

management believe did not accurately reflect the underlying

trading performance of the business in the period. The Directors

believe that the trading profit/(loss) is an important measure of

the underlying performance of the Group. 'EPS - Adjusted' also

provides the earnings per share figure after removing these

exceptional costs.

Going Concern

The directors have a reasonable expectation that the Group has

adequate resources to continue operating for the foreseeable

future, and for this reason they have adopted the going concern

basis of preparation in the consolidated interim financial

statements. The financial statements may be obtained from Touchstar

plc, 7 Commerce Way, Trafford Park, Manchester, M17 1HW or online

at www.touchstarplc.com .

4. Critical accounting estimates and assumptions

The Group makes estimates and assumptions concerning the future.

The resulting accounting estimates will, by definition, seldom

equal the related actual results. The estimates and assumptions

that have a significant risk of causing a material adjustment to

the carrying amounts of assets and liabilities within the next

financial year are discussed below.

Development expenditure

The Group recognises costs incurred on development projects as

an intangible asset which satisfies the requirements of IAS 38. The

calculation of the costs incurred includes the percentage of time

spent by certain employees on the development project. The decision

whether to capitalise and how to determine the period of economic

benefit of a development project requires an assessment of the

commercial viability of the project and the prospect of selling the

project to new or existing customers.

5. Other operating income

Six months ended Year ended

30 June 31 December

2020 2019 2019

GBP'000 GBP'000 GBP'000

----------------------------------- ----------------- ------------------- ----------------

Government funding Job Retention 113 - -

Scheme

----------------------------------- ----------------- ------------------- ----------------

This income is deemed to be operational in nature as it relates

to government funding received towards the Group's salary costs in

a bid to secure longer-term employment as a result of the COVID-19

pandemic.

6. Income tax credit

Six months ended Year ended

30 June 31 December

2020 2019 2019

GBP'000 GBP'000 GBP'000

---------------------------------- ----------------- ----------------- --------------

Corporation Tax

Current tax (20) (170) (326)

Adjustments in respect of prior

years - - (12)

Deferred tax - - 12

---------------------------------- ----------------- ----------------- --------------

Total current tax (20) (170) (326)

---------------------------------- ----------------- ----------------- --------------

7. Earnings per share

Earnings per ordinary share (pence) attributable to owners of the parent during the

period:

Year ended 31 December

Six months ended 30 June

Earnings per share 2020 2019 2019

----------------------------------- ------------------------- ------------------------ -----------------------

Basic 1.77 p (4.21)p (5.91)p

Adjusted 1.77 p (0.63)p (1.05)p

Basic earnings per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of ordinary shares in issue during the year. The calculation

of adjusted earnings per share for the six month period to 30 June

2019 excludes exceptional costs of GBP303,000 (31 December 2019:

GBP412,000).

Reconciliations of the earnings and weighted average number of

shares used in the calculation are set out below:

For six-month period 30 June 2020 30 June 2019

------------------------------- ----------------------------------------- ------------------------------------------

Profit Weighted average number of Profit Weighted average number of

GBP'000 shares (in thousands) GBP'000 shares (in thousands)

------------------------------- --------- ------------------------------ --------- -------------------------------

Basic EPS

Profit/(loss) attributable to

owners of the parent 150 8,475 (357) 8,475

Exceptional costs (note 8) - 303

Adjusted EPS

Profit/(loss) attributable to

owners of the parent before

exceptional items 150 8,475 (54) 8,475

------------------------------- --------- ------------------------------ --------- -------------------------------

For year ended 31 December 2019

-------------------------------------------- ----------------------------------------------------------------

Loss Weighted average number of shares (in

GBP'000 thousands)

Basic EPS

Loss attributable to owners of the parent (501) 8,475

Exceptional costs (note 8) 412

-------------------------------------------- ------------------- -------------------------------------------

Adjusted EPS

Loss attributable to owners of the parent

before exceptional items (89) 8,475

-------------------------------------------- ------------------- -------------------------------------------

8. Exceptional costs

30 June 30 June 31 December

2020 2019 2019

GBP'000 GBP'000 GBP'000

----------------------------------------- -------------- ------------

Restructuring expenses:

Redundancy costs - 166 229

Onerous lease costs - 137 154

Development expenditure impairment - - 29

------------------------------------- --- -------------- --------------

- 303 412

------------------------------------- --- -------------- --------------

The exceptional costs incurred during early 2019 relate to

management's decision to significantly reduce running costs for the

Onboard product with support for the existing clients moved to the

main offices in Manchester. The Kenilworth office where the Onboard

division was situated was closed.

The development expenditure impairment for 31 December 2019

relates to the remaining write off of the carrying value for

NOVOStar - the Onboard Retail product.

The Onboard business was sold on 6 November 2019 and was

reported in the period 31 December 2019 as a discontinued

operation.

Details of the sale of the Onboard business:

31 December 2019

GBP'000

Consideration received or receivable:

Cash 10

Fair value of liabilities disposed of 75

Total disposal consideration 85

Carrying amount of net assets sold -

Gain on sale 85

9. Leases

The note provides information for leases where the group is a

lessee.

The statement of financial position shows the following amounts

relating to leases:

30 June 2020 31 December

GBP'000 2019

GBP'000

--------------------- ---- -------------- ----------------

Right-of-use assets

Buildings 388 438

Vehicles 42 84

--------------------------- -------------- ----------------

430 522

-------------------------- -------------- ----------------

Lease Liabilities

Current 131 171

Non-current 356 418

--------------------------- -------------- ----------------

487 589

-------------------------- -------------- ----------------

Under IFRS 16 the assets are presented in property, plant and

equipment and the liabilities as part of the group's

borrowings.

The Income statement shows the following amounts relating to

leases:

30 June 2020 31 December

GBP'000 2019

GBP'000

------------------------------------- --------------------- ------------------

Depreciation charge relating

to right-of-use assets

Buildings 32 74

Vehicles 39 111

-------------------------------------- --------------------- ------------------

71 185

------------------------------------- --------------------- ------------------

Interest expense (included

in finance cost) 9 19

Expense relating to short-term

leases (included in administrative

expenses) 22 23

The practical expedient for rent concessions occasioned by

Covid-19 has been applied to all rent concessions which meet the

conditions in the 6 months to 30 June 2020, leading to a credit of

GBP24,000 being recognized in the Income Statement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UPUQPBUPUGQC

(END) Dow Jones Newswires

September 07, 2020 02:00 ET (06:00 GMT)

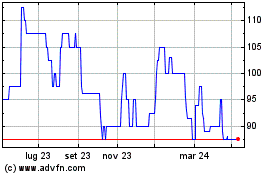

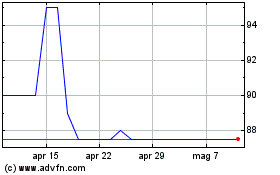

Grafico Azioni Touchstar (LSE:TST)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Touchstar (LSE:TST)

Storico

Da Apr 2023 a Apr 2024