TIDMTRP

RNS Number : 0218G

Tower Resources PLC

13 March 2020

13 March 2020

Tower Resources plc

Cameroon Reserves Report Update

Tower Resources plc (the "Company" or "Tower" (TRP.L, TRP LN)),

the AIM listed oil and gas company with its focus on Africa, is

pleased to announce that it has received an updated independent

Reserves Report (the "2020 Reserves Report") from Oilfield

International Limited ("OIL") on behalf of the Company's wholly

owned subsidiary, Tower Resources Cameroon S.A, covering its Thali

production sharing contract, offshore Cameroon (the "PSC"). The

2020 Reserves Report, which conforms to SPE_PRMS guidelines, does

not contain new technical information compared with the previous

report prepared by OIL and announced by the Company on 1(st)

November 2018 (the "2018 Reserves Report"), but the 2020 Reserves

Report reflects updated prices and costs reflecting the changes in

the market over the intervening 16 months or so.

The 2020 Reserves Report, like the 2018 Reserves Report, has

quantified contingent and prospective resources across multiple

fault block prospects on the Thali licence, including the existing

oil discovery at Njonji in the southern part of the licence,

together with their calculated Net Present Value ("NPV") and

Expected Monetary Value ("EMV"), as detailed below. The NPVs and

EMVs have been calculated based on two price sets: a standard North

American forecast methodology using a February 2020 forecast price

for 2021 and a constant money price escalation of 2% pa - the

"Sproule Energy Forecast" - in order to provide comparability with

other reports on other assets using this type of methodology; and

the actual Brent Forward Curve at close of business on 10(th) March

2020, which is the primary focus of this 2020 Reserves Report, to

illustrate the impact of the recent fall in oil prices, and to

confirm the economic viability of the contingent resources in the

current lower price environment.

2020 Reserves Report highlights:

-- Gross mean contingent resources of 18 MMbbls of oil across

the proven Njonji-1 and Njonji-2 fault blocks (with low/best/high

estimates of 5/15/34 MMbbls) are unchanged, with a development

contingency probability of 80% on first phase and 70% on second

phase;

-- Gross mean prospective resources of 20 MMbbls of oil across

the Njonji South and Njonji South-West fault blocks (with

low/best/high estimates of 5/16/39 MMbbls) are also unchanged;

-- Gross mean prospective resources of 111 MMbbls of oil across

four identified prospects located in the Dissoni South and Idenao

areas in the northern part of the Thali licence (with low/best/high

estimates of 21/84/237 MMbbls) are also unchanged;

-- The NPV10 of the Best Estimate of Contingent Resources using

the Sproule Energy Forecast is $179 million, with an EMV10 of $143

million, however it should be noted that these figures are based on

a February 29(th) forecast based on a 2021 Brent price of

$68/barrel;

-- The NPV10 of the Best Estimate of Contingent Resources using

the March 10(th) 2020 Brent Forward Curve is $119 million, with an

EMV10 of $91 million - these figures compare with the 2018 Reserves

Report NPV10 of the Best Estimate of Contingent Resources of $158

million, and an EMV10 of $118 million using the then-current Brent

Forward Curve at a time when the 2019 forward Brent price was over

$71/bbl.

The reasons why the NPV10 and the EMV10 of the Contingent

Resources at Njonji have fallen by less than 25% compared to the

figures in the 2018 Reserves Report, despite an approximate halving

of the oil price, are that:

-- Forward Brent prices have fallen by less than prompt prices,

which is usual when the prompt market is oversupplied, so for

example the average forward price of Brent in 2021 is approximately

$44/barrel;

-- The projected costs of the project, which are low, have

actually fallen a little reflecting the Company's actual experience

in sourcing equipment and services for the NJOM-3 well; and

-- The profit allocation mechanism in the PSC attributes a

greater share of oil to the contractor when oil prices are low, and

a smaller share of oil when prices are high, which can be observed

in the different volumes of recoverable oil "attributable to Tower"

for the different price scenarios, when comparing the tables below

to those in the 2018 Reserves Report.

Jeremy Asher, Chairman and CEO, commented:

"We are pleased to present this updated 2020 Reserves Report on

the Thali licence in Cameroon. I already observed last year that

our project economics were attractive across a wide range of oil

price scenarios, and in September last year I presented one of our

internal cash flow forecasts showing the very attractive cash

generation from the project assuming a flat $40/bbl Brent price,

which can be still be found in our September 2019 corporate

presentation on our website. The 2020 Reserves Report confirms the

attractiveness of the Njonji project economics.

It is also worth noting that the riskier prospective resources

on Thali can be tested at very low cost during the process of

developing the contingent resources already discovered. In

particular, the Phase 1 development process at Njonji will also

test the Njonji South Prospective Resources of 18 million barrels

(Pmean), which would be additional to the 18 million barrels

(Pmean) of existing contingent resources already discovered at

Njonji, thus providing a natural additional upside to the project

which is not reflected in the NPVs and EMV10 of the contingent

resources.

So even in the lower oil price environment in which we now find

ourselves, which echoes the price environment at the end of 2015

shortly after we first entered the Thali license, the Thali license

is an attractive asset which we expect will earn excellent

returns."

2020 Reserves Report details:

The 2020 Reserves Report was independently compiled by UK-based

industry specialist Oilfield International Limited and was based on

the work that Tower undertook during 2018 including a reprocessing

and reinterpretation of all of the existing 3D seismic data over

the licence area, and substantial further analysis of the data

including an independent fault seal analysis undertaken by Dr Tim

Needham of the University of Leeds Institute of Applied Geoscience,

as described in the executive summary of the 2018 Reserves Report,

which is still available in the Company's website. The economic

analysis in the report was updated as described above to reflect

more recent price assumptions and also the Company's more recent

experience with costs.

The tables below are summaries of some of the key tables in the

Executive Summary of the 2020 Reserves Report, which is available

on the Company's website. The "Gross" figures refer to the

recoverable volumes from a given structure, the "Net Attributable

to Tower" figures refer to the equivalent volumes that Tower can

actually expect to receive for its own account in respect of its

cost recovery and profit oil under the terms of its licence, using

the March 10(th) 2020 Brent Forward Curve. As noted above, the

"Gross" volumes are the same as in the 2018 Reserves Report, but

the "Net Attributable to Tower" volumes differ from those in the

2018 Reserves Report because the of the profit allocation

mechanisms in the PSC.

The NPV10 and EMV10 tables presented below are the tables based

on the March 10(th) 2020 Brent Forward Curve, but the full set of

valuation tables including the Sproule Energy Forecast tables are

contained in the Executive Summary available on the Company's

website.

NJONJI - OIL CONTINGENT RESOURCES (Gross, MMbbls)

Operator: Low Estimate Best Estimate High Estimate Mean Estimate (Phase Chance of

Tower 1&2) Development

------------------- --------------------------- -------------------------------- --------------------- -------------------

Development

Unclarified

------------------- --------------------------- -------------------------------- --------------------- -------------------

Phase I 5.0 11.8 19.6 17.9 80%

------------------- --------------------------- -------------------------------- --------------------- -------------------

Phase II 0.0 3.4 14.8 70%

------------------- --------------------------- -------------------------------- --- ------------ -------------------

TOTAL 5.0 15.2 34.4

------------------- --------------------------- -------------------------------- --------------------- -------------------

NJONJI - OIL CONTINGENT RESOURCES (Net Attributable to Tower, MMbbls)

Operator: Low Estimate Best Estimate High Estimate Chance of

Tower Development

------------------- --------------------------- -------------------------------- --------------------- -------------------

Development

Unclarified

------------------- --------------------------- -------------------------------- --------------------- -------------------

Phase I 3.0 7.3 10.4 80%

------------------- --------------------------- -------------------------------- --------------------- -------------------

Phase II 0.0 1.9 7.9 70%

------------------- --------------------------- -------------------------------- --------------------- -------------------

TOTAL 3.0 9.3 18.3

------------------- --------------------------- -------------------------------- --------------------- -------------------

NJONJI - OIL PROSPECTIVE RESOURCES (Gross, MMbbls)

Operator: Low Best Estimate High Estimate Mean Estimate Chance of Chance of Chance of

Tower Estimate Discovery Commercial Success Development

--------- ------------------- ---------------------- ------------------- -------------- ------------------- ------------

Prospects

--------- ------------------- ---------------------- ------------------- -------------- ------------------- ------------

Njonji South 4.7 14.9 35.4 18.2 42% 70% 30%

--------- ------------------- ---------------------- ------------------- -------------- ------------------- ------------

Njonji SW 0.2 1.1 3.6 1.6 32% 50% 16%

--------- ------------------- ---------------------- ------------------- -------------- ------------------- ------------

TOTAL 4.9 16.0 39.0 19.8

--------- ------------------- ---------------------- ------------------- -------------- ------------------- ------------

NJONJI - OIL PROSPECTIVE RESOURCES (Net Attributable to Tower, MMbbls)

Operator: Low Best Estimate High Estimate Chance of Chance of Chance of

Tower Estimate Discovery Commercial Success Development

--------- ------------------- ---------------------- ------------------- -------------- ------------------- ------------

Prospects

--------- ------------------- ---------------------- ------------------- -------------- ------------------- ------------

Njonji South 2.6 7.4 16.6 42% 70% 30%

--------- ------------------- ---------------------- ------------------- -------------- ------------------- ------------

Njonji SW 0.2 0.8 2.1 32% 50% 16%

--------- ------------------- ---------------------- ------------------- -------------- ------------------- ------------

TOTAL 2.8 8.2 18.7

--------- ------------------- ---------------------- ------------------- -------------- ------------------- ------------

DISSONI & IDENAO - OIL PROSPECTIVE RESOURCES (Gross, MMbbls)

Operator: Low Best Estimate High Estimate Mean Estimate Chance of Chance of Chance of

Tower Estimate Discovery Commercial Success Development

--------- ------------------- ---------------------- ------------------- -------------- ------------------- ------------

Leads

--------- ------------------- ---------------------- ------------------- -------------- ------------------- ------------

Dissoni

South A 8.3 30.9 76.2 37.8 24% 80% 19%

--------- ------------------- ---------------------- ------------------- -------------- ------------------- ------------

Dissoni

South B 1.3 5.6 16.8 7.8 17% 80% 13%

--------- ------------------- ---------------------- ------------------- -------------- ------------------- ------------

Idenao East

FOI2 5.1 21.2 62.0 28.6 18% 80% 14%

--------- ------------------- ---------------------- ------------------- -------------- ------------------- ------------

Idenao East

FOI1 6.4 26.6 82.1 37.1 18% 80% 14%

--------- ------------------- ---------------------- ------------------- -------------- ------------------- ------------

TOTAL 21.2 84.3 237.1 111.3

--------- ------------------- ---------------------- ------------------- -------------- ------------------- ------------

DISSONI & IDENAO - OIL PROSPECTIVE RESOURCES (Net Attributable to Tower, MMbbls)

Operator: Low Estimate Best Estimate High Estimate Chance of Discovery Chance of Commercial Chance of

Tower Success Development

-------------- --------------------- ------------------------- --------------------- ---------------------- -------------

Leads

-------------- --------------------- ------------------------- --------------------- ---------------------- -------------

Dissoni

South A 5.9 17.4 34.7 24% 80% 19%

-------------- --------------------- ------------------------- --------------------- ---------------------- -------------

Dissoni

South B 0.9 3.1 7.6 17% 80% 13%

-------------- --------------------- ------------------------- --------------------- ---------------------- -------------

Idenao East

FOI2 3.6 10.7 26.6 18% 80% 14%

-------------- --------------------- ------------------------- --------------------- ---------------------- -------------

Idenao East

FOI1 3.8 11.8 28.5 18% 80% 14%

-------------- --------------------- ------------------------- --------------------- ---------------------- -------------

TOTAL 14.2 43.0 97.4

-------------- --------------------- ------------------------- --------------------- ---------------------- -------------

NJONJI - CONTINGENT RESOURCES (Attributable to Tower NPV10 and EMV10 US$ millions)

Operator: Tower After Tax NPV10 EMV10

--------------------------------------------- ---------------------- ---------------

Low Estimate Best Estimate High Estimate Chance of Development Swanson's Rule

------------- -------------- -------------- ---------------------- ---------------

Development Unclarified

------------- -------------- -------------- ---------------------- ---------------

Phase I -15 103 158 80% 64

------------- -------------- -------------- ---------------------- ---------------

Phase II 0 16 105 70% 27

------------- -------------- -------------- ---------------------- ---------------

TOTAL -15 119 263 91

------------- -------------- -------------- ---------------------- ---------------

Swanson's Rule: 40% P50+30% P90+30% P10

THALI LICENCE - PROSPECTIVE RESOURCES (Attributable to Tower NPV10 and EMV10 US$ millions)

Operator: Tower After Tax NPV10 EMV10

--------------------------------------------- ---------------------- ---------------

Low Estimate Best Estimate High Estimate Chance of Development Swanson's Rule

------------- -------------- -------------- ---------------------- ---------------

Prospective Resources

------------- -------------- -------------- ---------------------- ---------------

Prospects

------------- -------------- -------------- ---------------------- ---------------

Njonji South 19 92 207 30% 31

------------- -------------- -------------- ---------------------- ---------------

Njonji SW -5 3 22 16% 0

------------- -------------- -------------- ---------------------- ---------------

Leads

------------- -------------- -------------- ---------------------- ---------------

Dissoni South A -5 162 390 19% 33

------------- -------------- -------------- ---------------------- ---------------

Dissoni South B 4 31 94 13% 4

------------- -------------- -------------- ---------------------- ---------------

Idenao East FOI2 16 112 319 14% 19

------------- -------------- -------------- ---------------------- ---------------

Idenao East FOI1 24 125 331 14% 22

------------- -------------- -------------- ---------------------- ---------------

TOTAL 53 525 1363 110

------------- -------------- -------------- ---------------------- ---------------

Swanson's Rule: 40% P50+30% P90+30% P10

The Executive Summary extracted from the 2020 Reserves Report

includes more detailed versions of these tables and additional

figures, tables, details relating to the initial development plan

and a summary of risk factors. The Executive Summary is available

on the Tower Resources website at www.towerresources.co.uk.

A glossary of technical terms is included at the end of this

announcement.

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

Contacts

Tower Resources plc +44 20 7157 9625

Jeremy Asher

Chairman and CEO

Andrew Matharu

VP - Corporate Affairs

SP Angel Corporate Finance

LLP

Nominated Adviser and Joint

Broker + 44 20 3470 0470

Stuart Gledhill

Caroline Rowe

Turner Pope Investments

(TPI) Limited

Joint Broker

Andy Thacker

Zoe Alexander + 44 20 3657 0050

Whitman Howard Limited

Joint Broker

Nick Lovering + 44 20 7659 1234

Notes:

In accordance with the guidelines for the AIM market of the

London Stock Exchange, Dr. Mark Enfield, BSc Geology, PhD Geology,

Advisor to the Board of Tower Resources plc, who has over 30 years'

experience in the oil & gas industry, is the qualified person

that has reviewed and approved the technical content of this

announcement.

Tower Resources Cameroon S.A, a wholly-owned subsidiary of Tower

Resources plc, holds a 100% interest in the shallow water Thali

(formerly known as "Dissoni") Production Sharing Contract (PSC), in

the Rio del Rey basin, offshore Cameroon. Tower was awarded the PSC

on 15 September 2015 for an Initial Exploration Period of 3 years.

Extensions to the Initial Exploration Period have been granted

until 14 September 2020.

The Thali PSC covers an area of 119.2 km(2), with water depths

ranging from 8 to 48 metres, and lies in the prolific Rio del Rey

basin, in the eastern part of the Niger Delta. The Rio del Rey

basin has, to date, produced over one billion barrels of oil and

has estimated remaining reserves of 1.2 billion barrels of oil

equivalent ("boe"), primarily at depths of less than 2,000 metres.

The Rio del Rey is a sub-basin of the Niger Delta, an area in which

over 34.5 billion barrels of oil has been discovered, with 2.5

billion boe attributed to the Cameroonian section.

Glossary:

Best Estimate: At least a 50% probability (P50) that the

quantities actually recovered will equal or exceed the Best

Estimate (in statistical terms, a median).

Brent Forward Curve: the prices on a given day for Brent Crude

Oil for forward delivery, month by month, ranging from the first

traded month forward for ten years or more.

Chance of Development: The chance of discovery multiplied by the

chance of commercial success.

Contingent Resources: Those quantities of Petroleum estimated,

as of a given date, to be potentially recoverable from known

accumulations, by the application of development Project(s) not

currently considered to be Commercial due to one or more

contingencies.

DST: Drill Stem Test.

EMV10: Expected Monetary Value derived from a discount rate of

10%.

EWT: Extended Well Test.

High Estimate: At least a 10% probability (P10) that the

quantities actually recovered will equal or exceed the High

Estimate.

Low Estimate: At least a 90% probability (P90) that the

quantities actually recovered will equal or exceed the Low

Estimate.

MDT: Modular Dynamic Formation Test.

Mean Estimate: The expected value of the full probability

distribution of resource volumes.

MMbbls: Millions of barrels.

NPV10: Net Present Value at a discount rate of 10%.

Prospective Resources : Those quantities of petroleum estimated,

as of a given date, to be potentially recoverable from undiscovered

accumulations by application of future development projects.

Recoverable : Those quantities of hydrocarbons which are

estimated to be producible from accumulations, either discovered or

undiscovered. Note that Contingent and Prospective Resources as

estimated herein are all estimates of recoverable quantities.

Risked: Quantities that have been adjusted for the probability

of success or loss/failure.

Swanson Rule: A methodology for calculating the EMV of an oil or

gas prospect.

Unrisked : Quantities which have not been adjusted for the

probability of success or loss/failure.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDJTMJTMTJBTBM

(END) Dow Jones Newswires

March 13, 2020 03:00 ET (07:00 GMT)

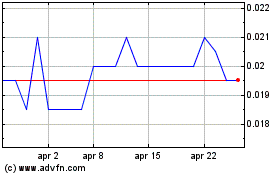

Grafico Azioni Tower Resources (LSE:TRP)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Tower Resources (LSE:TRP)

Storico

Da Apr 2023 a Apr 2024